Speed Up The Process Of Eliminating Debt

To help rid yourself of debt even more quickly, start eliminating unnecessary household expenses and put that saved money toward your credit card bills.

You need to be tracking your actual income and expenses down to the penny, says Michael Kern, a CPA and founder of Talent Financial, a personal finance and small business consulting company focused on helping people get their finances in order.

Go line by line and cut any expenses that are not necessary, continued Kern. This will allow more income to flow into savings and paying off debt, which will ultimately get you to your financial goals faster.

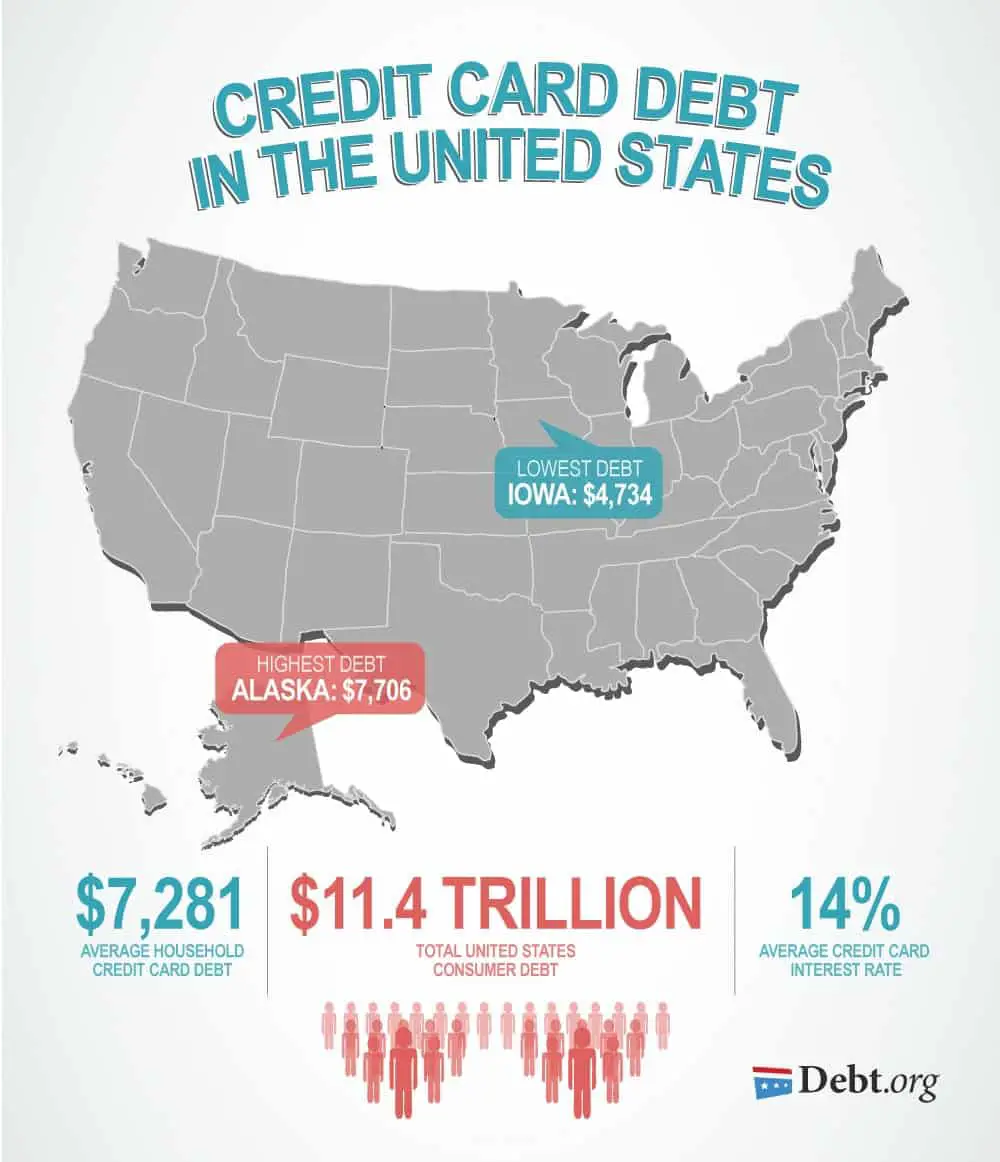

How Much Credit Card Debt Do Americans Have

Since the second quarter of 2021, credit card balances have risen by $100 billion. Thats a 13% increase, the largest year-over-year jump in more than 20 years.

With the increase, Americans credit card debt stands $40 billion below the record set in the fourth quarter of 2019, when balances stood at $927 billion. Thanks to rising interest rates, stubborn inflation and myriad other economic factors, its likely a matter of time before credit card balances surpass the 2019 record.

Though balances arent quite at record levels yet, theyre still light years above the $480 billion seen more than 20 years ago in the first quarter of 1999.

Card debt showed hockey-stick growth until the financial collapse in 2008, when balances fell from $866 billion in the fourth quarter of 2008 to $660 billion in the first quarter of 2013. But, as you can see in the chart below, the hockey stick returned.

Then, when the pandemic took hold in 2020, credit card balances plunged again from $927 billion in the fourth quarter of 2019 to $770 billion in the first quarter of 2021. But again the hockey stick returned, thanks to a massive spike in the fourth quarter of 2021.

Those With Higher Incomes Feel The Crunch Much More Than Those With Lower Incomes

The amount of outstanding debt is strongly tied to the level of income. This means that with higher income comes higher loan balances. With a higher income, you can obtain a larger mortgage or auto loan. You have a greater capacity to incur debt and a better capacity to repay it.

In terms of homeownership, a lower salary equals a lower probability of even qualifying for loan debt. Although credit card qualification is less demanding, the underlying guideline remains the same.

Also Check: How Many Times Has Trump Filed Bankruptcy

How Can I Start Paying Off My Debt

Many people carry a car loan, mortgage, or some other type of financial aid throughout their lives. But you can speed up the repayment process with some careful planning. Heres how you can get started paying down your personal debt.

1. Make a list of outstanding debts

To pay down debt, it helps to know how much money you currently owe. You can start by making a list of all your debts. Be sure to include loans, credit card balances, and any money you owe to family and friends.

As you write down each debt, include the most important details: the total outstanding balance, the interest rate, and the minimum monthly payment.

What is an interest rate?

The interest rate is the cost you pay each year to borrow money expressed as a percentage. This is in addition to paying back the original loan amount.

Just having this information written down can make you feel more in control of your finances. Now that you know exactly where you stand, youre ready to create a personalized debt payment plan.

2. Choose a debt payment method

Paying down your debt is much easier when you have a plan. A debt payment plan can motivate you to pay off your debt faster and more strategically.

Here are two popular payment methods to consider.

3. Make your debt more affordable

When you have debt, you pay interest on every dollar you owe. The higher your interest rates are, the more money you have to pay.

Capital One Quicksilver Cash Rewards Credit Card

Like other cards on this list, the Capital One Quicksilver has no annual fee. It has unlimited 1.5% cash back on all purchases. Plus, it has 0% APR for 15 months from account opening on purchases and balance transfers, followed by a APR. It typically comes with a sign-up bonus, too.

The Citi Custom Cash is one of the strongest cards in Citis portfolio. Its name indicates its unique benefit: it automatically gives you 5% cash back in eligible categories, up to $500 per billing cycle.

You earn based on your spending patterns, and no activation is required. This card has no annual fee and typically has a sign-up bonus. It also has 0% APR for 15 months from account opening on purchases and balance transfers, followed by a APR.

This Discover It Cash Back is a cashback credit card worth a look. It has no annual fee and 5% cash back on quarterly bonus categories . You also receive a dollar-for-dollar cashback match at the end of your first year. It also has 0% APR for 15 months from account opening, followed by a APR.

The Bank of America Unlimited Cash Rewards card has no annual fee and has unlimited 1.5% cash back on all purchases. There is typically a sign-up bonus, and it has an introductory APR.

This cards APR canbe longer than others on this list you get 0% APR on balance transfers for 18 billing cycles for any balance transfers made in the first 60 days, followed by a APR.

Recommended Reading: What Happens To Judgments After Bankruptcy

Total Outstanding Credit Card Debt

As more Americans get vaccinated and more states open, credit card debt is ticking back up a bit. Americansoutstanding revolving debt, most of which is credit card debt, reached $998.4 billion2 in July 2021, according to data from the Federal Reserve.

Thats an increase from a low of $974.6 billion2 in the fourth quarter of 2020 after the amount of revolving debt owed by U.S. consumers fell throughout the year.

Use A Balance Transfer Credit Card

If you’re looking to get out of credit card debt, opening a new credit card may not be your first thought.

But you can transfer debt from high-interest credit card to a balance transfer credit card, that offers no interest for up to 21 months.

Completing a balance transfer can save you a significant amount on interest fees and allow all payments you make to go toward your principal balance .

If you want to maximize no-interest periods, consider the Citi Simplicity® Card with a 0% intro APR for 21 months on balance transfers from date of first transfer . There’s also the Wells Fargo Reflect® Card, which offers a 0% APR intro period for 18 months from account opening on purchases and qualifying balance transfers with an extension for three months with on-time minimum payments during the intro period . The introductory balance transfer fee for the Reflect Card is 3% , whichever is greater, of the amount of each balance transfer for 120 days from account opening. After that, it’s up to 5% for each balance transfer, with a minimum of $5.

Take note that balance transfer cards often set maximum limits on the amount of debt you can transfer , and you can’t complete a transfer between cards issued from the same bank. Make sure you read the fine print before requesting a transfer. Good or excellent credit are often required to qualify for a balance transfer credit card.

Also Check: What Happens After Bankruptcy Is Dismissed

The Pandemics Continuing Impact On American Finances

The COVID-19 pandemic has affected Americans finances in multiple ways. One such way is the relief and stimulus programs available over the past almost two years.

According to our survey, more than three-quarters of Americans reported that they had received some form of pandemic relief since March 2020. Close to two-thirds of Americans say they received stimulus payments, and some Americans received extended/supplemental federal unemployment benefits , the expanded child tax credit and automatic forbearance on federal student loans , among other things.

Of Americans who received pandemic relief, 43% say they used the extra money to pay for necessities, and another 43% say they saved some or all of the money. Close to 2 in 5 Americans who received pandemic relief repaid debt with this money.

Some Americans took big steps over the past 12 months that will affect their finances in the long term, for better or worse. More than 1 in 10 Americans say they purchased a home over the past year, and the same proportion say they enrolled in college courses or continuing education during that time. Around 1 in 12 Americans say they quit their job in the past 12 months, with Gen Zers and millennials more likely to say this than Gen Xers and baby boomers . Those saying they quit a job include 16% of Gen Zers, 11% of millennials, 6% of Xers, and 3% of boomers.

Americans Want To Use Their Credit Cards Less Often

Americans seem to understand that credit card use can expose them to risks, whether through theft or overspending. That may be why nearly 3 in 5 Americans say they want to decrease their credit card usage.

When possible, Americans say they prefer to make day-to-day purchases with a debit card. The most-preferred methods of payment for day-to-day purchases are:

Read Also: Unclaimed Pallets For Sale

A Lifestyle Out Of Control

Mike Pearson, founder of , suggests the challenge so many Americans are now facing having more credit card debt than emergency savings has a great deal to do with how we frame the issues.

not a matter of simply not having enough money, but rather having your spending totally out of control, explained Pearson. When you control your spending, everything else including debt payoff and savings falls into place.

In other words, he says, the best way out of this situation is to create a reasonable budget, stick to it, and at the end of the day, know that you simply cannot spend more money than you earn.

If you take home $2,500 after taxes each month, then your expenses cannot exceed $2,500. Simple concept to understand, but much more difficult to apply in real life, said Pearson.

Only when youve mastered this concept, however, can you truly start to make progress paying down your credit card debt and building up your emergency savings because you will actually have money available to address both of those problems.

Some will say its a good idea to have a $1,000 emergency fund first, just in case something bad happens. Others will say pay off credit card debt first because youre getting killed with interest charges, concluded Pearson.

Borrowers With Lower Income Worse Credit Adding Debt

Data from Bank of America reflects higher rates of borrowing among lower income Americans. Credit utilization, a ratio of how much available credit a person has used as a percentage of their credit limit, has been rising since early 2021. According to Bank of America, households with an annual income of less than $50,000 have a roughly 28% credit utilization ratio, compared to around 23% for households with an income higher than $125,000.

Were acknowledging that the consumer is under pressure, but the strong wage growth, the robust labor market and their higher savings deposit levels are all buffers, said David Tinsley, senior economist at the Bank of America Institute.

TransUnion found that over the past year or so, unsecured debt held by subprime borrowers climbed by roughly four percentage points. Observers worry that if economic conditions sour, this debt could quickly become unmanageable, especially since subprime borrowers pay higher interest rates and generally earn less than prime borrowers.

Transunion said the rate of serious delinquency debt that is past due by 90 days or more across the consumer credit landscape is within its pre-pandemic range, but has begun to rise.

Don’t Miss: Can Just One Spouse File Bankruptcy

Some Generations Reduce Balances

Total balances fell significantly in 2020 regardless of a borrower’s age, as consumer spending was broadly curtailed from initial pandemic restrictions on gathering and travel. In 2021, the change in balances reverted to its more typical pattern, where younger borrowers generally grow their average balances, while older generations tend to both spend less and carry lower balances as they age.

| Change in Average Credit Card Balances by Generation |

|---|

| 2020 |

| -3.1% |

Millennials and the fast-growing Generation Z saw their average balances increase in 2021, as both generations typically encounter their own financial milestones: first residence, first automobile, repayment of student loans and first mortgage, to name a few examples. Generation X joined baby boomers and the silent generation in lowering balances in 2021, though Generation X still carries the largest average balance among all the generations.

| Change in Average Credit Card Limits by Generation |

|---|

| 2020 |

Heres How Us Credit Card Debt Has Changed In Five Years

Quick Answer

- Over the past five years, the average credit card balance decreased by 10.7% .

- The average American carried $5,589 in credit card debt at the end of 2021.

- The states with the steepest balance decline were Alaska and Virginia, with a 16% decrease and a 12% decrease, respectively.

In this article:

When convenience is the priority, credit cards are king. The 2-by-3-inch plastic rectangle transformed how American consumers shop: With one swipe, people can buy dinner, cover unexpected or urgent expenses at the last minute, or finance a large household purchase. Credit cards can also be an effective way to build your credit by establishing a track record of on-time debt payments.

Convenience comes with responsibility, however. That same little card can also cause financial woes if not managed wisely. Credit cards have higher interest rates than many other forms of borrowing money, which can add up if balances aren’t quickly paid down. In the world of lending, convenience isn’t always cheap.

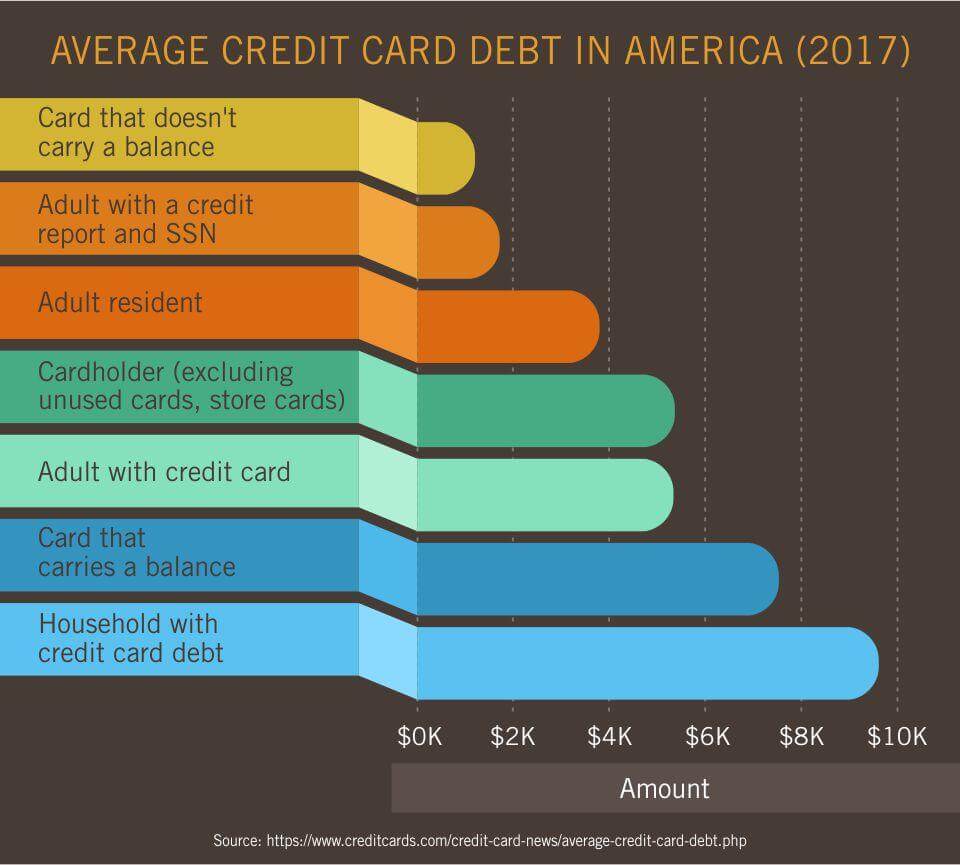

The average U.S. consumer carries thousands of dollars in credit card debtan average of $5,589 as of the fourth quarter of 2021, according to Experian data. To see how consumer credit habits have changed over time, Experian looked at the average credit card balance at a national and state level going back to 2017.

You May Like: How Much Debt Before Filing Bankruptcy

What Percentage Of Credit Card Accounts Carry A Balance

Americans carried a balance on 54% of all active credit card accounts in the first quarter of 2022, according to the most recent available data from the American Bankers Association.

Job No. 1 for anyone with a credit card is to pay off that balance in full at the end of each month. But we all know that life happens, and that means that its not always possible to pay off your credit cards each month.

Unfortunately, most people with an active credit card account dont always pay their bills in full. More than half of all active accounts carried a balance in the first quarter of 2022. This is the third straight quarter in which that percentage has increased. However, that percentage had fallen significantly during the pandemic, dropping from a high of 60% in the first quarter of 2019 to as low as 51% in the second quarter of 2021.

If you look at all credit card accounts, the American Bankers Association data shows that 41% of accounts were active and carried a balance at some point in the first quarter of 2022, 36% of accounts were active but didnt carry a balance and 24% of accounts were dormant for the quarter.

Those Who Started Using Credit Cards Earlier Have Less Debt

Our survey data suggests using credit cards at a younger age may actually help card holders avoid debt later in life.

Americans who started using their cards at age 25 or younger are 13% more likely to not carry credit card debt compared to those who took out their first credit cards at a later age.

About 68% of Americans say they started using their own credit card at age 25 or younger. Americans started using their cards at age:

Read Also: How To Find Collection Agency

Quick Facts: Credit Card Debt And Delinquency Rates

- U.S. credit card debt hit an all-time high of $930 billion

- Debt surpassed the $870 billion peak during the 2008 financial crisis

- Younger Americans have a 76% higher delinquency rate than anyone else

Delinquency rates for credit cards which are the portion of payments late 90 days or more also rose to 5.32%, up from 5.16% from the prior quarter.

“The data also show that transitions into delinquency among credit card borrowers have steadily risen since 2016, notably among younger borrowers,” Wilbert Van Der Klaauw, senior vice president at the New York Fed, said in the press release.

The youngest Americans suffer the highest delinquency rates of 9.36%. That’s 76% higher than the total average credit card delinquency rate.

Older Americans have delinquency rates below 5%, which tends to track with their increased wealth compared to younger generations.

Here’s a breakdown of credit card delinquency rates by age:

- 18 to 29: 9.36%

- 60 to 69: 4.34%

If you’re one of the many Americans struggling to pay off credit card debt, there’s no time like the present to start chipping away. Select breaks down some tips on how you can tackle debt, potentially by using a credit card to your advantage.