White House Releases Student Loan Forgiveness Application

The Biden administration officially launched its student loan forgiveness application in October, which is currently available through an online portal.

Borrowers with federal student loan debt can fill out the simple application that includes questions such as the borrowers’ name, Social Security number and email. They then need to confirm their eligibility for student debt relief before submitting the form.

Borrowers have until Dec. 31, 2023, to apply for federal student debt forgiveness.

“As millions of people fill out the application, were going to make sure the system continues to work as smoothly as possible so that we can deliver student loan relief for millions of Americans as quickly and as efficiently as possible,”Biden said at the time of the launch.

Although private student loan borrowers do not qualify for Bidens debt forgiveness plan, you could consider refinancing your loan to potentially reduce your monthly payment. To see if this is the right option for you, contact Credible to speak to a student loan expert and get your questions answered.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

Tracking The Federal Deficit: April 2019

The Congressional Budget Office reported that the federal government generated a $161 billion surplus in April, the seventh month of Fiscal Year 2019, for a total deficit of $531 billion so far this fiscal year. Aprils surplus is 33 percent less than the surplus recorded a year earlier in April 2018. If not for timing shifts of certain payments, the surplus would have been 5 percent smaller than the surplus in April 2018. Total revenues so far in Fiscal Year 2019 increased by 2 percent , while spending increased by 6 percent , compared to the same period last year.

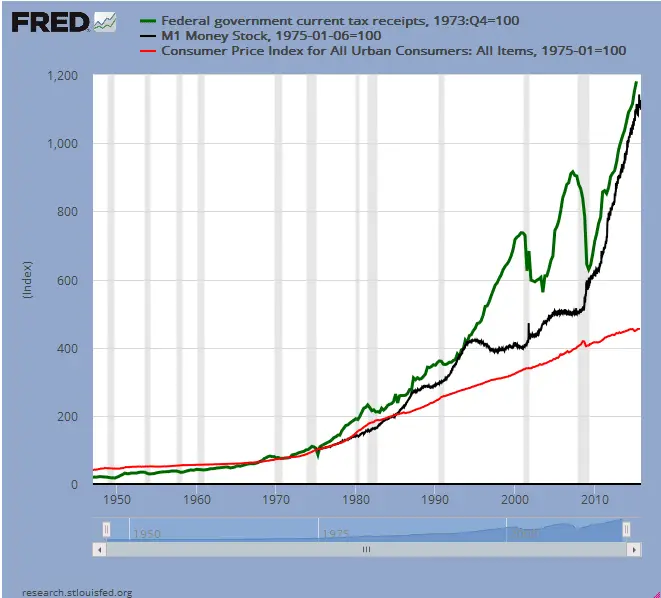

Analysis of Notable Trends this Fiscal Year to Date: Income tax refunds were down by 5 percent compared to last tax season, contrary to many analysts expectations. Further, outlays from the refundable earned income and child tax credits increased by 12 percent versus last year, reflecting expansions enacted in the Tax Cuts and Jobs Act of 2017. Net interest payments on the public debt continued to rise, up 13 percent compared to last year, largely as a result of higher interest rates and the nations steadily growing debt burden.

Tracking The Federal Deficit: July 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $212 billion in July 2022, the tenth month of FY2022. This deficit was the difference between $272 billion in receipts and $484 billion in spending. This is the second largest single month deficit this fiscal year, but still $90 billion less than July 2021. July receipts were up by $10 billion , as outlays decreased by $80 billion compared to this time last year.

Analysis of notable trends: Over the first 10 months of FY2022, the federal government ran a deficit of $727 billion29% the size of the $2.5 trillion deficit over the same period in FY2021. So far this year, revenues were $789 billion higher than over the same period in FY2021. Individual income and payroll tax receipts increased by $709 billion over the same period, in part because wages and salaries remained high amid a tight labor market. Customs duties and excise tax receipts went up by $18 billion and $11 billion respectively, reflecting increased domestic and international economic activity this year.

You May Like: Can You File Bankruptcy Twice In Ohio

Change In The Employment

Percentage Points

Data source: Congressional Budget Office, using Current Population Survey data from IPUMS-CPS. See www.cbo.gov/publication/57950#data.

The change over the pandemic period is the change in the average hourly wage rate between the six-month period before the onset of the pandemic and the most recent six-month period analyzed . The change during the prepandemic period is the change in the average hourly wage rate between the six-month period two years before the pandemic and the six-month period just before its onset.

2. CBO used race and ethnicity to define four race-ethnicity categoriesHispanic, Black, White, and Asian and Otherthrough the following steps. Respondents who identified their ethnicity as Hispanic were classified as Hispanic, regardless of the race or races they identified. Of respondents not already classified as Hispanic, those who identified their race as African American were classified as Black, regardless of whether they identified other races as well. Of respondents not already classified as Hispanic or Black, those who identified a race other than White were classified as Asian and Other. Finally, respondents not classified as Hispanic, Black, or Asian and Other were classified as White.

Tracking The Federal Deficit: July 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $61 billion in July, the tenth month of fiscal year 2020. Although this Julys deficit was actually smaller than last Julys $120 billion deficit, the change does not represent an improved fiscal condition but a mere timing shift. The deadline for non-withheld individual and corporate income taxes, normally in April, was delayed until July of this year, causing an unusual spike in July revenue . Even this influx of taxes was overcome by monthly outlays that, at $624 billion, were 68% greater than last Julys. The cumulative budget deficit for FY2020 now stands at $2.8 trillion, more than triple the deficit at this point last year.

Analysis of notable trends: Stepping back from monthly fluctuations caused by the change in filing deadlines, total revenue so far this fiscal year is down 1% from this point last year. Revenues through this March had actually been 6% higher than through the same point last fiscal year, as higher individual and corporate earnings led to greater individual and corporate income tax receipts. Then the pandemic hit. From April through July, revenues are 10% lower than over same months last year, a combination of economic damage and legislation that gave individuals and corporations greater tax deductions.

Don’t Miss: Are Student Loans Included In Bankruptcy

Price And Wage Inflation

There is much uncertainty about the rate at which wages and consumer prices will grow. The projected path of wages is highly uncertain and is related to uncertainty about the increase in the labor force, the effect of that increase on wage growth, and the degree to which the increase in inflation will feed into wages in the future. To some extent, the uncertainty about the path of wages is related to the uncertainty about the continuation of the pandemic. Further outbreaks could slow or even reverse the recent increase in the labor force, which could result in a more persistent increase in wage growth than CBO projects. But if the labor force returns to its potential level faster than CBO expects, and past inflation does not create additional upward pressure on wages, then the growth of wages could be slower than the agency anticipates. If wage growth is faster than CBO projects, businesses could pass through those higher wages in the form of higher consumer prices, especially in the prices for services, which might result in higher inflation than the agency expects.

Which States Residents Have The Most Credit Card Debt

LendingTree analysts reviewed anonymized January and February 2021 credit report data from more than 1 million LendingTree users to calculate these averages and create a list of states with the most debt.

Overall, the national average card debt among cardholders with unpaid balances was $6,569. That includes debt from both bank cards and retail credit cards.

The four states with the most debt were all on the East Coast, while the three lowest were found in the South. There was a major difference in balances between the states at the top and bottom of our rankings, with New Jersey cardholders owing $7,872 and Kentuckys owing $5,441. That means the average New Jersey balance is 45% higher than the average balance in Kentucky.

Recommended Reading: How To File Bankruptcy In Iowa

Trust Funds For Federal Employees Retirement Programs

After Social Security, the largest trust fund balances at the end of 2021 were held by the Military Retirement Trust Fund and by various civilian employee retirement funds .7 Those accounts are mainly funded through transfers from federal agencies, payroll deductions from workers, and supplemental payments from the Treasury. Unlike Social Securitys OASI fund and Medicares trust funds , those retirement funds are projected to have surpluses throughout the coming decade. In CBOs baseline projections, the combined annual surpluses total $217 billion in 2022, average around $150 billion per year through 2026, and then average roughly $45 billion per year through 2032.

Of the cumulative growth in the funds projected balances over the 10-year period, about two-thirds is attributable to the Military Retirement Trust Fund . In CBOs current baseline projections, the balance of the Military Retirement Trust Fund increases by an average of 4 percent annually over the coming decade, reaching nearly $1.8 trillion in 2032. That funds growth, particularly through 2026, stems from additional payments that the Treasury is required to make in those years to increase the size of the fund so that it aligns better with projected liabilities. Balances in the civilian retirement funds are projected to grow more slowly, increasing by an average of less than 3 percent annually over the next decade and totaling roughly $1.3 trillion at the end of 2032.

Tracking The Federal Deficit: January 2020

The Congressional Budget Office reported that the federal government generated a $32 billion deficit in January, the fourth month of fiscal year 2020. Januarys deficit is a $40 billion change from the $9 billion surplus recorded a year earlier in January 2019. Januarys deficit brings the total deficit so far this fiscal year to $388 billion, which is 25% higher than the same period last year . Total revenues so far in FY2020 increased by 6% , while spending increased by 10% , compared to the same period last year. (After accounting for timing shifts, spending rose by 6% or $90 billion.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first four months of FY2020, revenue from corporate income taxes rose by 27% . Additionally, Federal Reserve remittances increased by 14% partly due to lower short-term interest rates that reduced its interest expenses. On the spending side, after accounting for timing shifts, total Social Security, Medicare, and Medicaid outlays rose by 6% . Outlays for the Department of Defense rose by 7% , largely for procurement and research and development.

Read Also: Can You File Bankruptcy On Taxes

Tracking The Federal Deficit: May 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $63 billion in May 2022, the eighth month of FY2022. This deficit was the difference between $389 billion in receipts and $452 billion in spending, down from a $132 billion deficit in May 2021. In both years, May 1 fell on a weekend, shifting certain federal payments that would have otherwise been paid in May. These shifts decreased outlays by $65 billion in May 2022 and by $60 billion in May 2021. If not for these timing shifts, the deficit in May 2022 would have been $127 billion, $64 billion less than May 2021s deficit without timing shifts. The following discussion excludes the effects of these timing shifts.

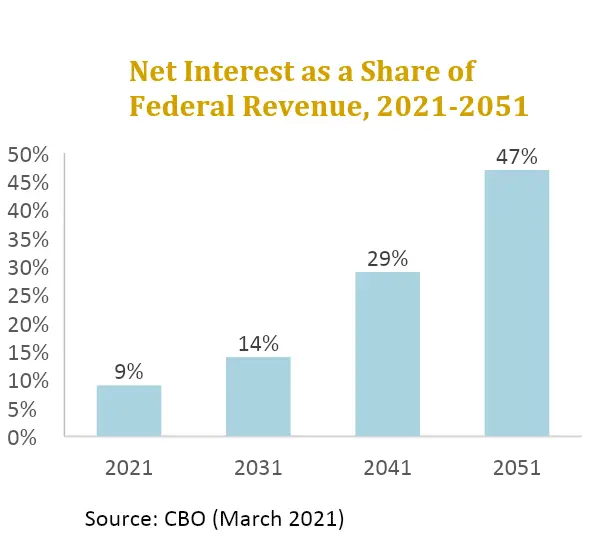

In contrast, outlays for major mandatory spending programs increased by $101 billion . Most notably, Medicaid outlays rose by $47 billion . Enrollment remains elevated because the Families First Coronavirus Relief Act requires states to maintain eligibility of all enrollees for the duration of the public health emergency. Other significant increases in spending included the Food and Nutrition Service , the Department of Education , and the Public Health and Social Services Emergency Fund . Finally, interest on the public debt continues to be one of the fastest-growing pieces of the budget, up by $73 billion fiscal year to date.

Tracking The Federal Deficit: June 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in June, the ninth month of fiscal year 2021. Junes deficit was the difference between $450 billion in revenue and $623 billion in spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.2 trillion, the difference between $3.1 trillion in revenue and $5.3 trillion in spending. This deficit is nearly triple the shortfall over the same period in FY2019 , but is 19% lower than at the same point in FY2020. This is the first time in FY2021 that the cumulative deficit has decreased year-over-year.

Analysis of Notable Trends: Thus far in FY2021, year-over-year comparisons of deficit levels have largely reflected the trajectory of the COVID-19 pandemic and subsequent federal response. BPC expects this trend to continue through the rest of the fiscal year.

Cumulative year-to-date outlays are up 6% compared to the first nine months of FY2020 and are 58% greater than at this point in FY2019. These changes are indicative of continued spending towards COVID-19 relief programsin particular, refundable tax credits and supplemental unemployment compensationas every month to date in the current fiscal year has contained pandemic-related expenditures, whereas only March-June did for the relevant period last year.

Also Check: What Does It Mean When A Bankruptcy Case Is Dismissed

Output And The Labor Market During The Pandemic And Its Aftermath

The speed at which disruptions to supply chains will ease is uncertain. If consumers and businesses return to prepandemic patterns of spending and production quickly, then such disruptions will abate more quickly, and price pressures will ease more quickly, than they otherwise would. But if that transition takes longer than CBO expects, the pressure on those strained supply chains will persist, dampening and delaying consumption and investment and increasing inflationary pressures. If governments abroad relax measures aimed at mitigating the spread of the virus more quickly than the agency expects, then the strain on global supply chains might ease more rapidly. But if governments abroad pursue more aggressive mitigation measures than CBO anticipates, that might further exacerbate disruptions in global supply chains, and production might increase less rapidly than it otherwise would.

In the agencys projections, the magnitude of inflationary pressure resulting from historically low levels of slack in the labor market is highly uncertain. Few periods over the past 50 years have had less slack in the labor market than the agency is projecting for the next few years, making historical comparison more difficult. Little slack in the labor market could cause wages to increase more rapidly than the agency projects, which might lead businesses to raise prices more than expected.

Take Advantage Of Fresh Start To Get Your Student Loans Out Of Default

For borrowers with defaulted federal student loans, the Education Department is offering a one-time opportunity called the Fresh Start initiative that will allow many borrowers to get out of default and restore their loans to good standing. Getting out of default is important not only to avoid damaging outcomes like ongoing negative credit reporting or wage garnishment, but it also may be necessary in order to qualify for some student loan forgiveness programs.

Fresh Start isnt available yet, but it should be by January. You can learn more here.

Recommended Reading: States That Are In Debt

Social Securitys Trust Funds

Social Security provides benefits to retired workers, their families, and some survivors of deceased workers through the OASI program it also provides benefits to some people with disabilities and their families through the Disability Insurance program. Those benefits are financed mainly through payroll taxes that are collected on workers earnings at a rate of 12.4 percenthalf of which is paid by the worker and half by the employer. Of that 12.4 percent tax, 10.6 percentage points is credited to the OASI trust fund and the remaining 1.8 percentage points to the DI trust fund.

Retroactively Extend Certain Expired Tax Provisions

An additional 18 revenue provisions that were in place before the start of the pandemic and that have been extended in the past expired at the end of 2021. Among those expired provisions are ones that provided tax credits for certain producers of clean energy and that allowed certain homeowners to deduct mortgage insurance premiums. According to JCT, if those provisions were retroactively made permanent, the deficit would be $37 billion larger over the 20232032 period. Debt-service costs would add $4 billion to those deficits.

Recommended Reading: Can You File Bankruptcy On Attorney Fees

Cbos Baseline Projections Of Mandatory Spending For 2022 To 2032

In 2022, if there are no changes in law, total mandatory outlays will amount to $3.7 trillion, or 14.9 percent of GDP, CBO estimates, down from $4.8 trillion, or 21.6 percent of GDP, in 2021. Most of that decrease is attributable to waning spending in response to the pandemic. CBO estimates that outlays for certain refundable tax credits will fall by half a trillion dollars from 2021 to 2022. CBO also anticipates significant declines in pandemic-related outlays for unemployment compensation, the Small Business Administration, the Coronavirus Relief Fund, and higher education.

Mandatory outlays are projected to fall in 2023 and 2024 as pandemic-related spending continues to decline. In CBOs projections, after 2024, outlays grow by about 5 percent per year, on average, reaching $5.5 trillion by 2032. As a share of GDP, mandatory outlays follow a similar path, declining to 13.6 percent in 2025 and then rising steadily to 14.9 percent in 2032. By comparison, those outlays averaged 12.7 percent of GDP over the 20102019 period and 10.7 percent over the past 50 years.

States With The Most Debt

1. New York

New York has the highest debt of any state, with total debt of over $203.77 billion. New York’s total assets are around $106.61 billion, giving the state a debt ratio of 273.8%. The main culprit for New York’s towering debt is overspending on Medicaid. New York has attempted to fill budget gaps by cutting school aid and health care costs in recent years.

2. New Jersey

New Jersey has the second-highest amount of debt in the country. The state’s total liabilities total $222.27 billion, surpassing its assets by $198.67 billion. New Jersey’s debt ratio is 441.7%. The largest source of debt is the state’s unfunded pension and benefits system for public employees. New Jersey legislators are looking toward tax increases because of the state’s debt and the growing pressure to fund other priorities such as infrastructure and education.

3. Illinois

Illinois has the third-highest debt in the U.S., with total liabilities equaling $248.67. With total assets of $53.05 billion, Illinois has $187.7 billion in unfunded liability. This creates a debt ratio of 468.7%, the largest in the U.S. To pay that off, every person in Illinois’s 12.7 million population would need to pay $14,780. Like New Jersey, the biggest problem in Illinois contributing to the debt is billions of dollars for retired government workers’ pensions and health insurance benefits.

4. Massachusetts

5. California

You May Like: How Many Years Does Bankruptcy Last