Create A Simple Spreadsheet

The first thing is a place to write down each bank, debt collector, and collection agency you owe money to, and how much you owed them on what date. Most people will use a simple spreadsheet for this. You can put the name of the creditor in column A, the date in column B, and the amount you owe in column C.

Itâs also a good idea to label the type of debt, so you can see at a glance which debts might be governed by different rules for collection purposes. Start by putting the original creditor or information about the debt in column D.

-

Secured debts are debts that have something backing them up like your mortgage or car loan. These are debts where your property could be repossessed by a creditor if youâre unable to make your payments.

-

Unsecured debts arenât backed up by property. Common unsecured debts include student loans, credit card debt, or medical bills.

-

Priority debts include back taxes, child support payments, or spousal support . These debts are labeled as priority debts under the Bankruptcy Code. They canât be discharged in bankruptcy.

Youâll also want to create a column for the contact information for each creditor, including their mailing address and phone number.

Finding A Collection Agency: Part 2

The United States overall mortgage delinquency rate was 5.9% in November 2020. And its not just mortgages that are going unpaid. In every sector, people are failing to make their payments on their debt.

As a business, you know how detrimental unpaid bills can be. It can undercut your margins, wreak havoc on your cash flow, and cause you to consider raising prices and cutting expenses.

Perhaps you need to consider working with a collection agency. Read on to learn how to hire a collection agency that will serve your best interest and protect your good reputation.

Assert Your Affirmative Defenses

Your responses in step one state your denials of the claims made. But you must also list your affirmative defenses that excuse or justify why BAR should lose the case. For instance, if you state the statute of limitations as a defense, it limits the time Bay Area Receivables has to sue you to collect the debt.

If you skip a debt payment, the clock starts ticking towards expiry , and your unpaid debt becomes “time-barred” once the statute of limitations expires. For example, California’s statute of limitations on debt is six years.

Other affirmative defenses to debt collection cases are:

- You do not own the debt account.

- Your debt to the creditor has been canceled, so you are not responsible for it.

- There was a payment or an excuse for the debt.

- A partial payment was made on the debt.

- You were a co-signer but unaware of your obligations.

Now, lets consider another example.

Example: When Todd gets sued by Bay Area Receivables for an old debt in Maryland, he is shocked. After doing some research online, Todd learns that the statute of limitations on credit card debt is only three years in Maryland. He checks the last activity on the debt account and realizes the account has been inactive for almost four years. Todd uses SoloSuit to draft an Answer to the lawsuit, where he uses the expired statute of limitations as an affirmative defense. The case gets dismissed, and Todd is off the hook!

Recommended Reading: How Does Bankruptcy Affect Your Job And Future Credit

Is The Collection Agency Reputable

Reputation is everything. Thats particularly true with collection agencies. They are reaching out to your clients on your behalf. If they are rude and unprofessional, it hurts your reputation.

Following these tips can provide some assurance that you that youre hiring a reputable and effective collection agency:

- Poll your attorney, accountant or business associates to find out what agencies theyve used and why.

- The Association of Credit and Collection Professionals, otherwise known as ACA International, manages a directory of members that are licensed in your state. ACA International members are required to adhere to specific standards.

- The Better Business Bureau manages a database of complaints and rates businesses based on feedback from consumers. If the collection agency has one or two complaints against it, it may not be a big deal, but if multiple complaints say the same thing, it should raise a red flag.

- Select a collection agency that is licensed and/or bonded in your state and the states where your customers live.

- Check with the collection agency to see that it has errors and omissions liability insurance. E& O insurance covers the collection agency from consumer complaints of improper conduct, such as harassment. In many cases, that coverage extends to your business. E& O insurance is not required by federal or state laws, but its a sign of good faith.

Understand Your Rights When Dealing With Debt Collectors

In accordance with the Fair Debt Collection Practices Act , The Federal Trade Commission makes sure that certain debt collection laws are followed by all debt collectors. Its important to know what these laws are so that you know if your rights are being violated by a debt collector. All debt collectors must follow these rules:

If you feel like any of your debt collections rights are being violated, you should report the debt collector to the , the Consumer Financial Protection Bureau or your state attorney general.

Don’t Miss: How Long Does Bankruptcy Stay On Your Credit File

You Didnt Receive A Letter In The Mail

If a debt has gone to a debt collector, you should receive formal, written notification in the mail. If youre contacted by someone who you suspect is a scammer, ask them for verification of the debt. This is a letter that all debt collectors are required to send within five days of first contact with a consumer.

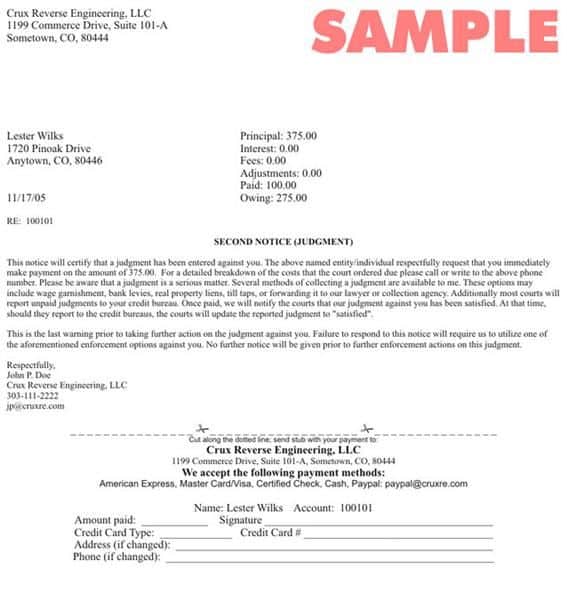

The letter should disclose:

- The debt amount in question

- The creditor who is owed the debt

- A disclosure statement giving the consumer 30 days to dispute the debt.

When you do receive such letters, hold on to them. You can refer to them should a scammer contact you.

How To Start A Collection Agency

In order to start, it is important to follow the steps mentioned below.

1. Understand the pre-requisites of opening a collection agency

The legal requirements vary significantly based on the state in which one intends to operate each state has its own unique requirements. Firstly, they should register within their own state. Later it can register and possibly get licenses in other states too.

2. Learn about the various debt collection laws

There are plenty of laws that govern the actions of a collection agency, and each state has different rules and regulations. So, one needs to do the necessary research to learn about the various debt collection laws. Some of the major federal laws that a collection agency must comply with include Gramm-Leach-Bliley Act , Telephone Consumer Protection Act , Health Insurance Portability and Accountability Act , Fair Credit Reporting Act , and Fair Debt Collection Practices Act .

3. Plan out capital and operating expenses

The prospective collection agency must plan and arrange the capital required to make it through the initial phase. After that, it needs to plan out the operating expenses for the first 2-3 years basic office supplies, salaries, and other operating expenses. Further, costs of registration, obtaining necessary licenses & bonds, marketing, and securing clients should also be factored in the expenses. The costs would vary based on the number of states one intends to operate in.

Also Check: Where To Pay Collections

Asking The Original Lender

The lender you originally had the account with may be able to tell you which collection agency purchased or otherwise acquired your account. However, it’s also possible the account has been transferred to a third agency, and in that case, your original lender is unlikely to be of assistance.

Before paying, ask the debt collector to send proof of the debt in the form of a written debt validation letter.

It’s also possible the original lender will not accept payment from you or even discuss the account with you. Once a lender sells a debt, there’s often very little they can do to settle the account. To make a payment, you’ll likely need to contact the collection agency to find out what you owe and how to pay the balance.

Check Your Voicemail Or Caller Id

If debt collectors call you and you dont pick up, they may leave voicemail messages explaining which agency they represent and how to contact them.

If all they say in the voicemail is the company name, search for it in this list of common debt collection agencies to find out everything you need to know about your debt collectors, including whether theyre legit and how to contact them.

Another way to track down the debt collection agency is to get their phone number from the voicemail message or your caller ID and enter it into a search engine. Other people may have posted online about receiving debt collection calls from this number.

Recommended Reading: Bankruptcy Attorneys In Panama City Florida

What Going Into Collections Means

Depending on the type of debt owed, collections can affect you in different ways. If your debt is unsecured, such as credit card debt, and you default on your payments with that debt sent to collections, the credit card company would stop trying to collect the debt from you. Instead, the collections company that your debt was sent to, would pursue the debt and try to collect money from you. If your debt was secured, such as an auto loan and you default, then the lender might repossess your car, sell it at auction, and sell the remainder of debt you owe to a collections company. Lenders can collect money from debt in the following ways:

- Contact you on their own and ask for payment using their internal collection department.

- Hire a collection agency to try and collect.

- For revolving debt, such as credit card debt, the credit card company could sell your debt to a collection agency, which would then try to get the money from you.

- For installment loan debt, such as an auto loan, the lender may repossess the car, sell it auction, and then sell the remaining debt to a collection agency.

The federal Fair Debt Collection Practices Act strictly regulates how debt collectors can operate when trying to recover a debt. For example, they can’t threaten you with imprisonment or make any other kind of threat, if you don’t pay. However, they can and typically do report the unpaid debt to credit reporting agencies.

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Read Also: Pre Foreclosure Homes Zillow

Check Out The Reputation Of The Collection Agency

A collection agency will contact customers on your behalf. The way they treat your customers could hurt your image. That is why it is vital to choose account collection services that are reputable and professional.

One of the best ways to be assured that you are hiring the best collection agency is to partner with an organization that has credentials to prove its reputation.

For example, look for a company that is accredited by the Better Business Bureau. Accreditation by the BBB means that the business meets strict standards, including a commitment to resolve customer complaints.

The BBB has a database of complaints and ratings for businesses based on feedback from consumers. You will want to review the rating, comments, and complaints about any agency you are considering partnering with.

Another option is working with companies that are members of ACA International. ACA International members must adhere to specific standards.

Browser And Assistive Technology Compatibility

We aim to support the widest array of browsers and assistive technologies as possible, so our users can choose the best fitting tools for them, with as few limitations as possible. Therefore, we have worked very hard to be able to support all major systems that comprise over 95% of the user market share including Google Chrome, Mozilla Firefox, Apple Safari, Opera and Microsoft Edge, JAWS and NVDA , both for Windows and for MAC users.

Read Also: How To File Bankruptcy In Mississippi

What Debt Repayment Agencies Do

A debt repayment agency is a business that charges a fee to act for you in negotiating or making arrangements with creditors for you to pay what you owe. This is a voluntary agreement between the debt repayment agency and your creditors.

A creditor does not have to accept your payment proposal. Even if a creditor accepts your payment proposal, it can be cancelled if you do not abide by all the terms of the agreement. The creditor can then resume collection activity on your debt.

The agency must tell you within 30 days of being informed by a creditor that the creditor has decided not to participate in or has withdrawn from a debt repayment program.

For more information about how debt repayment agencies work, see the Bill Collection and Debt Repayment tipsheet.

What A Collection Agency Can Do

Collection agencies collect unpaid debts or locate debtors for others.

A collection agency or collector must:

- be licensed in Alberta

- use the name that is shown on their licence in all contacts and correspondence related to their collection activities

- provide you with information about the original creditor and current creditor of the debt and any details of the debt

- disclose in writing the fee the agency will charge for a non-sufficient funds cheque before the submission of the cheque

- provide a receipt for all cash transactions and payments made in person or at your request

- give you an account of the debt if you ask for it

- the accounting must include details of the debt

- agencies only have to give you this information once every 6 months

- if the agency cannot provide the accounting within 30 days from the request, they must cease collection activity until they can

A collector can:

- contact you at home between 7 am and 10 pm Alberta time

- contact your spouse, adult interdependent partner, relative, neighbour, friend or acquaintance to request your residential address, personal or employment telephone number

- contact you at work to discuss your debt unless you ask them not to

- if you dont want to be contacted at work, you must make other arrangements to discuss the debt and you must keep those arrangements

Don’t Miss: How Much Does Filing Bankruptcy Lower Your Credit Score

Owing Money To A Bank

If you have an overdue debt owing to a bank, the bank can use its right of set-off to recover the money. The right of set-off allows a bank to withdraw money from your accounts to pay your overdue debt. The bank does not have to give you notice or ask your permission before taking this action. The bank does not have to ask the permission of the court.

Banks may use their right of set-off to collect overdue payments on credit cards, loans, overdrafts or lines of credit. A bank may withdraw money that you have on deposit in any of its branches and apply it to your debt. The bank does not have to leave any money in your account.

How To Obtain Addresses For Collection Companies

Obtaining addresses for collection agencies can be challenging considering the nature of the industry. Collection accounts are constantly being purchased between collection agencies, which can make it difficult to locate the collection account necessary to resolve any issues you may have. Track down the collection agencies with a few basic strategies.

1.

Obtain a copy of your credit report. You can obtain your credit report by going online to Equifax.com, Transunion.com or Experian.com. You also have the option of contacting the credit bureaus over the phone or via mail. It is important that you obtain all three credit reports to cross reference pertinent collection agency information.

2.

Find out if the collection agency you are looking for still holds your account. You will know which collection agency has the account in question by looking at the status on your credit report. If the status line says “transferred or purchased by another agency,” that means the collection agency no longer has your account. Also look at the dates open on your credit report. This lets you know how long the collection agency has had your account. You can contact the old collection agency and they may give you the information on the new collection agency.

References

Don’t Miss: How Long Do Bankruptcy Restrictions Last

If A Creditor Sues You

A creditor has the option of suing you in the Civil Division of Provincial Court or the Court of Kings Bench.

If you are sued, you will be served with a civil claim. Dont ignore the claim.

If you are served with a civil claim:

- talk to your creditor

- file a dispute note

If you receive a civil claim in Alberta, you have 20 calendar days from the time you are served to file the dispute note. If the claim is served on you outside Alberta you will have one month to respond.

If you do not file a valid dispute note within the required time or appear in court on the day of the hearing, the court will award the creditor with a judgement against you.

Once a judgement is granted the creditor can take several steps to get the money that you owe: