American Credit Card Debt Statistics And Key Findings

- Average American family credit card debt: $6,270

- Total outstanding U.S. consumer debt: $4.2 trillion

- Total credit card debt: $807 billion

- 45.4% of families carry some sort of credit card debt.

- Families with the lowest quartile of net worth hold an average of $4,830 in credit card debt, although only 44% have card debt.

- The West holds the highest average credit card debt, averaging over $7,000.

Consolidate Debt With A Personal Loan

If you have a large amount of debt, consolidating it with a personal loan can be a good alternative to balance transfers that may not cover your total balance. And depending on your credit score, you may qualify for a loan amount that will cover your entire balance.

A personal loan provides you with a fixed amount of money over a fixed time period and at a fixed interest rate. While interest rates for personal loans are rarely 0%, they’re often lower than keeping a balance on your current credit card.

Financial Situation Changes Over The Past Year By Household Income

| 32% | 26% |

Aside from an overall decrease in household income and an overall increase in expenses, some of the top reasons why some Americans finances have gotten worse are a specific, unexpected large expense and job loss .

Meanwhile, Americans whose household finances have gotten better over the past 12 months report opposite experiences. More than half of those with better finances say its because their household income increased overall, and 24% say its because their household expenses decreased.

Recommended Reading: Can You Declare Bankruptcy On Credit Cards

% Of Americans Believe It Will Take More Than 2 Years To Pay Off Their Credit Card Debt

Although 39% of Americans believe they will be able to pay off all of their credit card debt at some point in the next year, a good portion think it will take two years or longer. Twenty-four percent believe it will take a couple of years, 5% believe they will be able to pay off their debt within five years and 3% believe they will never pay it off.

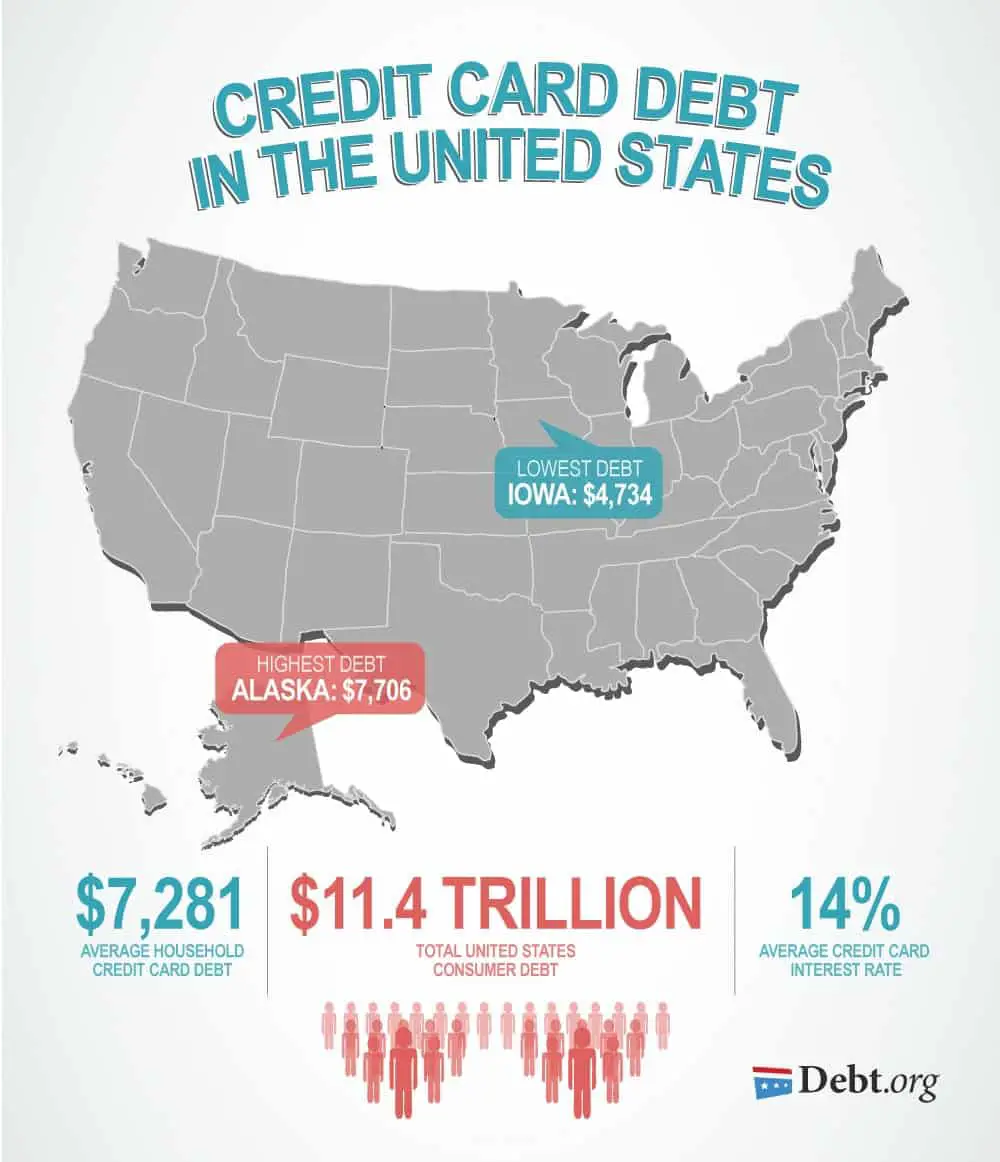

Which States Residents Have The Most Credit Card Debt

LendingTree analysts reviewed anonymized January and February 2021 credit report data from more than 1 million LendingTree users to calculate these averages and create a list of states with the most debt.

Overall, the national average card debt among cardholders with unpaid balances was $6,569. That includes debt from both bank cards and retail credit cards.

The four states with the most debt were all on the East Coast, while the three lowest were found in the South. There was a major difference in balances between the states at the top and bottom of our rankings, with New Jersey cardholders owing $7,872 and Kentuckys owing $5,441. That means the average New Jersey balance is 45% higher than the average balance in Kentucky.

Also Check: How Do You Recover From Bankruptcy

How Can I Reduce Credit Card Debt

The best way to reduce a current debt balance is to increase your monthly payments. This helps pay off more of your balance instead of just covering interest, and reduces the interest you pay each month, too.

The snowball debt repayment method is a popular way to manage multiple accounts by paying as much as you can afford on your lowest debt balance while paying the monthly minimum on other accounts.

This lets you see your repayment progress on the lowest account, encouraging you to continue repayment until the debt is cleared another motivator to continue maximizing repayment.

In addition to paying down existing debt, you need to adjust your finances to avoid taking on any additional debt. This includes funding an emergency savings account and creating savings goals for large purchases youd otherwise charge to your card.

An effective budget can help you prioritize savings and track where youre excessively spending. Once youve built a budget, you can confidently enroll in auto payments for your monthly expenses, knowing that the cash is available. This reduces your risk of late fees and credit penalties.

That extra spending money is also an opportunity to invest in your future with assets like annuities or mutual funds that can help you grow your wealth.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Filing Bankruptcy Chapter 7 Colorado

College Students And Credit Card Debt

Young Americans tend to have the least amount of credit card debt of all generations, but they also tend to have less income than older generations. This means a few small purchases can become expensive financial burdens as interest payments grow month over month.

Smart spending early in life can have significant benefits for future financial health. Debt can become a cycle as monthly repayments make it difficult to save, so emergency expenses or even lifestyle costs encourage individuals to continue relying on credit.

When students cover their necessary expenses with credit cards and pay off the complete balance each month, they benefit from improved credit scores and credit card rewards without overpaying on interest.

The difference between these two scenarios is intentional spending and proper budgeting. You should know how much you can afford to spend each month and limit your credit use accordingly.

College students who have already accumulated credit card debt should prioritize repayment before they graduate and are faced with student loan repayment, too.

How Much Credit Card Debt Do Americans Have

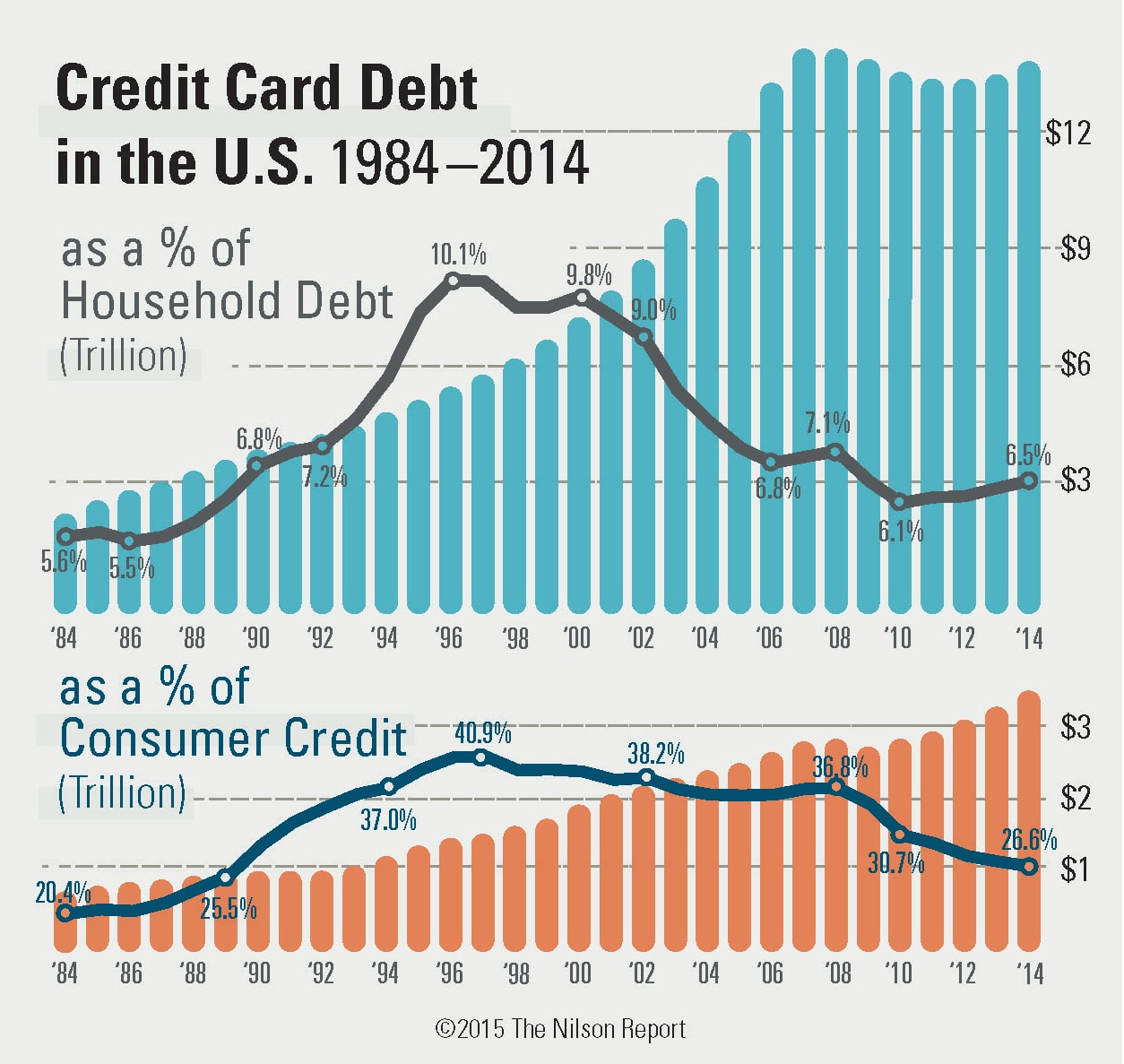

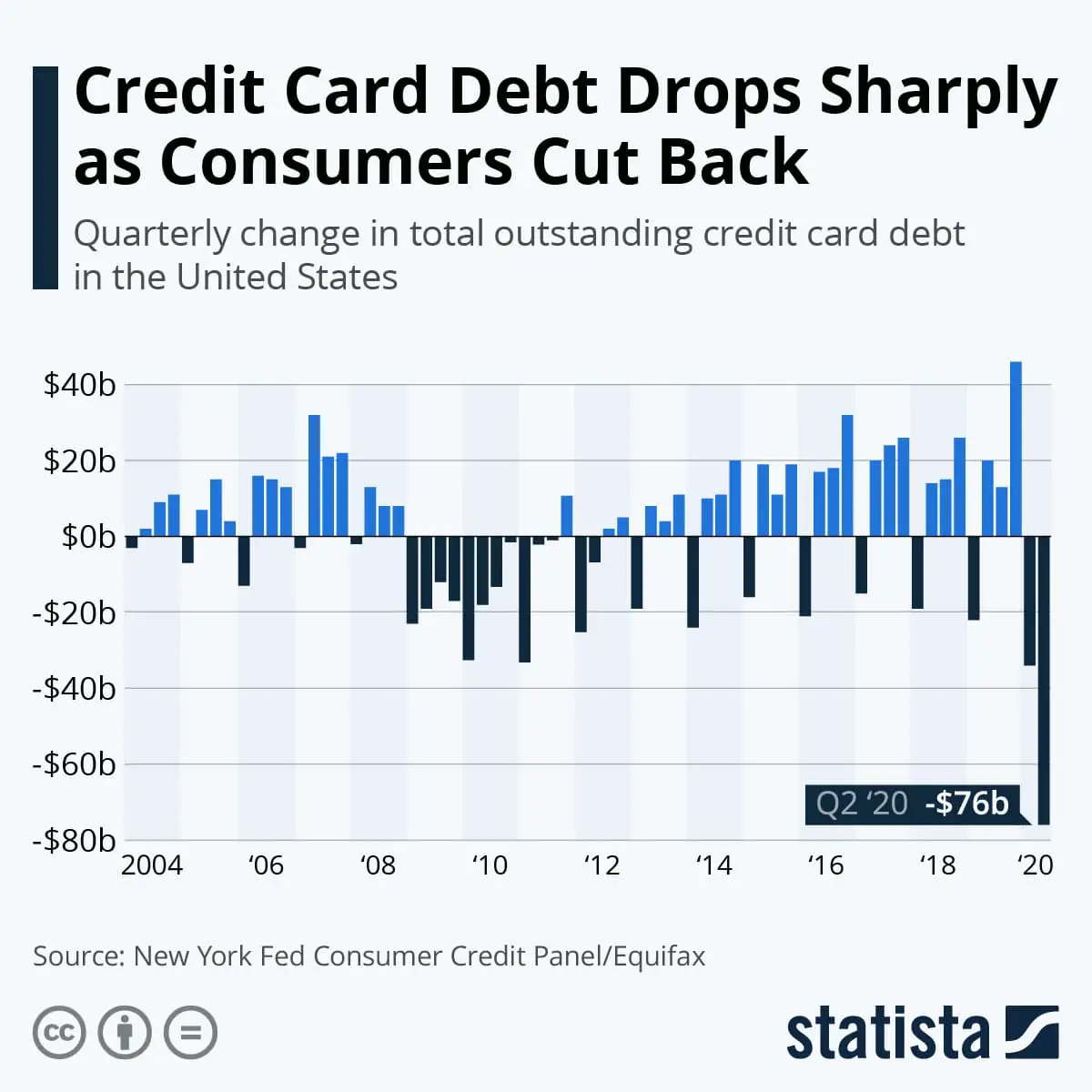

Since the second quarter of 2021, credit card balances have risen by $100 billion. Thats a 13% increase, the largest year-over-year jump in more than 20 years.

With the increase, Americans credit card debt stands $40 billion below the record set in the fourth quarter of 2019, when balances stood at $927 billion. Thanks to rising interest rates, stubborn inflation and myriad other economic factors, its likely a matter of time before credit card balances surpass the 2019 record.

Though balances arent quite at record levels yet, theyre still light years above the $480 billion seen more than 20 years ago in the first quarter of 1999.

Card debt showed hockey-stick growth until the financial collapse in 2008, when balances fell from $866 billion in the fourth quarter of 2008 to $660 billion in the first quarter of 2013. But, as you can see in the chart below, the hockey stick returned.

Then, when the pandemic took hold in 2020, credit card balances plunged again from $927 billion in the fourth quarter of 2019 to $770 billion in the first quarter of 2021. But again the hockey stick returned, thanks to a massive spike in the fourth quarter of 2021.

You May Like: Is It Bad To File For Bankruptcy

Negotiate With Your Credit Card Company

If youve already missed a payment or are about to, reach out to your credit card issuer. The company may be willing to work out a more manageable repayment plan for you. Some offer forbearance or hardship programs that could reduce your monthly payment or postpone a certain number of payments. You may even be able to settle your debt for a lower amount if the company determines that you arent able to pay back the full amount.

If you are able to work out an alternate repayment plan with your creditor, be sure to ask for the plan in writing.

Consider A Personal Loan To Consolidate Credit Card Debt

Consolidating your credit card debt into a personal loan may help you pay your debt off faster. With a debt consolidation personal loan, you make a single payment each month, and your interest rate is fixed, meaning it wont change based on an index. Another benefit: Interest rates on personal loans tend to be lower than credit card rates. This can help lower your overall monthly payment and/or allow you to pay down your debt more quicky.

Take note that personal loans may come with fees, such as an origination fee or paperwork processing fee. Consider these fees when determining whether you might be able to save money with debt consolidation.

You May Like: Houses For Sale Newr Me

Average Credit Card Interest Rates

The average on interest-bearing accounts is 16.4% as of 2021, but that will likely increase a considerable amount due to interest rate hikes in 2022.

Interest-bearing accounts include all credit cards that charge interest. It excludes credit cards that aren’t charging interest at that time, so 0% intro APR credit cards don’t count until the introductory period ends.

| Year |

|---|

Pay Down Existing Debt Now

A balance transfer credit card is a great tool to pay off your debt. Even if you cannot pay the balance before the introductory period ends, it can put a huge dent in your credit card debt if youre paying as much as possible each month, says Harzog.

Even small rate APR increases can result in more debt, which a balance transfer can help you offset. For instance, say you have the average $5,525 debt balance on a card with the average 16% variable APR.

Heres a breakdown of how much youll pay if you make a 3% minimum payment with your current interest rate over time, compared to how much more you may pay if your rate increases by 0.75%. Youll also see the result of using a balance transfer card with a 21-month intro period and 3% balance transfer fee, paid off before interest kicks in.

| Current Average APR |

|---|

Read Also: Does Chapter 13 Bankruptcy Stop Garnishment

The Best Ideas For You To Build Wealth

A members-only investing club that helps you grow your portfolio with real-time trade alerts, analysis of major market events, and key opportunities.

- Real-Time Trade Alerts

- 24/7 Access To The Portfolio

- Portfolio Price Targets

The average credit card interest rate is 17.5%, which can go up to 18% or 18.5% depending on what the Federal Reserve does, Solomon added. So credit card consumers really have to pay attention.

What Percentage Of Credit Card Accounts Carry A Balance

Americans carried a balance on 54% of all active credit card accounts in the first quarter of 2022, according to the most recent available data from the American Bankers Association.

Job No. 1 for anyone with a credit card is to pay off that balance in full at the end of each month. But we all know that life happens, and that means that its not always possible to pay off your credit cards each month.

Unfortunately, most people with an active credit card account dont always pay their bills in full. More than half of all active accounts carried a balance in the first quarter of 2022. This is the third straight quarter in which that percentage has increased. However, that percentage had fallen significantly during the pandemic, dropping from a high of 60% in the first quarter of 2019 to as low as 51% in the second quarter of 2021.

If you look at all credit card accounts, the American Bankers Association data shows that 41% of accounts were active and carried a balance at some point in the first quarter of 2022, 36% of accounts were active but didnt carry a balance and 24% of accounts were dormant for the quarter.

Read Also: Legit Debt Relief Programs

How Interest Rates Affect Your Credit Card Apr

The Feds decision to increase its target rate is meaningful for cardholders because the prime rate which most credit card variable APRs are based on is tied to the federal funds rate. When the prime rate goes up, credit card interest rates do, too.

If you pay your balance on time and in full each month, avoiding interest, an APR increase may not mean much.

But if youre already carrying a credit card debt balance, a higher APR can prolong the amount of time it takes to pay it off, and the total interest youll pay over that time especially if you have less-than-stellar credit. If your cards variable APR is between 16% and 24%, youre most likely to get the lower end of that range if you have excellent credit. If you have a lower score, you may pay the higher end of the variable rate.

Why Do Midwesterners Have The Least Credit Card Debt

If you break the U.S into regions, theres one trend worth noting. Consumers living in the midwest tend to have the least amount of credit card debt. Consumers in Iowa, Wisconsin, North Dakota, Minnesota, Michigan, and Indiana have debt ranging from $7,382 in Michigan to $6,726 Iowa.

Whats going on in the Midwest? Why does this region have some of the lowest credit card debt? For starters, midwestern states have strong economies and low cost of living. Consumers in the region are also a bit more frugal than others, and are even embarrassed to admit they have credit card debt, says . In short, there are a lot of factors at play, both on the state and personal level.

Also Check: Chicago Bankruptcy Law Firms

Us Credit Card Debt Keeps Climbing

- Publish date: Sep 20, 2022 2:50 PM EDT

Financial debt is to consumers what an interception is for NFL quarterbacks a big step backward, only on the wrong side of the financial gridiron.

Yet thats exactly where a growing number of U.S. credit card consumers find themselves in the second half of 2022, with plastic debt a burgeoning problem.

CreditCards.com has the goods, with a new study showing 60% of U.S. credit card debtors saying theyve been in card debt for at least a year. Thats up from 50% in 2021, the report noted.

Overall, nearly half of credit cardholders carry credit card debt from month to month. 40% of credit card debtors have been in debt for at least two years , 28% for at least 3 years and 19% for at least five years, CreditCards.com reported.

The biggest household credit card debt culprit is emergency expenses. 46% of survey takers cited an emergency/unexpected expense, including an emergency/unexpected medical bill , home repair , car repair , or some other emergency/unexpected expense , as the major reason for rising debt.

Next came daily household expenses. 24% of credit card holders said day-to-day expenses, such as groceries, child care, and utilities, have plunged them into deeper credit card debt.

How To Get Out Of Credit Card Debt

As we’ve seen from these statistics, owing money to your credit card issuer is common. Many American credit card holders have expensive balances that are costing them interest charges every month.

If you’re in this situation, here are some methods to consider that can help you get out of credit card debt:

Also Check: Foreclosures In Jacksonville Fl

Reducing Your Credit Card Debt

During the pandemic, Americans did a great job of reducing their overall debt, especially when it came to credit cards. But now that life is back to normal, some ugly financial habits have once again reared their head.

Total credit card debt in the United States in the second quarter of 2022 rose 14% versus year-ago levels. According to a WalletHub study, the average credit card debt per household now stands at $8,942. This debt is financially crippling some families and adding tremendous stress. Here are some ways to lower your credit card debt.

How to pay off some of that stressful credit card debt

getty

Pay More than the Minimum Payments

Paying just the minimum amount each month on any type of debt, especially high-interest debt, is never a good idea. Interest on credit cards is extremely high when compared to home or car loans because credit card debt is a short-term loan that is unsecured. The average credit card debt is now almost 19%, so it is crucial to pay more than the minimum amount each month. You will likely save hundreds of dollars over the life of the debt just by paying more than the minimum. Evaluate what you can afford to pay toward your credit card each month, and you’ll start to see noticeable declines in the amount owed.

Ask for a Lower Interest Rate

Make Sacrifices to Free Up More Income

Use a Cash Back Card

Consolidate Your Credit Card Debt

Pay Your Credit Card Bills on Time Each Month

Make Credit Card Payments Every Two Weeks

What Do Interest Rates On The Average Us Credit Card Look Like

The average credit card interest rate sits below 15%

Most credit cards feature some form of fees

US consumer credit scores have grown since the pandemic

Read Also: National Debt Real Time