How Debt Discharge Works In Ga Chapter 7

Discharge means the judge eliminates the legal obligation to repay unsecured debts. Dischargeable unsecured debts usually include medical bills, payday loans, signature loans, and credit cards.

A bankruptcy judge can only discharge a debt. A judge cannot erase the debt itself or reverse the collateral consequences of debt. So, if the IRS files a lien against Tony because he has back taxes before he filed bankruptcy, that lien remains, even if the judge discharges the tax debt.

Speaking of back taxes, these obligations are priority unsecured debts. They are only dischargeable in certain situations. Other priority unsecured debts include past-due child support and student loans.

Chapter 7 filings usually remain on your credit history for ten years. However, the effects usually fade within a few months, if former debtors work to improve their credit scores. For example, to demonstrate responsible credit use, many former debtors charge items on credit cards and pay the balance in full every month.

Chapter 7 gives your family a fresh financial start. For a free consultation with an experienced Athens bankruptcy lawyer, contact Morgan & Morgan, Attorneys at Law, P.C. Convenient payment plans are available.

Recommended Reading: How To Declare Bankruptcy Without A Lawyer

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much Does It Cost To File Bankruptcy In Texas

Bankruptcy allows indebted consumers and businesses to make a fresh start.

However, this start will come at a price.

At Simer & Tetens, we receive many calls from the public, and one common question is, How much does it cost to file for bankruptcy?

Below, our experienced Texas bankruptcy attorneys review the costs to file bankruptcy.

Read Also: How Much Do Bankruptcy Trustees Make

Benefits Of Chapter 7

Chapter 7 is especially powerful because it allows you to get a fresh start immediately by erasing most major types of debt like credit card debt, medical bills, personal loans, and more.

Once you file, you will be protected from creditors. This means a stop to harassing phone calls, wage garnishments, collections letters, and lawsuits. Temporary stops are even put on evictions, foreclosures, and repossessions.

When your debts are discharged, you are not obligated to pay your unsecured debt. If you are eligible to file, then your debt discharge will most likely be approved and you will be able to keep most of your belongings as well!

How To Save Money On Bankruptcy Costs

Although everyone who files for bankruptcy protection has unmanageable debts, some applicants are worse off than others. Be sure to fully document your financial situation before consulting a bankruptcy attorney. If you are unemployed, a low-wage earner, disabled or elderly, you might be able to use these low cost bankruptcy options.

Bankruptcy is a hard step to take and recovering from it isnt easy. Though a successful Chapter 7 petition will discharge your debts, it will remain on your for 10 years, affecting your ability to get a loan or any type of credit. A Chapter 13 resolution might not be as damaging, but it will require that you stick to a repayment plan for three to five years, even if the court reduces your debts.

Given the consequences of bankruptcy, an open discussion with an attorney about his or her fees can help. Obviously, if there are impediments to rebuilding your finances after bankruptcy such as a disability or your advanced years, that is relevant, and an attorney might be willing to reduce fees to mitigate the damage bankruptcy is certain to cause.

As we noted earlier, in most Chapter 7 and Chapter 13 instances, bankruptcy attorneys charge a flat fee, meaning they will tell you before starting work on your case what it will cost. In Chapter 7 cases, theyll want the money up front in Chapter 13, they often demand just a portion of the fee to start the case and will take the remainder through the court-approved Chapter 13 plan.

Recommended Reading: How To File Bankruptcy In Idaho

Voluntary Versus Involuntary Bankruptcy

As a threshold matter, bankruptcy cases are either voluntary or involuntary. In voluntary bankruptcy cases, which account for the overwhelming majority of cases, debtors petition the bankruptcy court. With involuntary bankruptcy, creditors, rather than the debtor, file the petition in bankruptcy. Involuntary petitions are rare, however, and are occasionally used in business settings to force a company into bankruptcy so that creditors can enforce their rights.

Chapter 13 Attorney Fees

Attorney fees for a Chapter 13 bankruptcy tend to be more expensive than attorney fees for a Chapter 7 bankruptcy case. There’s a much greater workload associated with filing a Chapter 13 case.

Unlike Chapter 7 bankruptcies, which usually take around four months to complete, Chapter 13 cases are open for 3 to 5 years. Plus, Chapter 13 bankruptcies are more complex and must include a proposed repayment plan specifying which creditors will be repaid and by how much, which requires court approval.

It isn’t necessary to pay all of the attorney fees upfront in a Chapter 13 case as it is in a Chapter 7 case. Usually, a Chapter 13 bankruptcy lawyer will require a portion of the attorney fees be paid before filing the case. The remaining attorney fees will get paid through the Chapter 13 plan. The filer will make a monthly payment to the trustee, who will then make payments to the filer’s creditors â including their attorney who filed the case. Outstanding attorney fees at the time of filing are not paid in addition to the plan payment, they’re part of the plan payment.

Lawyers can ask for priority to receive full payment before certain other creditors. This helps attorneys be more willing to file Chapter 13 cases before full payment of attorney fees because it minimizes the risk of not being paid if the filer later stops making plan payments.

Recommended Reading: Average Credit Card Debt Usa

Heres A Breakdown Of The Cost:

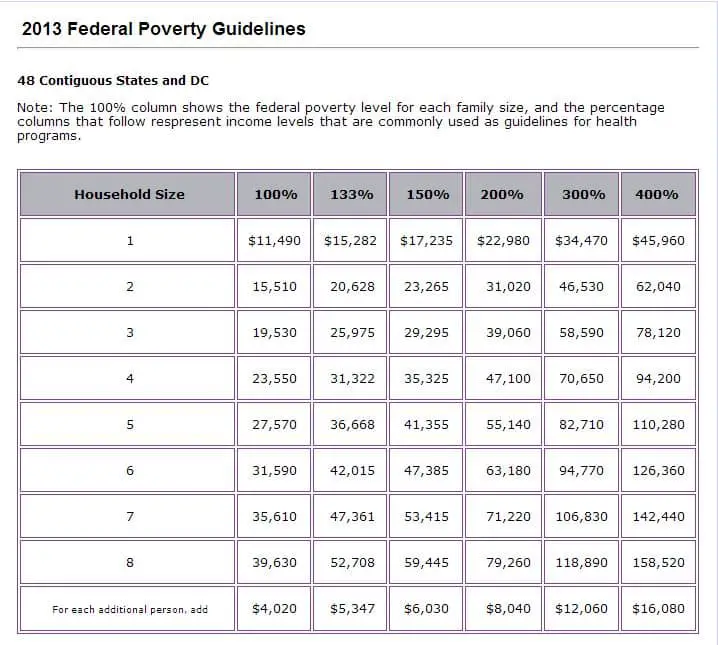

You can request that your Chapter 7 bankruptcy filing fee should be waived. However, what determines whether your request will be granted or not is your income. To get a fee waiver, then the income for your household should be below %150 of the government stipulated poverty line as at the time youre filing for a discharge.

However, if your income does not fall below the requirement for a fee waiver, then you should request an instalment payment. Before youre allowed to make an instalment payment, then you must fill the form that allows you to pay your filing fee in instalments. In an instance where the bankruptcy court approves your instalment request, then you must make all payments in four instalmentsat most. Also, you wont be issued your bankruptcy discharge certificate if you havent paid your filing fee in full.

Bankruptcy Cost Of Credit Counseling And Debtor Education

Since 2005, in order to get a discharge of your debts youll have to complete both a credit counseling and debtor education course. Ill save the particulars of how it works for another post but most approved courses charge between $20-$50. Just like most things, some places will rip you off and some might be free if you qualify. Please dont spend more than $10, however, on a debtor education course before calling us. Well be able to refer you to a couple approved places will keep your bankruptcy cost to a minimum. 237-7979

Read Also: Filing For Bankruptcy In Az

How To Find Bankruptcy Attorney Costs In Your Area

The attorney fees above are just averages, and, as we noted, fees quite possibly have increased since the Martindale-Nolo survey was conducted. Plus, they differ from region to region so it might be difficult to get a sense for a fair going rate where you live.

Given the consequences of bankruptcy, its wise to weigh the following considerations and steps to make finding bankruptcy attorney costs more clear.

Remember, not all bankruptcies are the same. Those with complicated cases might benefit from an experienced bankruptcy lawyer. If creditors challenge your financial statements and allege fraud, having an attorney able to navigate a complex case would benefit you. The same would be true for cases springing from medical debt, a fairly common culprit in bankruptcy filings.

How Much Does Bankruptcy Cost

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Bankruptcy costs include court filing fees, credit counseling course fees, and if you hire a bankruptcy lawyer, attorney fees. The total cost will largely depend on your financial situation, the complexity of your case, and whether you file Chapter 7 or Chapter 13 bankruptcy.

Written byAttorney Jenni Klock Morel. Legally reviewed byAttorney Andrea Wimmer

Chapter 7 bankruptcy provides relief for individuals and businesses that have no hope of ever repaying their debts. Thatâs why it seems strange to some that there are actual costs involved to get this relief. Keep in mind, though, that everyoneâs case is different and someoneâs inability to pay their debts as they come due does not necessarily mean that they canât pay the costs of filing a Chapter 7. Letâs take a look at what they are.

Bankruptcy costs include court filing fees, credit counseling course fees, and if you hire a bankruptcy lawyer, attorney fees. The total cost will largely depend on your financial situation, the complexity of your case, and the type of bankruptcy you file .

You May Like: How To Handle Debt In Collections

Bankruptcy Court Filing Fees

The bankruptcy court filing fee for Chapter 7 bankruptcy is $338. Itâs due when the bankruptcy petition is filed, unless the court grants an exception to this rule.

Since Chapter 7 bankruptcy is only available to consumers who pass the means test, the bankruptcy laws provide two exceptions to this requirement.

-

Paying the fee in installments

How Much Does Filing Bankruptcy Cost In Dallas And Fort Worth

It is important for you to know that we care about your concern related to how much to file bankruptcy. We work with our clients to find an affordable solution to their debt problems. Please contact our office to discuss how we can work with you on the payment of attorney fees to make filing bankruptcy affordable and practical.

When you need to know how much does it cost to file for bankruptcy, call Leinart Law Firm for a free consultation with a Texas bankruptcy lawyer in Dallas or Fort Worth. Contact our law firm by calling 232-3328 or 426-3328.

Free Bankruptcy Evaluation

Discuss your situation and your options with an experienced bankruptcy lawyer.

Your privacy is important to us. We’ll never share your information.

Schedule a FREE, no-obligation consultation and evaluation today.

Read Also: When Did Toys R Us File For Bankruptcy

Chapter 7 Bankruptcy For Llcs: Everything You Need To Know

By Maddy Teka, Esq. | Reviewed by Bridget Molitor, J.D. | Last updated June 30, 2021

If your limited liability company is going out of business due to financial challenges, or has a lot of business debts, filing for a Chapter 7 bankruptcy may be a good option for you.

When an LLC files for bankruptcy, a trustee will step in to liquidate the remaining business assets, which will then be used to pay creditors.

We Offer Exact Fees No Extra Charges And Payment Plans

In the initial free consultation, you will be quoted anexact fee for representation in the case. The fee quoted covers the entire bankruptcy representation, except for rare circumstances which will be explained if applicable to your case. We donât add additional fees for services such as phone calls, letters, the number of creditors you have, reaffirmation agreements, etc. You will know the exact fee for your case after the free consultation. Also, our firm offers payment plans to allow you to get your case filed as quickly as possible.

Don’t Miss: Homes Up For Auction

Chapter 7 Bankruptcy In Ga

Chapter 7 bankruptcy can be a very valuable tool for some people. It allows those who qualify to ask the courts to forgive their debt so they gain an important fresh start. Yet, it also comes with some limitations. To determine if you will benefit from filing Chapter 7 bankruptcy in GA, focus first on your financial struggles and how well this type of change can enhance your financial future.

Filing Fees And Required Courses

First off, bankruptcy filers must pay a filing fee. For a Chapter 7 case, the fee is $335. For a Chapter 13 case, the fee is $310. The Bankruptcy Trustee may charge a fee of $15 to $20 when you file, as well. You may request to pay the filing fees in installments most courts will allow it if you can show it would be a financial hardship to pay all at once.

If you file under Chapter 7 and later convert to Chapter 13 , you wont have to pay any extra fee. However, if you file under Chapter 13 and later convert to Chapter 7 youll have to pay a conversion fee of $25.

Aside from the filing fees, youll be required to obtain credit counseling and take a personal financial management course. That generally costs anywhere from $20 to $100, depending on where you file.

Read Also: When Can You Refinance After Bankruptcy

How Much Does It Cost To File Chapter 13

In emergency situations such as a garnishment, we can file your Chapter 13 case for $100.00 . You must pay the remaining $230.00 within 60 days of your filing date).

Generally, I charge $330.00 to file Chapter 13 .

If you file your case for $100.00 and agree to pay the rest of the Chapter 13 filing fee in installments to the court, your case will be automatically dismissed if you miss a single installment. It is much safer for you to pay the entire filing fee upfront.

I file cases only in the Northern District of Georgia in the Rome and Atlanta Divisions.

You may see some other attorneys advertise that they will file your case for $75. However, the truth is that your filing fee for the bankruptcy court is $310.00 no matter who you file with.

Furthermore, you have to take a consumer credit counseling course BEFORE YOU FILE YOUR CASE and while there might be cheaper classes out there, $20.00 is the cheapest class I have found. When you hire me, I am going to be completely honest and upfront with you. In a Chapter 13, your attorneys fees are paid through your monthly chapter 13 plan payment. Attorneys fees in Chapter 13 vary from case to case.

How Much Does It Cost To File For Bankruptcy

Youll face two expenses: the court filing fees, and attorney fees for the bankruptcy lawyer who files your petition, helps you through the means test and represents you in court.

You’ll generally decide between Chapter 7 vs Chapter 13 bankruptcy. In a Chapter 7 bankruptcy, most all of your debts will be forgiven and Chapter 13, which reorganizes debts into a repayment plan and can reduce what you owe while letting you retain key assets.

|

Chapter 7 |

|---|

|

$1,813 – $6,313 |

*Attorney fees vary greatly these are approximate ranges.

Filing fees are the same nationwide, but attorney fees vary based on your location, the complexity of your case and the attorney. In general, theyll be lower if you live in a rural area or have a simple case. A complex bankruptcy case in Manhattan, however, will likely cost several thousand dollars.

If youre filing for Chapter 13 bankruptcy, your court will review your attorney fees unless they fall below the so-called no-look level thats recognized as reasonable. This level varies from one district to another, so check with your local court before hiring an attorney.

Also Check: How Many Times Can A Person File Bankruptcy

Higher Income And Assets Can Mean Higher Attorneys’ Fees

Your attorney may charge you a higher fee if any of the following statements are true about your income or property :

- You make more than the median income in your state for your households size.

- You have multiple sources of income.

- You have a retirement account or a pension plan.

- Youre filing a business bankruptcy .

- Your case is an “asset case” .

- You have equity in your house, car, or other assets .

- You want to keep more property than you can exempt in bankruptcy under your states exemption statutes.

In our survey, readers in households with more than $6,000 in income per month reported paying average attorneys’ fees of $300 more than the overall average.

Chapter : Reorganization For Municipalities

A Chapter 9 bankruptcy is available only to municipalities. Chapter 9 is a form of reorganization, not liquidation. Notable examples of municipal bankruptcies include that of Orange County, California and the bankruptcy of the city of Detroit, Michigan in 2013.

Also Check: Can One Spouse File Bankruptcy Without The Other