How Soon After Closing Is First Payment Due

Generally, a homeowners first mortgage payment is due the first day of the month following the 30-day period after the close. If youre buying a home and you close on August 30, for example, your first payment would be due on October 1. That means you basically get a month to live in the home mortgage-free.

Can I Refinance My Home After Chapter 7

You can refinance your home after a Chapter 7 bankruptcy between 2 4 years after discharge. To know when youll be eligible to refinance, its important to understand the difference between your filing date and your discharge or dismissal date. The filing date is when you begin the bankruptcy process.

Failing The Means Test

Your disposable income must be low enough to pass the means test before you qualify for a discharge. The bankruptcy means test compares your average income for the six-month period before filing your case against the median state income for a similar household.

If your income is below the state median, you qualify automatically. However, if it is above, you still might qualify. You’ll be allowed to deduct the national and local living expense standards for your area to determine whether you qualify. If you fail the means test, the court will likely either dismiss your Chapter 7 bankruptcy or give you the option to convert to a Chapter 13 case.

You May Like: How Do You Get A Bankruptcy Off Your Credit Report

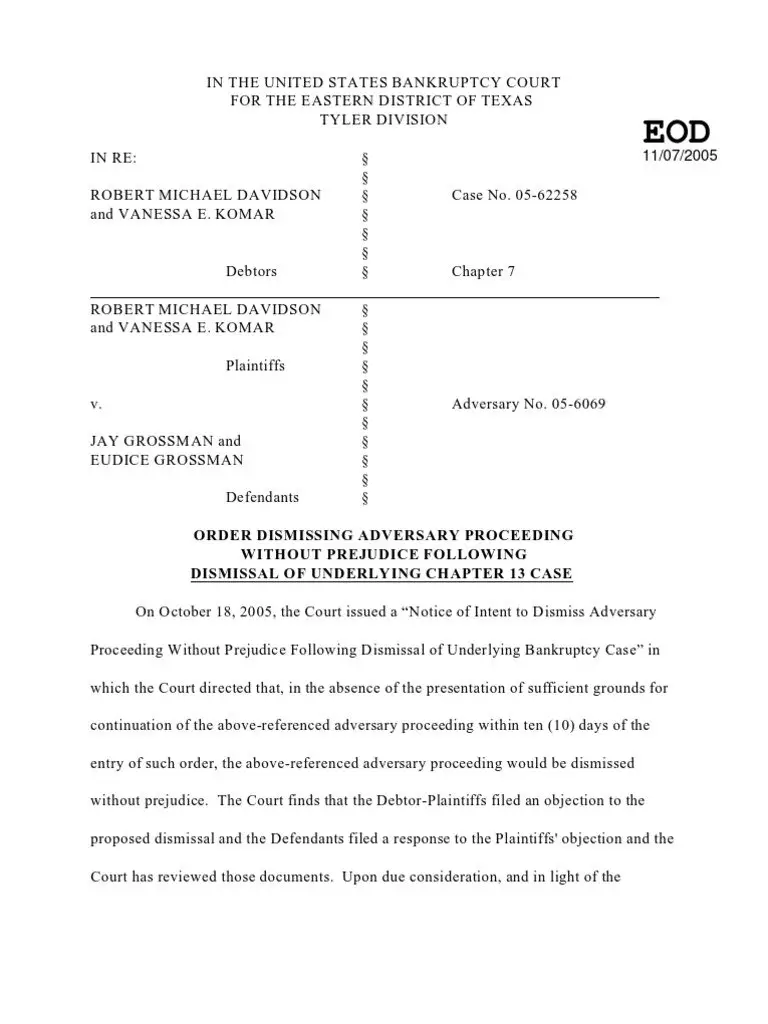

Failure To Attend The Meeting Of Creditors

A meeting of creditors is scheduled for every bankruptcy case. Attending this meeting is one of the requirements to get your bankruptcy discharge. A no-call no-show at the meeting of creditors is one of the fastest ways to get a case dismissed. Of course, if something comes up that prevents you from attending your meeting of creditors, you do have options. The first thing youâll need to do is contact your bankruptcy trustee and explain whatâs going on.Â;

Get Help From Acclaim Legal Services

As you can see, there are many reasons why re-filing a bankruptcy may be necessary and beneficial. Further, there are several variables and nuances that dictate when and what protections can be established by a re-filed bankruptcy.

Contacting an experienced bankruptcy attorney should be your first step in the process of exploring your options on how many times can you file bankruptcy. We offer free same-day bankruptcy evaluations.

Please call us toll free at 866-261-82822 or;schedule a consultation right now.

Read Also: Does Bankruptcy Get Rid Of Irs Debt

Western Tennessee Statistical Analysis: Racial Disparities Persist Even Controlling For Income And Other Debtor Characteristics

As with the national analysis, we used multivariate logistic regression to evaluate three key questions about the role of race in the district while holding constant debtor income and other characteristics. The analysis included cases from 2008-2010. Cases were identified as being in majority black or non-Hispanic white census tracts, and only cases in majority black or white census tracts were included in the analysis. Full regression results and model specifications are available in Appendix A.

1) How big was the racial disparity in the outcome of all bankruptcy filings?

Using the methods employed to analyze the national data, we evaluated the disparity evident in both Chapter 7 and 13 filings in the Western District of Tennessee. For debtors living in mostly black areas, the odds of having a case dismissed were about 2-1/2 times as high as those for debtors living in mostly white areas, controlling for income and other financial characteristics of debtors.

Bankruptcy Case Dismissals & How To Avoid Them

5 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Many worry that their case wonât be accepted if they file bankruptcy without the help of a bankruptcy lawyer. Even though itâs scary to think that this may happen, it doesnât really work that way. You are allowed to file bankruptcy without a lawyer. And, as long as you follow the bankruptcy courtâs instructions and complete all required steps, the risk of having your case dismissed is actually pretty low.

Written by Attorney Andrea Wimmer. Â;

Many worry that their case wonât be accepted if they file bankruptcy without the help of a bankruptcy lawyer. Even though itâs scary to think that this may happen, it doesnât really work that way. You are allowed to file bankruptcy without a lawyer. And, as long as you follow the bankruptcy courtâs instructions and complete all required steps, the risk of having your case dismissed is actually pretty low.Â;

Don’t Miss: How Long Does Bankruptcy Show Up On Credit Report

National Bankruptcy Filing Rates By Race

Nationally, bankruptcy filings are much higher among blacks than whites, but how the two populations use bankruptcy is very different.

Chapter 7 filings were noticeably higher for black debtors, especially in recent years, remaining elevated even after the recession, while filings by white debtors dropped off.

Common Reasons For Dismissal

2005 changes to the U.S. Bankruptcy Code now require all debtors to complete a credit counseling course from an approved credit counseling agency within 180 days before filing their petition. Failure to comply with this requirement will result in an automatic dismissal of the case. Similarly, a bankruptcy case will be dismissed if the debtor fails to appear at the meeting of creditors or does not file a financial management certificate with the court soon thereafter.

Other common reasons for a bankruptcy dismissal include:

- Concealing property or transferring property within one year of filing for bankruptcy, in an attempt to defraud creditors

- Unable to explain missing assets

- Destroying or failing to keep good records

- Lying under oath

See also:How to Screw Up Your Bankruptcy Discharge

Read Also: How To File Bankruptcy In Texas Without An Attorney

Black Debtors Filing Under Chapter 13 Are Increasingly Poorer

The differences between black and white debtors in Chapter 13 are even more marked than in Chapter 7. In a textbook Chapter 13 case, the debtor files to prevent foreclosure. Most debtors from majority black zip codes who filed under Chapter 13 in 2014 and 2015 did not own a home.

This phenomenon is not limited to black debtors. However, the trend among debtors from majority white zip codes in recent years was basically flat, while the number of these filings in majority black zip codes rose by 50 percent from 2010 through 2015. Of course, Chapter 13 filings overall are down since the recession, making the changing nature of the Chapter 13 usage even more stark. In 2015, Chapter 13 filings by debtors without real estate assets comprised about 40 percent of all Chapter 13 filings .

What Happens After The Court Dismisses Your Case

If the court dismisses your case because you failed to comply with the various bankruptcy requirements, usually you can file for bankruptcy again right away. However, if the court dismissed your matter due to fraud, youll likely be barred from discharging that debt in the future. You might also be precluded from filing a bankruptcy case for a certain period. The order dismissing your bankruptcy will list the conditions.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

How Chapter 7 Bankruptcy Works

In Chapter 7 bankruptcy, the court appoints a trustee to oversee your case, and part of the trustee’s job is to take ownership of your assets, sell them, and distribute that money to your creditors. Creditors must submit proper claims to receive payment.

However, the trustee can’t take all your assets. You’re permitted to keep certain “exempt property”;so you’re not stripped of everything you need to live, and you have a foothold to get a fresh start.

Exemptions can refer to either federal or state statutes, and they apply to certain types of property. The federal government offers a list of exemptions, and many states have adopted their own lists. Debtors must use the state list in some of these jurisdictions, while other states allow them to choose between their own and the federal lists. Debtors can elect the set of exemptions that are most beneficial.

Common exemptions include:

- Certain retirement accounts

- Property that’s necessary for work/earning a living

Retirement plan exemptions are available to everyone, even if they must accept their state’s list and their state doesn’t provide an exemption for such accounts.

This list is by no means exhaustive. In fact, many Chapter 7 cases are considered to be “no asset” cases because there’s little or nothing left for the trustee to sell or liquidate after exemptions are applied.

Inflexible Calculation Of Required Payments

The Bankruptcy Code says that a Chapter 13 debtor must devote all of his disposable income to repaying creditors for 3 or 5 years, depending on his prior annual income.

Thats right, ALL of the available money.

Worse, the drafters of BAPCPA ;thought they could develop an objective formula for calculating what is available that would fit each and every family who needed bankruptcy relief.

Hello?

One doesnt have to look beyond the families on your block to see the enormous variation in circumstances that impact family finance.; Yet our law makers wanted to deprive judges of any discretion to make the rules adapt to the real world.; One size shall fit all, they decreed.

And, this business of all continues to distress me.; What responsible financial counselor would tell a client to spend every dollar they make?

Whether you save for emergencies, retirement, or; big purchases,; living below your means is the key to financial stability.; Chapter 13 should promote reasonable saving.

Not in Chapter 13, says the current practice.; The formulas applied to debtors budgets make no allowance for savings.

When, as John said, life happens, the debtor has no reserves.

Don’t Miss: Which Statement Regarding Bankruptcy Is Not True

The End Of Your Automatic Stay Period

When you file for bankruptcy, you enter what is known as an automatic stay period. This is one of the primary advantages of bankruptcy and describes the period when creditors and trustees are not able to take any legal action against you or attempt to collect on the debt you owe.

This is the part attorneys refer to when they say get relief from creditors, and when you get dismissed, this period ends.

When you re-file for Chapter 7 after a dismissal, your automatic stay period will be reduced to only thirty days. If your case is again dismissed, any future bankruptcy filings will not be accompanied by any automatic stay period and creditors will be allowed to continue to collect.

What Is An Automatic Stay

After you file for bankruptcy, you have the protection of an immediate, but temporary, automatic stay. The automatic stay can, for example, immediately stop a foreclosure, an eviction, car repossession, or wage garnishment. It can also stop debt collection, harassment, and disconnection of utilities.

The automatic stay may provide a powerful reason for filing for bankruptcy. In most of the situations listed above, the automatic stay can buy you a few days or weeks in which to figure out your next move. If your primary motivation in filing bankruptcy is to gain the benefits of the automatic stay, you donât need to file all of your papers at once. You just need to file the three-page petition, a signature declaration, and a listing of your creditors. In addition, within 180 days prior to filing, you will have to visit an approved credit counseling agency for advice and budget analysis. You will have to file a certification of such counseling when you file your petition. You have 15 days in which to file the rest of your papers. If you donât, your case will be dismissed.

Recommended Reading: Can You Buy A Car After Filing Bankruptcy

Chapter 13s Popularity In The South Among Low

Before continuing to our examination of the Western District of Tennessee, its important to understand a bit of context. In addition to the racial differences discussed throughout this analysis, there are also huge differences regionally in how frequently Chapter 13 is used. Only in the South is Chapter 13 the predominant form of bankruptcy.

For the purposes of discussion, the South consists of the states where Chapter 13 cases have accounted for at least half of filings in recent years: Alabama, Arkansas, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, and Texas.

Because there are large black populations in the South, and, as shown above, black debtors disproportionately file under Chapter 13, this means the style of bankruptcy practiced in the South particularly affects black debtors. It also means that, although we found racial disparities all over the country, it is in the South where black debtors see their cases dismissed in the greatest numbers.

The no money down Chapter 13 arrangement has an obvious attraction for debtors with less income. As a result, large numbers of lower-income black and white debtors file under Chapter 13 in the South. In contrast, outside the South, Chapter 13 is overwhelmingly used by middle-income homeowners.

What Happens When A Chapter 13 Case Is Dismissed In 2021

4 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

If you have a dismissed Chapter 13 case, you may have several options. You might be able to file a Chapter 7 bankruptcy case, even if you can’t afford to pay another attorney to help you.

Written by Attorney Jonathan Petts. Â;

When an individual doesnât qualify for debt relief under Chapter 7 because they make too much money or had a prior Chapter filing, that person can file Chapter 13 instead. A Chapter 13 bankruptcy case is a debt reorganization.

When you file under Chapter 13, you propose a repayment plan for your debts. You make aÂ; payment each month to a Chapter 13 trustee who pays your creditors according to the terms in the Chapter 13 plan. The amount of your Chapter 13 plan payment depends on several factors. Only certain debts – like mortgages – may be paid directly while the case is open.Â; In some cases, you may pay some creditors outside of the plan, such as your mortgage payment.

You May Like: Can You File Bankruptcy On Just Credit Cards

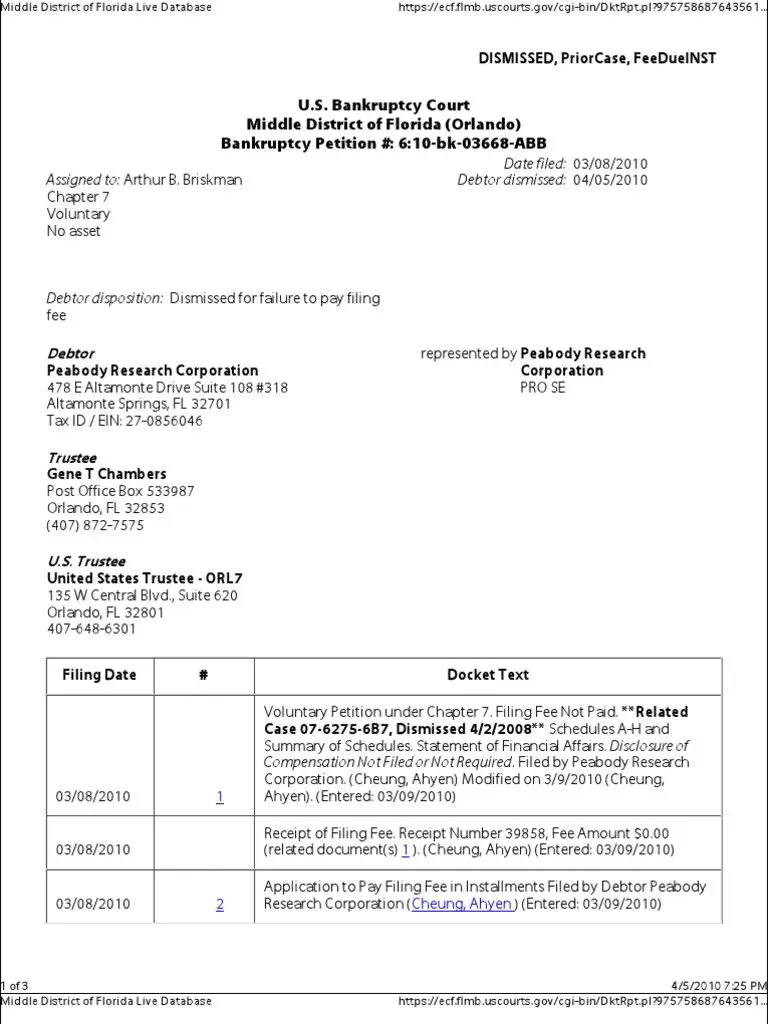

Western Tennessee Earned Chapter 13 Fees By Top Volume Law Firms 2010

| Law Firm | Estimated earnings from 2010 Chapter 13 cases | Percentage of Total District Filings | Percentage of Total Est. District Earnings |

|---|---|---|---|

| Cohen & Fila | |||

| $1,343 | $16,077,362 |

In particular, even though less than a quarter of McElroys Chapter 13 cases reached discharge, his firm still reaped significant revenue. Meanwhile, Teel & Maroney, with its whiter clientele and higher discharge rates, outperformed its market share. The two firms with the lowest income client base underperformed their market share.

Finally, this data complicates the argument by some scholars that these attorneys steer their clients to Chapter 13 because of the higher $3,000 fee. In actuality, the average amount earned for Chapter 13 cases in the district was only a few hundred dollars more than the average attorney fee for a Chapter 7 filing, which was around $885.33 Instead, we believe the balance of the evidence suggests that the difference in down payments between Chapter 13 and Chapter 7 is more important.

Is It Better To Close At The End Of The Month Or Beginning

When purchasing a new house, its best to close as late in the month as possible if low closing costs are your goal. You dont make your first house payment at closing, but the lender wants you to pay interest for each day you own the home. If you close on the 1st, you have to pay interest for every day in that month.

Recommended Reading: How Long Does Bankruptcy Stay On Credit Report

You Can Be Denied A Discharge

if the Court determines that you committed any of the following acts:

- make a false oath, claim or account ;

- give or receive money for taking certain action or agreeing not to take certain action;

- withhold books, records, documents or other records from the bankruptcy court;

- You fail to explain satisfactorily any loss of assets or deficiency of assets to meet your liabilities;

- You refuse to obey an order of the bankruptcy court, or refuse to answer a material question.

- You make too much money and need to switch to a Chapter 13.

Why Is It Better To Close At The End Of The Month

The clear benefit of closing later in the month is that you wont need to bring as much cash to closing. Thats because mortgage interest accrues from the date of closing through the last day of the month. So, with an end-of-month closing, therell only be a small window for interest to accrue, and less for you to pay.

Don’t Miss: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy