What To Do If Your Debt

Whether you figure out your debt-to-income ratio using our DTI calculator, or you have been told by a potential lender that your DTI is too high for consideration of a loan, you might consider the following ideas for improving your financial situation. You should look at these ideas whether you plan to re-apply for the potential loan or not.

Word Of Advice For Loan Borrowers

Did you gain a better understanding of the debt-to-income ratio? Before you leave for your dream home loan, here are a few words of advice. If your DTI ratio stands at more than 36%, it would be wise for you to look for ways to lower it. A lower DTI will drastically improve your chances of getting the loan sanctioned.

What Is Included In Dti

Your debt-to-income ratio starts with your gross income, which is all of the money that you make before you subtract out things like taxes, insurance costs, retirement account contributions, or any other expenses.

You then have to find the sum of all of your monthly debt payments. This includes things like:

- Other debts, such as personal loans

- Court-ordered fixed payments, like child support

Some lenders include monthly housing payments, like rent, in the calculation even though they are not debt payments. When renters calculate their DTI and exclude their rent costs, they may want to aim for a lower DTI than homeowners with a mortgage to account for their higher monthly costs.

Read Also: What Happens If You File Chapter 7 Bankruptcy

What Is The Difference Between A Dti Ratio And A Debt

Your debt-to-income ratio compares your monthly income and your monthly debt payments.

Your debt-to-limit ratio ignores your income and payments, comparing your debt balance to your total credit limits.

For example, imagine you have three credit cards with the following balances and credit limits:

| Balance | Credit Limit || ———- | ———- || $2,000 | $5,000 || $0 | $1,000 || $3,000 | $3,000 |

Your debt-to-limit ratio is:

/ = 55.56%

Debt-to-limit ratios only apply to revolving debt, like credit cards, where you receive a credit limit and can borrow money up to that limit.

Your debt-to-limit ratio impacts your credit score, as lenders view people who max out their credit cards as riskier than people who use a smaller proportion of the limit.

Your DTI ratio doesnt impact your credit score directly, but it does have an impact on your ability to qualify for loans.

What Is On Your Credit Report

When was the last time you looked at your credit report? If it has been more than a few months, head on over to the federally-mandated site at AnnualCreditReport.com to pull one, two, or all three of your credit reports. You wont find your credit rating there, but you will see all the lines of credit and loans you have had in the past seven to ten years.

The Consumer Reporting Agencies generally group potentially negative accounts together so you can see what might be hurting your credit. Often, it will be a missed or late payment, especially if it occurred in the past one to two years.

For others, the negative effect on your credit rating comes from high account balances on your credit cards, store and retail accounts, and car and home loans. Pay those down as much and as quickly as possible.

Besides lowering your DTI, work on improving your credit score by cleaning up your credit report. If there are errors or inaccuracies in your report, go directly to the home pages of Equifax.com, Experian.com, and TransUnion.com to dispute them. It may take 30 days, but in the end, removing inaccurate items will generally build your credit rating in the eyes of potential lenders.

Also Check: Does Credit Score Go Up After Bankruptcy Discharge

S To Decrease The Debt

1. Decrease monthly debt payments

Consider an outstanding $50,000 student loan with a monthly interest rate of 1%. Scenario one involves an individual who is not repaying their principal debt, while scenario two involves an individual who has paid down $30,000 of their principal debt.

As illustrated above, as an individual pays down more of their principal debt, the monthly interest payments decrease.

2. Increase gross income

Consider two scenarios with a monthly debt payment of $1,500 each. However, the gross monthly income for scenario one is $3,000, while the gross monthly income for scenario two is $5,000. As such, the debt-to-income ratio would be as follows:

DTI Ratio = $1,500 / $3,000 x 100 = 50%

DTI Ratio = $1,500 / $5,000 x 100 = 30%

Why Is Dti Important

Debt-to-income ratios are important because they give both borrowers and lenders a quick way to measure budget flexibility and the ability to handle new loans.

If someone has a high debt-to-income ratio, they know that they do not have much flexibility with their budget. Most of their income must go toward paying monthly bills. If they stop making those debt payments, they will likely default on the loans, incur heavy fees, and damage their credit.

DTI is also important because many lenders use it when making lending decisions. Lenders know that people with high DTI ratios dont have much budget space to handle new monthly payments.

If an applicants DTI is too high, the lender knows that the borrower may not be able to make his or her payments, and the lender wont approve the loan.

Read Also: How Much Money Do The Us Owe China

How To Improve Dti In A Manageable Way

If youre looking to increase your chances of getting approved for a loan or just want to improve your DTI for peace of mind, there are a few straightforward ways to do so. You can:

- Increase the amount you typically put towards paying off your debts.

- Avoid taking on added debt.

- Splurge less on larger, non-essential purchases.

To give yourself the best chance at hitting these goals, create a budget and stick to it.

Now that you understand debt-to-income ratios, you might have questions about how your DTI will affect your unsecured loan application. At Unsecured Funding Source , well be happy to help you through what is needed from lenders to increase your chances of getting approved for an unsecured loan. Contact us today to get started!

Learn More About Saving And Buying A Home

After getting your finances in order, you may be in a strong position to start shopping for a home. Congrats on all that hard work! Theres a lot to learn about each phase of the home-purchasing process, so take the time to educate yourself. Our first-time home-buyers guide can help educate you on what youll need to know.

While youre making strides towards that big purchase, remember to get in touch with your American Family Insurance agent. Theyre your trusted resource that can help you get the coverage your new home needs. And with an easy-to-understand plan in place, youll know youve got the coverage you need to protect everything that matters most.

Also Check: Can You File Bankruptcy On Your Own

Dti And Getting A Mortgage

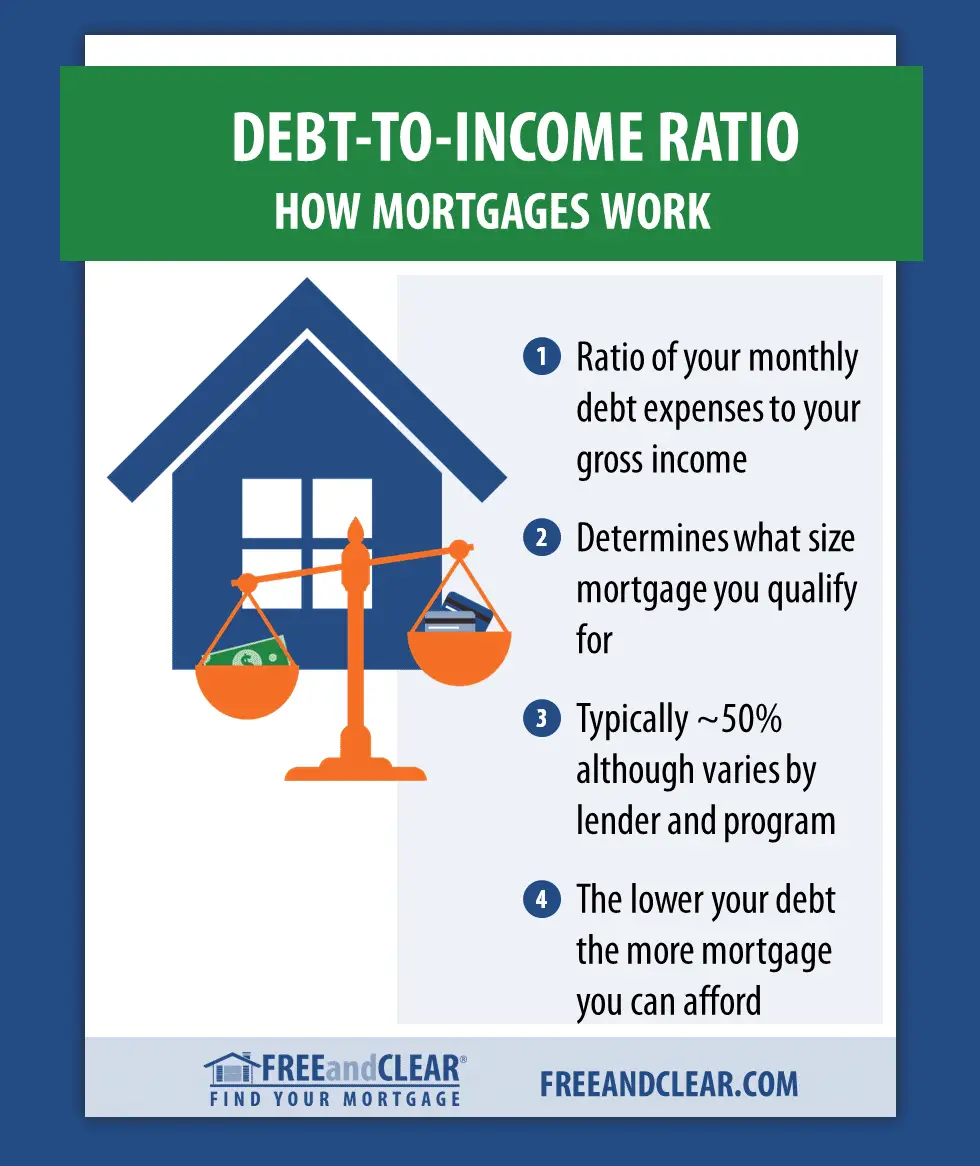

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

Understanding The Impact Of Your Debt

While mortgage rates and closing costs might be the biggest numbers on your mind when you are considering buying a home in North Carolina, there is one number you cant forgetyour debt-to-income ratio, or DTI. In this weeks Home Matters Blog, we explore your DTI FAQs so you can better understand this important number and how it will impact your financial future.

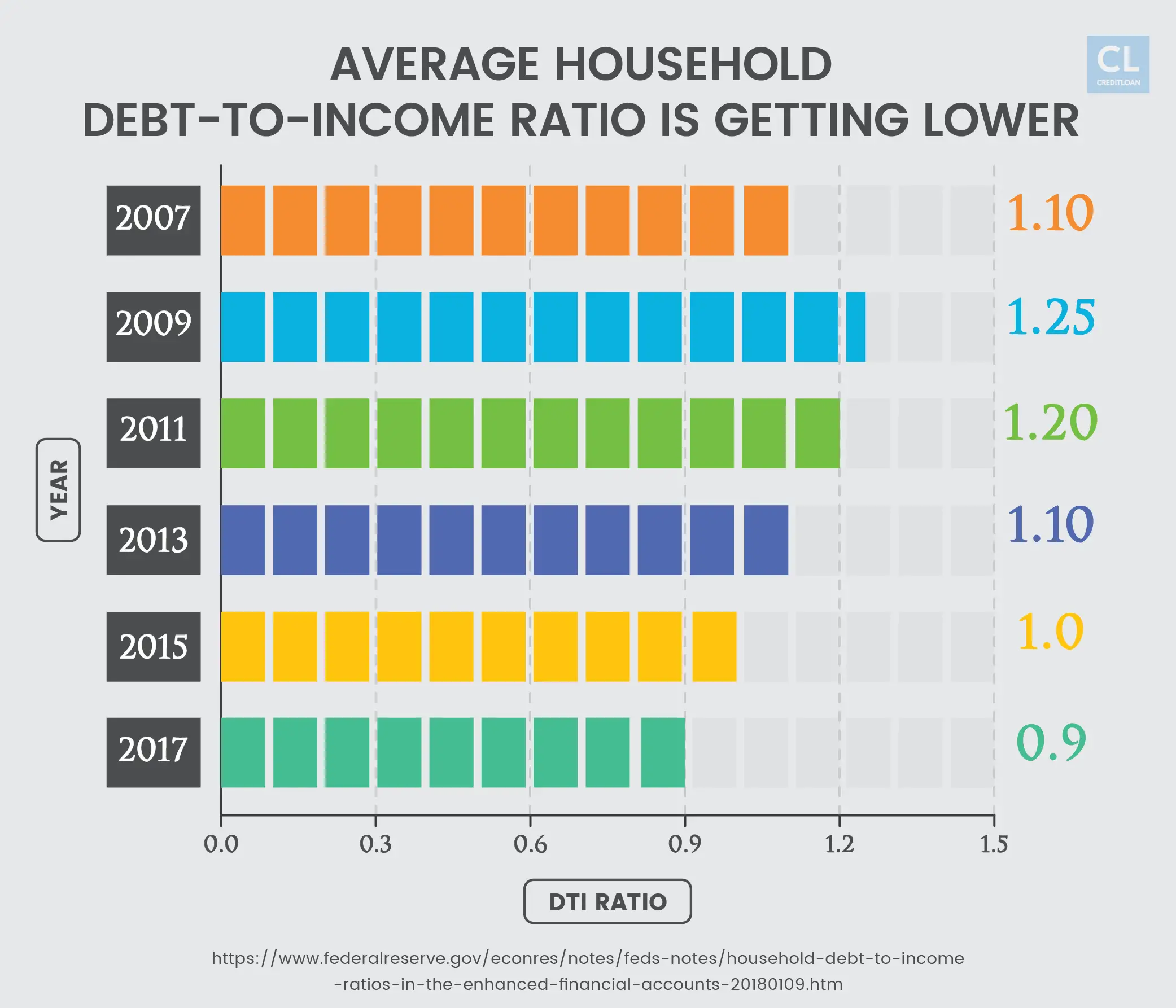

What is DTI?According to Investopedia, a debt-to-income ratio is the percentage of your gross monthly income that goes into paying your monthly debt payments and is used by lenders to determine your borrowing risk. Put in laymans terms, your DTI ratio is a way of expressing how much you pay per month in debt in relation to how much money you bring in each month. A high DTI means that you have a lot of debt to pay off each month in relation to your income, so you might not be ready to take on debt. On the other hand, a low DTI tells lenders that you have a manageable amount of debt and will likely be able to handle paying off more in the form of a mortgage.

How Can I Improve My DTI?Since the two parts of your DTI are your income and your debt payments, it makes sense that the best ways to improve it are through increasing your income or reducing your debt. Before you start looking for a mortgage, work on paying down your debt so that you pay less each month on debt payments. In addition, any increases in income can help get your DTI where you want it to be.

Read Also: What Is The Automatic Stay In Bankruptcy

What Is The Ideal Debt

If you arent thinking about applying for an auto or home loan, opening a credit card account, moving into a new apartment, or doing anything else that requires someone to review your credit and finances, you may not care too much about your DTI. But when you are seeking credit, part of the application process may include a thorough review of your finances. Even though it will vary, every creditor and lender has certain criteria that applicants must meet in order to approve an application, so they might be interested in examining your DTI to determine if you should be approved.

Since this number gives insight into how you manage your debt, specifically your ability to repay your debt, the higher your DTI, the more likely you are to be denied. Creditors will look for borrowers who have a debt-to-income ratio no higher than 43%. This means that if your monthly income is $4,000, your total monthly debt payments should be equal to no more than $1,720. Although 43% is acceptable to most creditors, a lower DTI is even better.

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Read Also: Can You Claim Bankruptcy On Student Loans

Monitor Your Dti And Your Credit For Better Access To Credit

Even if you dont anticipate needing to apply for credit anytime soon, its a good idea to keep an eye on your DTI and your credit score to make sure youre ready when you need it. To monitor your DTI, keep a running list of your debt payments and calculate your DTI whenever you pay off a loan or credit card or take on new credit.

For your credit score, you can use Experians free credit monitoring service, which provides access to your Experian credit report and FICO® Score. Youll also get real-time alerts whenever changes are made to your credit report, so you can track your progress and spot potential issues before they wreak havoc on your credit health.

Dti Isn’t A Full Measure Of Affordability

Although your DTI ratio is important when getting a mortgage, the number doesn’t tell the whole story about what you can afford.

DTIs don’t take into account expenses such as food, health insurance, utilities, gas and entertainment, and they count your income before taxes, not what you take home each month.

Youll want to budget beyond what your DTI labels as affordable, and consider all your expenses compared with your actual take-home income.

» MORE: How much house can you afford?

Also Check: What Happens If You Declare Bankruptcy In Canada

What Does A D/e Ratio Of 15 Indicate

A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million. Because equity is equal to assets minus liabilities, the companys equity would be $800,000. Its D/E ratio would therefore be $1.2 million divided by $800,000, or 1.5.

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Also Check: What Happens After Bankruptcy Trustee Meeting

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Also Check: How Long After Bankruptcy Can You Buy A House

How To Calculate Dti

Just like understanding debt-to-income ratio is fairly easy, knowing how to calculate DTI is very simple, assuming youve already been keeping track of your debt payments and income.

Calculating ones DTI is as simple as adding up all the debt payments youve made in a month and then dividing that number by your gross monthly income. Gross monthly income refers to the amount of money you earned prior to taxes and other deductions being taken out. Debt-to-income ratio is typically expressed as a percentage rather than a decimal number, so after dividing your debt payments by your income, you can multiply that number by 100 or move the decimal over two places to the right.

For example, if your monthly debt repayments are $2,500 and your monthly gross income is $5,000, your DTI is 50%.

What Is The Formula For The Dti Ratio

The result of total monthly debt payments divided by gross monthly income is the formula for calculating the DTI ratio. Gross income is the income before taxes and other deductions while the summation of the payments made towards EMIs on loans, credit cards and other debts in a month. The formula can be mathematically written as: Total Monthly Debt Payment/Gross Monthly Income*100

Read Also: What Is The National Debt Now

What Happens If My Debt

If your debt-to-income ratio is higher than the widely accepted standard of 43%, your financial life can be affected in multiple waysnone of them positive:

- Less flexibility in your budget. If a significant portion of your income is going towards paying off debt, you have less left over to save, invest or spend.

- Limited eligibility for home loans. A debt-to-income ratio over 43% may prevent you from getting a Qualified Mortgage possibly limiting you to approval for home loans that are more restrictive or expensive.

- Less favorable terms when you borrow or seek credit. If you have a high debt-to-income ratio, you will be seen as a more risky borrowing prospect. When lenders approve loans or credit for risky borrowers, they may assign higher interest rates, steeper penalties for missed or late payments, and stricter terms.