Estimated Home Loan Eligibility

| Your DTI is very good. Having a DTI ratio of 36% or less is considered ideal, and anything under 20% is excellent. | Your DTI is good. Having a DTI ratio of 36% or less is considered ideal. | Your DTI is OK. It’s under the 50% limit, but having a DTI ratio of 36% or less is considered ideal. Paying down debt or increasing your income can help improve your DTI ratio. | Your DTI is over the limit. In most cases, 50% is the highest debt-to-income that lenders will allow. Paying down debt or increasing your income can improve your DTI ratio. |

|---|---|---|---|

| Remaining |

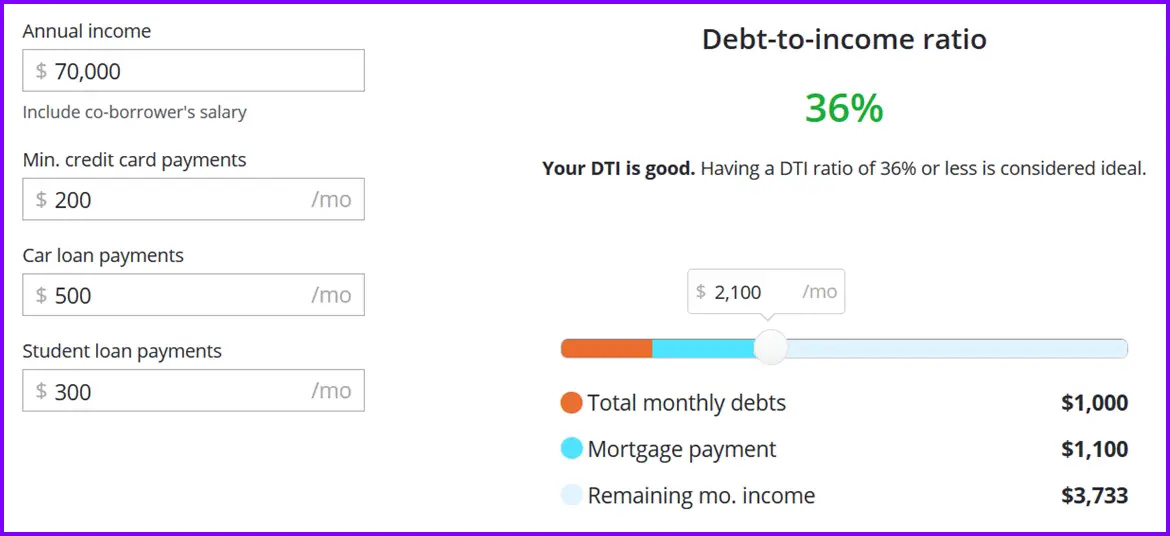

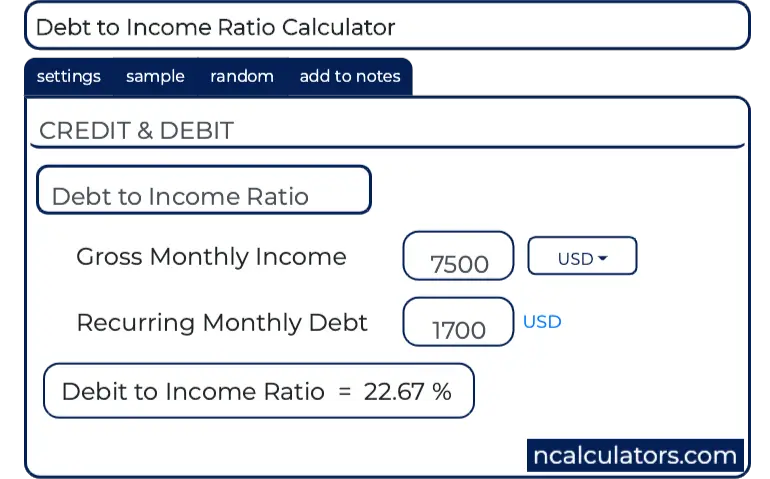

Your debt-to-income ratio measures your monthly debt obligations in comparison to your monthly gross income, or the amount of money you earn before taxes. Its calculated by dividing your minimum monthly debt payments by your monthly gross income, and its expressed as a percentage.

When you go through the mortgage application process, lenders review your DTI ratio to assess whether you can handle monthly mortgage payments in addition to your current monthly obligations. If you dont meet a lenders minimum DTI ratio requirements, you might not be approved for a mortgage loan. A debt-income ratio calculator can help you crunch the numbers.

What Should Your Debt

Creditors will also consider your DTI ratio when applying for a mortgage refinance. As with mortgage loans, a higher DTI will make it much harder to get approved for refinancing your home loan. Check our refinance calculator to determine if refinancing your mortgage is the right choice for you.

- For cash-out refinance, Chase recommends that consumers have a DTI of 40% or lower.

- Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50% or lower when applying for mortgage refinance.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

You May Like: How Long Bankruptcy Last On Credit Report

How Is The Debt

Here’s a simple two-step formula for calculating your DTI ratio.

Keep in mind that other monthly bills and financial obligations — utilities, groceries, insurance premiums, healthcare expenses, daycare, etc. — are not part of this calculation. Your lender isn’t going to factor these budget items into their decision on how much money to lend you. Keep in mind that just because you qualify for a $300,000 mortgage, that doesn’t mean you can actually afford the monthly payment that comes with it when considering your entire budget.

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

Also Check: How To Pay Collections

Pay More Than The Minimum

Pay off your debt and save on interest by paying more than the minimum every month. The key is to make extra payments consistently so you can pay off your loan more quickly. Some lenders allow you to make an extra payment each month specifying that each extra payment goes toward the principal. Before you begin, check the terms of your loan to determine whether additional fees or prepayment penalties may apply.

When Do You Include Your Spouses Debt

Including your spouses debt depends on whether youll be applying for the mortgage jointly or as an individual. Certain states operate under community property rules, which establish that both spouses are under equal obligation to repay debts incurred during the marriage. In those states, excluding a spouses debt from the DTI ratio is not allowed.

States where community property rules apply are:

- Washington

In the rest of the country common-law rules apply. Couples are not legally obligated to equally share all debt acquired while married. This means they can apply for a loan as individuals and the spouses income and debt will bear no influence in the lenders evaluation.

In common-law states, applying as a couple is favorable if the combined debt results in a lower, stronger DTI ratio. Having two incomes also means that you could qualify for larger loans.

However, if a couples combined credit score and debt-to-income ratio severely impacts their eligibility for a good mortgage loan, its best to apply as an individual.

Also Check: How Did Gm Get Out Of Bankruptcy

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

Don’t Miss: How To View Bankruptcy Records Online

How To Calculate Debt

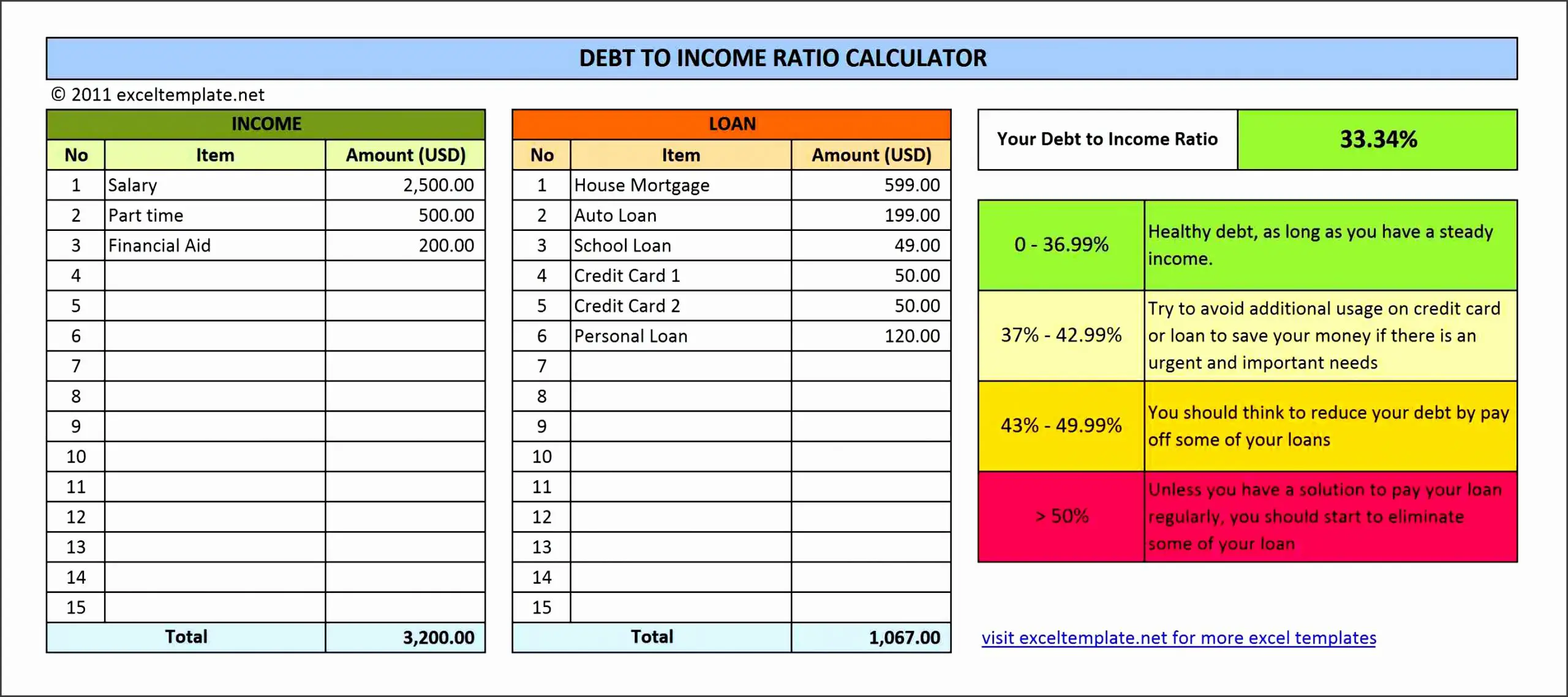

The debt-to-income formula is simple: Total monthly debt payments divided by total monthly gross income . Then, multiply that number by 100. That final number represents the percentage of your monthly income used towards paying your debts.

Say you make $3,000 a month before taxes and household expenses. Your monthly debts include $1,200 for rent, $200 in student loan payments, and $100 in car payments, for a total of $1,500. Divide your total monthly debt payments by the total monthly income, $3,000, and the result is 0.5 or 50%. This means that 50% of your monthly income goes towards paying back your debts.

You May Also Find These Calculators Helpful

No results found

This information is provided for educational purposes only and should not be relied on or interpreted as accounting, financial planning, investment, legal or tax advice. First Citizens Bank neither endorses nor guarantees this information, and encourages you to consult a professional for advice applicable to your specific situation.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Read Also: Liquidation Pallets For Sale Online

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Multiply That Number By 100 To Get A Percentageand Thats Your Debt

Lets look at an example:

Bob pays $600 a month in minimum debt payments plus $1,000 per month for his mortgage payment. Before taxes, Bob brings home $5,000 a month. To calculate his DTI, add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 0.32. Multiply that by 100 to get a percentage.

So, Bobs debt-to-income ratio is 32%.

Now, its your turn. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

Recommended Reading: How To Claim Bankruptcy In Ontario Canada

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

How Do I Lower My Debt

Is your debt-to-income ratio over 50%? This may be a sign that youre living above your means.

To make getting a mortgage loan easier, you could figure out how topay off your debt. Here are a few things you could do:

Make a budget: Having an overview of your monthly income and expenses will allow you to determine how much money you can put towards paying off your debt, even if youre only paying off a little at a time. To put the odds in your favour, review your budget regularly, spend reasonably, and consider whether a major expense that will increase your debt load is really something you need. Prioritize your debts: List the totals of all your debts, as well as their interest rates. Pay off debts with a high interest rate first, as these are usually the most expensive. You can also prioritize paying off bad debt, meaning loans taken out to make purchases that will quickly lose value, rather than good debt, which is considered an investment, or debts whose interest is tax deductible, such as student loans. Consolidate your debt: To make payments easier and potentially get a lower interest rate, you could ask the bank for a loan in order to consolidate all your debt. On top of having only one monthly payment to make, this could also have a positive impact on your budget and borrowing capacity. Talk it over with an advisor.

Recommended Reading: What Does The Bankruptcy Trustee Investigate

Pay More Than Once A Month

Pay your credit card bills more than the required once per month. This may make it easier to stay on track of how much you owe. Paying your credit card bill regularly may also lower your balance/utilization ratio. The credit utilization ratio is the percentage of your total available credit that is currently being used. The utilization ratio is one of the components used by credit reporting agencies to calculate your credit score.

Pay Off Your Most Expensive Loan First

Your most expensive loan is the loan with the highest interest rate. By paying it off first, youre reducing the overall amount of interest you pay and decreasing your overall debt. Then, continue paying down debts with the next highest interest rates to save on your overall cost. This is sometimes referred to as the avalanche method of paying down debt.

Also Check: Can Student Loans Be Discharged In Bankruptcy

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when they’re considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Get Free Issues Of The Motley Fool Collective

FREE email newsletter

RISK WARNINGS AND DISCLAIMERS

We have taken reasonable steps to ensure that any information provided by The Motley Fool Ltd, is accurate at the time of publishing. Any opinions expressed are the opinions of the authors only. The content provided has not taken into account the particular circumstances of any specific individual or group of individuals and does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation, when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser. No liability is accepted by the author, The Motley Fool Ltd or Richdale Brokers and Financial Services Ltd for any loss or detriment experienced by any individual from any decision, whether consequent to, or in any way related to the content provided by The Motley Fool Ltd the provision of which is an unregulated activity.

The Motley Fool Ltd. Registered Office: 5 New Street Square, London EC4A 3TW. | Registered in England & Wales. Company No: 3736872. VAT Number: 188035783.

Read Also: How To Check If A Bankruptcy Has Been Discharged

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

You May Like: Bankruptcy Law Chapter 13

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns