Medical Bankruptcies In The Us

Declaring a Chapter 7 bankruptcy is one of the ways to eliminate medical debt. However, you must first check whether you qualify for one. To do so, you can use a Chapter 7 Bankruptcy Means Test Calculator.

Now:

Do you wonder how often healthcare-related expenses force people into bankruptcy? Read on!

18. Medical costs caused bankruptcy every 30 seconds before the Affordable Care Act.

President Obama said in March 2009 that the cost of healthcare causes a bankruptcy every 30 seconds and that 1.5 million Americans were expected to lose their homes during the year.

In 2010, the Affordable Care Act was signed into law. The healthcare reform aimed to provide affordable health insurance coverage for all US citizens. And while still a problem, we cant ignore the decline in medical bankruptcies since Obamacare.

19. Medical bankruptcies represent 66.5% of all personal bankruptcies.

The declining healthcare affordability remains one of the major issues in the US. A simple injury or a minor medical inconvenience can run you thousands of dollars. Even those with health insurance can be charged absurd amounts of money. This is the main reason why two-thirds of all personal bankruptcies in the US are due to medical bills.

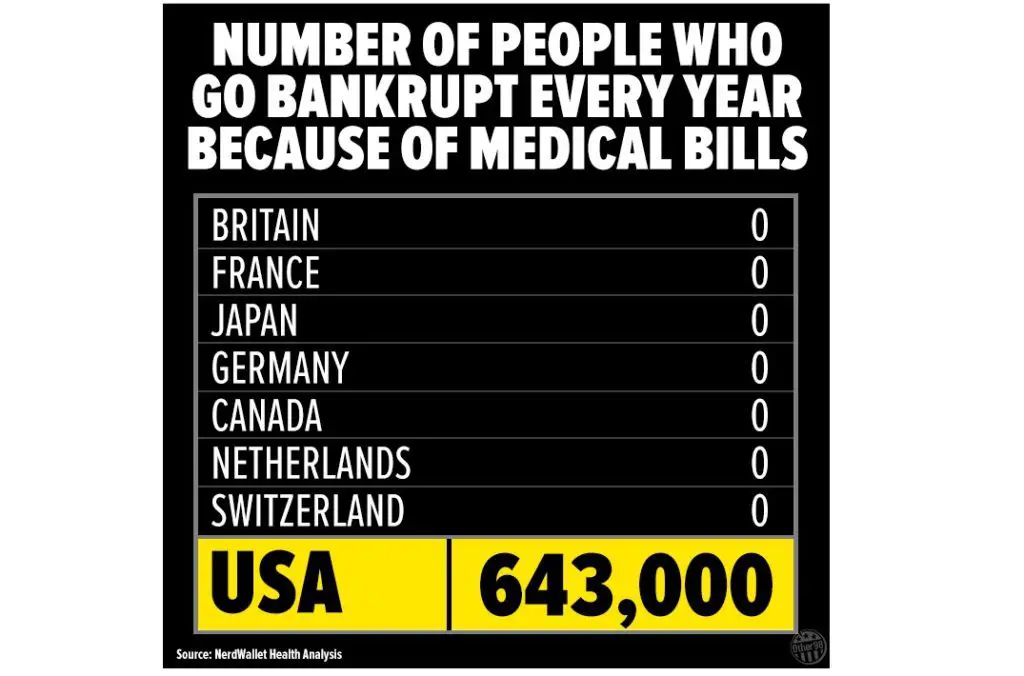

More than half a million American families are forced to file for bankruptcy every year as they cant repay their healthcare-related debt, 2019 medical bankruptcy statistics show.

20. The average age of those who file for medical bankruptcy is 44.9 years.

What Causes Medical Debt

Not every medical expense turns into debt. And the bills themselves arent always the sole problem. People who get sick or have to care for a sick loved one may see their income drop because of time off work. In fact, more than 1 in 7 medical bankruptcies is due to a childs illness.

Through surveys, researchers have identified people dealing with medical debt. These Americans responses reveal the financial and medical situations that are most likely to lead to severe financial stress.

- 62.1% of those who filed for bankruptcy named medical bills or loss of income due to sickness or caretaking as the reason for their bankruptcy.

- 14.6% of medical bankruptcies were due to an illness of a child.

- Among those with medical bill problems, 10% say they had bills as low as $500 or less.

One recent survey identified the specific medical services that led to medical debt. Among the reported services that led to problems with medical bills the findings were:

- Doctor Visits: 65%

- Short-Term Single Hospital Stay: 66%

Another study asked similar questions about the causes of medical debt.

What Happens When People File Medical Bankruptcies

Filing for bankruptcy is a controversial decision. On the one hand, its subject to moral judgment and can even be seen as a failing. On the other hand, however, there are also benefits of declaring bankruptcy, like a chance to get a fresh start, move forward, and get out of uncontrollable debt due to an accident or severe illness.

Bankruptcy can be good for the economy because the affected people become contributing members of society again. The US Constitution established the uniform laws on the subject of bankruptcy throughout the United States as a mechanism to help people in such situations.

As for what happens tomedical debt after death, the medical bills dont go away. Instead, medical debt, as well as all the other debt you have, is paid by your estate. And by estate, we mean all the assets you owned at death. Moreover, even thoughlife insurance programsguarantee payments after the insured persons death, health insurance pays for their medical expenses.

You May Like: Car Loans After Bankruptcy Discharge

How Are Medical Care Costs Being Spent

A recent study identified what medical services account for the most U.S. medical spending. In the U.S., here is the annual spending for treating the following conditions:

- Routine Care, Signs, and Symptoms: $289.9 billion

- Circulatory System Diseases: $259.2 billion

- Musculoskeletal System Diseases: $219.8 billion

- Respiratory System Diseases: $176.5 billion

- Endocrine System Diseases: $168.7 billion

- Nervous System Diseases: $159.5 billion

- Mental Illness: $109.6 billion

- 33% of U.S. health spending goes toward hospital care.

- 20% of U.S. health spending goes toward physician and clinical services.

- 10% of U.S. health spending goes toward prescription drugs.

RELATED: How to save on prescriptions

Filing For Bankruptcy Can Provide Relief From Medical Bills But It Can Also Have Undesirable Consequences For Other Debts Credit Scores And Key Assets Like A House Or Car

If youre considering bankruptcy as a solution for medical debt, youre not alone. Unmanageable medical care debt and the hardships that often come along with it like loss of work or reduced access to credit can be a recipe for financial ruin.

But filing for bankruptcy isnt always an ideal solution. Although bankruptcy can help you manage or eliminate medical debt, its not possible to limit your claim to only one kind of debt during the process. Plus bankruptcy has a long-term negative impact on your credit and can put your assets in jeopardy.

Heres what you should know before you file.

Read Also: How Much Does Credit Score Go Up After Chapter 7 Falls Off

What Percentage Of Bankruptcies Are Medical

- Medical debt is both a direct and indirect cause of bankruptcy in a substantial number of cases.

We dont know how many bankruptcies are caused by medical debt. Medical debt bankruptcy numbers will fluctuate from year-to-year, influenced by factors like economic variables, political policy shifts, etc. During the debates over Obamacare, health care reform advocates suggested that more than half of all bankruptcies in the United States were caused by medical bills. Numerous studies have refuted that statistic. They argue instead that medical debt is a modest but rising component of debt in consumer bankruptcy. Regardless, there is little doubt that bankruptcy due to medical bills is a serious problem in the United States.

Medical Bills Can Bankrupt

As the Harvard study showed, medical bills remained the primary factor in filing bankruptcy in more than 50% of all bankruptcy cases. Many people see a chance to overcome medical debt by filing for medical bills bankruptcies.

As weve already explained, not only those who dont have health insurance but also insured people are left with overwhelming medical debt. Some of the reasons for that are the increasing medical insurance premiums. Thus, even the Affordable Care Act marketplace policies are affordable only because of the high set policy deductibles.

Deductibles are the remaining money that has to be paid by the patient before their insurance covers any other medical bills. Nowadays, deductibles can reach $10,000 for one person or $20,000 for a whole family.

You May Like: How Many Times Has Donald Trump Declared Bankrupcy

How Many People Go To Bankruptcy Each Year

In 2015, the Kaiser Family Foundation found that medical bills made 1 million adults declare bankruptcy. Its survey found that 26% of Americans age 18 to 64 struggled to pay medical bills. 10 According to the U.S. Census, thats 52 million adults. The survey found that 2%, or 1 million, said they declared bankruptcy that year. 11

Speak To An Experienced Bankruptcy Attorney Today

This article is intended to be helpful and informative. But even common legal matters can become complex and stressful. A qualified bankruptcy lawyer can address your particular legal needs, explain the law, and represent you in court. Take the first step now and contact a local bankruptcy attorney to discuss your specific legal situation.

Recommended Reading: Best Bankruptcy Software

The American Journal Of Public Health Study

Senator Sanders statistic of 500,000 medical bankruptcies per year is based on a study published by the American Journal of Public Health. In the study, researchers mailed over 3,000 bankruptcy filers a survey that asked respondents whether either medical expenses or loss of work related to an illness contributed to the bankruptcy. Some thirty percent of people responded, and of those who responded 66.5 percent said at least one of the medical factors contributed somewhat or very much to the bankruptcy.

Extrapolating from the 66.5 percent who stated a medical condition was at least somewhat a factor in the bankruptcy, then indeed one could state that about 500,000 medical bankruptcies are filed annually. However, the problem comes with the ambiguous nature of the survey. When responders said an illness somewhat contributed to the filing, what exactly does this mean?

Another study published by the New England Journal of Medicine took a different approach. There, researchers took a group of people with medical debt and determined how many filed for bankruptcy. They found that medical bankruptcies comprised just four percent of all bankruptcies. However, it could be argued that this study falsely deflated medical bankruptcy rates by ignoring the medical-related issues that may snowball to cause bankruptcy.

Retailer Closures & Bankruptcy Statistics

Theres an ongoing retail apocalypse, involving massive shop closures in the US and elsewhere. Its not only because of the continuing dominance of Amazon. Critical factors for these widespread retail closures include soaring debts, poor adaptation, and even wrong business decisions. Here are the most notable retail bankruptcies from 2016 to 2019:

2019 Major Retailer Bankruptcies

- In February 2019, Payless ShoeSource filed for bankruptcy. The closure of its remaining 2,100 stores in the US is the highest for last year.

- American apparel firm Diesel filed for bankruptcy in March 2019 due to massive losses from its brick-and-mortar stores.

- In 2019, the Ascena Retail Group closed 781 stores. These include all of its 650 Dress Barn locations

- Last September 2019, Forever 21, a popular fashion apparel and accessories firm, filed for Chapter 11 bankruptcy. However, it plans to continue its operations once it has restructured its finances.

- Luxury store Barneys New York filed for bankruptcy in August 2019. While the main store in New York City will likely remain in operation, the company is likely to be purchased by Authentic Brands by 2020.

2018 Major Retailer Bankruptcies

2017 Major Retailer Bankruptcies

2016 Major Retailer Bankruptcies

Don’t Miss: Can You Rent An Apartment With A Bankruptcy

Medical Bankruptcy Is Real Even If The Washington Post Refuses To Believe It

The Washington Post has broken new ground, calling a presidential candidate a liar for citing a statistic from research published in the world’s leading public health journal. The Post’s Fact Checker column labeled Bernie Sanders a “three pinocchio” level liar for saying that 500,000 Americans are bankrupted by medical bills each year. Sanders’ statement relied on research that we and three colleagues published in the American Journal of Public Health . Dozens of politicians and publications have cited that study as a reliable source.

Our AJPH study was part of an ongoing research effort by the Consumer Bankruptcy Project . For decades, the CBP has been surveying debtors about the causes and consequences of their bankruptcy. In our 2019 research, 37.0% of bankrupts “very much” agreed that medical bills were an important factor, while another 21.5% “somewhat agreed”. Many others cited lost wages due to illness, and overall, two-thirds cited illness-related bills, income loss or both. As we wrote in the AJPH, that’s “. . . equivalent to about 530 000 medical bankruptcies annually.” That figure is in line with estimates based on our earlier CBP studies , which were published in leading medical and policy journals.

Yet despite these flaws, the economists behind the study insisted that their math was a more reliable indicator of what caused financial ruin than the testimony from the thousands of debtors surveyed and interviewed by the CBP.

Sign Up

Response By Himmelstein And Woolhandler

An August 28 Fact Checker article in the Post assigned a Three Pinocchios rating to Sen. Bernie Sanders statement that 500,000 Americans are bankrupted by medical bills annually. Sanders estimate relied on an editorial by David Himmelstein and colleagues in the American Journal of Public Health reporting findings from a Consumer Bankruptcy Project survey that asked debtors about causes of their bankruptcy. The editorial updated previous CBP studies carried out by Himmelstein, along with then-Harvard Law Professor Elizabeth Warren, Steffie Woolhandler and Deborah Thorne that reached similar conclusions and appeared in leading medical and policy journals.

The Posts denigration of Sanders statement rests on an econometric study that found only a modest uptick in bankruptcy filings among persons hospitalized in California between 2003 and 2007. As Himmelstein, Woolhandler and Warren noted in their response to that study in the New England Journal of Medicine, the study excluded most persons with frequent hospitalizations assumed that anyone not hospitalized could not suffer medical bankruptcy that a child or partners illness couldnt lead to bankruptcy and that potentially bankrupting illnesses always commence at the moment of hospitalization – an assumption contradicted by the studys own data.

Rather than checking facts, the Post has chosen one side in an ongoing and unsettled scholarly debate, and labeled those on the other side liars.

Sincerely,

Also Check: How Do I File For Bankruptcy In Virginia

Us Bankruptcies 2020 Corporate Level

6. As of September 2020, 470 companies have gone bankrupt.

In light of the COVID-19 crisis that has negatively affected the economy, its not surprising to see more and more companies filing for bankruptcy. If we look at the historical data on corporate bankruptcies by year, the latest figure is bigger than the filings recorded during any comparable period since 2011.

7. Based on bankruptcy statistics, the consumer discretionary sector has the largest number of bankruptcies 93.

The bankruptcies 2020 report shows that most of the companies that filed for bankruptcy came from the consumer discretionary sector. The analysis is limited to public or private companies with public debts and assets or liabilities equal to $2 million or more at the time of bankruptcy filing. It also includes private companies having either assets or liabilities greater than or equal to $10 million at the time of filing.

8. The first three quarters of 2020 recorded the highest number of mega bankruptcies 52.

Historical bankruptcies data show that the number is greater than in any full year during the 20052019 period. The only exception is the year 2009 when mega bankruptcies reached 57. The analysis of mega bankruptcies covers companies with over $1 billion in assets at the time of filing.

The Best Way To Avoid Medical Debt Bankruptcy

One of the best ways to skip bankruptcy related to medical bills is disease prevention, primarily by managing chronic illnesses and keeping away from their medical complications. However, it is clear that accident-related medical costs cant be avoided.

Furthermore, health insurance cant wholly protect from higher medical prices since there can be unforeseen out-of-pocket expenses. If this is the case, a financial backup is needed. Unfortunately, according to medical bankruptcies for 2021 statistics, only one-third of Americans have more than $1,000 in savings. Its recommended that people store away 36 months of expenses in savings to cover at least the amount of possible deductibles.

Don’t Miss: Epiq Bankruptcy Solutions Llc Ditech

How Do I File For Medical Bankruptcy

- Although medical bankruptcy is not a form of bankruptcy relief, medical debt can be discharged through a filing of Chapter 7 or Chapter 13 bankruptcy.

You cant specifically file for medical bankruptcy. Nowhere on the bankruptcy paperwork does it require the debtor to specify the reason for filing bankruptcy. However, bankruptcy can still be a solution to your medical bills crisis. Unpaid medical bills eventually turn into medical debt. Medical debt is dischargeable via bankruptcy. Those who wish to file for bankruptcy resulting from medical debt may do so through either Chapter 7 or Chapter 13.

In Chapter 7, you can discharge your medical debt after the court liquidates your non-exempt assets. In Chapter 13, your medical debt is discharged after the completion of a three- to five-year repayment plan. The two chapters have different eligibility criteria your income and other factors may play a part in determining whether you qualify for Chapter 7 or Chapter 13.

Per Capita The Us Spends More Per Person On Health Care Than Any Other Country

The United States spends more than $9,000 per person on health care. While this might initially sound like a good thing, its not despite its high spending, our country doesnt have the best health outcomes. For instance, the U.S. ranks 12th in life expectancy among the 12 wealthiest industrialized countries.

See also:Household Debt Near Great Recession Level: What Does it Mean?

You May Like: Renting A House After Bankruptcy

Personal Bankruptcy Statistics For 2020

By: Lyle Daly | Updated March 24, 2020

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Bankruptcy is a last resort for consumers in financial distress, giving them a chance to liquidate their debts and have a fresh start. That opportunity comes at a cost, both in what consumers pay to file bankruptcy and in the damage it does to their credit score — and getting access to credit with a bad credit score can be difficult for many years.

How many people file bankruptcy every year? Are some demographics more likely to file bankruptcy? And what’s the most common cause?

If you think the answer to that last one is medical debt, you’ll soon learn that’s something many news articles have gotten wrong.

In this analysis, we’ll be exploring the most important personal bankruptcy statistics dating back to the 1980s.