You Need To Know This Number If Youre Going For A Mortgage

Your debt-to-income ratio is a personal finance measure that compares the amount of debt you have to your gross income. You can calculate your debt-to-income ratio by dividing your total recurring monthly debt by your gross monthly income

Why do you need to know this number? Because lenders use it as a measure of your ability to repay the money you have borrowed or to take on additional debtsuch as a mortgage or a car loan. Itâs also a helpful number for you to know as you consider whether you want to make a big purchase in the first place. This article will walk you through the steps to take to determine your debt-to-income ratio.

How To Calculate Your Dti

To calculate your debt-to-income ratio, start by adding up all of your recurring monthly debts. Beyond your mortgage, other recurring debts to include are:

- Child support and alimony

- Any other additional income

Now divide your total recurring monthly debt by your gross monthly income. The quotient will be a decimal multiply by 100 to express your debt-to-income ratio as a percentage.

Your debt-to-income ratio, along with your credit score, is one of the most important factors lenders consider when you apply for a loan.

Which Option Is Best For You

The right option will depend on your timeline for achieving your homeownership goals, the amount of available spare cash, and your potential lender’s willingness to work with you. Your homeownership dream doesn’t necessarily have to come to an end if a lender says you have too much debt to get approved for a loan. The important thing is to explore all the possible solutions.

Don’t Miss: How Many Bankruptcies Has Donald Trump Have

Why Is Your Dti Ratio Important

A DTI is often used when you apply for a home loan. Even if youre not currently looking to buy a house, knowing your DTI is still important.

First, your DTI is a reflection of your financial health. This percentage can give you an idea of where you are financially, and where you would like to go. It is a valuable tool for calculating your most comfortable debt levels and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If youre interested in applying for a credit card or an auto loan, lenders may use your DTI to determine if lending you money is worth the risk. If you have too much debt, you might not be approved.

Your Student Loan Debt Matters

For the millennial generation, saddled with student loan debt and more than half unsure how long it will take to become debt-free, obtaining a mortgage can be a trickier process. This is because your student loan debt is factored into your debt-to-income ratio. For example, home loans insured by the Federal Housing Administration actually requires your student loan debt to be factored in one of two ways:Your lender must use:

-

Your anticipated monthly student loan payment , or

-

The greater of: one percent of your outstanding student debt balance can be used if you dont know your anticipated monthly payment, or the monthly payment as reported on the credit report

Even if your loans are currently in deferment, they will be counted as part of your debt-to-income ratio. So, as you can see, your student loans can have a big impact on your ability to borrow money to purchase a home. Each program varies, so dont forget to check with your lender about student loan guidelines.

Don’t max out your credit cards

Recommended Reading: Can A Married Person File For Bankruptcy Alone

How To Lower Your Dti Ratio

You can reduce your DTI ratio and increase your chances of getting approved for a loan with favorable rates and terms in a number of ways. Here are several suggestions:

Its a good idea to recalculate your DTI ratio every month to find out whether youre making progress. By watching the percentage go down slowly but surely, youll be motivated to keep your debt at manageable levels.

When Can Dti Be Higher Than 36%

Some mortgages such as those offered by the FHA, have certain, more stable features that make it more likely youll be able to afford your loan, according to the CFPB. Current FHA loan requirements allow for a total DTI ratio of up to 50% or less.

Both small lenders and large banks may offer loan options at higher DTI percentages. Be sure to compare mortgage loans from several lenders to find the best option for your financial needs.

Recommended Reading: How To File For Bankruptcy In Ms

What Is A Front

Also known as your housing ratio or mortgage-to-income ratio, your front-end ratio is how much you pay toward your housing expenses each month compared to your monthly income. This might include your mortgage payment, mortgage insurance, and property taxes. To find your front-end ratio, divide your total housing costs by your gross monthly income.

Doing The Simple Math

Once you’ve calculated what you spend each month on debt payments and what you receive each month in income, you have the numbers you need to calculate your debt-to-income ratio. To calculate the ratio, divide your monthly debt payments by your monthly income. Then, multiply the result by 100 to come up with a percent.

Recommended Reading: Does Bankruptcy Clear Income Tax Debt

What Your Debt To Income Ratio Means

Your final result will fall into one of these categories.

- 36% or less is the healthiest debt load for the majority of people. If your debt-to-income ratio falls within this range, avoid incurring more debt to maintain a good ratio. You may have trouble getting approved for a mortgage with a ratio above this amount.

- 37% to 42% isn’t a bad ratio to have, but it could be better. If your ratio falls in this range, you should start reducing your debts.

- 43% to 49% is a ratio that indicates likely financial trouble. You should start aggressively paying your debts to prevent an overloaded debt situation.

- 50% or more is an extremely dangerous ratio. This means that more than half of your income goes toward debt payments each month. You should be aggressively paying off your debts. Don’t hesitate to seek professional help.

Explore Other Options To Lower Your Payments

Reducing your monthly payments can help improve your DTI, and refinancing may be one way you can do that. For example, you might be able to substantially lower your required monthly payments if you refinance a bunch of high-interest debt into a low-interest personal loan. In this case, while your total debt balance won’t change, your new monthly payment will be lower.

Some mortgage lenders may still disqualify you based on your total loan balance, or based on the fact you recently applied for new credit, so ask your lender how they’d view this action.

Of course, you may decide it makes sense to do it anyway, even if it doesn’t immediately enable you to get a mortgage loan. After all, who doesn’t want to lower their monthly payments? Just be sure you don’t lengthen your repayment timeline so much that you also raise your total interest costs.

Also Check: House For Sale By Bank

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johnâs income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

Recommended Reading: Can You Reopen A Bankruptcy Case After Discharge

What Should You Do If You Have A High Debt To Income Ratio

For your own knowledge, you should at all times monitor your debt to income ratio. It is a part of good financial planning to have a tab on your finances. When your income rises or when you are considering the idea of availing a new loan, it is a good idea to re-check your debt-income ratio and assess your financial position.

If you notice that your Debt to Income Ratio is high then there are things you can do to lower it. You can:

- Postpone a purchase if it is not essential.

- Increase your EMI and pay off the loan quicker this will temporarily raise your debt-income ratio but make it lesser in the long run.

- Not take more debt until your ratio has stabilized to below 35%.

- Look for ways in which you can increase your income

- If possible, foreclosing any existing loans would also be a good idea.

Top Credit Card Wipes Out Interest Until 2024

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR for up to 21 months! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

Recommended Reading: Can You Refile Bankruptcy If Dismissed

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Different loan products and lenders will have different DTI limits. To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

How Can You Use Dti For Personal Loans

Ideally, a DTI between 21 and 35 per cent is considered ideal from the lenders perspective. If the DTI lies between 35 and 60 per cent, there are chances of loan approval but with a relatively higher interest rate. Applicants having more than 60 percent DTI might find it very tough to get loans sanctioned.

For example, consider Mr Amit, who wishes to take a personal loan and earns an annual income of Rs. 10,00,000. His current debt includes a home loan of Rs. 40,000 and an auto loan of Rs. 20,000.

His computed DTI ratio is as follows:Gross Monthly Income: 10,00,000/12 = 83,333Gross Monthly Debt: 40000 + 20000 = 60,000

The DTI ratio will be *100 = 72%

Also Check: Do Bankruptcies Clear Judgements

How Much Do Debt Ratios Affect A Credit Score

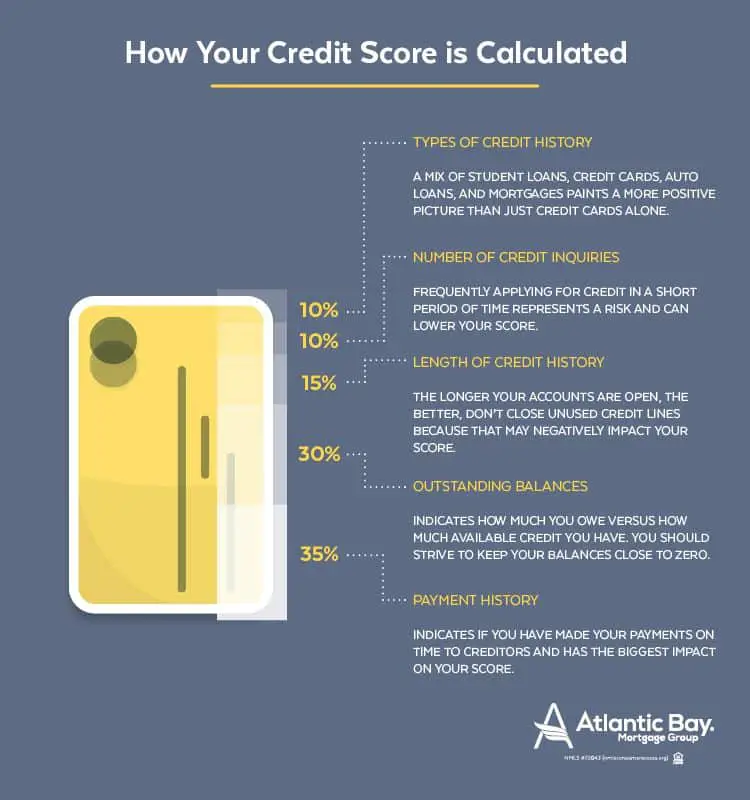

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

Also Check: Does Chapter 7 Bankruptcy Get Rid Of Student Loans

When Is A Debt To Income Ratio Used

The debt to income ratio is used largely when getting a home or lot loan, but it can also help land buyers know their overall financial health before applying for a large acreage land loan.

Land loans that are more than five acres are typically more risky to lend on than home loans in the eyes of a lender. Some land lenders will use other ratios in conjunction with debt to income to analyze your ability to repay the loan, says AgSouth Farm Credit Credit Analyst Robby Williams.

Whether you are buying a home or land, knowing your debt to income ratio and where you fall will be a good indicator of your chances of getting approved.

Recommended Reading: What Happen When You File Bankruptcy

The Ascent’s Best Mortgage Lender Of 2022

Mortgage rates are at their highest level in years and expected to keep rising. It is more important than ever to check your rates with multiple lenders to secure the best rate possible while minimizing fees. Even a small difference in your rate could shave hundreds off your monthly payment.

That is where Better Mortgage comes in.

You can get pre-approved in as little as 3 minutes, with no hard credit check, and lock your rate at any time. Another plus? They dont charge origination or lender fees .

What Is The Debt

Its a pretty simple concept.

Your debt-to-income ratio compares what you owe against what you earn. In mathematical terms, its the quotient of your monthly obligations divided by your monthly gross income: R = D/I, where D is your total debt, I is your total income, and R is your debt-to-income ratio.

Recommended Reading: How To File Bankruptcy Chapter 7 Yourself In Texas

How To Calculate Debt

Figuring out your DTI is a fairly simple process if you know how to do it. Heres how the debt-to-income ratio is calculated:

Total monthly debt payments/Gross monthly income x 100 = Debt-to-income ratio

In this formula, total monthly debt payments represent the total amount combined you pay to debt each month. So this includes payments to student loans, credit cards, car loans, personal loans, mortgages or any other debts you have.

Your gross monthly income is your income before taxes and other deductions are taken out. This is your total income from all sources, including a 9 to 5 job, a part-time job or second job, a side hustle and any payments you receive in the form of government benefits, child support or alimony.

So, heres an example of how to calculate your debt-to-income ratio:

First, youd add up all of your monthly debt payments. Remember, youre only looking at debts here, not other expenses such as utility bills or insurance.

Next, add up your gross monthly income. If you work a regular 9 to 5 you can find your gross pay listed on your pay stubs. If youre self-employed or do gig work, you may need to check your bank statements to see how much youve deposited.

Now, say you have total debt payments of $1,500 each month. Meanwhile, your total gross monthly income is $5,000. To find your DTI, youd divide $1,500 by $5,000 to get 0.3. Youd then multiply that by 100 to get your final debt-to-income ratio of 30%.

Lower Interest On Debt

The lower your interest rate, the faster you can pay the debt off in full. There are several ways to lower your rate. The first is to call the lender and ask for a reduction in the rate. If you’ve been working with a particular financial institution for years, they know your reputation for paying on time and may want to keep you as a customer enough to lower the rate.

Or, you can consider consolidating higher-interest debt into a single personal loan with a lower interest rate. Say you have three credit cards, each carrying an interest rate between 15% and 17%. If you can land a personal loan at 5% and use the funds to pay the credit cards off, you’ll save money, pay your debt off faster, and quickly lower your DTI.

If your credit score is strong, you also have access to some pretty great credit cards with 0% introductory offers. Here’s how these offers work: A credit card company offers 0% interest for a set period to new customers. You use the 0% offer to pay off outstanding debt or transfer outstanding credit card balances to the new card. You save money by not paying interest as long as you pay the new credit card off in full before the promotional period ends. In addition, your DTI drops with each payment.

You May Like: Pallet Items For Sale

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.