What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

How Lenders Use Front

Lenders use both front-end and back-end debt-to-income ratios to determine your ability to repay a home mortgage loan. A higher DTI can signal to lenders that you might be stretched thin financially, while a lower DTI suggests that you have more disposable income each month that isn’t going to debt repayment.

Debt-to-income ratio is just one part of the puzzle, however. Lenders can also look at your income, assets, and employment history to gauge your ability to repay a mortgage loan. Debt-to-income ratios can play a part in decision-making for purchase loans as well as mortgage refinancing.

How To Calculate Your Debt

Here’s an example:

You pay $1,900 a month for your rent or mortgage, $400 for your car loan, $100 in student loans and $200 in credit card paymentsbringing your total monthly debt to $2600.

Your gross monthly income is $5,500.

Your debt-to-income ratio is 2,600/5,500, or 47%.

You May Like: Can You File Bankruptcy On Your Car And Keep It

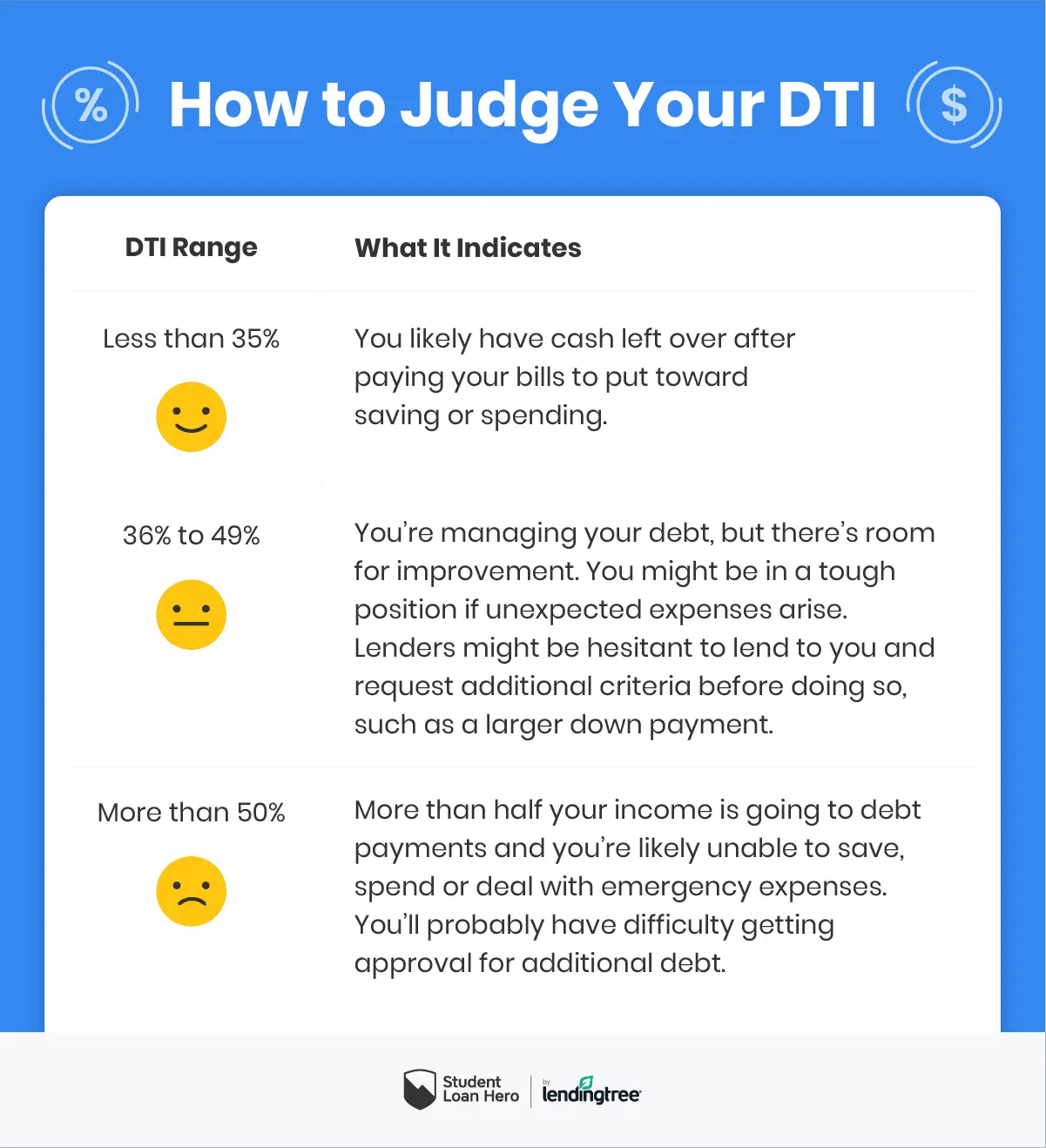

What Happens If My Debt

If your debt-to-income ratio is higher than the widely accepted standard of 43%, your financial life can be affected in multiple waysnone of them positive:

- Less flexibility in your budget. If a significant portion of your income is going towards paying off debt, you have less left over to save, invest or spend.

- Limited eligibility for home loans. A debt-to-income ratio over 43% may prevent you from getting a Qualified Mortgage possibly limiting you to approval for home loans that are more restrictive or expensive.

- Less favorable terms when you borrow or seek credit. If you have a high debt-to-income ratio, you will be seen as a more risky borrowing prospect. When lenders approve loans or credit for risky borrowers, they may assign higher interest rates, steeper penalties for missed or late payments, and stricter terms.

How Your Dti Is Used By Lenders

When you apply for a mortgage, lenders will look at DTI, your credit history and your current credit scores. Why? Because all this information taken together can help them better understand how likely you will be to repay any money they loan to you. While there’s no immediate way to improve a credit score, certain actions can help , and can start you on a better path today. Think about:

- Pay down existing debt, especially revolving debt like credit cards. This will help improve both your DTI and your credit utilization ratio.

- Pay all bills on time every month. Late or missed payments appear as negative information on credit reports.

- Avoid applying for any new credit, as too many hard inquiries in a short time frame could affect your credit scores.

- Use your existing credit wisely. For example, make a small purchase with a credit card and pay off the full balance right away to help establish a positive payment history.

http://www.investopedia.com/terms/f/front-end-debt-to-income-ratio.asp

Don’t Miss: What Does Chapter 13 Mean On Bankruptcies

What Is Your Debt

Your debt-to-income ratio refers to the total amount of debt payments you owe every month divided by the total amount of money you earn each month. A DTI ratio is usually expressed as a percentage.

This ratio includes all of your total recurring monthly debt credit card balances, rent or mortgage payments, vehicle loans and more.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

You May Like: When Did Puerto Rico Declare Bankruptcy

Limitations Of The Debt

A DTI ratio is free from the consideration of kinds of debts and the values that go in its repayment. For instance, credit cards have higher rates of interest in comparison to student loans, but both are merged to formulate a persons debt-income ratio. The monthly payments of a card would decrease if your transfer the balance from a card with a high-interest rate to a card with low-interest rates. But this will only reduce your monthly payments and DTI ratio, the outstanding debt value will remain the same.

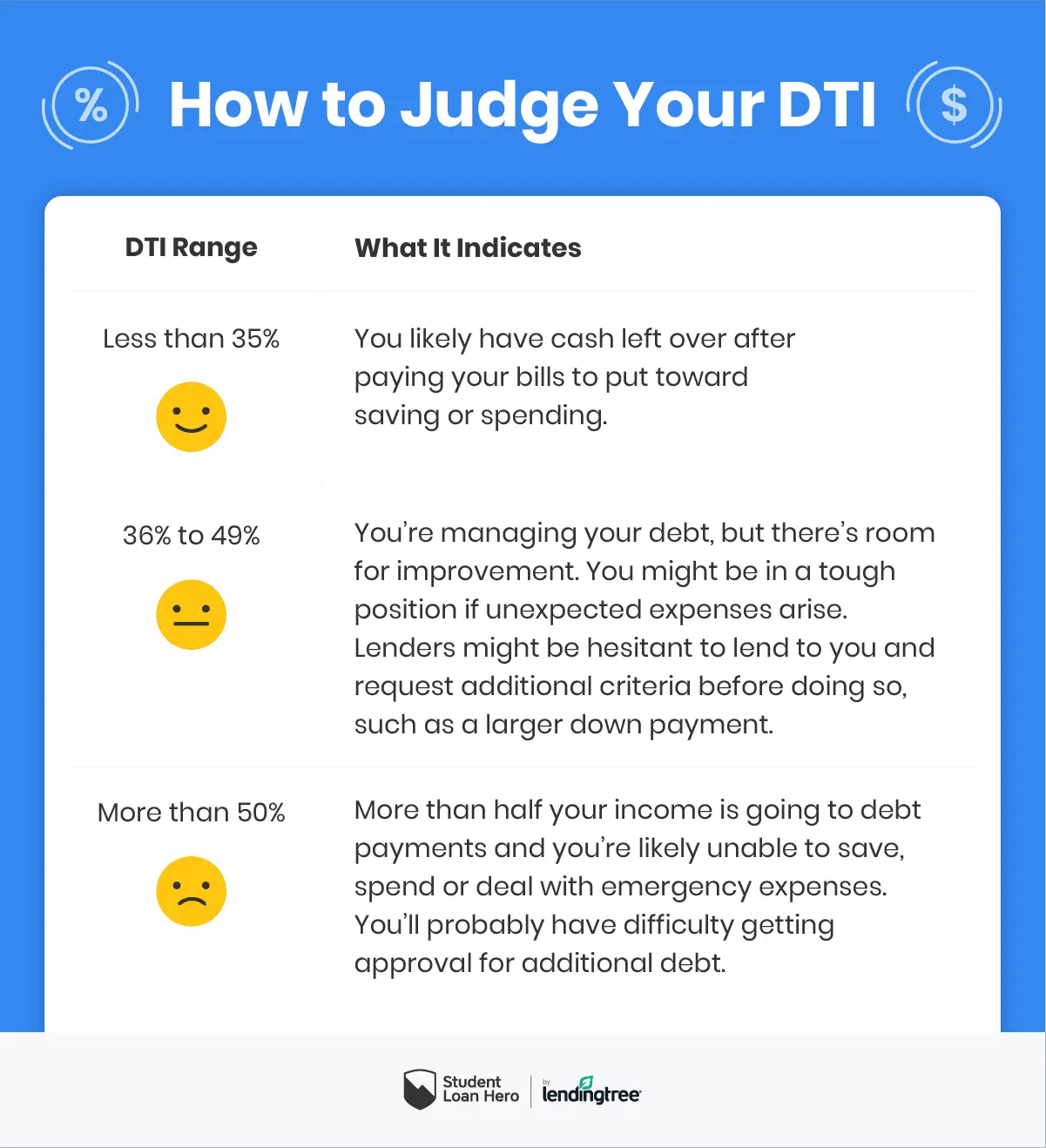

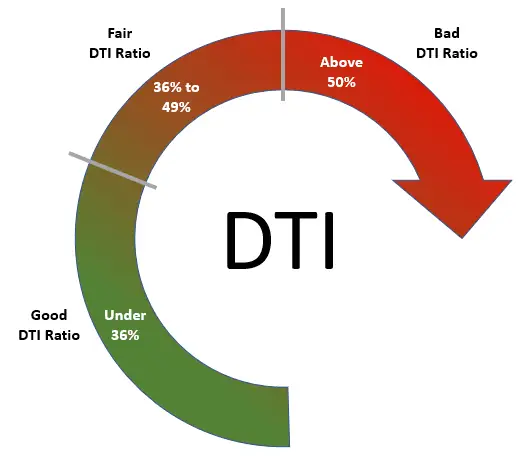

What Is A Good Debt To Income Ratio

Different lenders and loan programs have varying requirement ranges for debt to income ratios. Before you get prequalified or apply for a loan, ask your lender what the debt to income requirement is for the loan product you are thinking of getting.

AgSouth Mortgages Home Loan Originator Brandt Stone says, Typically, conventional home loan programs prefer a debt to income ratio of 45% or less but its not necessarily a hard stop as other factors can influence the decision . FHA and VA loans will allow debt to income ratios above 45% as long as there are other positive factors. For USDA loans you must have a debt to income ratio of 41% or less. This is due to the loan to value being 100% , therefore, the USDA wants to see a lower debt ratio since they are financing all of the purchase price. Typically, anything less than 35% will help get you a favorable interest rate and loan terms. Anything more than 45% means you have little to no extra spending money per month and might have a harder time being approved for credit.

Don’t Miss: What Happens When A Corporation Files Bankruptcy

How Is Your Debt

You can determine your debt-to-credit ratio by dividing the total amount of credit available to you, across all your revolving accounts, by the total amount of debt on those accounts.

For example, say you have two credit cards with a combined credit limit of $10,000. If you owe $4,000 on one card and $1,000 on the other for a combined total of $5,000, your debt-to-credit ratio is 50 percent.

Debt To Income Ratio Calculation

Let us explore the following DTI ratio example below to understand the concept and calculation:

David applies for a credit card for smaller purchases. The credit card company asks him to provide his proof of income. It finds that David earns around $10,000 per month. Thus, the company calculates the ratio to check if it fulfills the companys repayment terms.

The company also asks for details about the other debts that David has to pay. It comes to know that the credit card seeker has a mortgage loan of $2,000 and a car loan of $1,000 to pay every month. Based on the information, it calculates the DTI ratio:

DTI = /

= / = 3000/1000 = 30%

Davids credit card application gets approved as he fulfills the companys repayment terms.

Read Also: What Is The Best Way To Reestablish Credit After Bankruptcy

How Do I Lower My Debt

Is your debt-to-income ratio over 50%? This may be a sign that youre living above your means.

To make getting a mortgage loan easier, you could figure out how topay off your debt. Here are a few things you could do:

Make a budget: Having an overview of your monthly income and expenses will allow you to determine how much money you can put towards paying off your debt, even if youre only paying off a little at a time. To put the odds in your favour, review your budget regularly, spend reasonably, and consider whether a major expense that will increase your debt load is really something you need. Prioritize your debts: List the totals of all your debts, as well as their interest rates. Pay off debts with a high interest rate first, as these are usually the most expensive. You can also prioritize paying off bad debt, meaning loans taken out to make purchases that will quickly lose value, rather than good debt, which is considered an investment, or debts whose interest is tax deductible, such as student loans. Consolidate your debt: To make payments easier and potentially get a lower interest rate, you could ask the bank for a loan in order to consolidate all your debt. On top of having only one monthly payment to make, this could also have a positive impact on your budget and borrowing capacity. Talk it over with an advisor.

How Do You Calculate Debt

To calculate your current debt-to-income ratio, add all of your monthly debt payments, then divide your monthly debt payments by your monthly gross income.

The Balance

Multiply your income by a target debt-to-income level, such as 30%. The resulting dollar amount is an upper limit on your total monthly payments if you want to meet that target.

Monthly debt payments include the required minimum payments for all your loans, including:

The gross monthly income used in the calculation equals your monthly pay before any deductions for taxes or other items on your paycheck.

You May Like: What Does Bankruptcy Do To Your Credit

What Is The Debt

The debt-to-income ratio is a metric used by creditors to determine the ability of a borrower to pay their debts and make interest payments. The DTI ratio compares an individuals monthly debt payments to his or her monthly gross income. It is a key indicator that lenders use to measure an individuals ability to repay monthly payments and accumulate additional debt.

What Is The Maximum Allowable Dti

The specific debt-to-income requirements vary from lender to lender, but conventional loans often range from 36% to 45%.

For your mortgage to be a qualified mortgage, the most consumer-friendly type of loan, your total ratio must be below 43%. With those loans, federal regulations require lenders to determine you have the ability to repay your mortgage. Your debt-to-income ratio is a key part of your ability.

Lenders may look at different variations of the debt-to-income ratio: the back-end ratio and the front-end ratio.

Recommended Reading: What Happens When You Claim Bankruptcy In Australia

If I Have A High Debt

These ratios are indicators of the position you typically need to be in to get financing. If your debt-to-income ratio is too high, you may be turned down. However, depending on your financial situation, you may still qualify for a loan.

Your file will be examined by your bank in order to evaluate your situation and your profile as a whole, taking into account several elements such as:

How much do you make? What field do you work in? How long have you been in your current job? Why are you applying for a loan? What are your assets and your liquidity? How is your credit report?

A lender could also ask you to find a co-borrower or an endorser in order to reduce the risks related to granting you a loan.

If you want to get a loan, you should not exceed the limits on these ratios they are critical thresholds, and indicators of a high debt load. Getting close to that maximum not to mention exceeding it is dangerous. You may find yourself in a precarious situation if an unexpected event should arise, like if youre faced with unexpectedly high interest rates, lose your job, or encounter a health issue.

How To Lower Your Debt

If your debt-to-income ratio is close to or higher than 36 percent, you may want to take steps to reduce it. To do so, you could:

- Increase the amount you pay monthly toward your debt. Extra payments can help lower your overall debt more quickly.

- Avoid taking on more debt. Consider reducing the amount you charge on your credit cards, and try to postpone applying for additional loans.

- Postpone large purchases so youre using less credit. More time to save means you can make a larger down payment. Youll have to fund less of the purchase with credit, which can help keep your debt-to-income ratio low.

- Recalculate your debt-to-income ratio monthly to see if youre making progress. Watching your DTI fall can help you stay motivated to keep your debt manageable.

Keeping your debt-to-income ratio low will help ensure that you can afford your debt repayments and give you the peace of mind that comes from handling your finances responsibly. It can also help you be more likely to qualify for credit for the things you really want in the future.

Recommended Reading: Can You Declare Bankruptcy On Federal Student Loans

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowerâs total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Debt To Income Ratio Explained

If the ratio obtained is higher than expected, the banks and financial institutionsFinancial InstitutionsFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations. read more do not agree to offer finances in such a scenario. A higher DTI ratio indicates the debts and liabilities are considerably higher, and another loan would be difficult to manage for a borrower. On the other hand, when the debt to income ratio for mortgage is low, lenders know they will receive payments on time.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Debt to Income Ratio

The DTI ratios are of two kinds front-end ratios and back-end ratios. The front-end ratios include the portion of the gross monthly income used for repaying mortgage installments, rent, property taxes, insurance, etc. On the contrary, the back-end ratios mark all recurring payments that borrowers are liable to pay, including those under the front-end ratios category.

Also Check: How Long For Bankruptcy To Be Discharged

What Is A Desirable Front

To qualify for a mortgage, the borrower often must have a front-end debt-to-income ratio of less than an indicated level. Paying bills on time, having a stable income, and having a good won’t necessarily qualify you for a mortgage loan. In the mortgage lending world, how far you are from financial ruin is measured by your DTI. Simply put, this is a comparison of your housing expenses and your monthly debt obligations versus how much you earn.

Higher ratios tend to increase the likelihood of default on a mortgage. For example, in 2009, many homeowners had front-end DTIs that were significantly higher than average, and consequently, mortgage defaults began to rise. In 2009, the government introduced loan modification programs in an attempt to get front-end DTIs below 31%.

Lenders usually prefer a front-end DTI of no more than 28%. In reality, depending on your credit score, savings, and down payment, lenders may accept higher ratios, although it depends on the type of mortgage loan. However, the back-end DTI is actually considered more important by many financial professionals for mortgage loan applications.

How To Achieve A Good Debt Ratio

You can reduce your debt-income ratio in two ways, either by increasing your income or by decreasing the levels of your debts. Usually, increasing the income is the tougher option out of the two. In case, a high DT ratio is restricting you from accessing the required credit, the lenders might suggest that you go for a co-signer or co-applicant for your loan whose income can be considered in your credit application. This might help get the needed credit, but it will not reduce your debt-to-income ratio.

Read Also: How Do You File For Bankruptcy In Sc

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Different loan products and lenders will have different DTI limits. To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

Read Also: How Does Chapter 13 Bankruptcy Affect Your Credit Score