Breaking Down The Dti Ratio

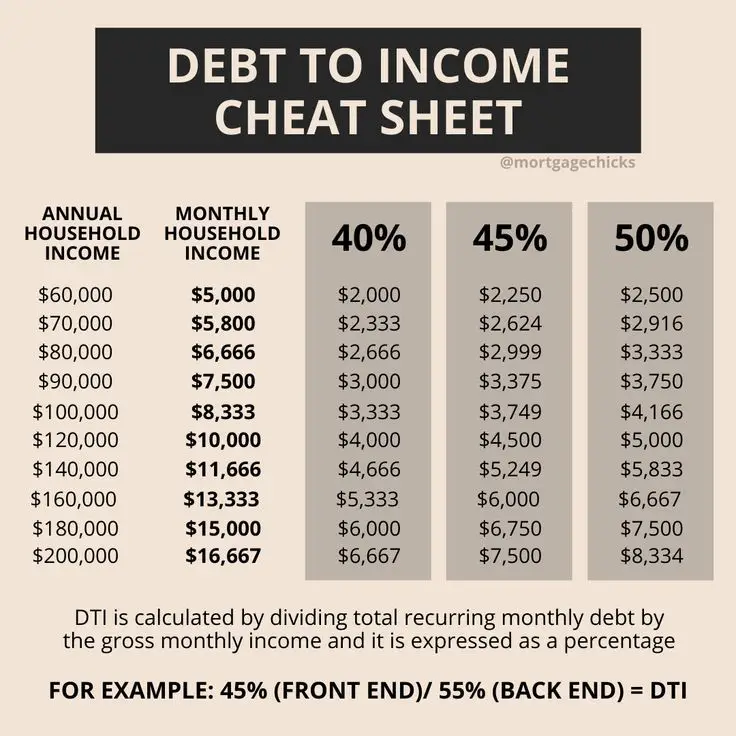

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

How High Interest Rate Environments Affect Debt To Income Ratio Requirements

When interest rates rise, the monthly payment for your loan is higher than compared to the payment with a lower rate, therefore, you will qualify for less of a mortgage. This is something to keep in mind when interest rates are rising, especially if your debt to income ratio is in the higher range. Rising rates may decrease what you qualify for, says Stone.

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

You May Like: Where Can I Buy Liquidation Pallets

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

Buyer Bewareof How Much You Can Afford

Because debt-to-income ratios are calculated using gross income, which is the pre-tax amount, its a good idea to be conservative when you feel comfortable taking on. You may qualify for a $300,000 mortgage, but that amount may mean living paycheck-to-paycheck rather than being able to save some of your income each month. Also remember, if youre in a higher income bracket, the percentage of your net income that goes to taxes may be higher.

While your debt-to-income ratio is calculated using your gross income, consider basing your own calculations on your net income for a more realistic view of your finances and what amount youd be comfortable spending on a home.

Also Check: At& t Bankruptcy Department

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

What Dti Do You Need For A Home Equity Loan

More than anything, lenders want borrowers who can pay back their loans regularly and on time. To that end, they look for people with low DTIs because it indicates that they has sufficient income to pay for a new loan after paying their current debt obligations.

The maximum DTI that most home equity loan lenders will accept is 43%. Of course, lower DTIs are more attractive to lender because it indicates you have more room in your budget to afford a new loan. A lower DTI can make you eligible for a larger loan or a lower interest rate, or both.

To decrease your DTI, you can pay off some debts before applying for a home equity loan. Paying down your credit cards is one way to do that. Reducing your credit card balance will also lower your , which can boost your credit score, further helping you qualify for a loan.

The Consumer Financial Protection Bureau suggests that homeowners aim for a total DTI no higher than 36%. In terms of mortgage debt alone it suggests a DTI of no more than 28% to 35%.

Don’t Miss: Pallets Of Merchandise For Sale

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt-to-income ratio means.

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Read Also: Do It Yourself Bankruptcy Chapter 7 Software

How Lenders Decide How Much You Can Afford

Lenders use a few different factors to see how much home you can afford. They use your debt-to-income ratio, or DTI, to make sure you can comfortably pay your mortgage as well as your other debt. This includes credit cards, car loans, student loan payments and more.

You can calculate your DTI ratio by adding up all your debt payments and dividing it by your gross monthly income. Say your monthly income is $7,000, your car payment is $400, your student loans are $200, your credit card payment is $500 and your current home payment is $1,700. All that together is $2,800. So, your DTI ratio is 40% since $2,800 is 40% of $7,000.

In general, a good DTI to aim for is between 36% and 43%. Some lenders will go higher, but the lower your DTI, the more likely you are to be pre-approved for a mortgage. Different lenders have different DTI requirements, though, so compare multiple mortgage lenders to find one that works for you.

How To Improve Your Debt

The goal is usually 43% or less, and lenders often recommend taking remedial steps if your ratio exceeds 35%. There are two options to improving your debt-to-income ratio:

Neither one is easy for many people, but there are strategies to consider that might work for you.

Don’t Miss: How Much Do Bankruptcy Trustees Make

How Lenders View Your Debt

Now that you know how a debt-to-income ratio is calculated, you might be wondering what lenders think of your score.

The criteria can vary from lender to lender, but heres a general breakdown of the industry standards:

DTI less than 36%Lenders view a DTI under 36% as good, meaning they think you can manage your current debt payments and handle taking on an additional loan.

DTI between 3643%In this range, lenders get nervous that adding another loan payment to your plate might be challenging, especially if an emergency pops up. You wont necessarily get turned down for another loan, but lenders will proceed with caution.

DTI between 4350%When your DTI gets to this level, youre almost too risky for lenders, and you may not be able to get a loan.

DTI over 50%At this point, youre in the danger zone, and lenders probably wont lend you money. With a DTI ratio over 50%, that means over half of your monthly income is going to pay debt. Add in normal living expenses, like groceries and insurance, and theres not much left over for saving or covering an emergencyand another loan could tip you over the edge.

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Don’t Miss: Pender County Tax Foreclosures

Dti Isn’t A Full Measure Of Affordability

Although your DTI ratio is important when getting a mortgage, the number doesn’t tell the whole story about what you can afford.

DTIs don’t take into account expenses such as food, health insurance, utilities, gas and entertainment, and they count your income before taxes, not what you take home each month.

Youll want to budget beyond what your DTI labels as affordable, and consider all your expenses compared with your actual take-home income.

» MORE: How much house can you afford?

What Is A Good Credit Score To Buy A House 2020

While you don’t need a perfect 850 credit score to get the best mortgage rates, there are general credit score requirements you will need to meet in order to take out a mortgage. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages.

Also Check: Bank Foreclosure Houses For Sale

Mortgage Approval: Whats Behind The Numbers In Our Dti Calculator

Your debt-to-income ratio matters when buying a house. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. DTI is calculated by dividing your monthly debt obligations by your pretax, or gross, income.

In most cases, lenders want total debts to account for 36% of your monthly income or less. Nonconventional mortgages, like FHA loans, may accept higher a DTI ratio, but conventional mortgages may not be as flexible.

Lenders consider low DTI as important as having a stable job and a good credit score. When evaluating your mortgage application, DTI tells lenders how much of your income is already spoken for by other debts. If the percentage is too large, its a clue you may have trouble paying your monthly mortgage payments, and lenders will be reluctant to approve your loan.

Hate surprises? Estimating your DTI with the NerdWallet calculator before submitting your mortgage application can help you understand how much house you can afford.

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

Also Check: Can You File Bankruptcy On Utility Bills

What Is A Good Debt To Income Ratio And How To Calculate Yours

When getting a loan, one factor your lender is going to look at will be your debt to income ratio. Before you apply for a loan, you should know your ratio and how it might affect your loan approval or terms.

This article discusses the debt to income ratio for individuals – not business entities. If you are a farm business or a young, beginning, or small farmer looking for farm finance guidance, please visit here.

In this article:

- When a debt to income ratio is used

- Debt to income definition

- What is included in your debt to income ratio and how to calculate yours

- What is a good debt to income ratio

- How different interest rate environments affect what ratio your lender is looking for

- How to improve your debt to income ratio

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Read Also: New Jersey Chapter 7 Bankruptcy

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Read Also: How To Fix My Credit After Bankruptcy

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individualâs monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individualâs ability to manage monthly payments and repay debts.

How To Lower Your Monthly Mortgage Payment

Your monthly mortgage payment is going to take up a good chunk of your overall debt, so anything you can do to lower that payment can help. Consider some options, like:

- Find a less expensive house. While your lender might approve you for a loan up to a certain amount, you donât necessarily have to buy a home for the full amount. The lower the home price, the lower your monthly payments will be.

- Boost your down payment. The higher your down payment, the lower your monthly payment will be. So, if you can, save up so you can secure that lower payment.

- Get a lower interest rate. Most of the time, your interest rate is based on your credit score and DTI. Try to pay down outstanding debt, like credit cards, car loans or student loans. This not only lowers your DTI, but could also improve your credit score. A higher credit score means you could get a lower interest rate offered by your lender.

You May Like: Who Reports Bankruptcies To The Credit Bureaus