How Does A Bankruptcy Affect My Credit Score

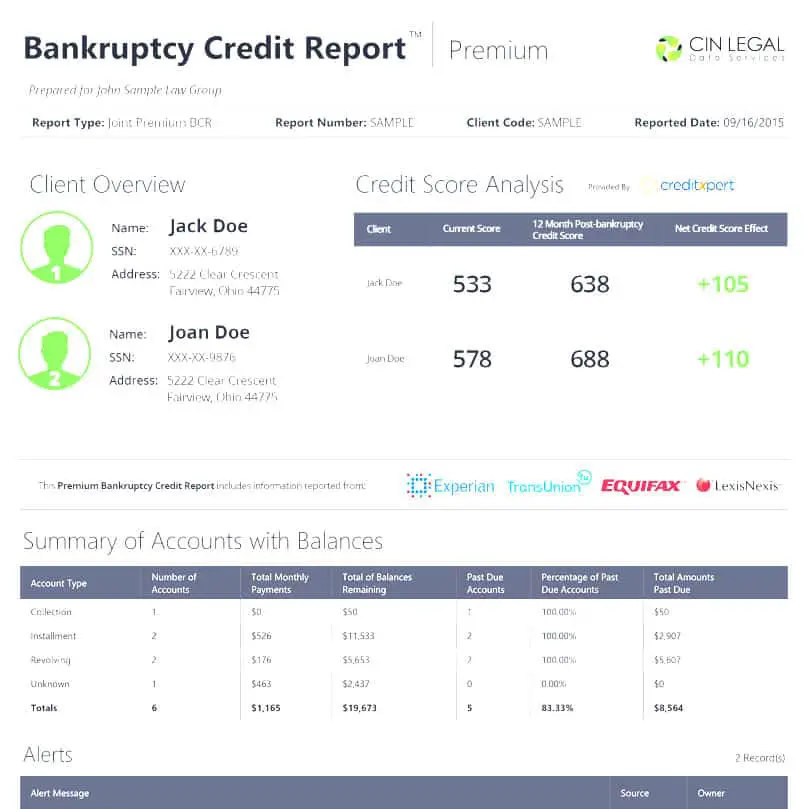

A bankruptcy is one of the financial situations that can have the most negative effect on your credit scores. A legitimate bankruptcy can decrease a credit score by anywhere from 130 to 240 points, depending on the original score range.

If you have an average score of 680, for example, your score will drop by between 120 and 150 points following a bankruptcy. But if your score is 780, it will drop by between 220 and 240 points.

Thus, the higher your original score, the farther it will drop after filing for Chapter 7 or Chapter 13 bankruptcy. If your score starts out in the “good” range, it could immediately drop to “poor” following a bankruptcy.

Related Content:

How To Reestablish Your Credit

After declaring bankruptcy, you’ll want to look at ways you can earn a score in a range that will qualify you for better financing options and that begins with rebuilding your credit.

You may not be able to immediately qualify for the best credit cards, but there are others that apply to people with less-than-stellar credit.

Secured credit cards require a deposit that acts as your credit limit. If you make your credit card payments on time and in full on this new secured card, you then have a greater chance at qualifying for an unsecured credit card in the near future.

The Capital One® Secured has no annual fee and minimum security deposits of $49, $99 or $200, based on your creditworthiness. Those who qualify for the low $49 or $99 deposits will receive a $200 credit limit. Cardholders can obtain a higher credit limit if they make their first five monthly payments on time.

The Citi® Secured Mastercard® is another option with no annual fee. There is a $200 security deposit required, which would mirror your credit limit. Cardholders can also take advantage of Citi’s special entertainment access, which provides early access to presales and premium seating for concerts and games.

Once you add this new credit car, make sure you pay your monthly bills on time and in full to quickly work your way toward better credit.

Editorial Note:

How Long Does A Bankruptcy Stay On A Credit Report

The amount of time that a bankruptcy remains on your credit report depends on the type of bankruptcy you file.

According to the Fair Credit Reporting Act, a Chapter 13 bankruptcy can stay on your credit report for up to seven years from the bankruptcy filing date. Meanwhile, a Chapter 7 bankruptcy can remain for up to ten years. All of the accounts included in your bankruptcy will stay on the report until the bankruptcy clears.

These timelines are the legal maximum that bankruptcies can stay on your credit report. However, you may be able to have a bankruptcy removed from your credit report sooner by following the steps above.

Read Also: Epiq Corporate Restructuring Llc Phone Number

What You Need To Know About Credit Reports

A credit report reflects a consumers history of establishing credit accounts and taking out loans and repaying the money borrowed. Lenders use credit reports to help them decide whether to loan you money and what interest rates they will charge. Others who may base a decision on your credit reports include insurance companies, landlords, and utility providers, including cable TV, internet, and cell phone service providers.

The three national credit bureaus are Equifax, Experian and TransUnion. There are also regional companies. Most people have more than one credit score.

Almost all credit bureaus use information on your credit report to assign you a three-digit FICO Score, which was . FICO scores estimate how likely you are to repay a loan on time, or what level of risk a creditor undertakes by loaning you money or extending you a line of credit.

FICO scores differ slightly among credit bureaus, but most have a 300-850 score range. The higher the score, the lower the risk to lenders. A good credit score is considered to be in the 670-739 score range. You may get credit or a loan with a fair score , but your interest rate will be higher.

Because a bad FICO score can cost you thousands of dollars over the life of a loan, you should check your credit reports regularly or sign up for alerts to be notified when your score changes, in case there are errors.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: How Long A Bankruptcy Stays On Credit Report

New Public Record Policy

In the past, there were three types of public records that could appear on your credit report: bankruptcies, judgments and tax liens. In recent years, however, there have been major changes that have reduced the number of public records added to credit reports to one.

While its still common today to find bankruptcies on credit reports, you typically wont find a judgment or tax lien.

The reason judgments and tax liens have gone missing from credit reports is because of new policies adopted by the three major credit reporting agencies Equifax, TransUnion, and Experian stemming from a 2015 settlement between the CRAs and 31 state attorneys general.

The landmark settlement resulted in the creation of the National Consumer Assistance Plan , an initiative designed to make credit reports more accurate and make it easier for people to fix any errors.

As part of the consumer-friendly changes, the credit reporting agencies agreed to implement new standards related to public records. Namely, for any public record to be included on a credit report, it has to satisfy the following criteria:

- The public record has to contain, at minimum, the consumers name, address, plus a Social Security number or date of birth.

- The public record information must be updated/verified at least once every 90 days.

Bankruptcy records already met these stricter requirements. Many tax liens and civil judgments, however, did not .

Can I Rebuild My Credit After Bankruptcy

You can rebuild your credit after bankruptcy, but its a long process. Your options will be limited at the start, but it is key to not get discouraged. As time goes on, if you consistently pursue a credit rebuilding strategy, your reports and scores can improve.

Here are some recommendations to start with:

- Understand the cause: Identify, accept, and learn from the root causes of your bankruptcy so you wont find yourself in the same position down the road.

- Stick to a budget: Re-evaluate your finances and see where you can cut expenses and save more money if you can.

- Start establishing a new credit history: No, this does not mean using an alias . It means starting fresh with whatever credit you can obtain.

This may mean settling for an extremely high-interest rate, taking on a co-signer, depositing cash into a secured credit card, or other options that have been designed specifically to help you re-establish a positive credit record.

Use these credit options sparingly and never put more on a card than you can pay off by the end of the month so your credit improves over time.

Also Check: Has Mark Cuban Ever Filed For Bankruptcy

How To Rebuild Credit After Bankruptcy

Accounts included in a bankruptcy filing wont be reported as unpaid or past due anymore on your credit reports. Assuming you pay new debts on time as you incur them, your credit rating will start to recover.

In the meantime, review your credit reports. Accounts that were discharged as part of your bankruptcy filing should be reported as discharged or included in bankruptcy on your credit reports. They should not show any money owed on them a balance of $0.

If there are errors in a credit report, contact the credit bureau to have the report corrected.

You can also start to rebuild your credit standing by obtaining a new credit card. You may have to resort to obtaining a secured credit card, which requires a deposit with the creditor. A third option is to have a family member or friend who has a good credit history apply for a card with you as a co-signer.

Rebuilding your credit is a gradual process. As you use a credit card and pay on time each month, other creditors will see your good financial habits on your credit report when its time to seek additional credit. It is best to avoid carrying a balance. If you must, it should not exceed 30% of the entire line of credit. You may review some tips to improve your credit score.

How Long Does Bankruptcy Or A Proposal Remain On Your Credit Report

TransUnion is very transparent about how long they maintain information on your credit report. According to their website, a record of your filing is retained on your report as follows:

Bankruptcy: TransUnion maintains this information for the maximum length of time permitted by provincial law. For a first time bankruptcy that means:

BC, YK, NWT, NU, AB, SK, MB, NS- six years from the date of dischargeON, PQ, NB, PEI & NL- seven years from the date of discharge.

If you declare bankruptcy more than once, each bankruptcy will remain on your report for fourteen years from the date of discharge.

When your bankruptcy is removed, all of the debts included in your bankruptcy will be removed from your file as well.

Consumer Proposal: A consumer proposal and all accounts satisfied through the proposal will be removed from your file three years from the date you completed the proposal or years after the date you defaulted on the account, whichever date comes first.

Other Debt Repayment Programs: Debts satisfied through the filing of an Orderly Payment of Debts or a Debt Management Plan will be removed from your file two years from the date you completed the program or years after the date you defaulted on the account, whichever date comes first.

Recommended Reading: How To File Bankruptcy In Iowa For Free

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

What Is Credit Reporting And How Does It Affect Me

In Canada there are two major credit reporting agencies Equifax and TransUnion. Most people commonly refer to these agencies as the credit bureaus. Credit reporting agencies do exactly that: they report credit history. They can also be referred to as an information service as they provide copies of your credit report to potential lenders. This allows the banks and other lenders to determine how much risk they are taking when they loan you money. Whenever anyone lends money they are taking a risk that it will not be repaid.

To get any significant credit, you need a good borrowing history.

Approximately once each month every major lender in Canada sends a report about their borrowers to the credit bureaus. Also, the federal Superintendent of Bankruptcy reports a list of everyone who filed a consumer proposal or bankruptcy to the credit bureaus, as well as a list of everyone who has been discharged. The credit bureaus collect this information, summarize it, and sell it to their members, the lenders.

When you apply for credit you normally sign an application that provides the lender consent to access your credit history. Generally this consent allows then access not only the first time you apply, but anytime afterwards as well, as long as your account is open. It is also this consent that allows the lender to provide the bureau information on your payments etc. once you have been approved.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

If I Pay Accounts Will They Come Off My Credit Report

Like other credit history, paid accounts generally remain on file for seven years from the date of first delinquency if they contain any adverse information. If an account is paid and does not contain any adverse information, the account would remain on your file for 10 years from the date of last activity.

Why Do You Store Social Security Numbers On Credit Reports

Your personal information, such as name, address, date of birth, and Social Security Number, is reported to TransUnion by your creditors. TransUnion maintains a separate credit file for each individual. Without your Social Security Number, the quality and accuracy of your credit history could be compromised. The federal Fair Credit Reporting Act permits TransUnion to maintain personal and credit information in our records.

You May Like: How Many Bankruptcies Has Donald Trump Filed

What Do Creditors Have To Report To Credit Bureaus

Creditors and lenders are not required by law to report anything to . However, many businesses choose to report on-time payments, late payments, purchases, loan terms, credit limits, and balances owed. Credit bureaus collect this data, and it helps create a person’s credit report, and often this information can impact credit scores.

Businesses usually also report significant events such as account closures or charge-offs. For example, if a mortgage is paid off, this information is reported.

Governmental organizations that maintain public records don’t report to the credit bureaus, but the bureaus usually obtain the documents on their own. For this reason, bankruptcy filings also typically show up on credit reports.

Another example, if a person owes the IRS money, chances are, a public record of a tax lien may find its way onto their credit report, and that can impact your .

What Is The Credit Reporting Process For A Bankruptcy

In Canada, credit reports are maintained by two main credit bureaus: Equifax Canada Inc. and TransUnion of Canada. Their objective is to collect information that lenders would consider important in making a decision about whether or not they should grant you a loan.

What each does is collect and compile factual information about your bill and debt payment history. This information comes from two sources:

- Transactions reported to them by banks, credit card companies, finance companies and other financial institutions.

- Public records. This includes items such as judgements, bankruptcies, consumer proposals and any registered liens or debt actions.

As a result, you can see that if you file for bankruptcy, or file a consumer proposal, it will appear on your credit report. What the credit bureau is reporting however is a statement of the facts. What will be included will be:

- The fact that you filed bankruptcy, a consumer proposal, or that your debts have been subject to a repayment program including an or Debt Management Plan through a credit counselling program.

- The date of filing.

- The date of discharge or completion.

Don’t Miss: Has Mark Cuban Ever Filed For Bankruptcy

Here’s How Bankruptcies Impact Your Credit Score

While bankruptcies on your credit report will always get factored into your credit score for as long as they are on there, the impact on your score lessens with each year that passes. So, you may see a dramatic drop in your score in the first month immediately following your bankruptcy filing, but by the end of the first year it could have less weight, and certainly less in later years compared to year one.

Your own credit profile will also play a part in how much your credit score is affected when you declare bankruptcy. Similar to how having a higher credit score can ding your more points if you miss a credit card payment, so, too, is the case if you file for bankruptcy. According to FICO, someone with good credit may experience a bigger drop in their score when a bankruptcy appears on their report than someone with an already poor credit score.

Estimates we found online from places like Debt.org show how people with different credit scores would be impacted by a bankruptcy filing. Someone with a credit score of 780 or above would be dinged between 200 and 240 points, while someone with a 680 score would lose 130 to 150 points.

Whatever the case, no one really benefits from filing for bankruptcy. It’s an option of last resort that sometimes even those with good credit find themselves making.

Why Can’t You Delete My Credit File At Transunion

TransUnion is a credit reporting company that operates under the Fair Credit Reporting Act. Your credit file is maintained as allowed by federal and state laws. The Fair Credit Reporting Act does not require credit reporting companies to maintain a file on every person, or require credit reporting companies to delete files at a consumers request. The Act does require the companies to use reasonable procedures to assure accuracy. Creditors may access your credit report only if they have a permissible purpose under the Fair Credit Reporting Act.

Also Check: Has Trump Filed Bankruptcy

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.