How To Discharge Debt With Bankruptcy In Florida

In most cases, obtaining a discharge will be the primary reason why a borrower files for bankruptcy. If a debt is discharged in bankruptcy, the borrower will be released from all personal liability on the debt. Further, creditors will be restricted from taking any collection action against the debtor for debts discharged in bankruptcy. Creditors will not be allowed to call, sue, send letters, garnish wages, or take any other collection action.

Most unsecured loans are eligible for discharge in bankruptcy. Unsecured loans are debts that dont have collateral. For instance, credit cards, student loans, and medical bills are usually unsecured loans. On the other hand, secured loans give the lender collateral for the loan. For instance, home mortgages and car loans are typically secured debts.

Not all types of debts are eligible for a discharge in Chapter 7 or Chapter 13 bankruptcy. You should consult with a bankruptcy law firm in Tampa before taking action. An experienced attorney can help get the most out of bankruptcy and obtain the fresh start you need. Bankruptcy law is complex, and the circumstances will depend on the unique facts of each case.

A Judgment Is Not A Lien But A Lien Can Be Created From A Judgment

A judgment and a lien are not the same thing.

A lien is a legal right to get paid from a specific asset/property, as opposed to from an individual person.

A judgment, however, is merely a court order that allows a creditor to pursue collection actions against someone .

Depending on the laws of the state involved, such collection actions can include getting a lien against property, or wage garnishment, or seizures of bank accounts, etc.

But as far as discharge in bankruptcy goes, a debt on a judgment is no different than any other debt that doesnt yet have a judgmentthey are dischargeable in bankruptcy unless they meet one of the exceptions set forth in 11 U.S.C. 523, as described above.

Is A Judgment A Dischargeable Debt In Bankruptcy

The manner in which a judgment is obtained has no bearing on whether bankruptcy can eliminate it. What matters is if the debt or obligation underlying the judgment is subject to discharge through bankruptcy.

- Overdue rent or bill payments

- Private debts to friends or family members

The attachment of a judgment to a debt does not change the debt’s eligibility for discharge through bankruptcy, and judgments associated with debts such as these are typically eliminated in the bankruptcy process.

Debts are discharged in a Chapter 7 proceeding following the debtor’s forfeiture of assets . Debts are discharged in a Chapter 13 bankruptcy after the debtor completes the repayment plan imposed by the bankruptcy court.

Neither Chapter 7 nor Chapter 13 bankruptcy can discharge all debts, however. Obligations that cannot be eliminated through bankruptcy include:

- Child support and alimony

- Obligations incurred through negligence, fraud or other criminal acts

In addition

- Chapter 7 bankruptcy cannot discharge car loans, obligations to pay court costs or fees, or debts secured by liens .

- Chapter 13 specifically cannot discharge certain tax debts.

Read Also: How Many Times Can You File Bankruptcy In A Year

Which Type Of Bankruptcy Chapter Should You Use To Get Rid Of Medical Debt

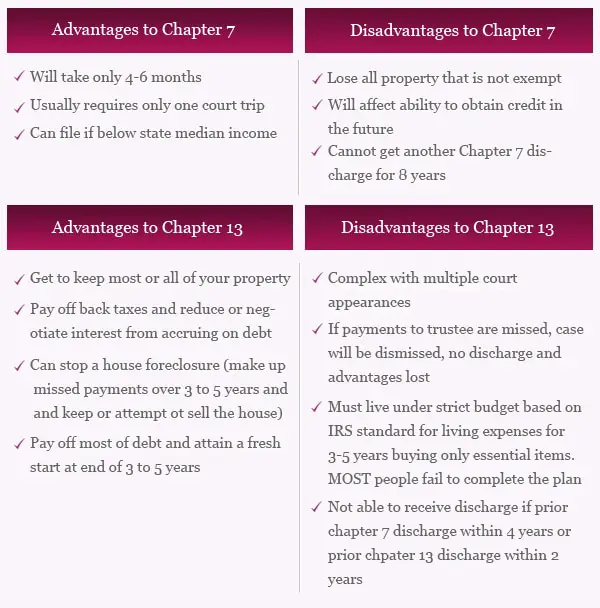

Before anything else, you need to remember that bankruptcy will leave a significant effect on your credit report, which will last from 7 to 10 years. Its a decision that should not be taken lightly. Chapter 7 and Chapter 13 bankruptcy can help get rid of your medical debt. But the processes involved are different for each type of legal proceeding.

If you dont have a regular or stable income and your assets have little to no equity, a Chapter 7 bankruptcy may be a good option. Theres no cap to the number of debts you need to have. Plus, its a good solution if your goal is to get rid of your medical debt.

Meanwhile, Chapter 13 bankruptcy is best if you didnt qualify for a Chapter 7 bankruptcy. If you have a stable income and there are assets that you dont want to lose, then this option is for you. The court will issue a repayment plan that lets you make affordable payments to your debt, including your medical bills. Once the plan ends, the court will discharge all of your remaining debt.

What Are The Consequences For A Bankrupt Of Not Being Discharged

Not being discharged has important consequences for a bankrupt.

A person who is bankrupt may not borrow more than $1,000 without informing the lender that he/she is bankrupt. Failure to do so is an offence under the BIA that is liable to a fine, imprisonment or both.

Information pertaining to bankruptcy remains on an individuals credit file for 6-7 years following discharge of a first-time bankrupt. Times may vary across provinces/territories.

- Date modified:

You May Like: How Often Can You File Chapter 13 Bankruptcy

May The Debtor Pay A Discharged Debt After The Bankruptcy Case Has Been Concluded

A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced. Sometimes a debtor agrees to repay a debt because it is owed to a family member or because it represents an obligation to an individual for whom the debtors reputation is important, such as a family doctor.

What Can The Debtor Do If A Creditor Attempts To Collect A Discharged Debt After The Case Is Concluded

If a creditor attempts collection efforts on a discharged debt, the debtor can file a motion with the court, reporting the action and asking that the case be reopened to address the matter. The bankruptcy court will often do so to ensure that the discharge is not violated. The discharge constitutes a permanent statutory injunction prohibiting creditors from taking any action, including the filing of a lawsuit, designed to collect a discharged debt. A creditor can be sanctioned by the court for violating the discharge injunction. The normal sanction for violating the discharge injunction is civil contempt, which is often punishable by a fine.

Recommended Reading: How To File Bankruptcy Yourself In Ohio

After Filing Your Answer

After you file your answer, the court sets a hearing date. You are not required to hire an attorney, but it can be beneficial to have an attorney working on your behalf. An attorney understands the various defenses you may use to avoid a judgment. An attorney also understands the court process and how to investigate and gather evidence that could be used to win the case.

At the hearing, each side presents the facts and arguments they believe support their position. If the other party proves its case, the judge can order that you compensate the party for the amount you owe plus other costs and fees. A judgment is entered on the record and filed with the clerk of court.

The laws of each state vary slightly regarding how long a judgment remains active. In many cases, judgments remain active for at least ten years. Active means that you have a legal obligation to pay the debt and the party that you owe can take further legal action to collect the debt. In some states, a party can renew the judgment for an additional period to keep it active.

Eliminate Judgments With A Discharge

Under Bankruptcy law, a discharge will eliminate judgments in bankruptcy, to the extent that it is a determination of the personal liability of the debtor. Any action to collect money from the debtor will be barred. Most types of judgments are eligible for a discharge in Chapter 7 or Chapter 13 bankruptcy. However, there are some types of judgments that are excluded from being discharged. Therefore, you should contact a bankruptcy attorney in Tampa to review your judgment before filing bankruptcy.

Most types of judgments are eligible for discharge however, some judgment debts you cant discharge in bankruptcy. For instance, alcohol-related injury judgments are non-dischargeable. Similarly, judgments for malicious or wanton conduct resulting in serious bodily injury or death cannot be discharged. If you have debts that are not eligible for discharge all hope is not lost, there may be other options. A bankruptcy lawyer in Tampa can help provide some options for relief.

Restitution judgments are also often excluded from a Chapter 7 or Chapter 13 bankruptcy Discharge. Restitution is often money owed in response to injuring a person or damaging property while committing a crime. See Bankruptcy Law 11 US 727. A common example is causing a car accident while driving drunk.

Also Check: Best Site For Foreclosures

Can You Exempt The Property In Bankruptcy

When you file for bankruptcy, you’re allowed to keep or “exempt” a certain amount of property. If the judgment lien gets in the way of this right, the court will likely agree to avoid it so that you maintain clear property ownership. If you aren’t entitled to exempt the asset, or if the lien is another typesuch as a voluntary lien given when purchasing a house or carthe lien will remain in place.

Example 1. Henry can exempt $5,000 in equity in a car. His vehicle is worth $4,000, allowing him to protect it in a Chapter 7 bankruptcy. However, in his state, a creditor with a judgment automatically gets a lien against all of the debtor’s personal property, including a car . His attorney files a motion asking the court to avoid the lien. Because Henry can entirely exempt the vehicle, the court agrees.

Example 2. Tiffany’s credit card company obtained a judgment for $25,000 and filed it with the Stoney County recorder’s office, giving the credit card company a lien on all of Tiffany’s real estate in the county. An exemption doesn’t cover Tiffany’s cabin. Even though she can wipe out the credit card debt in a Chapter 7 bankruptcy because the property is nonexempt , the court won’t remove the lien. After the bankruptcy, the credit card company can sell the cabin and recover the lien amount.

For more details, see What Happens to Liens in Chapter 7 Bankruptcy?

When Does The Discharge Occur

The timing of the discharge varies, depending on the chapter under which the case is filed. In a chapter 7 case, for example, the court usually grants the discharge promptly on expiration of the time fixed for filing a complaint objecting to discharge and the time fixed for filing a motion to dismiss the case for substantial abuse . Typically, this occurs about four months after the date the debtor files the petition with the clerk of the bankruptcy court. In individual chapter 11 cases, and in cases under chapter 12 and 13 , the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan. Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. The court may deny an individual debtors discharge in a chapter 7 or 13 case if the debtor fails to complete an instructional course concerning financial management. The Bankruptcy Code provides limited exceptions to the financial management requirement if the U.S. trustee or bankruptcy administrator determines there are inadequate educational programs available, or if the debtor is disabled or incapacitated or on active military duty in a combat zone.

Read Also: Auctions In My Area

Find Out If You Can Wipe Out A Lawsuit Judgment In Bankruptcy And What Happens If The Creditor Has A Lien Against Some Of Your Property

If a creditor gets a judgment against you and the debt is dischargeable in a Chapter 7 bankruptcy, filing for bankruptcy will wipe out a creditor’s ability to collect. Judgments, however, can create a lien on your property. And liens don’t go away in bankruptcy automatically. So it’s possible to wipe out a judgment in bankruptcy and remain obligated to pay the lien.

Before determining whether you can use bankruptcy to get out from under a judgment entirely, you’ll need to learn:

- the differences between a judgment and a judgment lien

- whether you can erase the debt in bankruptcy

- if you can exempt the property securing the lien, and

- the steps involving lien avoidance in Chapter 7 and Chapter 13.

Lien removal is a tricky area of bankruptcy law that could require professional help. If you’d like to ensure that you protect valuable property to the best of your ability, it’s prudent to seek the advice of a knowledgeable bankruptcy attorney.

For step-by-step guidance through the bankruptcy process, read What You Need to Know to File for Bankruptcy in 2021.

Objecting To Confirmation / Motion To Dismiss / Proof Of Claim

In a Chapter 13, the debtor must propose a plan and the plan must be confirmed by order of the Court. The plan must propose to pay back any DSO arrearage in full and must list the DSO as a priority unsecured debt . If the debtor spouse fails to properly list or account for the debts owed to the non-filing spouse, then the non-filing spouse should file an objection to the confirmation of the plan.

Additionally, if the sole purpose of the filing of the bankruptcy was to frustrate the collection of the amounts owed to the non-filing spouse, then a Motion to Dismiss for a bad-faith filing should be considered. See In re Ellis, 406 B.R. 736

Lastly, the non-filing spouse should file a proper proof of claim to ensure that they are paid and have not waived any claim to any amounts that they are owed.

Recommended Reading: Can You Declare Bankruptcy On Federal Student Loans

Will Bankruptcy Stop A Judgment

Melissa Lyken | July 21, 2022

Summary: Are you filing for bankruptcy and worried about a standing judgment or one that’s soon to be filed? Learn how bankruptcy affects judgments in this post.

Did your creditor obtain a favorable judgment on the collection lawsuit they filed against you? If so, your wages and bank account may be garnished, and properties may be foreclosed or repossessed to satisfy your obligations. Your judgment creditor may garnish up to 25% of your disposable income, and this is the last thing that you need to happen.

If you’ve explored all other options, filing for bankruptcy may be a good solution for you. Push your misconceptions to the side and focus on the advantages bankruptcy can bring you. Many everyday folks have filed bankruptcy, and like them, you can obtain a fresh financial start and future good credit. For now, let’s concentrate on getting rid of your legal obligations by filing bankruptcy.

Nondischargeable Debt And Judgments

The general rule for nondischargeable debts is the flipside of whatâs described above. Dischargeable debt stays dischargeable when reduced to judgment. Nondischargeable debt remains nondischargeable.

For example, a judgment for unpaid child support, alimony, or student loan debt generally wonât be cleared in Chapter 7 bankruptcy. Thatâs because most student loans and domestic support obligations are nondischargeable under the U.S. Bankruptcy Code. Certain other types of debts are also nondischargeable, including some tax debt, debt resulting from embezzlement and certain other financial crimes, and debt relating to injuries caused while operating a vehicle under the influence.

Read Also: What To Know Before Filing Bankruptcy

Can You Avoid The Judgment Lien In Bankruptcy

Obtaining a bankruptcy discharge will give you little comfort if the creditor’s lien is still attached to your assets, such as your house. If the lien remains, the creditor will retain a right to sell the property after the bankruptcy case’s conclusion or wait until you sell it to take its share.

However, there is a way that you can get rid of the judgment lien in your bankruptcy. It is called lien avoidance. Here are the three conditions you’ll need to prove to qualify for lien avoidance:

- the lien came from a money judgment issued against you

- you have property equity that you can claim an exemption against, and

- the judgment lien eats up some or all of the equity that you could have exempted.

To avoid a judgment lien, you must follow bankruptcy procedures, and it’s best to act quickly . Learn more about the different types of property liens.

File Chapter 13 Bankruptcy To Stop Judgment

Chapter 13 is a reorganization. People who file Chapter 13 are those who failed the means test. In this type of bankruptcy, you can keep your properties and assets, and in return, you have to make a monthly payment to pay off all your debts within 60 months . You will be required to propose a monthly repayment plan, which can be determined in two ways, first, via the value of your non-exempt assets, or second, via your disposable income. Whichever will pay the most significant amount off your debts will be used as the basis for determining the amount of your monthly payment.

You May Like: Can You Be Denied A Job Because Of Bankruptcy

Can An Employer Terminate A Debtors Employment Solely Because The Person Was A Debtor Or Failed To Pay A Discharged Debt

The law provides express prohibitions against discriminatory treatment of debtors by both governmental units and private employers. A governmental unit or private employer may not discriminate against a person solely because the person was a debtor, was insolvent before or during the case, or has not paid a debt that was discharged in the case.

The law prohibits the following forms of governmental discrimination: terminating an employee discriminating with respect to hiring or denying, revoking, suspending, or declining to renew a license, franchise, or similar privilege. A private employer may not discriminate with respect to employment if the discrimination is based solely upon the bankruptcy filing.