What Is A Bankruptcy Case Number And The Bankruptcy Docket

- > > Bankruptcy

Ill use this post to answer two questions New York bankruptcy debtors might have that relate to each other: What is the case number in bankruptcy and what is the docket? Ill also discuss why these items are important.

The case number, as its name implies, is the specific code that identifies a debtors case. It distinguishes their cases from those of others, and it gives parties a unique key for searching for specific cases.

In the Eastern District of New York, which includes Brooklyn bankruptcy cases as well as those of Staten Island, Queens, and Long Island, the case number is usually a two-digit number, followed by a hyphen and a five-digit number, and then a hyphen with just three letters. The two-digit number is the year in which the case was filed, and the five digit number is the case identifier. Those final three letters are the presiding judges initials.

Take for example this opinion I randomly pulled from the Eastern Districts Web site: 14-73390-las. It was filed in 2014 and presided by Judge Louis A. Scarcella. It discusses an adversary proceeding that has a different case number, 14-08229-las. Interested parties can look up the case by using the number for the bankruptcy or just the adversary proceeding if thats what theyre interested in.

If youre experiencing serious financial difficulties, then talking to an experienced New York bankruptcy lawyer can help you strategize your options and ensure the paperwork is done correctly.

Fee Exemptions For Researchers

Individual researchers working on defined research projects intended for scholarly work can use the attached form to request PACER fee exemptions from multiple courts. In accordance with the EPA fee schedule, the request should be limited in scope, and not be intended for redistribution on the internet or for commercial purposes.

Please note, if you are seeking a fee exemption from a single court and/or for non-research purposes, contact that court directly.

Research Database

Define the data needs for research using the Federal Court Cases Integrated Database provided free of charge by the Federal Judicial Center. The IDB has case data for criminal, civil, appellate, and bankruptcy cases that can help researchers refine their requests.

Why Should I Find Out If Someone Filed Bankruptcy

Discharging debts in bankruptcy means that a debtor is no longer required to pay those debts. Debs are either discharged and assets sold to pay the creditors, or the court creates a repayment plan for the debtor to repay debts in a way that is more manageable based on their current income and finances.

The court enters an order that prohibits creditors to attempt to collect the discharged debts via legal action, telephone calls, letters, or other forms of contact.

There are a variety of reasons why someone might file for bankruptcy. Some of the more common reasons include:

- Unemployment

- Overextended personal lines of consumer credit

Filing for bankruptcy is generally not a decision people take lightly, but the fact that someone has taken that route to get out of debt might be of interest to other individuals who have an interest in their financial history and current financial health.

Bankruptcy cases are exclusively the jurisdiction of federal bankruptcy courts. Bankruptcy records are public information and can be helpful for making financial decisions. There are several reasons why you might want to find out if someone filed for bankruptcy. Some of the more common reasons are:

- Researching the financial history of a potential business partner

- You need to determine whether it is a smart decision to loan money to someone or

- You are interested in the financial history of a business.

Read Also: How Many Bankruptcies Has Donald Trump Filed

How To Find Bankruptcy Records

Filing for bankruptcy is not an easy decision for anyone. Anyone that has ever filed for bankruptcy or knows someone who has experienced bankruptcy, understands how stressful the process can be. However, the bankruptcy process is also a method of relief and financial freedom for many hardworking people who have experiencing financial hardship.In many cases, the same factors that cause debt burdens significant enough to need bankruptcy relief in the first place, are the same factors that typically require detailed financial records years later. For example, tax, business or legal matters may require the information included in your bankruptcy petition and/or discharge. For this reason, a record of bankruptcy filing is an important source of information. To make matters worse, finding these old records or level of financial details again can be nearly impossible. Until now.If you are looking for bankruptcy records, BKDATA can provide them. Use this guide to learn more about finding bankruptcy records as quickly as possible.Searching For Bankruptcy Records

How To Check A Bankruptcy Status Online

Once you file for bankruptcy, a lot happens behind the scenes within the court system. To keep track of your case and make sure it’s moving smoothly towards bankruptcy, you should learn how to check your case online. While you can usually get information about your case from your attorney, sometimes he will charge you for the privilege or otherwise be unreachable. Checking your case yourself is particularly important if you file bankruptcy without an attorney.

Don’t Miss: Sba Loan Bankruptcy Discharge

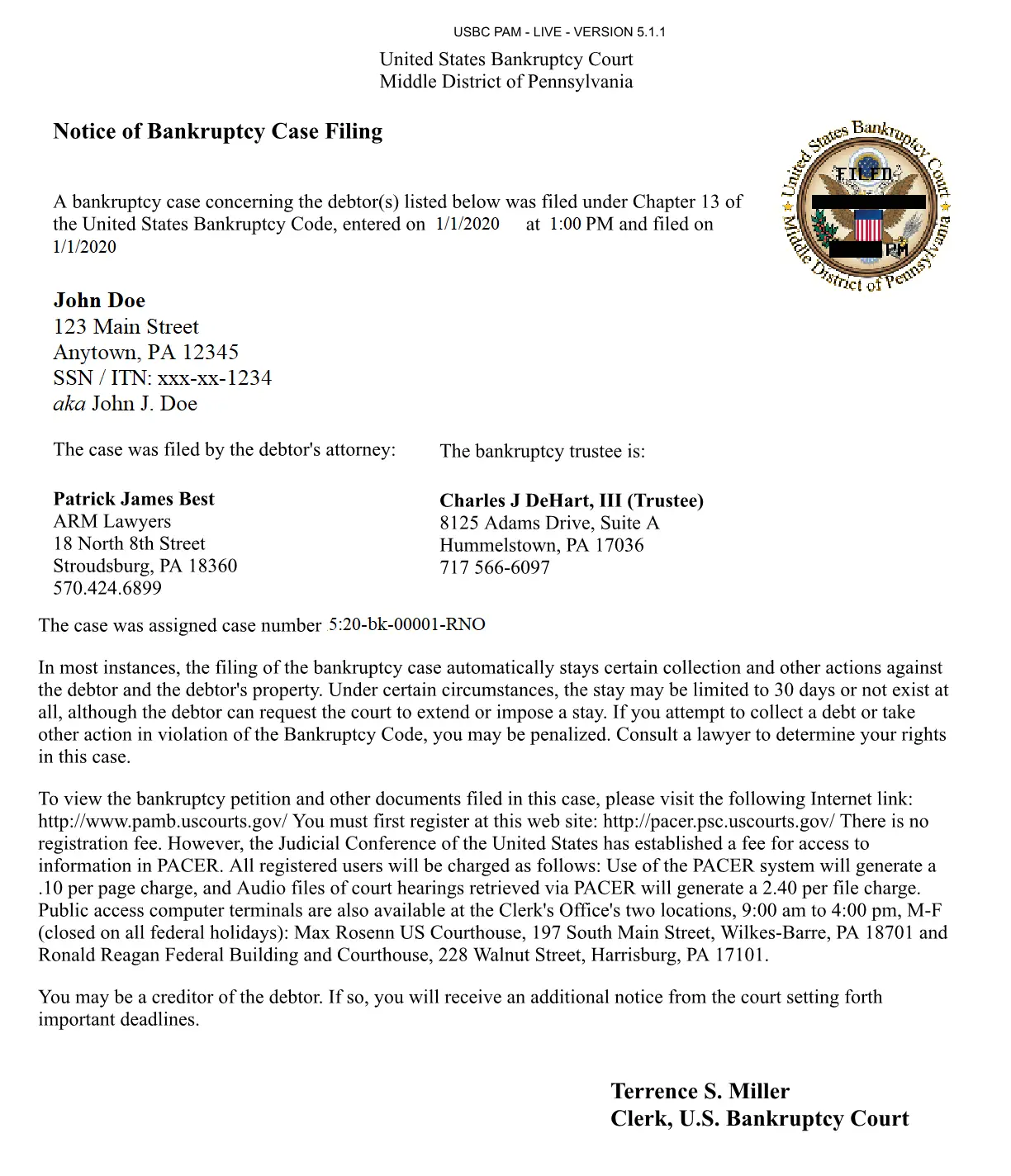

How Do My Creditors Learn Of My Bankruptcy

The Licensed Insolvency Trustee in an individuals consumer bankruptcy mails a notice of bankruptcy to each of the individuals creditors. Creditors of a bankrupt individual record the bankruptcy when they receive this notice.

If you are applying for new credit while your bankruptcy remains on your credit bureau records, the companies considering granting credit to you may record the bankruptcy when they check your record at a credit bureau.

What Happens After Bankruptcy

Many people believe that bankruptcy is the end of the line, and life after bankruptcy is bleak. This is not true. Bankruptcy will start a fresh financial start. The first step is to file all bills, lay out a budget, and start to manage money with more intent. Start by making a budget that includes monthly expenses and immediate bills.After you file bankruptcy, there are some things that that need to be done.First, debtors will have to go to a credit counselor who will help build a plan to improve their credit. Next, debtors will have to follow the budget and make sure that they are managing your money. Also, it is important to remember to avoid taking on any new debts. This means that avoiding opening any new credit cards, signing up for any new loans, or buying anything with credit unless it is a necessity.

Read Also: How To Become A Bankruptcy Lawyer

Cds Of Recorded Hearings:

Court hearings may be reported by a traditional court reporter or recorded electronically. The court minutes for the hearing will indicate the method of reporting or recording.

If a court reporter was present at the court hearing, the court reporter is the only person available to prepare a verbatim transcript of the reported proceeding. To obtain a transcript from a court reporter, contact Superior Court Administration.

To request a copy of a hearing that was recorded, please complete the Recorded Hearing Request Form. The completed form can be mailed in with the appropriate payment in the form of a cashiers check or money order payable to Snohomish County Clerk or you can bring the completed form to the Clerks Office, located in Room M-206.

Efforts will be made to have these requests available within 10 business days from the date received. The expense of searching for and duplicating the applicable proceeding is $25 per request pursuant to RCW 36.18.016. Completed requests can be picked up in the Clerks Office or mailed back to the requestor for an additional fee of $2.50 per CD.

How Do I Find Out If My Bankruptcy Case Is Closed In Florida

It is quite easy to find out if a bankruptcy case has been closed in Florida. When a case is closed, the debtor will be notified of the action. If the petitioner has an attorney, this notice will be sent to them. Nevertheless, there are still a few ways to check the status of a case: an interested party may contact the appropriate clerks office to make inquiries, or use the PACER or McVCIS systems to obtain the information.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

The Law Offices Of Kretzer And Volberding Pc Can Help Throughout Your Bankruptcy Case

To navigate bankruptcy and to access records through the PACER system, it is invaluable to have a lawyer with experience on bankruptcy in Texas and who has the right knowledge and resources to help you. For help from the Houston bankruptcy lawyers at the Law Offices of Kretzer and Volberding P.C., contact us online today.

What Is Chapter 7 Bankruptcy In Florida

In Florida, Chapter 7 bankruptcy is the type of bankruptcy that provides liquidation of assets and properties to debtors. The bankruptcy court appoints a trustee who oversees the sales of the debtor’s non-exempt properties and assets and distributes the proceeds to repay creditors. The Chapter 7 bankruptcy is available to individuals, partnerships, corporations, or other business entities.

Under Chapter 7, individual debtors are eligible for debt discharge regardless of the amount owed. Therefore, the Chapter 7 bankruptcy is regarded as a fresh start. Examples of such debts include medical bills, personal loans, income tax debts, etc. However, debts such as spousal support, court fees and penalties, and child support are examples of debts not exempted. Chapter 7 bankruptcy report may last 10 years on a debtor’s credit record.

Read Also: How Many Bankruptcies Has Donald Trump Filed

What Are Florida Bankruptcy Records

Florida bankruptcy records originate from bankruptcy filings and court proceedings that took place within the state. These court records are matters of public record, as directed by 11 U.S.C. § 107 unless sealed by court order or the law. Bankruptcy proceedings are governed by federal laws or rules and heard in the federal bankruptcy courts. Based in the Middle, Northern, and Southern districts of Florida, these courts are responsible for creating and preserving bankruptcy records, and processing requests for publicly available records. It should be noted that the courts in the state judiciary system do not have the authority to hear bankruptcy cases and cannot provide anyone with bankruptcy records or information.

Linking Bankruptcy Public Records For Easier Scrubbing

When youre scrubbing records, its extremely important that youre scrubbing them for the right person. For example, its common for people to mix up two records because they belong to people with the same name. To avoid this problem and ensure youre gathering information about the right person, use a public and private records search engine that links records between additional points such as bankruptcy public records from national archives, bankruptcy court records, and private records, rather than just linking records by name.

- Scrubbing records can be difficult because there are many people in the United States with the same name and records can get mixed up.

- When youre scrubbing records like bankruptcy public records for any reason, you need to know youre accessing the right records.

- Instead of just matching records using someones name, you can match those records with additional points in a public and private records search engine for better accuracy.

Read Also: How Many Times Have Donald Trump Filed For Bankruptcy

What Does Pacer Show

If you look up a particular bankruptcy case on PACER, you’ll be able to view the entire history of documents filed in the case from the beginning, including the bankruptcy petition and schedules and any motions, notices or orders filed by the debtor, the trustee, the creditors or the court. The list of documents and events, called a docket, provides a chronological list of all the things that happened in the case. You can also look at the list of creditors who filed claims in the case as well as all the attorneys who appeared in the case and other important information.

Most documents on PACER are in PDF format, so you’ll need a PDF reader to view them.

What Do I Need To Get Started With Using Bankruptcy Records Software In My Own Agency

When you need up-to-date information and the ability to view bankruptcy records online for debtors and anything else associated with collections, consider Tracers. With Tracers, you can search through over 100 million records to understand more about someones financial background, as well as maximize your options with batch processing, making it easier for you to focus on collections efforts.

Explore More Solutions

You May Like: How Many Times Has Trump Filed For Bankruptcy

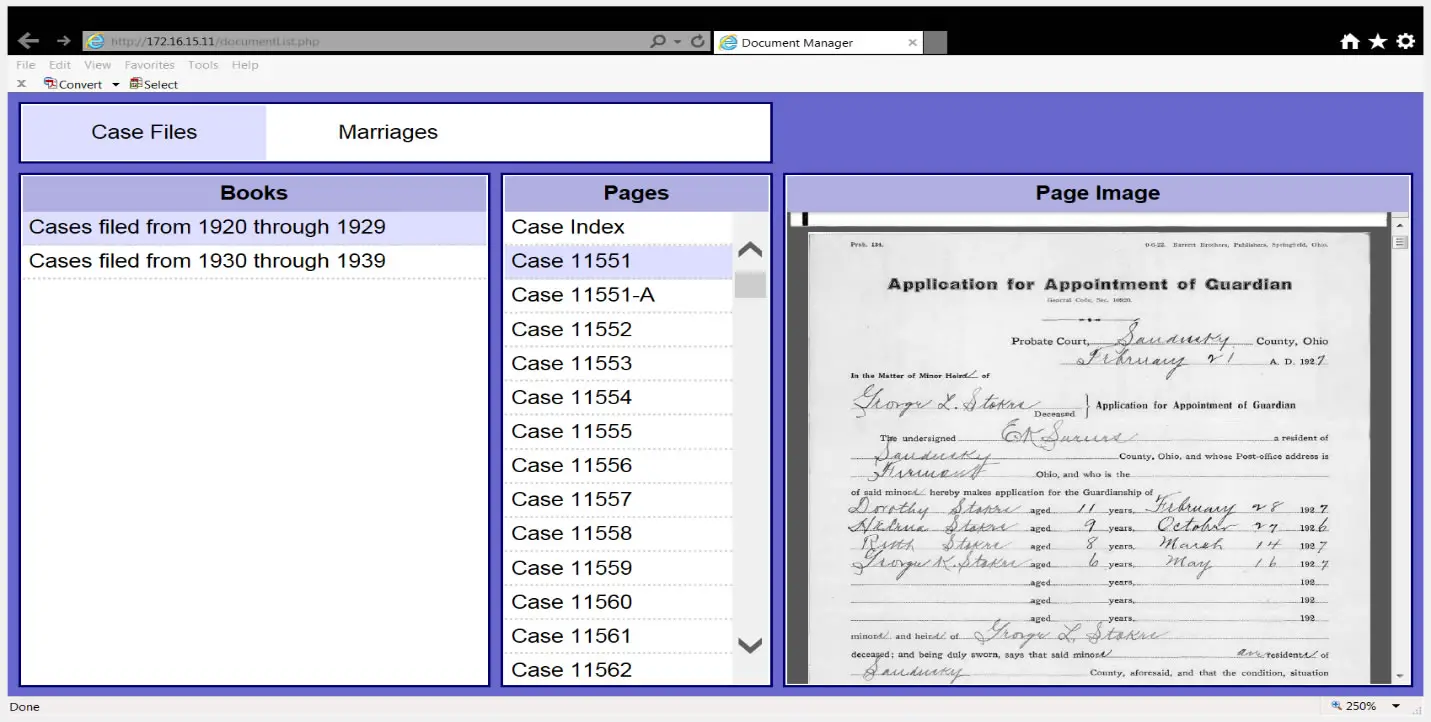

Bankruptcy Case File Record Requests

Please provide the following information:

- name of the court where the case was filed

- case number and name of parties on the case and

- time period the case was filed.

For bankruptcy cases filed 1940 and after, a FRC transfer number is required. This is obtained by contacting the court where the bankruptcy was originally filed. If the court does not have the transfer number due to the age of the case, please note this with your request.

There is no charge to perform a search. Do not send any money or credit card information when you make your initial request. Digital and paper reproductions from the case file will incur a charge. Staff will communicate the fees prior to making the copies.

We receive requests by e-mail, postal mail, or phone.

- National Archives at Kansas City 400 W. Pershing Rd.

- Phone: 816.268.8000

What Do Florida Bankruptcy Records Contain

A requester can expect to find the following information in a Florida bankruptcy record:

- Information on the debtors assets and income sources

- Personal details of the debtor and debtors attorney

- The petitions chapter

- Case status

- The U.S. trustees information

- The presiding judge and court

- The filing, closing, and discharge dates

- A creditors list bearing names, addresses, and money owed

- Schedules

- The debtors voluntary petition

You May Like: Epiq Corporate Restructuring Llc Letter

Bankruptcy Processing Software To Scrub Records

Bankruptcy scrubbing isnt something you can just do once you need to routinely check for records you may not be able to collect on anymore in order to maintain regulatory and legal compliance. People can file for bankruptcy at any time, so its possible for someone to file between the time your company first receives the records and the time your company puts in a collection request. Consistently scrubbing records with a public and private records search search engine is an easy way to avoid this problem and ensure youre only collecting on collectible debts.

- Its important that you have the most up-to-date information for collections, including whether people have filed for bankruptcy.

- Because people can file for bankruptcy at any time, its important that youre consistently checking your records to determine if there are any new bankruptcy filings.

- The best public and private records search engine makes it easy for you to scrub your records on a routine basis.

Can I Look Up Online If Someone Filed For Bankruptcy

All of the documents filed in a bankruptcy proceeding are available as public record. You can use the Public Access to Court Electronic Records service to look up bankruptcy records online. All that is needed is an account to search and locate bankruptcy court cases. PACER charges a fee for each page that is viewed using the system.

If you know the case number you can do a bankruptcy case number search to find the information you need. Using the case number, complete name, or social security number, you can call a toll free number to reach an automated system and access the following information:

- Case number

- Case disposition.

Also Check: What Is Epiq Bankruptcy Solutions Llc

Obtaining Florida Bankruptcy Records

Interested members of the public can generally obtain bankruptcy records and information from the clerk of the courts office using in-person or mail request methods. The appropriate clerks office for inspection or copying of records is the one that received the initial bankruptcy petition. Requesters can also retrieve bankruptcy information or records from the Phone: and internet records systems operated by the courts.

In addition to the government-operated sites and platforms, third-party websites also provide search and retrieval tools to assist persons who want to obtain Florida bankruptcy case records.

There Are A Few Ways In Which To Find Bankruptcy Records

Read Also: How To File Bankruptcy In Wisconsin

Who Will Know About My Bankruptcy

In most cases, only your Trustee, your creditors, and the Office of the Superintendent of Bankruptcy Canada will know you have filed for bankruptcy.

If you apply for credit with another lender while the credit bureaus still have a record of your bankruptcy, that lender will learn about your bankruptcy from a credit bureau.

Nobody else is likely to know about your bankruptcy, unless something causes them to suspect it and they take the trouble to search OSB records.

You need not fear the embarrassment of your friends or relatives seeing any bankruptcy records about you, except those you choose to tell. With this reassurance, you can contact a Licensed Insolvency Trustee near you now, for a free, confidential consultation. Your first appointment is free. We have trustees everywhere from Calgary to Montreal and more. Get a free consultation and solve your money problems today!