Business Bankruptcy: Chapter 7 Vs Chapter 11

Businesses can file either Chapter 7 or Chapter 11 bankruptcy. Businesses who file Chapter 7 bankruptcy are in the process of shutting down. All of the business assets – from real estate to personal property – are sold and unsecured creditors are paid in order of priority. Businesses donât get to claim exemptions – everything goes.Â;

A bankruptcy proceeding under Chapter 11, on the other hand, can be used to restructure the business and its financial obligations. The bankruptcy protections granted by the automatic stay give the business an opportunity to propose a payment plan. As of February 20, 2020, small businesses are able to file a less complicated version of Chapter 11 called Subchapter V.Â;

Bankruptcy And Lehman Brothers

Because bankruptcy among individuals is still seen as a last resort, the term is still thought of more for when businesses run out of money and are forced to shut down. As the anniversary of its bankruptcy declaration approaches, let’s look at the most notable bankruptcy event of the 21st century: The collapse of Lehman Brothers.

Lehman Brothers was an investment bank and global financial services firm who spent the first several years of the 2000s riding high. This can be attributed to what was, at the time, a booming housing market.

More and more Americans were buying houses, thanks to a major increase in subprime mortgages being given out by institutions like Lehman Brothers. Subprime mortgages were the loans offered to prospective homeowners with poor credit, and financial institutions were happy to give them out in the early 2000s when interest rates were historically low. But when the housing bubble burst, the U.S. Federal Reserve raised interest rates several times. People suddenly could not make their monthly mortgage payments; they defaulted and homes went into foreclosure. What was a thriving market turned into a subprime mortgage crisis.

- Tags

Can I File Bankruptcy

Bankruptcy may be the answer to your debt problems, but not everyone qualifies. Find out if you meet the requirements and can file for bankruptcy.

If you are faced with overwhelming debt, bankruptcy may be a solution for your problems. There are restrictions that control who can , so if you are wondering should I file bankruptcy, it is important to understand the rules when weighing your options.

Means Test

If you are interested in filing bankruptcy Chapter 7, the type of bankruptcy that completely wipes out most of your debts and lets you start fresh, you must pass a bankruptcy means test. The only people exempted from this are disabled veterans filing for bankruptcy to discharge debt incurred while they were on active military duty or people with debt that comes from operating a business. Everyone else must pass the means test.

Understand Median Income

The first step in the means test is monthly median income. If your current income is lower than your states median income for a household of your size, you immediately qualify to file. Income includes: wages, salary, tips, bonuses, commission, overtime, business income, interest, royalties, child support, spousal support, unemployment, workers comp, annuities, retirement income, rent, and dividends. It does not include Social Security retirement benefits or income tax refunds.

Find Your Disposable Income

Bankruptcy Means Test Calculator

Other Bankruptcy Requirements

About the Author

Read Also: What Percent Of Chapter 7 Bankruptcies Are Dismissed

Which Bankruptcy Should I File

Your trustee can help you determine which of the different types of bankruptcy you should consider filing for. Keep in mind, there are some major disadvantages to filing for any type of bankruptcy, including: damaging your credit score and the ability to obtain future credit for a minimum of six years; potential surrender of assets; releasing your tax information and other detailed income/expense information.

The bankruptcy types explained here are meant to inform you of your options, but you should also understand that there are alternatives to declaring bankruptcy. One of these alternatives is whats known as a Consumer Proposal.

Take Care Of Necessities First

Before you do anything, you want to make sure the Four Walls are covered: food, utilities, shelter, and transportation. You wont have the energy to fight your way out of debt if you dont have a house to sleep in or food to eat. So make sure youre taking care of yourself and your family first. The collectors can wait. ;

Recommended Reading: How To File Bankruptcy In Texas Without An Attorney

Types Of Business Bankruptcies

Business bankruptcies typically fall into one of three categories. Two Chapter 7 and Chapter 13 are variations on the personal bankruptcy theme. Chapter 11 bankruptcy is generally for businesses that have hit a bad patch and might be able to survive if their operations, along with their debt, can be reorganized.

Business bankruptcies involve legal entities ranging from sole proprietorships and LLCs to partnerships, professional associations, and corporations.

Chapter 15: I Is For International

Many companies operate abroad. They are subject to the laws of the countries where they operate. Chapter 15 represents a team effort where different jurisdictions cooperate. Its patterned after the Model Law on International Commercial Arbitration. Eighty;countries are signatories. Its been around since 1978.;This version of the international bankruptcy code brings foreign creditors into the US court system to make their case.

Advantages: It gives foreign creditors standing in a case within the US courts.; US creditors have standing in foreign courts.

Disadvantages: None. Its procedural to see creditors arent ignored.

You May Like: How To Claim Bankruptcy Without A Lawyer

Median Income Limits Under The Means Test

To qualify for this type of bankruptcy, you have to pass a means test. Chapter 7 liquidation bankruptcy isnt available to high-income individuals. You must earn less than similarly sized households in your community.

Currently, the median income in Wisconsin is $48,407 for a single person, $62,914 for a two-person family, $76,179 for three people, and $89,245 for a four-person household.;The average for North Carolina is $50,797 and Illinois is $60,413.;;For each additional person, the ceiling increases by $8,400. The government periodically adjusts these income limits. Plus, deductions are available for many essential expenses, including groceries, rent, mortgage payments, utility bills, and transportation.

Benefits and Drawbacks of Chapter 7 Bankruptcies

- Your unsecured debts will be discharged in just three to six months.

- The Trustee;may try to;liquidate your nonexempt assets.

- Liquidation bankruptcies;may;stay on your credit report for;7;years;or longer.

What Are The Different Types Of Bankruptcy In The United States

While bankruptcy codes vary by country, and some countries may not allow for bankruptcy as many Western countries understand it, there are several types of bankruptcy options available in the United States. These types of bankruptcy are best known for the chapters in the US Code which describes them and their rules. They are Chapter 7, Chapter 11, Chapter 12 and Chapter 13.

Of all the types of bankruptcy, perhaps Chapter 7 is best known. It is also the most severe. All unsecured debts are terminated with money being paid after any assets are liquidated that are not exempt. In most cases, the liquidation of assets will not affect many people, unless they have substantial assets such as land or a second home. Chapter 7 is available both to individuals and corporations.

While Chapter 7 is seen as a termination of all debts, this is not necessarily the case. Some debts, such as secured debts, may be allowed to continue standing. Car loans and home mortgage loans, for example, will still be in effect unless they are defaulted on. If a default does occur, it is nearly like a liquidation in that cars can be repossessed and homes can be foreclosed upon.

Also Check: How To File Bankruptcy In Iowa For Free

Types Of Bankruptcy Discharge In Canada

When you complete your bankruptcy, whether personal or business, you will also receive a different type of bankruptcy discharge, depending on certain factors.

There are four types of bankruptcy discharge of your debts that you might receive:

Absolute Discharge This is the type of discharge from bankruptcy you want to receive, which happens automatically in most bankruptcies.

When you receive an absolute bankruptcy discharge you will be released from any legal obligation to repay the debts that existed at the time you filed bankruptcy, with certain types of debts not being discharged in bankruptcy .

Conditional bankruptcy discharge If you receive a conditional discharge from your bankruptcy you will have to complete certain conditions before you can receive your absolute discharge.

Suspended discharge If you receive a suspended bankruptcy discharge you will receive your absolute discharge at a future date.

Discharge refused In very rare cases the court has the right to refuse a discharge and you will have to work with your trustee to find out how to receive your discharge.

You might also need the assistance of an insolvency lawyer.

Chapter 7 Bankruptcy Liquidation

The title of Chapter 7 is Liquidation, which is why a Chapter 7 bankruptcy is called liquidation bankruptcy. Assets are liquidated, or sold off, to recoup funds for creditors.

With this first type of bankruptcy, you sell off almost everything that you own, take that money, and pay what you can before you walk away debt-free. Chapter 7 bankruptcy is a way to hit the reset button and start over.

Also Check: Will Bankruptcy Get Rid Of Irs Debt

Bankruptcy Alternatives And Debt Relief

Medical bills, job loss, divorce, separation and consumer debt are the leading causes of personal bankruptcy. Unexpected expenses have lasting financial consequences. With the increasing cost of living, it is difficult to support a family without relying on high-interest loans and credit cards. Americans owe a recording-breaking amount to credit card companies,;banks;and lenders. Mounting debt can quickly become an uncomfortable burden. Thats when bankruptcy can help.

Bankruptcy;may be;a last;resort for severe financial problems, so its important to examine alternatives. Debt consolidation and debt settlement may offer similar advantages in a shorter amount of time. In fact, you might be required to undergo credit counseling before you file for bankruptcy. If your creditors are threatening to take your car or repossess your house, bankruptcy can protect you while you get back on track. The right option often depends on the type of debt you owe.

What Are The Reasons A Person Would File A Chapter 13 Case Instead Of A Chapter 7 Case

There are a few advantages to filing a Chapter 13 case over a Chapter 7 case that you should keep in mind if you are considering bankruptcy. For example, you might have more equity in your home than can be protected by the exemption for real estate in a Chapter 7 case. Filing for Chapter 13 bankruptcy automatically stays a foreclosure proceeding, giving you time to incorporate into your plan a way to cure your delinquent mortgage payments that could allow you to keep your home. Furthermore, Chapter 13 bankruptcy has a special automatic stay provision that prohibits collection actions against co-debtors for consumer debt. Also, whereas you are required to surrender all your nonexempt assets for distribution under Chapter 7, so long as you successfully complete all the payments under your Chapter 13 plan, your nonexempt assets are protected and do not have to be turned over to creditors. Before filing for bankruptcy, you should contact an experienced bankruptcy attorney, who can conduct a means test to determine your eligibility to file a Chapter 7 or Chapter 13 bankruptcy.

Recommended Reading: How To Be A Bankruptcy Lawyer

Chapter 7 Bankruptcy In Nevada

When an individual files for Chapter 7 bankruptcy a trustee is appointed and given the authority to sell their assets so their creditors are paid back. But just because you are filing for bankruptcy doesnt mean they can take everything. In order to protect individuals and to help them financially have a fresh start, certain property is exempt, such as your house and car.

What Is Exempted Property

Exempted property refers to assets that a debtor is entitled to keep despite his bankruptcy filing. What this means is, that even though you are filing for bankruptcy and do not anticipate paying most, if not all, of your creditors ever again, you can still keep your car, your home, and that Breitling watch. At times, it can be confusing to remember the terms under bankruptcy exemptions. It is recommended that individuals and businesses consult with an attorney. An attorney can assist with the filing of all tedious and complex forms, filing the necessary pleadings, and attend court hearings on your behalf. There are many bankruptcy regulations that must be abided by or your petition will be dismissed.

Filing for bankruptcy is a long and complicated process. It would be in your best interest to seek the services of a bankruptcy lawyer who has the knowledge, experience, and expertise to help you succeed in filing a bankruptcy case.

Don’t Miss: How Does Bankruptcy Affect Buying A House

Getting A Lawyer To Help You With Your Bankruptcy

Bankruptcy is a specialized area of law that is very complex. And the issues are not always apparent or simple. The bankruptcy laws changed in October 2005 to discourage many people from filing for bankruptcy. So the law became more complicated. And there are more situations where a mistake can result in your case getting dismissed. If your case is dismissed, the bankruptcy court often imposes a penalty of 180 days before you can refile, and in this time period a lot can happen. This is why it is so important to have a lawyer advise you and help you with your bankruptcy.

Find a lawyer who can help you work through the issues, alternatives you may have, and consequences of your choices.

- Pick a lawyer with whom you are comfortable, one who will allow you to ask questions and give you responses that you can understand.

- Pick a lawyer who either specializes in bankruptcy or does a large part of his or her practice in the field.

- Ask questions until you understand what your choices are.

- Don’t be afraid to interview a lawyer and leave without hiring him or her.

If you decide to represent yourself in bankruptcy court, read a guide for Filing for Bankruptcy Without an Attorney.

To find a good bankruptcy lawyer:

- Check state bar groups and specialization/certification programs for bankruptcy lawyers in your community.

- Ask other lawyers or tax preparers you know for recommendations.

Discharging Debt Related To Fishing And Farming

If you qualify for this type of bankruptcy, you have to repay some or all of your debts within three to five years. Different debt ceilings apply for farmers and commercial fisherman. Your total debt must be less than $4,153,150 if you operate a farm or less than $1,924,550 if you have a commercial fishing operation.

The majority of your unpaid bills must be related to your business. For farmers, at least half of your debt has to be from your farm. For fishing operators, your personal debt cannot exceed 20 percent of the total.

You May Like: How Many Bankruptcies Has Donald Trump

Chapter 7 Bankruptcy: Liquidation

The basic idea with a Chapter 7 bankruptcy is that your assets are sold to pay your creditors.; You are assigned a trustee, who evaluates your property to see if there is anything valuable enough to be sold.; Some property is considered exempt from the creditors reach, while other property is non-exempt, meaning that it can be sold to repay creditors.

People often assume that exempt items are simply things that are important, like a house or a car.; Contrary to popular belief, its not always that cut and dry; exemptions are actually dollar amounts.; If your assets are worth more than the exemption dollar amount, the item can be sold, and the court will give you the cash value of the exempted amount.

For example, if you have $2,000 in home equity, and the federal exemption laws allow you to have $21,625, your house would be exempt from the creditors.; However, if your house has $50,000 in equity, only $21,625 would be considered exempt.; Thus, the house would be sold and you would be allowed to keep $21,625, while $28,375 would go to your creditors.; Exemption laws are guided by the state in which you reside.

In most states, Chapter 7 bankruptcy will stay on your credit report for 10 years from the date filed.

Chapter 13: K Is For Keep

This version is the solution most people who owe money hope to receive. This version is only available to individuals, not businesses. Its more suited for people with high incomes, significant assets and significant debts. The general idea is you keep almost everything in exchange for committing to a plan to apply your discretionary income to debt repayment. You dont need to pay off all the debt, the bigger issue is everything that can go towards debt reduction does flow in that direction.

The objective is for an individual to gain breathing space while retaining property they own.

Advantages: You can keep most of your property. Continue earning money. Priority and secured debt must be paid, but you can get relief from unsecured debt.

Disadvantages:; s with all chapters of bankruptcy, there are certain debts that dont go away. Examples are child support and alimony. Although you are allowed to keep your property, you must be able to afford it. Non-exempt property is sold.

Also Check: Can You Buy A House After Bankruptcy Canada

How Does Bankruptcy Work

Bankruptcy is a method to eliminate or at least reduce your debt when bills pile up beyond your ability to repay them. It should be viewed as a last resort to be considered only when all other potential courses of action to get back on track have been exhausted.

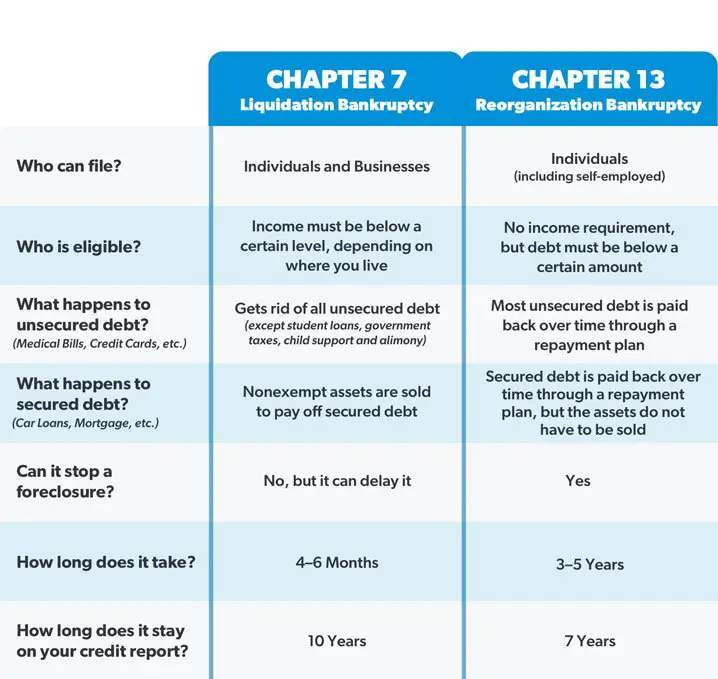

Individuals filing for bankruptcy mostly use either Chapter 7 or Chapter 13. The biggest difference between the two is what happens to your property:

- Chapter 7, which is known as liquidation bankruptcy, involves selling some or all of your property to pay off your debts. This is often the choice if you don’t own a home and have a limited income.

- Chapter 13, also known as a reorganization bankruptcy, gives you the chance to keep your property if you successfully complete a court-mandated repayment plan that lasts between three and five years.

Depending on where you live and your marital status, some of your property may be exempt from being sold when you file Chapter 7 because of state-specific and federal exemptions. With exemptions, whether they be your home equity, retirement accounts or even personal possessions such as jewelry, you receive the allowed exemption amounts, and the rest of the proceeds will be used to pay off debts. You can read more about potential exemptions, and check out this chart for a quick rundown on the two types:

| Chapter 7 |

|---|

- Child support or alimony

- Student loans