How Auto Loans Work

An auto loan is a type of secured loan that uses the car thats being financed as collateral. When you finance a car, the lender becomes the lienholder and is the owner of the car title until you pay the loan off.

In essence, this means that while you have the legal right to possess and use the car, its the lender that truly owns it. If you fail to make your loan payments, the financial institution can repossess the vehicle.

When you shop for auto loans, youll likely see them advertised by annual percentage rate . This figure includes your interest rate and the fees and other costs that come with the loan.

Before you start filling out loan applications, consider using an auto loan calculator to help you get an idea of how rates affect what you might pay. Many loan calculators allow you to enter basic information such as your desired loan amount, rate and term to see how much your monthly car payments would be and how much youd pay in interest over the lifetime of a loan.

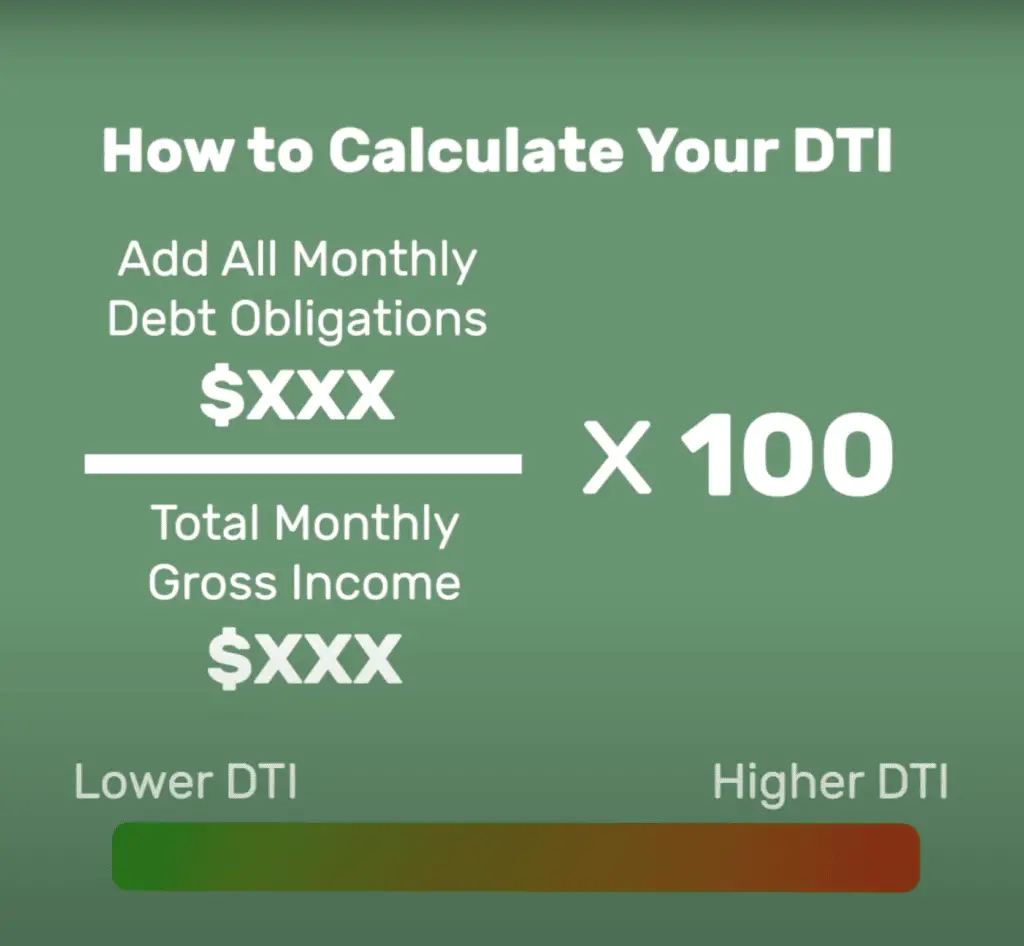

Dti Formula And Calculation

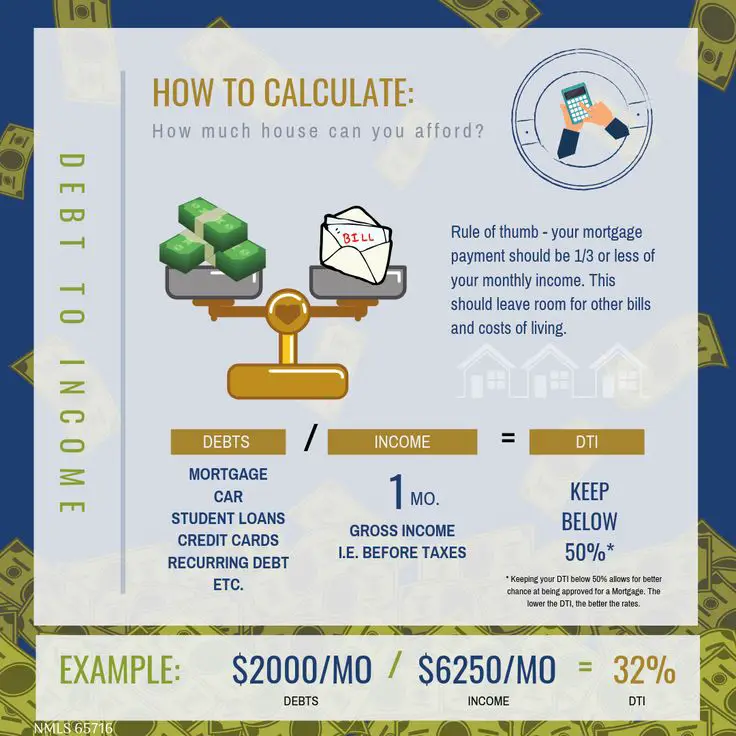

The debt-to-income ratio is a personal finance measure that compares an individualâs monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individualâs ability to manage monthly payments and repay debts.

What Goes Into Your Credit Score

- Payment history :One of the most significant factors in your credit score is whether youve missed payments. This includes whether youve had accounts that were delinquent.

- Amounts owed : While having debt doesnt necessarily mean youll have a low credit score, using too much of your available credit can cause your score to fall.

- Length of credit history :How long youve had accounts open with creditors affects your score. Having older accounts with long histories of regular, on-time payments will boost your credit score.

- New credit : Opening a new credit account can temporarily cause your credit score to drop.

- : Having a variety of credit accounts, such as credit cards, student loans and a mortgage, improves your score.

Also Check: Single Family Foreclosed Homes

What Is Considered A Bad Debt

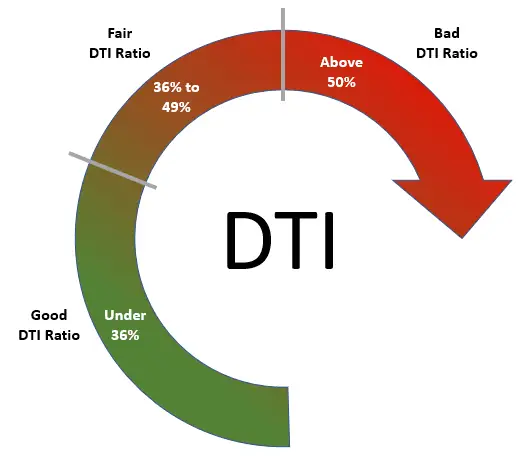

If your DTI ratio is higher than 50%, youll have a hard time getting a loan from a traditional lender.

A high DTI ratio indicates a significant portion of your monthly income is tied to debt. In other words, your cash inflows are restricted you owe a high percentage of your monthly income to someone else. It gives the impression that youre experiencing some financial struggles.

Can you still qualify for a loan with a high DTI ratio? It depends on the loan and the lender.

For example, 43% is the highest DTI ratio a person can have and still receive a Qualified Mortgage. This type of mortgage is more affordable and has more favorable loan terms. That being said, Fannie Mae, the leading provider of mortgage financing, will sometimes issue loans to people with DTI ratios as high as 50%.

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Also Check: How Many Members Of Congress Have Filed Bankruptcies

What Are Good Debt

The next time you want to get an auto loan, be prepared to be asked for your most recent pay stub. Although the lender also will pull your credit score, your debt-to-income ratio will play a significant role in the loan decision. This establishes whether you can comfortably meet your monthly expenses when the auto loan is added to your monthly debt obligations. DTI should not be confused with debt-to-credit ratio, which is a credit utilization parameter on your credit report that indicates the amount of debt you carry in relation to your credit limits.

Tips

-

Typically, a good debt-to-income ratio is 36 percent or less.

Why Do Lenders Care About My Debt

When a lender considers whether or not to let you borrow money, it wants information about how you handle your finances both past and present. So lenders will look at different factors like your , and debt-to-income ratio to get an idea of your financial picture.

When lenders see a healthy debt-to-income ratio, it can help them feel more confident that youll be able to make your loan payments. This might help you qualify for financing.

Also Check: Can You File Bankruptcy On Business Taxes

Refinance Your Current Loans

Depending on how high your DTI is, you might still be able to replace your current debt with a refinance loan. If you took out a loan when rates were higher, chances are theres a more affordable option today. For instance, if youre paying high interest on your current auto loan, you could refinance it to improve your monthly payments.

As a result, youll lower your debt-to-income ratio.

Struggling With Credit And Need A Car We Can Help

If youve taken the proactive step of lowering your amounts owed and reduced your DTI ratio to a good percentage, where do you go to find a bad credit car loan? You could go from dealer to dealer looking for an approval, but we want to point you in the direction of the right one the first time.

At CarsDirect, we work with a nationwide network of dealerships that specialize in helping consumers find the financing they need. All you need to do is fill out our auto loan request form to get started, and well do the searching for you!

Read Also: Are Medical Bills Dischargeable In Bankruptcy

Are There Different Types Of Debt

The short answer: sort of.

If youre trying to get a loan to buy a house, mortgage lenders will also look at your front-end ratio . Your front-end ratio only factors in your housing costs, such as mortgage payments, property taxes, and homeowners insurance. Instead of total debt payments, youd divide your monthly housing payments by your monthly gross income.

In the mortgage world, lenders consider both your front-end ratio and your back-end ratio. Your back-end ratio is the same formula we used in the previous section calculating DTI: your total monthly debt to total monthly income.

Lets stick with our previous example. Youre ready to buy a house. Since houses are significant purchases, you decide to apply for a mortgage which has a $1,000 monthly payment .

Pre-tax income: $4,000

Front-end ratio: $1,000 ÷ $4,000 x 100 = 25%

Back-end ratio: $1,925 ÷ $4,000 x 100 = 48.1%

In this example, your front-end ratio would be 25% , while your back-end ratio would be 48.1% .

How About Getting Two Cars Under One Auto Loan

In theory, its doable to finance two vehicles with a single loan, but such an approach is so inconvenient that most drivers who wish to acquire multiple cars at once will choose not to use it. But the consequences of a car wreck can be nerve-wracking, especially when your car gets labeled total loss, and you desperately need a car. It all comes down to who owns the title at each stage and the consequences of default.

Car lenders hold the title to each vehicle until you pay off the whole amount you owe. Two car repossessions at once might be catastrophic. Knowing this, having one loan for every car gives you greater financial flexibility and protection.

Other types of loans allow you to take possession of the car titles right away. But these options have other limitations.

Personal Loan

These loans are installment contracts that don’t have anything the lender can take away if you don’t pay. This means the lender takes a bigger risk when lending money, so you can expect to pay higher interest rates. It’s also harder to borrow enough money to buy two cars with a personal loan.

Home Equity Loan

Home equity loans use the value of your real estate property as securityprovided you are a homeowner, and the balance on the existing mortgage is low enough. However, if you cannot make your monthly payments on time, you may lose your home to foreclosure. And if you already have a lot of debt, taking on more could put you in over your head.

Read Also: When Can Bankruptcy Be Removed From Credit Report

Amount You Can Borrow Based On Income And Credit Score

willing afford

Many people, especially those with bad credit, may be willing to pay a large amount each month but lenders will only approve loans based on what borrowers can afford to pay.

The main thing lenders look at is your debt to income ratio , the percentage of your monthly gross income that goes toward paying debts.

Lenders like to see a DTI ratio of 40% or less, which means if you bring in $5,000 of income each month, your debt payments should be no more than $2,000.

Debt includes any installment loans such as car payments, student loans or personal loans, plus any rent or mortgage payments. It also includes your minimum monthly credit card payments. Normal expenses such as groceries and utility bills are not included as part of your debt.

In general, here is how lenders view your DTI ratio:

| 36% or less |

| 15% of gross monthly income | 24 months | Many lenders will limit loans to a maximum of $5,000 |

What you need to do is first check your credit score, then get a financing quote from online providers to see what kind of payment you qualify for.

You can then compare that figure to the charts above to make sure you’re within the acceptable range. If you’re not able to borrow as much money as the charts indicate, you may have some errors in your credit report .

What Factors Affect Auto Loan Rates

Auto lenders set interest rates based in part on the likelihood of repayment. The riskier the loan is for the lender, the higher the interest rate it is likely to charge. Several factors indicate risk to lenders and can affect the interest rate you get on a loan.

Here are the most critical factors used to determine your rates:

- :Your credit score is the factor that carries the most weight. The lower your score is, the higher your interest rate is likely to be.

- :Your credit score is part of your credit history, but it isnt all of it. Lenders look at a detailed credit report that includes information about how much of your available credit youre using and whether youve missed monthly payments.

- Loan term:Car loans generally have terms ranging from 12 to 84 months. Longer terms typically translate to lower monthly payments, but they also tend to come with higher interest rates.

- :The average market rate is a significant factor in the rates you get. Lenders adjust their rates based on what they pay to borrow money, so youll see higher rates if the average interest rate goes up.

- Loan-to-value ratio:The LTV ratio expresses how much of a cars value is borrowed. For example, if you want to borrow $20,000 for a car thats worth $40,000, thats an LTV ratio of 50%. The lower the LTV ratio is, the lower your interest rate is likely to be.

Read Also: Income Debt Ratio For Mortgage

How To Get Lower Interest Rates On Your Auto Loan

If youre looking for the best auto loan rates, these tips may help:

- Increase your down payment: Putting more money down on the car reduces the LTV ratio on your auto loan, which may get you a better interest rate.

- Get a discount: One of the most common discounts in the automotive finance industry is for setting up automatic payments, which can reduce your interest rate by as much as 0.5%.

- Get a co-signer:If you have bad credit, getting a friend or family member with a good credit score to co-sign a loan with you might get you a lower rate.

- Look for a newer car:Most lenders adjust their rates based on the age of a car. If you can find a newer car within your price range, you may get better auto loan interest rates for your credit score.

- Choose a shorter loan term:Longer loan terms have lower monthly payments, but they usually come with higher interest rates. If you can afford the higher payments that come with a shorter loan term, youll likely get a lower interest rate and pay less interest over the lifetime of your loan.

- Refinance later: If youre stuck with a high interest rate due to a poor credit score, you may benefit from refinancing your auto loan in the future. You can take the interest rate available to you now and make timely payments to improve your credit score, which will eventually put you in a better position with lenders.

Car Loan Debt To Income Ratio Explained

Banks Editorial Team

Banks Editorial Team

When you apply for a car loan, the lender will review your income, credit rating and debt-to-income ratio to determine if youre a good fit for financing. The lender wants assurance that you can make timely loan payments each month, and your DTI sheds light on your current debt load and how you manage your finances.

Read Also: How To Build Your Credit Fast After Bankruptcy

What Other Factors Are Considered For Qualification For The Car Loan

Other factors can affect your chances of securing an auto loan.

- You need a minimum FICO score of at least 660 to get an auto loan with a low-interest rate. Some lenders cater to applicants with bad credit but the loan tends to have high-interest rates.

- You need to prove that you have a steady source of gross monthly income by presenting your recent pay stubs or W-2 form.

- Proof of Residence and Identity You may need to provide a government-issued ID, drivers license, and proof of residence so lenders can verify your identity and address.

An Acceptable Debt To Income Ratio

- 100% or higher DTI â these prospective borrowers represent a huge risk and do not show an ability to make regular mortgage payments. Almost all lenders will reject an application in this instance.

- 75% to 99% DTI â borrowers who are very high risk. A select few specialist lenders will be willing to look at the application and make a positive decision where other factors are given more weight, such as credit score and a clean credit history or substantial deposit.

- 50% to 74% DTI â high risk borrowers. Some specialist lenders are willing to accept applications at this level, but terms are less favourable and larger deposits are required.

- 40% to 49% DTI â moderate risk borrowers. Specialist lenders will want to see good credit history and may ask for larger deposits.

- 30% to 39% DTI â acceptable risk. Most specialist lenders will offer a mortgage at this level at standard terms.

- 20% to 29% DTI â good borrower. Almost all lenders are happy to approve mortgage applications at this level.

- 0% to 19% DTI â very low risk borrower. All lenders will consider an application.

Also Check: How To File Bankruptcy Chapter 7 Yourself In Florida

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

What Is A Debt To Income Ratio For A Car Loan

What does a debt to income ratio mean? I want to take out a loan to purchase a car, but my friend said I will get approved if I have a low debt to income ratio.

a lower debt to income ratio will increase your chances of getting approved for a loanhow much you earn with how much debt you oweyour monthly debt payments and dividing that by your monthly income$6000$1,80030%30% of what you earn in a month goes towards making these monthly financial payments43%less than 36%before

You May Like: How Much The Us Owe China

Divide Your Debt Payment By Your Gross Income

Now that youâve determined your monthly gross income and your monthly debt payments, use the following formula to finish your calculations:

monthly debt payment total / gross monthly income = debt-to-income ratio

In other words, divide your monthly debt payment total by your gross monthly income.

For example:Using the values above, divide your monthly debt payment total of $2,400 by your gross monthly income of $3,467. This would result in a debt-to-income ratio of 0.69.

You May Like: Usaa Auto Loan Eligibility Requirements

Where Can You Get The Best Auto Loan Interest Rates

Lenders dont all offer the same auto loan interest rates by credit score. Youll likely find a range of rates available to you if you compare auto loan offers. Thats why its good to shop around. There are a number of places you can find auto loans. Some may have better loan options than others, depending on your circumstances.

Recommended Reading: Can You Discharge Medical Bills In Bankruptcy