Who Owns Chinas Debt

Who owns Chinas foreign debt? Of the $22 trillion in government debts, more than $5 trillion is actually owned by the federal government in trust funds. These are accounts dedicated to Social Security, Medicare and other entitlements. Does the US own any of Chinas debt? With Chinas 2014 GDP being ]

Why Does China Hold So Much Of The Debt

China is the second-largest holder of the debt, even after it reduced its holdings, which it has been doing since 2011. It has held up to $1.3 trillion of U.S. debt.

Every year since 2010, China has held more than $1 trillion in U.S. debt. That’s when the U.S. Department of the Treasury changed how it measures the debt. Before June 2010, Treasury reports showed that China held about $843 billion in debt. This Treasury-led change makes it difficult to make long-term comparisons.

China is taking steps to make its currency, the yuan, transition to a global currency. To do that, China had to loosen its peg to the dollar. That made the yuan more attractive to forex traders in global markets. China’s economic growth has slowed over the years. As its exports decline, China is less able to invest in U.S. Treasurys.

China also is liberalizing its control of the yuan, also called the “renminbi.” It has opened yuan trading centers in London and Frankfurt. Its allowed the yuan to trade in a wider trading range around a basket of currencies that include the dollar.

China is also responding to accusations of manipulation. Most countries want their currency values to fall so they can win global currency wars. Countries with lower currency values export more, since their products cost less when sold in foreign countries.

How The Ownership Of Us Debt Works

By mid-2017, the total amount of official debt owed by the federal, state, and local governments was more than $19.8 trillion. That figure was $30.5 trillion as of June 30, 2022. Some experts insist on adding hundreds of trillions in unfunded future liabilities on the federal government balance sheet.

Of the $30.5 trillion in government debts, more than $6 trillion is owned by the federal government in trust funds. These are accounts dedicated to Social Security, Medicare, and other entitlements.

In simpler terms, the government wrote itself a really big IOU and bankrupted one account to finance another activity. IOUs are formed and financed through joint efforts of the U.S. Department of the Treasury and the Federal Reserve.

Much of the rest of the debt is owned by individual investors, corporations, and other public entities. This includes everyone from retirees who purchase individual U.S. Treasurys to the Chinese government.

From May 2021 to May 2022, the debt to Japan and China decreased by 4% and 9%, respectively.

Japan commands the top spot among foreign creditors with $1.2 trillion4% of total U.S. debtowed by the U.S. government. China holds the number two position, holding $980.8 billion of U.S. Treasurys3.2% of the total U.S. debt.

Japanese-owned debt doesn’t receive nearly as much negative attention as Chinese-owned debt, ostensibly because Japan is seen as a friendlier nation and the Japanese economy hasn’t grown as fast as China’s year after year.

Read Also: What Are The Requirements To File Chapter 7 Bankruptcy

China Has Lost Its Crown As The United States’ Biggest Overseas Creditor That Title Now Belongs To Japan

Beijing has been dumping U.S. government debt to prop up its currency. China uses the dollars it gets from selling U.S. Treasuries to buy the yuan, which has sunk to an 8-year low as the world’s second largesteconomy slows.

China’s huge holdings of U.S. debt fell to $1.12 trillion at the end of October, their lowest level in more than six years, according to U.S. Treasury Department data. Japan held $1.13 trillion.

Both countries offloaded Treasuries during the month, but China dumped far more: its holdings dropped by $41.3 billion, while Japan’s fell by just $4.5 billion.

China’s willingness to lend vast sums to the U.S. government has drawn a lot of attention in recent years. Since September 2008, the Treasury Department has ranked it as the biggest foreign creditor to the U.S., with the exception of one month in early 2015 and again with its latest update.

The situation has raised concerns about Beijing’s leverage over the United States. President-elect Donald Trump has claimed the opposite, suggesting it gives the United States “a lot of power” over China.

Experts say the reality is more complicated, arguing that the debt relationship binds the world’s two largest economies closely together. Trump has suggested he will take a more confrontational stance toward China on trade, threatening to slap tariffs of as much as 45% on Chinese goods.

United States Of America

- State and local government pension funds: $342.8 billion

- U.S. savings bonds: $141.1 billion

Why would individual Americans, businesses and local governments continue to loan money to the United States? Doesn’t it seem risky to put money into an institution that’s already $28 trillion in the hole? Believe it or not, investing in the government isn’t a high-risk proposition. While the federal government is hemorrhaging thousands of dollars by the second in order to pay interest on its debts, the U.S. has a vested interested in not defaulting on its loans. America’s credit rating would drop, and the booming market for U.S. debt could dry up. How would the U.S. government function without its international credit card? Let’s hope we never find out.

Originally Published: Jul 26, 2011

Also Check: Pallets Returns For Sale

Under Which Program Does The Us Government Spend The Most Money

As Figure A suggests, Social Security is the single largest mandatory spending item, taking up 38% or nearly $1,050 billion of the $2,736 billion total. The next largest expenditures are Medicare and Income Security, with the remaining amount going to Medicaid, Veterans Benefits, and other programs.

Hidden Debts And Hidden Risks

Failing to account for these hidden debts to China distorts the views of the official and private sectors in three material ways. First, official surveillance work is hampered when parts of a countrys debt are not known. Assessing repayment burdens and financial risks requires detailed knowledge on all outstanding debt instruments.

Second, the private sector will misprice debt contracts, such as sovereign bonds, if it fails to grasp the true scope of debts that a government owes. This problem is aggravated by the fact that many Chinese official loans have collateral clauses, so that China may be treated preferentially in case of repayment problems. As a result, private investors and other competing creditors may underestimate the risk of default on their claims.

And, third, forecasters of global economic activity who are unaware of surges and stops of Chinese lending miss an important swing factor influencing aggregate global demand. One could look to the lending surge of the 1970s, when resource-rich, low-income countries received large amounts of syndicated bank loans from the U.S., Europe, and Japan, for a relevant precedent. That lending cycle ended badly once commodity prices and economic growth slumped, and dozens of developing countries went into default during the bust that followed.

You May Like: How To File Bankruptcy On Credit Cards Only

Who Owns The Worlds Debt

The rest of the $21 trillion national debt is owned by either the American people or by the U.S. government itself. China holds the greatest amount of U.S. debt by a foreign country. Japan comes second at $1.03 trillion, followed by Brazil and Ireland at around $315 billion each. The United Kingdom holds $273 billion.

How Much Of Our Debt Is Really Owned By China

The quick answer is that as of January 2018, the Chinese owned $1.17 trillion of U.S. debt or about 19% of the total $6.26 trillion in Treasury bills, notes, and bonds held by foreign countries. That sounds like a lot of moneybecause it isbut it is actually a little less than the $1.24 trillion China-owned in 2011.

You May Like: What Are The Consequences Of Filing Bankruptcy

What Is The National Debt Of China

The national debt of the Peoples Republic of China is the total amount of money owed by the central government, local governments, government branches and state organizations of China. As of 2020, Chinas total government debt stands at approximately CN¥ 46 trillion , equivalent to about 45% of GDP.

How Does The Federal Debt Work

The government finances the operation of the different federal agencies by issuing treasuries. The Treasury Department is in charge of issuing enough savings bonds, Treasury bonds, and Treasury inflation-protected securities to finance the government’s current budget.

Revenues generated by taxes are used to pay the bonds that come to maturity. Investors, including banks, foreign governments and individuals, can cash in on these bonds when they reach maturity. The debt ceiling is the cap that is set on what the Treasury Department can issue.

Congress keeps raising the debt ceiling to finance government spending. A deficit occurs when spending increases faster than revenues.

Don’t Miss: Credit Card Debt Relief Government Program

What Countries Hold Us Debt

Use this visualizationJapan holds more U.S. debt than any other country in the world at $1,271.7B, or 18.67% of the total.China used to own the most debt but is now in second place at $1,081.6B or 15.88%.No other country besides Japan and China holds more than 6% of total foreign-held debt. The U.K. Foreign countries control only about 30% of the entire national debt.

Who Owns Americas Debt

The rest of the $28.4 trillion national debt is owned by either people in the U.S. or by the U.S. government itself. 1 China has the second-greatest amount of U.S. debt held by a foreign country. Japan consistenly tops the list, owning about $1.3 trillion as of July 2021. 2 Why Does China Hold So Much of the Debt?

You May Like: Pallets Of Returns For Sale

Us Debt Hits Record: Should You Worry

Earlier this week, US gross national debt hit a new high, clocking $31 trillion. Gasp! Thats almost twice what it was a decade ago, and debt is now equal to well over 100% of GDP, hovering at the highest levels since World War II.

Is steadily rising US debt a problem, or is the risk of a financial meltdown overblown? Heres a quick guide to the debate over debt.

First, what is it? When the federal government spends more than it raises through tax revenue, it runs a deficit. Those deficits are financed by selling Treasury bonds to investors. The US government promises to buy back the bonds by a certain date and repays the interest in the meantime. The total amount of money that the US owes to its creditors is the gross national debt. It rises when the government spends more or has to pay higher interest rates, and falls when the government takes in more revenue either because of higher taxes or stronger economic growth .

Who holds it? Government agencies hold some of it, but more than three quarters of US debt is held by the public, which includes private investors as well as foreign governments. Foreign governments currently hold about $7 trillion of it, with China , Japan , and the UK the top three creditors.

How can the US keep doing this? The strength of the US economy and the fact that the dollar is the worlds most widely used currency mean that people and governments around the world see US treasuries as safe investments.

Should The Us Refuse To Pay Back Its $1 Trillion Debt To China

The recent intensification of President Donald Trumps hard line on China has included a wide-ranging grab bag of policies and proposals that touch on everything from student visas to soybean purchases. But the most explosive might be the suggestion floated by some right-wing lawmakers and commentators that the country could choose to default on some of the nearly $1.1 trillion in U.S. Treasury bonds held by China.

The proposal alarms analysts, who say even entertaining the idea is dangerous in an economic environment characterized by a pandemic-driven recession and a massive increase in the national debt.

Sen. Lindsey Graham, R-S.C., a close Trump ally, said on Fox News, They should be paying us, not us paying China, and expressed support for a suggestion from Sen. Marsha Blackburn, R-Tenn., that the U.S. should cancel its sovereign debt held by China.

John Yoo, a law professor at the University of California, Berkeley, and visiting scholar at the American Enterprise Institute, said in an article that the U.S. could make China pay for COVID-19 by reneging on its commitment to bondholders. Conceivably, Washington could even cancel Chinese-held treasury debt and us the proceeds to create a trust fund that would compensate Americans harmed by the pandemic, he wrote.

While Yoo allowed that this would roil financial markets, others say even that acknowledgement vastly understates the scope of economic calamity this would trigger.

You May Like: How Many Times Are You Allowed To File Bankruptcy

Consequences Of Owing Debt To The Chinese

It’s politically popular to say that the Chinese “own the United States” because they are such a huge . The reality is very different than the rhetoric.

If China called in all of its U.S. holdings, the U.S. dollar would depreciate, whereas the yuan would appreciate, making Chinese goods more expensive.

While around 3.2% of the national debt isn’t exactly insignificant, the Treasury Department has had no problems finding buyers for its products even after a rating downgrade.

If the Chinese suddenly decided to call in all of the federal government’s obligations , others would likely step in to service the market. This includes the Federal Reserve, which already owns six times as much debt as China.

Who Owns This Debt

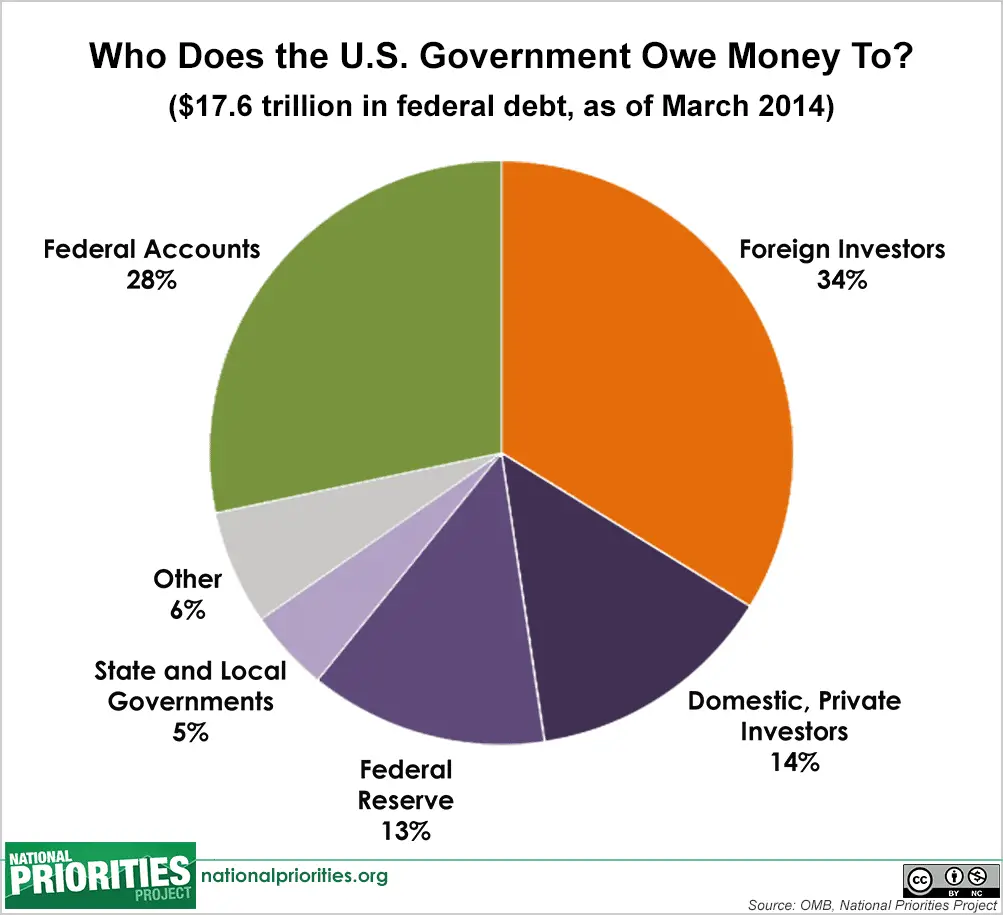

The public owes 74 percent of the current federal debt. Intragovernmental debt accounts for 26 percent or $5.9 trillion. The public includes foreign investors and foreign governments. These two groups account for 30 percent of the debt. Individual investors and banks represent 15 percent of the debt.

The Federal Reserve is holding 12 percent of the treasuries issued. The Federal Reserve has been purchasing these bonds to keep interest rates low after the 2008 Financial Crisis. States and local governments hold 5 percent of the debt.

Foreign governments who have purchased U.S. treasuries include China, Japan, Brazil, Ireland, the U.K. and others. China represents 29 percent of all treasuries issued to other countries, which corresponds to $1.18 trillion. Japan holds the equivalent of $1.03 trillion in treasuries.

Investing in U.S. treasuries is a deliberate strategy for foreign countries. China has been using these bonds to keep the Yuan weaker than the U.S. dollar and benefit from low import prices. Intragovernmental debt encompasses different funds and holdings.

Some agencies take in revenues and use this money to purchase treasury bonds. This makes the revenues usable by other agencies, and these bonds can be redeemed in the future when these funds and holdings need money.

Recommended Reading: How Much Is Bankruptcy Chapter 7

How Much Debt Does The Us Owe To China

It seems like every American politician and talking head is concerned by the huge amount of debt that the U.S. government owes Chinese lenders. The Chinese do own a lot of U.S. debt $1.123 trillion as of December 2018.

Milos Maricic, an international affairs expert and World Economic Forum contributor, concurred that while China owns close to $150 billion in U.S. companies not particularly huge in comparison to the U.S. economy there is a lot about the available figure that we simply do not know.

Content

Is It A Risk For America That China Holds Over $1 Trillion In Us Debt

Many worry that Chinas ownership of American debt affords the Chinese economic leverage over the United States. This apprehension, however, stems from a misunderstanding of sovereign debt and of how states derive power from their economic relations. The purchasing of sovereign debt by foreign countries is a normal transaction that helps maintain openness in the global economy. Consequently, Chinas stake in Americas debt has more of a binding than dividing effect on bilateral relations between the two countries.

Even if China wished to call in its loans, the use of credit as a coercive measure is complicated and often heavily constrained. A creditor can only dictate terms for the debtor country if that debtor has no other options. In the case of the United States, American debt is a widely-held and extremely desirable asset in the global economy. Whatever debt China does sell is simply purchased by other countries. For instance, in August 2015 China reduced its holdings of U.S. Treasuries by approximately $180 billion. Despite the scale, this selloff did not significantly affect the U.S. economy, thereby limiting the impact that such an action may have on U.S. decision-making.

Read Also: Credit Card Debt Forgiveness Mental Illness

Why Is China Americas Biggest Banker

Why China Is Americas Biggest Banker. Thats 19 percent of the $6.3 trillion in Treasury bills, notes, and bonds held by foreign countries. The rest of the $21 trillion national debt is owned by either the American people or by the U.S. government itself. China holds the greatest amount of U.S. debt by a foreign country.

A Conversation With Scott Miller

Skip to another question

- 0:12 Can China use its creditor position as an instrument of power or leverage against the U.S?

- 2:09 Why do countries buy each others debt?

- 3:40 If China sells its U.S. Treasury Bonds, what would happen? How would the economies of both countries be affected?

- 5:43 Would countries still eagerly buy US Treasury Bonds if the US dollar was no longer the world economys reserve currency?

Despite U.S. debts attractive qualities, continued U.S. debt financing has concerned economists, who worry that a sudden stop in capital flows to the United States could spark a domestic crisis.1 Thus, U.S. reliance on debt financing would present challengesnot if demand from China were halted, but if demand from all financial actors suddenly halted.2

From a regional perspective, Asian countries hold an unusually large amount of U.S. debt in response to the 1997 Asian Financial Crisis. During the Asian Financial Crisis, Indonesia, Korea, Malaysia, the Philippines, and Thailand saw incoming investments crash to an estimated -$12.1 billion from $93 billion, or 11 percent of their combined pre-crisis GDP.3 In response, China, Japan, Korea, and Southeast Asian nations maintain large precautionary rainy-day funds of foreign exchange reserves, whichfor safety and convenienceinclude U.S. debt. These policies were vindicated post-2008, when Asian economies boasted a relatively speedy recovery.

You May Like: How Long Does A Bankruptcy Stay On My Credit Report