Weigh Your Monthly Debt Payments Against Your Income To See If Youre Overextended

A debt-to-income ratio is a key factor that lenders use to determine if youll be approved for a loan. During the underwriting process after you apply for a loan, the underwriter will check your debt-to-income ratio to see if you can afford the loan payments. If your DTI is too high, you wont get approved for the loan.

For consumers, debt-to-income is an easy way to measure the overall health of your finances. You can check your DTI to see if you have too much debt for your income. If your debt ratio is too high, then you know to scale back and focus on debt repayment. If you need help, call to speak with a trained credit counsellor for a free debt and budget evaluation.

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowerâs total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Multiply That Number By 100 To Get A Percentageand Thats Your Debt

Lets look at an example:

Bob pays $600 a month in minimum debt payments plus $1,000 per month for his mortgage payment. Before taxes, Bob brings home $5,000 a month. To calculate his DTI, add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 0.32. Multiply that by 100 to get a percentage.

So, Bobs debt-to-income ratio is 32%.

Now, its your turn. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

Don’t Miss: How Much Is It To File Bankruptcy In Oklahoma

How Lenders View Your Dti Ratio

Lenders look at debt-to-income ratios because research shows borrowers with high DTIs have more trouble making their payments.

Each lender sets its own debt-to-income ratio requirement. Not all creditors, such as personal loan providers, publish a minimum debt-to-income ratio, but generally it will be more lenient than for, say, a mortgage.

Note that a debt-to-income ratio of 43% is generally the highest mortgage lenders will accept for a qualified mortgage, which is a loan that includes affordability checks.

You may find personal loan companies willing to lend money to consumers with debt-to-income ratios of 50% or more, and some exclude mortgage debt from the DTI calculation. Thats because one of the most common uses of personal loans is to consolidate credit card debt.

The required debt-to-income ratio for student loan refinancing varies by lender but generally, lenders look for DTIs of 50% or lower.

» MORE: Learn how to pay off debt in three steps

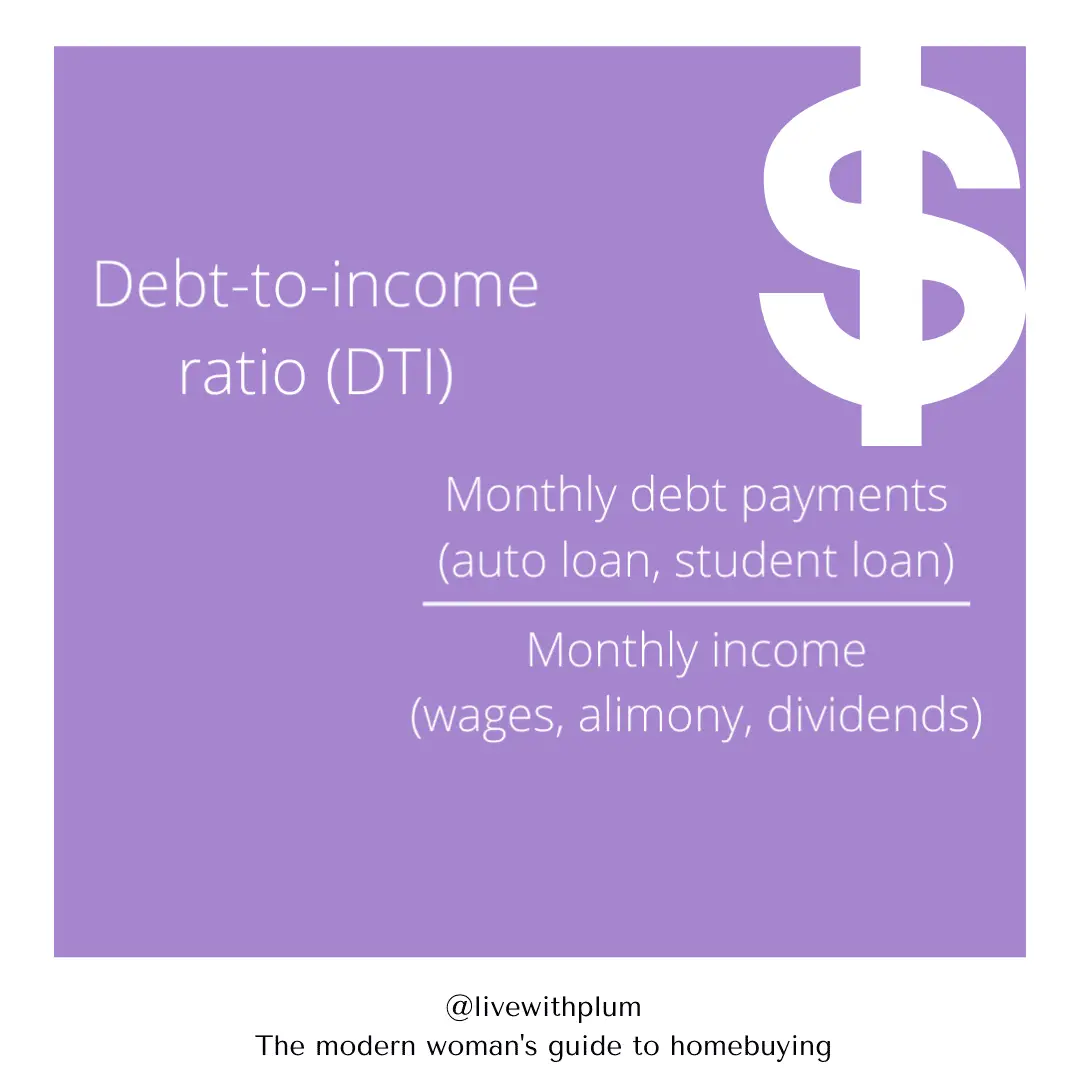

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

Recommended Reading: What Are The Consequences Of Filing Bankruptcy

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Also Check: How Much Debt Is The United States In

Buyer Bewareof How Much You Can Afford

Because debt-to-income ratios are calculated using gross income, which is the pre-tax amount, its a good idea to be conservative when you feel comfortable taking on. You may qualify for a $300,000 mortgage, but that amount may mean living paycheck-to-paycheck rather than being able to save some of your income each month. Also remember, if youre in a higher income bracket, the percentage of your net income that goes to taxes may be higher.

While your debt-to-income ratio is calculated using your gross income, consider basing your own calculations on your net income for a more realistic view of your finances and what amount youd be comfortable spending on a home.

Avoid Taking More Credit

Keep your debt from growing by avoiding more debt. Do not take a car loan or personal loan before getting a mortgage. This increases your DTI ratio, which is apparent when lenders review your profile. Also avoid making large credit card purchases before applying for a mortgage. If you know something can wait, be patient before taking out another loan for a large expense. Again, having too many debts on your profile is a red flag for lenders.

Read Also: What Does Bankruptcy Mean In Australia

How To Lower Your Dti

If your debt-to-income ratio is not within the recommended range, you can lower your DTI a number of ways:

- Pay off debt: If possible, the preferred option to lower your DTI is by repaying as much of your debt as you can manage. To make the most impact, prioritize the debt with the highest monthly payment.

- Restructure your loans: Seek out options for lowering the interest rate on your debt or attempt to lengthen the duration of the loan through refinancing options.

- Look into loan forgiveness: These types of programs may help to eliminate some of your debt entirely.

- Pay off high-interest loans: If youre unable to refinance your loans, focus on repaying the higher-interest ones first. These carry a heavier weight in your DTI calculation, so paying them off first will improve the ratio.

- Seek out an additional source of income: If youre able to, generating an additional income stream will help improve your DTI ratio.

What Is The Difference Between Front

Youll sometimes see a lender express maximum DTI ratios in pairs, such as 29%/41%. This is because theyre expressing two separate figures: front-end DTI and back-end DTI.

Front-end DTI is calculated using only housing-related debts and expenses, such as your mortgage, property taxes, and homeowners insurance.

Back-end DTI is calculated using all of your monthly debt repayments, including housing and the others listed above, and is also the number most often used by lenders to assess your eligibility. For the purposes of this article, all the specific debt-to-income ratios well mention are back-end DTI.

You May Like: How Long Does Bankruptcy Stay On Record

The Fha Streamline Refinance

The FHA offers a refinance program called the FHA Streamline Refinance which specifically ignores DTI, even if its a high DTI that wouldnt qualify for an FHA purchase loan.

Official FHA mortgage guidelines also waive income verification and credit scoring as part of the streamline refi process. Instead, the FHA looks to see that the homeowner has been making the homes existing mortgage payments on time and without issue.

If the homeowner can show a perfect payment history dating back three months, the FHA assumes that the homeowner is earning enough to pay the bills.

What Is A Good Dti Ratio

A good target for a front-end DTI ratio is below 28%, and a good target for a back-end DTI is below 36%.

But you can qualify for a mortgage with a higher DTI. The requirement will vary by the lender and type of mortgage.

Ideally, though, youll want to keep your DTIs as low as possible, regardless of lenders limits. Paying down debt will help improve your, and a higher credit score and lower DTI ratio will help you get a better mortgage interest rate.

» MORE:The best lenders for low credit score borrowers

Don’t Miss: How Many Times Can You File Bankruptcy In A Year

The Bottom Line On Dti Ratios

Your debt-to-income ratio is an important part of the mortgage qualification process. If your debts are too high to justify the loan, you could be disqualified even if you have stellar credit and a steady paycheck. DTI ratio requirements vary from lender to lender, but its rare to find a lender who will accept a back-end DTI ratio above 45%.

Keep in mind that just because a DTI ratio calculation says you can afford a certain home price doesnt mean that you need to spend that much. Many people arent comfortable spending 45% of their income on debt payments when you add in things like taxes, groceries, and other things that arent considered in the DTI calculation, such a high debt load could be overwhelming. So, in addition to determining if a home meets your lenders DTI standards, its still important to make sure your new housing payment will fit your budget.

Read Also: Recasting Mortgage Chase

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Recommended Reading: How Long Bankruptcy Stay On Credit Report

Add Up All Your Monthly Debt

When lenders add up your total debts, they typically do it one of two ways these two methods of determining your DTI are called front-end and back-end ratios.

Your front-end ratio only takes into consideration your housing related debts, such as rent payments, monthly mortgage payments, real estate taxes, homeowners association fees, etc.

Your back-end ratio, however, includes those monthly payments as well as other debts that might show up on your credit report, such as , personal loans, auto loans, student loans, child support, etc.

Your lender might calculate your front-end or back-end ratio when determining your DTI and sometimes they may look at both to get a better idea of your financial situation. When calculating your own DTI, its a good idea to add all these expenses up as part of your monthly debt to be prepared. Keep in mind that when tallying up your debts, lenders typically only look at things that appear on your credit report so things like utility payments may not actually count toward your total.

What Should You Do To Improve The Dti Ratio

- You can increase your EMIs toward a personal loan that you have availed. Though this will temporarily increase your DTI ratio , it will, in the long run, bring down your total debt considerably. This, in turn, will reflect well on your DTI ratio.

- Do not acquire more debt.

- Postpone a few large purchases if you can. This will give you more time to save and help you make a larger lump sum payment in time.

- Dont forget to keep track of the debt-to-income ratio every month. This will make it easier for you to notice deviations if any, and take corrective measures.

Availing of the financial assistance you need is easier with pre-approved offers on personal loans from Bajaj Finserv. All you need to do is share a few details and get your pre-approved offer.

*Terms and conditions apply

Recommended Reading: Mortgage Recast Calculator Chase

You May Like: How Often Can You File Bankruptcy In Oklahoma

How To Get Around A High Dti

The easiest way to lower your debt-to-income ratio is to pay off as much debt as you can but many borrowers dont have the money to do that when theyre in the process of getting a mortgage, because much of their savings are tied up in a down payment and closing costs.

If you think you can afford the mortgage you want but your DTI is above the limit, a co-signer might help solve your problem. Unlike with conventional loans, borrowers can have a relative co-sign an FHA loan and the co-signer wont be required to live in the house with the borrower. The co-signer does need to show sufficient income and good credit, as with any other type of loan.

Sometimes, though, a co-signer isnt the answer. If your DTI is too high, for example, you should consider focusing on improving your financial situation before committing to a mortgage.

Dti Isn’t A Full Measure Of Affordability

Although your DTI ratio is important when getting a mortgage, the number doesn’t tell the whole story about what you can afford.

DTIs don’t take into account expenses such as food, health insurance, utilities, gas and entertainment, and they count your income before taxes, not what you take home each month.

Youll want to budget beyond what your DTI labels as affordable, and consider all your expenses compared with your actual take-home income.

» MORE: How much house can you afford?

Read Also: Does Bankruptcy Stop You From Buying A House

If Your Dti Is Over 50%

A DTI ratio of over 50% is considered financially unsustainable, and you will likely have trouble qualifying for a conventional loan if the total of your debts consumes more than half of your monthly income.

If you are in this situation, you may want to consider contacting a reputable credit counselor to explore the options available to you. Many small businesses and people who are self-employed live with high debt levels as they build their businesses, so it doesnt necessarily mean you can never qualify for a loan with a DTI this high. Lenders do consider high DTI ratios to be a risk, however, so it may be in your best interest to attempt to pay down what you can before attempting to get a loan.

Create the bathroom you’ve always wanted.

Your Student Loan Debt Matters

For the millennial generation, saddled with student loan debt and more than half unsure how long it will take to become debt-free, obtaining a mortgage can be a trickier process. This is because your student loan debt is factored into your debt-to-income ratio. For example, home loans insured by the Federal Housing Administration actually requires your student loan debt to be factored in one of two ways:Your lender must use:

-

Your anticipated monthly student loan payment , or

-

The greater of: one percent of your outstanding student debt balance can be used if you dont know your anticipated monthly payment, or the monthly payment as reported on the credit report

Even if your loans are currently in deferment, they will be counted as part of your debt-to-income ratio. So, as you can see, your student loans can have a big impact on your ability to borrow money to purchase a home. Each program varies, so dont forget to check with your lender about student loan guidelines.

Don’t max out your credit cards

Also Check: Is There Such A Thing As Medical Bankruptcy

Whats The Maximum Dti For A Home Loan

Generally, a good debt-to-income ratio is around 36% or less and not higher than 43%. But each mortgage lender can set its own eligibility requirements and DTI guidelines.

Here are the common maximum DTI ratios for major loan programs:

- Conventional loans: 43% to 50%

- FHA loans: 45% to 50%

- VA loans: No max DTI specified, but borrowers with higher DTI could be subject to additional scrutiny

- USDA loans: 41% to 46%

- Jumbo loans: 43%

Most home loan programs can accept a pretty wide range of debt ratios. While lenders typically prefer a DTI on the lower end, they can often be flexible. If your DTI is closer to 50% than 43%, for example, other assets like a high credit score or substantial down payment may help you qualify.

What Goes Into A Debt

Debt-to-income ratios come in two forms: the front-end DTI and the back-end DTI. Lenders look at both of these when considering your loan application.

Heres how those break down:

- Front-end DTI: Also called a PITI ratio , this number reflects your total housing debt in relation to your monthly income. If you take home $6,000 per month and are trying to buy a home that would require a $1,500 monthly payment, your front-end DTI would be:

- Back-end DTI: Your back-end DTI encompasses all your monthly debts in relation to your income. For example, if you make $6,000 a month, have a $600 car payment, a $400 student loan payment, and an expected $1,500 mortgage payment, your back-end DTI would look like this:

For most lenders, the back-end DTI is most important, as it more accurately reflects what you can afford each month.

Don’t Miss: Do You Lose Your House With Bankruptcy

How Can I Lower My Debt

If you do need to lower your debt-to-income ratio in order to qualify for a mortgage loan, there are many ways to do so!

The most obvious answer is to work on paying down your debts, but approaching this project strategically can help you lower your debt-to-income ratio faster. Our debt related calculators may help you develop a plan.

Because every lenders parameters are different, its best to talk to your lender specifically to see what they require from their borrowers and how you might be able to shift your finances around to meet their eligibility needs. For instance, a lender might be willing to drop an installment loan from your ratio calculation if you can pay it down sufficiently up-front, even if there are some payments left. A lender may also be able to give you specific advice about which debts to focus on first.

Quontic is one of only 3% of U.S. banks bearing a CDFI certification. That shows were committed to providing financial services to underserved communities and one of the most important ways we do so is by offering a wide range of mortgage loans, including Community Development Loans that require little income verification to qualify.*

Additionally, we offer interest-bearing checking and savings accounts that can help you put your money to work. After all, you already work hard enough.