How To Calculate Your Dti Ratio

total monthly debt payments divided by monthly income = debt-to-income ratio

1. Take your annual income and divide it by 12 to get your monthly income.

2. Add up your reoccurring monthly expenses such as:

- Minimum monthly payments on credit cards

Note: To find your back-end DTI ratio add your monthly mortgage payment

3. Divide your monthly debt obligations by your monthly income to get your DTI ratio

For example: If your yearly income is $60,000 and your total monthly debt payments come to $1,000

$60,000 divided by 12 = $5,000

$1,000 divided by $5,000 = .2

= 20% debt-to-income ratio

Tips To Keep Your Debt

Are you worried that your debt-to-income ratio will make you ineligible for a mortgage loan?

You can follow these tips to lower your DTI and improve your chances of mortgage approval:

Even if your DTI is within the good range for mortgage qualifying, it doesnt hurt to try to lower it before you apply.

The lower your existing debts, the more youll be able to spend on your mortgage.

Working to improve your debt-to-income ratio before you apply for a home loan can make you eligibile for a bigger, more expensive home.

Tips To Lower Your Dti

If you arent happy with your current DTI, remember it isnt a fixed number, and you can lower it by either increasing your monthly income or decreasing your existing debt. Whether youre having trouble getting approved for a loan or are facing high interest rates, trying out these tips to reduce your DTI may help.

- Compare your credit card interest rates and pay down ones with the highest rates first.

- Use the 50/30/20 rules to create a budget you can stick to, that will help you manage your spending.

- Pay all bills on time to avoid piling on late fees.

- Get a side hustle like ridesharing, tutoring online, selling clothes in the resale market, or a part-time restaurant or retail position.

Read Also: Caliber Home Loans 1098 Form

You May Like: How To Rebuild Your Credit After Bankruptcy Discharge

How Much Of A House I Can Afford With Overtime Income

The first step is to figure out how long you will be receiving the overtime pay. Because overtime isnt always guaranteed, and it isnt included in your salary or hourly wage, a few weeks of extra work cant be used as income. It will take at least a year or two of constant overtime labor to be considered part of your income qualification. If you want to take advantage of this money to secure a better mortgage, then having to establish this history may put off homeownership goals for a year or two. Consider if this is a realistic timetable for you if your requirements push you to buy a home faster than that, do so. After calculating overtime income you have to add it to a salary and use our mortgage calculator to estimate your monthly payment and the maximum house price you can afford.

Documenting Income & Profit Trends In Mortgage Applications

If youre a W-2 employee and you earn a huge raise, a promotion or a better-paying new position, underwriters use your new, higher income. However, if youre self-employed and made a lot more income this year than the year before, lenders dont give you credit for all of it they average it over the last 24 months.

In addition, you must explain an exceptionally large year-over-year increase, or underwriters may conclude the income resulted from a windfall and not from normal business activities. Its smart, therefore, to prepare explanations for revenue increases that exceed 25 percent. An underwriter may ask you to provide CPA-audited financial statements.

What if revenue declines from one year to the next? Youll have a hard time finding approval if thats the case. FHA guidelines state, Annual earnings that are stable or increasing are acceptable, while businesses that show a significant decline in income over the analysis period are not acceptable, even if the current income and debt ratios meet FHA guidelines.

Recommended Reading: Can They Take Your Home If You File Bankruptcy

How Much House Can I Afford With A Conventional Loan

Conventional loans are popular for borrowers with credit scores of at least 620 and DTI ratios of 45% or less. Some conventional loan programs allow down payments as low as 3%, but you can avoid mortgage insurance if you make at least a 20% down payment. Conventional lenders often assess mortgage insurance to cover their losses if you default, and its usually part of your monthly payment.

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

You May Like: What Happens When You File Chapter 7 Bankruptcy

How Much House Can I Afford With A Usda Loan

Low- to moderate-income homebuyers searching for houses in USDA-designated rural areas may qualify for no-down-payment financing. The minimum score is typically 640, and buyers pay an annual and upfront guarantee fee instead of mortgage insurance. Strict income limits may cap how much home you can buy with a USDA loan, even if you meet the standard 41% DTI ratio requirement.

What Are The Most Important Factors That Help Determine How Much House I Can Afford

Figuring out how much you can spend on a home comes down to a few key figures: How much money you earn, how much money you can contribute to a down payment and how much money youre spending each month on other debts. When you apply for a mortgage, a lender will scrutinize every aspect of your personal finances to assign a level of risk on whether youll be able to pay the loan back. The more you can lower your debt-to-income ratio and increase the size of your down payment, the better.

Recommended Reading: Merchandise Pallets For Sale In Houston

General Guideline: 3x To 45x Annual Income

Lenders typically like to see borrowers put at least 5% down on their property. When borrowers put down less than 5% they are typically charged a significantly higher interest rate to offset the additional risk the lender is taking.

Borrowers can typically borrow from 3 to 4.5 times their annual income. Lenders may allow borrowers to borrow up to 5 times their annual income, though regulatory restrictions prohibit lenders from having more than 15% of their loans above 4.5 times annual income.

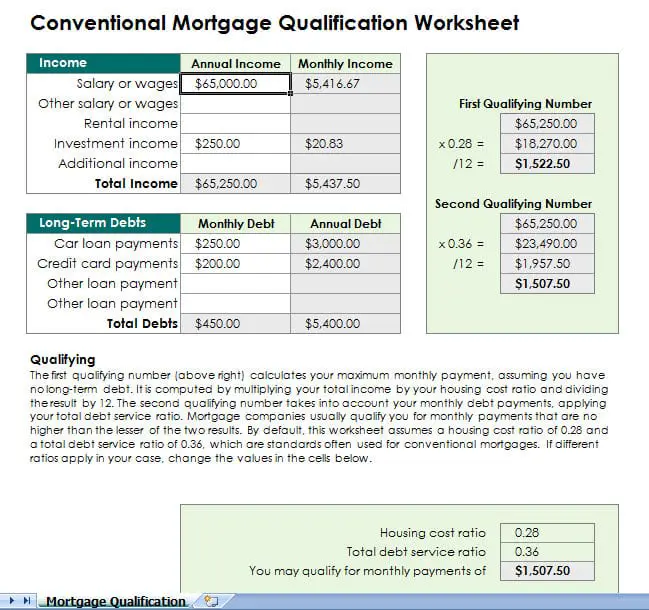

Calculate Your Mortgage Qualification Based On Income

In this calculator you can inclue investments, annuities, alimony, government benefit payments in the other income sources. Be sure to select the correct frequency for your payments to calculate the correct annual income.

- daily: 365 times per year

- weekly: 52 times per year

- biweekly: 26 times per year

- semi-monthly: 24 times per year

- monthly: 12 times per year

- bimonthly: 6 times per year

- quarterly: 4 times per year

- semi-annually: 2 times per year

- annually: 1 time per year

This calculator defaults to presuming a single income earner. If your household has 2 income earners then you can expand the “spouse or partner” section to enter their income information. We calculate the mortgage qualification ranges using the following maths:

| Your Mortgage Qualification |

|---|

Recommended Reading: How To Buy A House After Bankruptcy

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

How Much Mortgage Can I Get If I Earn 30000 A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Recommended Reading: How To Appeal A Bankruptcy Court Decision

Update On Minimum Down Payment And Debt To Income Ratio For Conventional Loan

Fannie Mae and Freddie Mac have brought back the 3% down payment conventional loan home purchase program for first-time homebuyers. Fannie Mae and Freddie Mac offer the 3% down payment conventional home purchase loan program to first-time home buyers. First-time homebuyers are defined as home buyers who had not owned a property in the past three years. Seasoned home buyers who had ownership of a home in the past 3 years require a 5% down payment on conventional loans. Private mortgage insurance is required on all conventional loans with higher than 80% loan to value.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Recommended Reading: How Long Does Chapter 13 Bankruptcy Stay On Your Record

How Do Underwriters Calculate Monthly Income On Overtime And Other Income Guidelines

Nobody can guarantee that borrowers overtime and other income will continue.

What the mortgage underwriter is going to request is a verification of employment from Human Resources. On the VOE, it will request to Human Resources representative to state the overtime. It will also ask if other income is likely to continue and the likelihood it will continue for the next three year is very likely:

- In the event, if the HR spokesperson is not willing to state that verbiage, overtime, and other income cannot be used as additional income in the monthly income qualification

- In the event, if the overtime incomeis allowed, then the way it is calculated is to take the sum of the two years of overtime income and divide it by 24 months

In the event, if the overtime or other income is last in the most recent year than the previous year, then the most current year overtime income or other income is only used and it is divided by 12 months to determine the monthly income.

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

If youre ready to get started on your mortgage application, you can apply online or give us a call at 452-0335.

Recommended Reading: Has Mark Cuban Ever Filed For Bankruptcy

What Monthly Debt Is Used To Calculate Debt To Income Ratio

Back-end DTI includes all your minimum required monthly debts including the anticipated mortgage payment.

Back-end DTIs also include any required minimum monthly payments that a lender finds on your credit report.

This covers debts such as credit card balances, loan balances from school and auto loans, and personal loan balances.

The majority of lenders place a greater emphasis on the figure that represents your back-end DTI since it provides them with a more comprehensive view of your monthly expenditures.

Why Do Lenders Care About My Emergency Savings Account

Lenders want to see that youd be able to make your payment for a while in the event that you lose your income temporarily. As you shop around, youll find that lenders may have vague or unwritten policies for how much emergency savings you need to have. Generally speaking, its a good idea to have at least 2 months worth of expenses in highly liquid savings.

Read Also: How Long Bankruptcy Remain On Credit

Every Lender Has Their Own Policy On Self

Rules can vary based upon the lender and the type of loan youre getting, so shopping around might be a little more difficult if youre self-employed. This is because every lender has different policies in place regarding risk mitigation. As you look around, make sure youre clear about what the lender will need from you.

Also Check: Are Online Mortgage Calculators Accurate

Mortgage To Income Ratio

There is a slightly different way that mortgage lenders look at your income to determine how much mortgage you can qualify for during the mortgage process.

Your mortgage to income ratio is calculated in exactly the same way as debt to income ratio, but with total monthly mortgage payments instead of debt payments.

The standard in the 28% rule which suggests that you should pay no more than 28% of your gross monthly income on your monthly mortgage payments.

Let’s say you make $6,000 a month. You can afford home payments of $1,680. As of 2022, the average monthly mortgage payment is $1,100.

Your mortgage payment can also be figured as 25% of your post-tax income.

The second method is the 35%/45% which states that you should pay no more than 35% of your pretax income or 45% of your net income on mortgage loan payments. This gives you a range for your house payments.

If you are looking for a home, a real estate agent or mortgage broker can help you determine your mortgage-to-income ratio.

If you have a higher debt-to-income ratio, shop around for a lender who may be able to help – there are different ways to decrease your MTI.

There are also DTI ratio lenders who will consider higher DTI. In addition, FHA loans and VA loan options may look at higher DTI ratio loans.

Recommended Reading: Does Bankruptcy Save Your Home From Foreclosure

How Is Income Calculated For A Mortgage

When trying to purchase your first home, many things can be confusing to borrowers during the mortgage process. From acronyms like DTI, ATR and front-end and back-end ratios, calculating income is an area many first time homebuyers dont understand.

However, a simple review of how lenders will evaluate your income can help you determine if you are buying a property that fits within your budget.

What Are The Upfront Costs Of Buying A Home

In addition to your down payment, you will have to pay a range of closing costs when you buy a home, which include an appraisal, title insurance, an origination fee for the mortgage, real estate attorney fees and more. The total will vary depending on what your lender charges, whether youll pay real estate transfer taxes and if the seller agrees to cover a portion of the fees. As youre budgeting for a home purchase, its wise to plan for between 2 percent and 5 percent of the homes purchase price. So, if youre buying a $400,000 home, your closing costs might range between $8,000 and $20,000. Some lenders might give you the option to roll those costs into the loan to avoid paying for them out-of-pocket. Keep in mind, though, that youll pay interest on them if you choose that option.

Don’t Miss: Foreclosed Homes In Jacksonville Fl

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

How To Qualify With A High Dti

If you have a DTI above 43%, you may find it more difficult to qualify for a mortgage loan. And if you are approved, your loan may be subject to additional underwriting that can result in a longer closing time.

Overall, higher DTI ratios are considered a greater risk when an underwriter reviews a mortgage loan for approval.

In some cases, if the DTI is deemed too high, the lender will require other compensating factors to approve the loan, explains DiBugnara.

He says compensating factors can include:

- Additional savings or reserves

- Proof of on-time payment history on utility bills or rent

- A letter of explanation to show how an applicant will be able to make payments

A higher credit score or bigger down payment could also help you qualify.

Cook notes that, for conventional, FHA, and VA loans, your DTI ratio is basically a pass/fail test that shouldnt affect the interest rate you qualify for.

But if you are making a down payment of less than 20 percent with a conventional loan, which will require you to pay mortgage insurance, your DTI ratio can affect the cost of that mortgage insurance, adds Cook.

In other words, the higher your DTI, the higher your private mortgage insurance rates.

Don’t Miss: Debt Per Person In Us