How To Build Your Credit After Filing For Bankruptcy

If you are one of those people who want to swear off credit altogether, this is actually a bad idea. You want to rebuild your credit score after bankruptcy even if you dont have any immediate plans on making big purchases. This is because when you have a good credit score, it gives you access to better deals and savings. You dont have to pay deposits or high-interest rates when getting necessary services like utilities and cell phone plans.

So, how can you rebuild credit without going under debt again? Here are some practical tips.

Not Attending Your Meeting Of Creditors

When you file for bankruptcy, you must attend a mandatory hearing called the meeting of creditors. The purpose of this hearing is to allow the trustee and your creditors to ask you questions under oath about your bankruptcy papers and financial affairs. You’ll also present proof of your identification. In general, the meeting of creditors will last only a few minutes, and creditors rarely show up. But if you fail to attend your meeting of creditors, the trustee will likely ask the court to dismiss your bankruptcy case.

Review Your Reports Once The Time Is Up

Once your bankruptcy has been completed and the seven- or 10-year clock has expired, review your reports again to make sure the bankruptcy was removed.

A bankruptcy should fall off your credit reports automatically, but if it doesnt, notify the credit bureaus and ask to have the bankruptcy removed and your reports updated.

Don’t Miss: How Many Bankruptcies For Donald Trump

Can I Remove A Legitimate Chapter 7 Or 13 Bankruptcy From My Credit Report Early

You can, but youll need to find an error or inconsistency in the bankruptcy listing on your report in order to file for removal.

The main thing to remember is that you always have the right to challenge anything that the credit bureaus are reporting.

If you can find anything thats not correct, then seize on it as an opportunity.

How To Get Proof You’ve Been Discharged

Your discharge from bankruptcy will happen automatically, so you won’t necessarily get proof sent to you.

Email the Insolvency Service to get a free confirmation letter. You should only ask for this after the discharge date.

If you ask for a confirmation letter, you must include your:

- full name

- National Insurance number

- court reference number

If youre applying for a mortgage, youll need a Certificate of Discharge. If you originally applied for bankruptcy through a court then youll need to ask them for a certificate. This costs £70 and £10 for extra copies.

If you originally applied for bankruptcy online, email the Insolvency Service for a certificate. Theres no fee for a Certificate of Discharge if you applied online.

You May Like: What Does Dave Ramsey Say About Bankruptcy

Why Can’t You Delete My Credit File At Transunion

TransUnion is a credit reporting company that operates under the Fair Credit Reporting Act. Your credit file is maintained as allowed by federal and state laws. The Fair Credit Reporting Act does not require credit reporting companies to maintain a file on every person, or require credit reporting companies to delete files at a consumers request. The Act does require the companies to use reasonable procedures to assure accuracy. Creditors may access your credit report only if they have a permissible purpose under the Fair Credit Reporting Act.

Will Your Credit Score Stay Poor Until Your Bankruptcy Is Removed From Your Credit Report

One common misconception is that your score will remain poor during the duration the bankruptcy is on your credit report. This is not true at all. In fact, you can start rebuilding your credit after your debt is discharged. According to bankruptcy experts, there is even a chance that your score will go above 700 after four to five years.

Recommended Reading: What Is A Bankruptcy Petition Preparer

Send The Courts Response To The Credit Bureaus

Send the statement from the court to the credit bureaus with a letter asking to have the bankruptcy removed. Mention that the bureau knowingly provided false information and has violated the Fair Credit Reporting Act.

If all goes well, removal of bankruptcy should occur.

- Top 11: Consolidation Loan Companies

How The Automatic Stay Protects You In A Bankruptcy

When a Chapter 7 or Chapter 13 bankruptcy case is filed, protections afforded by theautomatic stay are immediately put into place. Essentially, the automatic stay halts repossession actions, foreclosures, garnishments, and collection activity while the filerâs case remains active. Similarly, the automatic stay prohibits creditors from sending collection letters and making collection calls demanding payment. This safeguard allows the bankruptcy court time to evaluate the merits of a Chapter 7 or Chapter 13 bankruptcy case while granting the debtor relief from collection action and creditor harassment.

Also Check: Toygaroo

How To Remove A Bankruptcy From Your Credit Report

If you recently became one of the more than half a million Americans who declare bankruptcy each year, chances are you are counting the days until your bankruptcy disappears from your credit report or even wondering how to remove a bankruptcy from your credit report early.

Depending on the kind of bankruptcy you filed, it could take up to a decade for the bankruptcy to disappear from your credit report.

However, you may have heard that its possible to get rid of it sooner than that.

The truth is bankruptcies are tough to get rid of before their expiration date. That applies if the agency reported it correctly.

Bankruptcy filings are a matter of public record. The courts where you filed them maintain them.

So its only a matter of time before they end up on your credit report.

Once one lands on your report, its hard to remove early .

In order to tackle the monumental feat of removing a bankruptcy from your credit report, its important to know how bankruptcy works, how it impacts your credit, and what to do if youre stuck with a bankruptcy on your report for the long haul.

A Chapter 13 bankruptcy will linger on your report for seven years. If youre confused, thats understandable.

These are two of the more well-known types of bankruptcy.

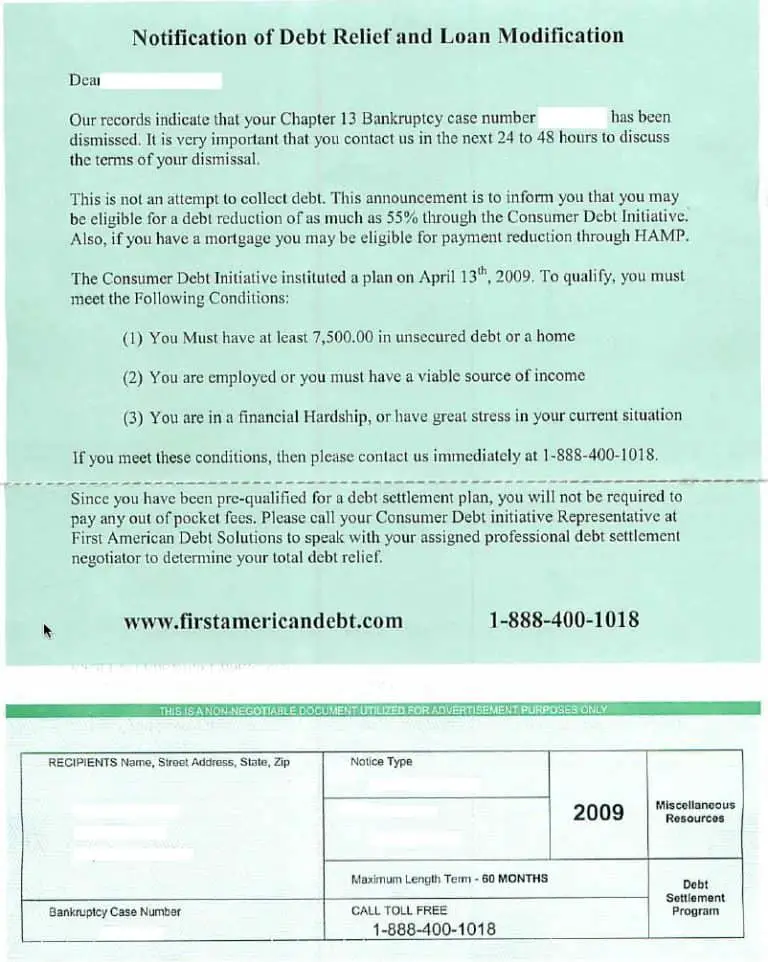

How To Remove A Bankruptcy Dismissal

- Aplikasi Lainnya

How To Remove A Bankruptcy Dismissal. If you are having trouble making the payments. A bankruptcy dismissal closes your bankruptcy case, and if it occurs before you receive a bankruptcy cases get dismissed for a variety of reasons ranging from intentional misconduct (such as take our bankruptcy quiz to identify potential issues and learn how to best proceed with your.

If you do not intend to go ahead with your bk case, you can request the court to have it. According to kathleen steffek, underwriting director at in contrast to a bankruptcy discharge, after which collectors may no longer recover payments, a dismissal occurs when something goes awry and the. Disputing any negative item diy is possible but it’s a. Technically, bankruptcy cannot be removed from your record untill one serves the number of years specified by law. The dismissal of a bankruptcy case ends it, including most of the legal consequences of the bankruptcy filing, but without giving the debtor a a dismissal of a bankruptcy case can be sought by the debtor, trustee, creditor, or other party in interest.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Reach Out To The Courts

Now you will want to reach out to the court with the same question. How did they verify your bankruptcy?

If the court responds they never verified the bankruptcy which is the most common scenario ask to get the statement in writing.

Related: 7 Steps How To Buy A House With Bad Credit With Good And Bad Income

Check Your Credit Report For Bankruptcy Errors

![[SOLVED] Removing Dismissed Bankruptcies Credit Report Latest [SOLVED] Removing Dismissed Bankruptcies Credit Report Latest](https://www.bankruptcytalk.net/wp-content/uploads/solved-removing-dismissed-bankruptcies-credit-report-latest.jpeg)

In this step, youll need a copy of all 3 of your credit reports. This is where having a comes in handy. TransUnion is the best credit monitoring service in my opinion, plus you get a free credit score.

Review the credit report carefully for any inaccurate or incomplete information. Here is a list of the most common bankruptcy errors. Names, addresses, and phone numbers Incorrect dates Discharged debts that still show a balance

If you have found no inaccuracies within the information on your credit report, then unfortunately theres nothing that can be done to remove it prematurely, youll have to wait 7-10 years for it to fall off your credit report.

Read Also: How Many Bankruptcies Has Donald Trump Filed

What Does Payment After Charge Off/collection Mean

The statement, “payment after charge off/collection,” means that the account was either charged off as a loss by the company with whom you had credit, or that the account was sent to a collection agency for payment. After either one of these situations happened, the full amount owed was paid to the appropriate parties which brought the account to a zero balance.

Why Would A Bankruptcy Trustee Request A Case Be Dismissed

A bankruptcy trustee assigned to a Chapter 7 case will, most commonly, request the dismissal of a case in the event that a filer doesnât attend their mandatory meeting of creditors. However, Chapter 7 cases may also be dismissed by a trustee if a filer doesnât properly complete and file their schedules, turn over requested documentation, or otherwise comply with mandatory directions provided by either the court or the trustee.

A trustee assigned to a Chapter 13 case may dismiss this kind of bankruptcy filing for all the same reasons. However, they may also dismiss a Chapter 13 case if a filer fails to create and submit a repayment plan, or fails to make their scheduled payments. Finally, they can request dismissal of a Chapter 13 case if the filer fails to meet plan obligations, such as selling real estate per the terms of the approved plan, or if the plan is failing for another reason. Because there are so many more opportunities for a Chapter 13 bankruptcy filer to misstep over a 3-5 year repayment period, dismissal requests by trustees are far more common in Chapter 13 cases than they are in Chapter 7 cases.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

Why Do You Store Social Security Numbers On Credit Reports

Your personal information, such as name, address, date of birth, and Social Security Number, is reported to TransUnion by your creditors. TransUnion maintains a separate credit file for each individual. Without your Social Security Number, the quality and accuracy of your credit history could be compromised. The federal Fair Credit Reporting Act permits TransUnion to maintain personal and credit information in our records.

How Long Does A Bankruptcy Stay On Your Credit Report

The amount of time a bankruptcy stays on your credit report is determined by the type of bankruptcy you filed for.

- A Chapter 7 bankruptcy will be removed from your credit report automatically in 10 years because, in this case, none of the debt is repaid.

- A Chapter 13 bankruptcy is cleared in 7 years since the debt is partially repaid.

You May Like: How Much Does It Cost To File Bankruptcy In Iowa

If You Do Not Intend To Go Ahead With Your Bk Case You Can Request The Court To Have It

Most people hire a bankruptcy lawyer to help them claim exempt property, which is property they can keep even after the bankruptcy has finished. Outline the bankruptcy dismissal information, including the court case number and the dates. How underwriter explains bankruptcy dismissal versus discharge mortgage guidelines. When the court dismisses a case without prejudice, you can file another bankruptcy matter right away instead this type of dismissal usually occurs because of a procedural mistake, such as a failure to file the correct. Is it possible to remove a bankruptcy from your credit report? The dismissal of a bankruptcy case ends it, including most of the legal consequences of the bankruptcy filing, but without giving the debtor a a dismissal of a bankruptcy case can be sought by the debtor, trustee, creditor, or other party in interest. Carron armstrong is a bankruptcy and consumer lawyer, and an expert in debt and bankruptcy for the balance. How to cancel a chapter 13 bankruptcy. How long does a chapter 7 bankruptcy stay on your credit report? How long does a bankruptcy stay on your report? However, certain requirements must be met. Removing a bankruptcy from your credit reports is somewhat complicated because bankruptcy is a legal action which dismisses you in part or in whole from your debts. If you do not intend to go ahead with your bk case, you can request the court to have it.

How long does a chapter 7 bankruptcy stay on your credit report?

What Are The Common Reasons For Dismissed Chapter 13 Cases

There are several reasons why a Chapter 13 case can be dismissed. Some are the same as for Chapter 7 cases. Things like not paying the court filing fee, not properly preparing for and attending the meeting of creditors, and not filing all required bankruptcy forms. Other reasons why a Chapter 13 bankruptcy case may be dismissed are:

-

Failing to pay the Chapter 13 payments

-

Failing to meet certain deadlines

-

Failing to propose a Chapter 13 plan that complies with bankruptcy law

-

Failing to submit the required documentation to the Chapter 13 trustee

-

Failing to file tax returns every year and submitting a copy to the trustee

As you can see, the reasons for a dismissed Chapter 13 usually involve the debtor failing to do something the debtor is required to do under the bankruptcy rules. However, sometimes, a dismissed Chapter 13 case is due to something beyond the debtorâs control.

For instance, if a debtor loses his or her job or becomes ill, the debtor may not have enough money to pay the Chapter 13 plan payments. If changing the plan payment or converting the case to a Chapter 7 case is not an option, there may be no choice but to let the Chapter 13 case be dismissed.

Recommended Reading: Can A Person File Bankruptcy Twice

Get Your Bankruptcy Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on orsetup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Causes Of Bankruptcy Dismissal

Here are some specific reasons your bankruptcy case might be dismissed:

- Failure to comply with court rules

- Procedural violations

- Fraud against creditors, lenders, or courts

- Failure to make court appearances or attend creditors meetings

- Failure to pay filing fees or installment payments

- Prior cases, prior dismissals, and prior discharges

- Failure to make timely plan payments in a Chapter 13 case

Also Check: How Many Times Donald Trump Bankruptcy

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Why Do I Have So Many Student Loans

Student loans may be reported as multiple entries on a credit report based on disbursements. A disbursement may occur for each school semester attended. The numbers added before and after the account number indicate that an additional disbursement was made. These extra numbers also help differentiate between the entries.

Student loans are often sold to other lenders and can be reflected on the credit report as transferred. Because they are not considered duplicates, we will continue to report the accounts separately.

Please contact the creditor directly if you want to dispute this information or need additional information.

Also Check: How To Buy A New Car After Bankruptcy

Types Of Bankruptcy Dismissal

There are a number of types of dismissal, each with different consequences. Among them is dismissal with or without prejudice, voluntary dismissal, and dismissal for abuse. In many cases, as long the details of your petition were made honestly and in good faith, you can either reinstate a dismissed petition or file again right away.

Sometimes a voluntary dismissal is sought because ones circumstances change. Usually, this means you are able to pay back your debts and no longer need bankruptcy relief.

However, a request for voluntary dismissal isnt always granted. If your bankruptcy case was dismissed and you still wish to file, mistakes are not taken lightly. Anyone wishing to cheat the system could claim it was an accident therefore, many mistakes will be cause for a dismissal that cannot be reinstated.

Dismissals with or without prejudice imply that cases were either dismissed for a good reason, such as fraud or because of unforeseen circumstances or honest mistakes. A dismissal for abuse or with prejudice means the bankruptcy case can never be filed again.

After a waiting period, however, usually half a year, a new case can be filed. Issues related to types of dismissals can be very different, so a great deal depends on your own particular circumstances.