Will Chapter 7 Bankruptcy Eliminate My Medical Debt

If you have acquired a significant amount of medical debt, it may be in your best interest to file forChapter 7 bankruptcyas this process would allow you to discharge most, if not all, of your unsecured debt over a short period of time. Once you have liquidated your non-exempt assets and used the proceeds to repay your creditors, the court will order a discharge of all remaining debts. This, in turn, would free you of the legal obligation to repay them.

Known as “fresh start” bankruptcy, Chapter 7 is often the most practical way to rid yourself of overwhelming medical debt once and for all. If you do notqualify for this chapter, however, you should not hesitate to consider the possibility of Chapter 13.

Is My Health Insurance Enough To Keep Me Out Of Medical Debt

You may feel secured because you are covered by your medical insurance. While it is true that getting yourself insured is best than not getting insured at all, having one is not a guarantee for immediate out-of-pocket costs when injuries happen and illness is in consideration. Here are some truth to why having health or medical insurance may not be an assurance to keep you out of debt:

- You have to pay a greater share of your bills out-of-pocket through rising deductibles and co-payments

- You may have been diagnosed with a chronic illness that wipes out your insurance plan in just one costly treatment

- Your health care provider may not be part of your insurances network of providers

- Your illness or injury may not be covered by your insurance

- You could not afford a premium insurance plan because of your low income

- You could not sustain paying for your insurance because of your medical condition and/or

- You could be denied of your claim

Can You Declare Bankruptcy On Medical Bills

When you need medical treatment, bills may be your last concernand understandably so. Wellness is your first priority when your health is at stake. But medical bills can cause their own kind of injury, specifically aimed at your financial well-being.

If you’re overwhelmed with medical bills and don’t know how you’ll pay them, you may wonder if declaring bankruptcy on your medical debt is a possibility. Technically, it isbut not as a standalone option. There is no such thing as medical bankruptcy, but medical debt is dischargeable through regular bankruptcy proceedings.

Recommended Reading: Can You File Bankruptcy On Student Loans In Kentucky

Filing Chapter 13 For Medical Debt

Chapter 13 will “discharge” your medical debt by lumping all your bills and debt together, but you still need to pay some of this overall debt back. It requires a repayment plan that is created based on your income, bills, equity, assets, and other expenses. You may not qualify for Chapter 13 if you cannot pay your bills and make monthly payments to your creditors.

Unlike Chapter 7, a Chapter 13 bankruptcy has debt limits. These limits change every few years, but the current debt limit is $419,275 for all unsecured debts . As long as your debt is less than this, you can file for Chapter 13 and have most of your medical debt dismissed while only paying back a fraction of it.

For example, depending on your debt amount, you might have 70% of the debt dismissed but need to pay back 30%. The percentages will change based on your debt, income level, and the bankruptcy courts in your state.

How Are Medical Bills Treated Under Bankruptcy Of Chapter 13

Chapter 13 bankruptcy makes the repayment of the medical bills more affordable. The court will give out a suitable debt repayment plan that is easily manageable for a duration of up to five years. The payments may involve monthly installments that are 15% of your total income. However, to qualify for chapter 13 bankruptcy, itll be important to have a stable income.

Recommended Reading: Will Filing For Bankruptcy Stop A Judgement

You May Like: How Many Times Can You File Bankruptcy In Ga

How Much Does It Cost To File Bankruptcy

Because clients finances are central to bankruptcy discussions, Sasser Law Firm works to be upfront about fees for bankruptcy filing and counseling.

An initial consultation with a board-certified bankruptcy attorney with Sasser Law Firm is free and involves no further obligation. We may be able to provide strategies for debt relief and/or refer you for financial counseling instead of bankruptcy.

Would You Still File For Bankruptcy If The Patient Dies

One question you should be asking yourself is what happens if your loved one dies while undergoing treatment. Does the medical bill go away, or would the doctor or collection agency still pursue payment? Would you be required to seek medical relief in the case the bill has to be paid, and you cannot afford it?

The answer to this depends on the property the deceased had, the legal relationship between the creditor and the deceased, and what California State laws demand. However, the creditor may try to enforce certain laws.

The family of the deceased has a duty of paying any outstanding medical debt incurred while the deceased was still alive. If you lack the resources to clear the debt, you should consult a bankruptcy attorney to give guidance on whether filing a bankruptcy is an option.

You May Like: How Do You Recover From Bankruptcy

Should I File Bankruptcy For Medical Expenses

If you cant cover medical bills, or youre struggling to make ends meet after taking time off work due to poor health, you might be thinking about filing for bankruptcy.

Before you make any decisions, its crucial to explore the options open to you and to ensure you understand what bankruptcy entails and how it will affect you and your family moving forward.

Your priority should always be your health, so try and focus on getting better if you are recovering from an illness or injury.

If youre not working, creditors will not be able to garnish your wages, so try not to panic.

Stress can slow your progress and impact your physical health and mental wellbeing.

The next step to take is to try and manage your money.

If your cash flow is restricted, look for ways to reduce spending and cut costs.

Analyse your budget, make cutbacks and explore options that could enable you to save in the long-term.

If youre caring for a parent, for example, and youve had to take time off work, see if your siblings or other family members could contribute or if there is any form of financial assistance available to help with care costs.

When youve reached a point where youre falling behind with payments, you have no means of paying bills, youve been refused credit and you dont think your financial situation will improve in the near future, you could consider filing a consumer proposal or explore the possibility of bankruptcy.

Here are some facts to be aware of:

Filing For Chapter 13 Bankruptcy

If you file for Chapter 13 bankruptcy, your medical bills will be consolidated with your general unsecured debts in your repayment plan. The amount youll have to pay will depend on your income, expenses, and nonexempt assets.

Next, your creditors will receive a pro rata portion of the total thats going toward the debts. In order to file for Chapter 13, you must earn enough income to pay the bills, and your debts must not exceed the Chapter 13 limits.

Recommended Reading: When To File Bankruptcy In Michigan

How To Tell You Are In Financial Trouble

One of the worst aspects of financial issues is how embarrassed we are by them. This often causes a painful delay in seeking help to resolve the situation. Many people spend months or sometimes years making increasing efforts to avoid debt collectors and struggling to make ends meet, as their financial situation deteriorates.

This is not a scenario you want when dealing with your own or a loved ones illness and recovery.

What Does It Mean To Declare Medical Bankruptcy

The phrase medical bankruptcy is a non-legal word for bankruptcy caused by medical debt.

Medical bankruptcy is not covered by any particular chapter of the Bankruptcy Code. However, the phrase medical bankruptcy has gained popularity in recent years due to a rise in the number of people applying for bankruptcy owing to medical debt.

While the actual magnitude of the issue is debatable, there is no question that massive medical expenditures may lead to bankruptcy.

Despite having health insurance, many people have been saddled with medical debt due to expenses not covered by their policys small print. As a result, some people have resorted to bankruptcy as a solution to their financial problems. Individuals may file for Chapter 7 or Chapter 13 bankruptcy relief to get rid of their medical debt.

Also Check: Bankruptcy Falls Off Credit Report

Don’t Miss: How To Get A Copy Of My Bankruptcy Discharge Letter

North Carolina Medical Debt Bankruptcy

It is often repeated that a major medical problem can wipe out a familys savings and create overwhelming medical debt. Depending on your particular circumstances, personal bankruptcy may be a viable option for dealing with unmanageable medical debt and making a fresh start. While there is no such thing as a medical bankruptcy under the U.S. Bankruptcy Code, personal bankruptcy under Chapter 7 and Chapter 13 of the Code can help you seek relief from debt caused by medical bills. Medical debt can be forgiven in Chapter 7 bankruptcy and possibly reduced or restructured in a Chapter 13 bankruptcy.

If you are overwhelmed by the amount of money you owe hospitals and other health care providers, contact a board-certified bankruptcy attorney at Sasser Law Firm today to discuss your options. We will review your debts and income and tell you if we think bankruptcy would be appropriate for dealing with your financial situation. Sasser Law Firm has been focused on helping individuals and families in North Carolina obtain financial relief from unmanageable debt for more than 20 years. During that time, we have handled more than 8,500 cases of personal and business bankruptcy.

Contact us today to learn about your options for obtaining relief from overwhelming medical debt. Our bankruptcy attorneys represent individuals and businesses in Cary, Raleigh, Durham, Knightdale, Holly Springs, Apex, Fuquay-Varina, and throughout the greater Triangle.

Use Bankruptcy To Eliminate Your Medical Debt

Millions of Americans face unexpected medical costs. Even with insurance, such costs can leave people with substantial debt. According to the Sycamore Institute, a public policy research institute in Tennessee, over one in five Tennesseans had medical debt on their credit report in 2018, before COVID.

Many people delay lifesaving medical treatment or face stark choices between paying for medical care or putting that money toward food or rent. Others endure wage garnishment or harassment from debt collectors. No one should have to risk their health or lose everything over medical costs.

Bankruptcy courts offer protection to people who cannot pay their debts. It can allow debtors some relief from debt and a chance to get their finances under control.

Bankruptcy has long-term consequences for your credit score. If you are considering bankruptcy, understand the benefits and costs before starting the process.

Also Check: How Often Can You File Bankruptcy In Tennessee

Medical Debt And Chapter 7 Bankruptcy

Chapter 7, known as straight bankruptcy, aims to liquidate most, if not all, of your debt in exchange for your property, including your medical bills. All medical bills for services provided before bankruptcy filing should be discharged even if the service provider has not submitted an invoice. A provider can still collect against any health insurance, but any co-pay or uninsured amount will discharge. The only exception is if the creditor can prove an exception to discharge like a fraud.

To be eligible to file for Chapter 7 bankruptcy, a qualified attorney will examine your income, expenses, assets, and liabilities. Suppose your household is either below median income for Maryland, or you pass the means test. In that case, you qualify for Chapter 7 income from an income point of view. We also examine to make sure there are no assets available for a Chapter 7 Trustee to sell or liquidate.

Bankruptcy And Medical Debt

You may be considering filing for bankruptcy to help with medical debt. Its possible to use bankruptcy to discharge your medical debt. But you should learn about the different types of bankruptcy you can file first.

Its important to understand that filing bankruptcy is not a perfect solution. It will have a negative effect on your credit score. It may make it harder for you to get credit in the future on affordable terms. Moreover, the bankruptcy process is complicated, time-consuming, and expensive. If you have medical issues that will result in more bills, you may not be able to use bankruptcy to get rid of those future debts. Talk to a lawyer or other experienced advisor to understand these issues in making decisions on whether and how to file a chapter 7 or chapter 13 bankruptcy.

Learn more about bankruptcy.

Read Also: Can You Keep Some Credit Cards When Filing Bankruptcy

Milwaukee County Bankruptcy Lawyer Guides You Through Relieving Medical Debt

Filing for bankruptcy is a stressful and exhausting period in your life. There is an overwhelming amount of information you need to be aware of before choosing to file. You need the help of an experienced, professional bankruptcy lawyer to guide you through the process of filing for bankruptcy and restoring financial order to your life.

Oak Creek bankruptcy lawyer Steven R. McDonald is a helpful guiding hand through one of the most important periods in your life. Mr. McDonald boasts 15 years of experience helping residents of southeastern Wisconsin through the trials and tribulations of filing for bankruptcy.

He can help you, too. You arent alone. Call his office in Oak Creek today and begin to piece your financial life back together.

Contact Oak Creek bankruptcy lawyer Steven R. McDonald today to schedule a free consultation when youre considering filing for bankruptcy to relieve debt from medical bills.

Pros Of Clearing Medical Debt In Chapter 7 Bankruptcy

- It’s quick. Most Chapter 7 cases are over in four months.

- It wipes out more than medical debt. You can get rid of an unlimited amount of medical bills, credit card debt, personal loans, past-due utility and rent payments, and even mortgage and car payments .

- You don’t pay creditors. Unlike Chapter 13, you won’t pay into a repayment plan before receiving your discharge.

Also Check: Can A Married Person File Bankruptcy Without Spouse

When Is It A Good Idea To Discharge Medical Debt By Declaring Bankruptcy

You may have heard the term medical bankruptcy in reference to discharging medical debt. Medical bankruptcy is not an official category of bankruptcy, though.

Individuals seeking relief from medical bills can file Chapter 7 and Chapter 13. Either bankruptcy filing will cover most of your debt, including medical bills.

If you have a regular source of income, a Chapter 13 debt reorganization and repayment plan may be best for you.

The status of your health may factor into your decision. If you expect very costly treatment in the near future, you might want to delay filing now if you can. Thats because your financial situation may get worse, and filing bankruptcy later could be more helpful. There are limits on how often you can file for bankruptcy.

If you complete a Chapter 7 or Chapter 13 bankruptcy, you cant file a Chapter 7 case for 6 years. If you had another bankruptcy dismissed, you might have to wait 6 months before you file again.

However, you can file repeated Chapter 13 cases, which may be needed if you have another financial disaster. As with Chapter 7, you may have to wait 6 months to file if you have had another bankruptcy case dismissed. Also, declaring Chapter 13 for a reorganization could make filing for Chapter 7 liquidation later more difficult.

Are There Other Ways To Erase Medical Debt Besides Bankruptcy

There may be something you can do, other than filing bankruptcy, to find relief from medical debt you cannot pay.

Below are some options that may help you avoid bankruptcy:

-

Check to see if your medical debt is legally due. Under the No Surprises Act, which went into effect in January 2022, private insurers can no longer bill you extra for most emergency services even if they are out of network or if they did not have prior authorization. Also, you cant be charged extra for out-of-network services received at an in-network facility. The new law also bans balance billing, which is holding you responsible for the remainder of a surprise bill after your insurance company pays the in-network charges.

-

Consider hiring a medical billing advocate. An advocate can perform an analysis of your medical bills to spot errors, duplicate charges, unreasonable charges, and even fraud. They can figure out whether your health insurance has paid its share and negotiate on your behalf with the insurer to get inappropriate charges fixed. Some advocates are willing to work on contingency, so you wont have to pay upfront. The Patient Advocate Foundation offers this service at no cost for patients and families dealing with serious or chronic health conditions.

You May Like: Houses In Foreclosure In My Area

How To Eliminate Medical Bills With Bankruptcy In Florida

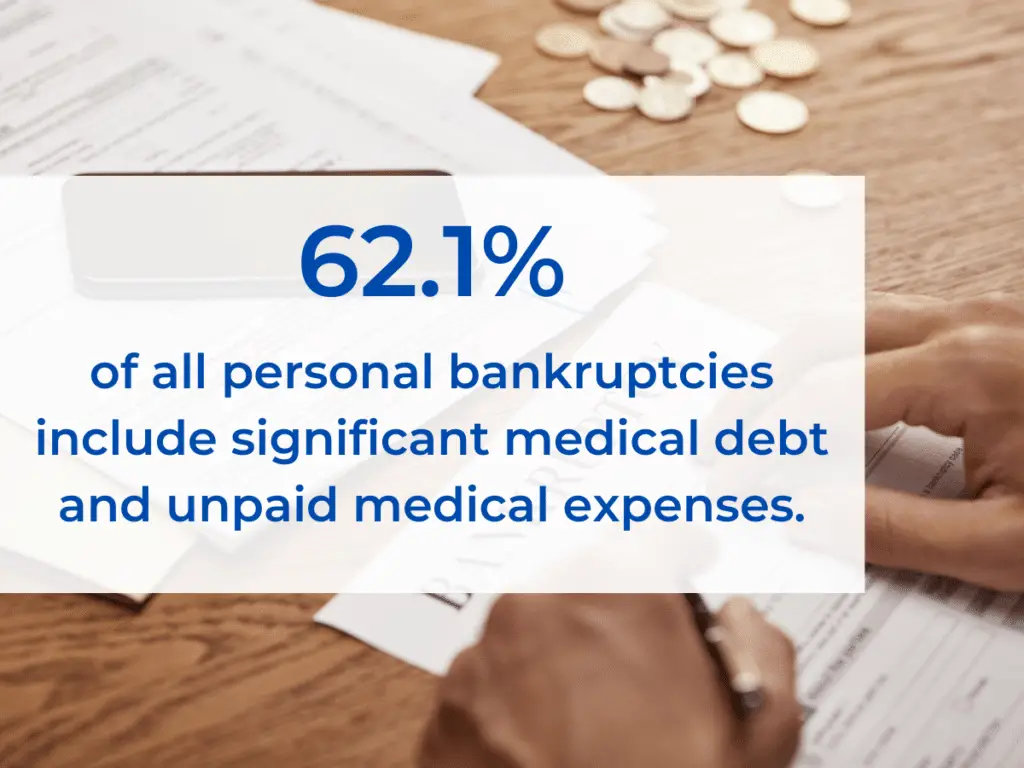

Unexpected medical bills can financially devastate a family for many years to come. The rising cost of health care is proving to be a tremendous burden on families. Most people file bankruptcy because of medical bills. A study by the American Journal of Medicine found that 62.1% of all bankruptcy cases are attributable to medical reasons. Further, the study found that 92% of the people filing bankruptcy for medical reasons had over $5,000 in medical bills.

Bankruptcy is used so often because it can wipe out all your medical bills. See Bankruptcy law 11 USC 524. This is because medical bills are almost always an unsecured debt. Unsecured debts are loans in which the borrower does not provide any collateral for the loan. Other examples of unsecured debts can include credit cards, student loans, rent, and gym memberships. When a debt is discharged in bankruptcy, the borrower will be released from personal liability on the debt. For more information about a specific bill or case, contact a Tampa bankruptcy law firm for advice.

Also Check: How Many Times Have Donald Trump Filed For Bankruptcy