What Does Bankruptcy Discharged Mean: Debts Never Discharged In Bankruptcy

In personal bankruptcy, there are certain types of debts that are not discharged. Section 178 of the BIA outlines the following debts that are nondischargeable debt:

- Any type of fine, penalty, restitution order, or other order similar to a fine, penalty or restitution order, imposed by a court for an offence, or any kind of debt arising from a recognizance or bond

- Damages awarded by a court in a civil case for:

- bodily injury intentionally caused, or sexual assault, or

- wrongful death as a result of these acts

What Debts Are Dischargeable In A Chapter 13 Bankruptcy

Most debts are dischargeable in Chapter 13 with a few exceptions. So we generally start by assuming the debt is dischargeable unless an exception applies. The common exceptions to dischargeability are:

- Fraud/Embezzlement

- Personal Injury Awards related to a DUI

- Student loans

The Chapter 13 discharge is far more comprehensive than the Chapter 7 discharge. Far more debts are dischargeable in Chapter 13 than in Chapter 7.

What Is A Discharge In Bankruptcy

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged. The discharge is a permanent order prohibiting the creditors of the debtor from taking any form of collection action on discharged debts, including legal action and communications with the debtor, such as telephone calls, letters, and personal contacts.

Although a debtor is not personally liable for discharged debts, a valid lien that has not been avoided in the bankruptcy case will remain after the bankruptcy case. Therefore, a secured creditor may enforce the lien to recover the property secured by the lien.

Don’t Miss: Can I Buy A Car After Bankruptcy Discharge

Can A Debtor Receive A Second Discharge In A Later Chapter 7 Case

The court will deny a discharge in a later chapter 7 case if the debtor received a discharge under chapter 7 or chapter 11 in a case filed within eight years before the second petition is filed. The court will also deny a chapter 7 discharge if the debtor previously received a discharge in a chapter 12 or chapter 13 case filed within six years before the date of the filing of the second case unless the debtor paid all “allowed unsecured” claims in the earlier case in full, or the debtor made payments under the plan in the earlier case totaling at least 70 percent of the allowed unsecured claims and the debtor’s plan was proposed in good faith and the payments represented the debtor’s best effort. A debtor is ineligible for discharge under chapter 13 if he or she received a prior discharge in a chapter 7, 11, or 12 case filed four years before the current case or in a chapter 13 case filed two years before the current case.

Limitations Of Bankruptcy Discharge

Contrary to what some consumers may believe, bankruptcy is not always the best option in a financial crisis, and a bankruptcy discharge may not relieve them from the obligation of paying off all their debts. Simply put, there are some debts that just cant be discharged.

According to the Federal Judiciary, there are 19 different types of debt that are not eligible for discharge. The most common are spousal child support, alimony payments, and debts for willful and malicious injuries to person or property.

For certain kinds of bankruptcies, condo fees, debts owed to some tax-advantaged retirement plans, debts from DUIs, and student loans are also among them. And any debt not listed on the bankruptcy cannot be discharged. In addition, valid liens on specific property to secure payment of debts that have not been discharged will remain in effect after the discharge, and a secured creditor has the right to enforce the liens to recover such property.

As mentioned above, creditors listed on the discharge are not permitted to contact the debtor or pursue collection activity, and a debtor may file a report with the court if a creditor violates the discharge order. The court may sanction the creditor with civil contempt, which also may be accompanied by a fine.

Recommended Reading: Bankruptcy Lawyer Software

What Are The Consequences For A Bankrupt Of Not Being Discharged

Not being discharged has important consequences for a bankrupt.

A person who is bankrupt may not borrow more than $1,000 without informing the lender that he/she is bankrupt. Failure to do so is an offence under the BIA that is liable to a fine, imprisonment or both.

Information pertaining to bankruptcy remains on an individual’s credit file for 6-7 years following discharge of a first-time bankrupt. Times may vary across provinces/territories.

- Date modified:

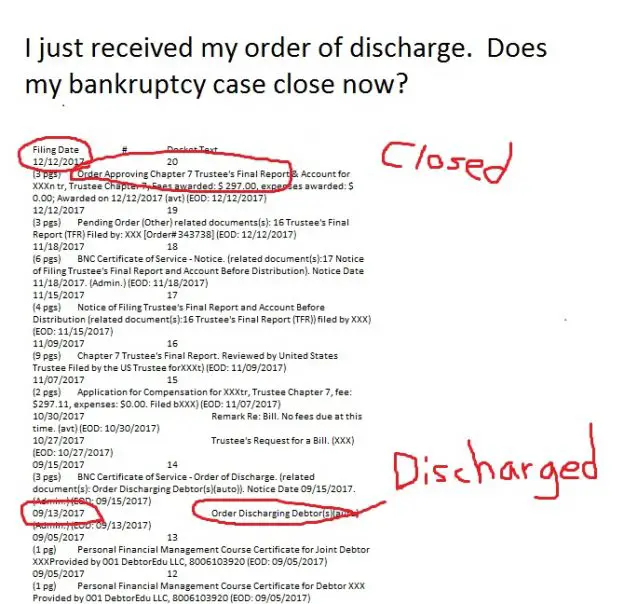

How Will I Be Notified That My Chapter 7 Bankruptcy Case Is Closed

Your Chapter 7 bankruptcy case is closed when the court issues an order closing it. If you have no nonexempt assets for the bankruptcy trustee to sell, your case will be closed shortly after you receive your discharge noticeusually about four months after you file your petition. If you do have assets for the trustee to administer or one of your creditors objects, the process can take longer. In either event, the court will send its closing order to you or to your attorney if you have one by mail.

You May Like: Has Trump Ever Declared Bankruptcy

What Does It Mean To Be An Undischarged Bankrupt

In the event, you were unable to fulfill your obligations under your personal bankruptcy proceedings, your Trustee, and maybe a creditor or two would have opposed your discharge from bankruptcy. A bankrupt who has not been discharged poses many potential problems. Therefore, if you are an undischarged bankrupt, it is because you have failed to fulfill one or more of your obligations as a bankrupt.

what does bankruptcy discharged mean

How To Get Proof You’ve Been Discharged

Your discharge from bankruptcy will happen automatically, so you won’t necessarily get proof sent to you.

Email the Insolvency Service to get a free confirmation letter. You should only ask for this after the discharge date.

If you ask for a confirmation letter, you must include your:

- full name

- National Insurance number

- court reference number

If youre applying for a mortgage, youll need a Certificate of Discharge. If you originally applied for bankruptcy through a court then youll need to ask them for a certificate. This costs £70 and £10 for extra copies.

If you originally applied for bankruptcy online, email the Insolvency Service for a certificate. Theres no fee for a Certificate of Discharge if you applied online.

You May Like: Has Mark Cuban Ever Filed For Bankruptcy

What Does Bankruptcy Discharged Mean: Debts Eliminated By Bankruptcy Discharge

A bankruptcy discharge means that you have completed your personal bankruptcy process and are no longer legally liable for any outstanding debt you included in the bankruptcy filing . Upon receiving an absolute discharge from bankruptcy , you are no longer responsible for any discharged debts.

The discharge in bankruptcy eliminates most of your debts, including unsecured debts such as , medical bills, and payday loans. When you are discharged from bankruptcy, not the fact that you filed for bankruptcy, is what eliminates your debts. You need your discharge to get rid of your debts, which explains why its so important. That is what does bankruptcy discharged mean, really means.

Limitations Of Chapter 7 Discharges

Section 523 of the Bankruptcy Code describes the types of debt that can’t be discharged in Chapter 7 proceedings, including:

- Domestic obligations such child support, alimony, and debts owed under a marriage settlement agreement

- Certain fines, penalties, and restitution resulting from criminal activities

- Certain taxes, including fraudulent income taxes, property taxes that came due within the previous year, and business taxes

- Court costs

- Debts associated with a DUI violation

- Condo or other homeowners association fees that were imposed after you filed bankruptcy

- Retirement plan loans

- Debts that weren’t discharged in a previous bankruptcy

- Debts you failed to list on your bankruptcy petition

Recommended Reading: How Long Does It Take To Finalize Bankruptcy

Can My Chapter 13 Bankruptcy Be Denied

Not really. At least not in the sense people think of. It would not be your bankruptcy that is being denied. However, a Chapter 13 discharge may be denied in a few situations.

First, in order to get a Chapter 13 discharge, you need to draft a Chapter 13 plan that meets all of the requirements of Chapter 13. The judge needs to then approve this plan at a Chapter 13 confirmation hearing. You then have to make your payments under the plan. If you fail to file a confirmable plan or fail to make your payments, your case may be dismissed and you would not get a discharge.

Second, you may also be denied a discharge if you filed the bankruptcy in bad faith.

Third, certain types of debts may also be deemed non-dischargeable. That means those specific debts are not discharged and must be repaid.

Your House And Other Real Property After Bankruptcy

Here are answers to some common questions about homes and mortgage loans after bankruptcy:

What should I do if I want to keep my home after bankruptcy? Make timely payments if keeping your house. If you did not reaffirm your home mortgage loans in Chapter 7 but are current and plan to keep your property, just continue to make your house payments on time. The bank still has a lien on your home and can foreclose if you fall behind on the payments. Note, as mentioned above, if you did not reaffirm the debt, your payments will not be reported to the credit bureau.

Can I walk away from my home after my Chapter 7 bankruptcy? If you did not reaffirm your mortgage loan in Chapter 7, you have more options than if you reaffirmed the loan. If you do not reaffirm your mortgage loan and decide later that you no longer wish to keep your home, you can simply stop making the payments. Eventually, the property will go into foreclosure, but the bank will not be able to obtain a deficiency judgment against you.

Can I walk away from my home after my Chapter 13 bankruptcy? It depends. Chapter 13 does not discharge your secured loans in most cases unless you surrender the property in your Chapter 13 plan. If you surrendered the property in your Chapter 13 plan, then you can treat it the same as if you had discharged the debt in Chapter 7.

Quick Note: In most instances, modifying a loan that was not reaffirmed will not cause the payments to show on your credit report.

Also Check: Leinart Law Firm

Dischargeable Debts In A Chapter 7 Bankruptcy

When it comes to Chapter 7 bankruptcy , the primary goal is to get most of your personal debts discharged. From the sky-high credit card bills to medical debts and everything in between discharging your biggest debts can give you the fresh start you need to start living a financially stable life.

However, it is important to note that not all of your debts will be dischargeable under a Chapter 7 bankruptcy. Additionally, you may find that more non-exempt property can be used to satisfy your debts in a Chapter 7 than in a Chapter 13 bankruptcy .

So what are dischargeable debts in a Chapter 7 bankruptcy and what debts will be leftover once your bankruptcy case has been approved?

Lets take a look:

Bankruptcy Discharge Certificate Canada: What If My Creditors Still Contact Me And Try To Get Me To Pay Them

If the creditors are consistently calling you and demanding settlement, supply them with a duplicate of your bankruptcy discharge certificate Canada. If the creditor states they were not aware of your bankruptcy, also offer them a duplicate of your sworn statement of affairs revealing them listed as a creditor.

If they are listed, then the Trustee sent them a notice of bankruptcy including a form 31 proof of claim to complete and return to the Trustee.

Recommended Reading: What Is A Bankruptcy Petition Preparer

Which Debts Get Discharged In Bankruptcy

Debts that are part of a Chapter 7 discharge include unsecured debts, collection agency accounts, medical bills, utility bills, dishonored checks, certain tax penalties, attorney fees, judgments from lawsuits, and any lease contracts a consumer may have.

In 2020, the CARES Act provides temporary relief to Chapter 13 debtors who have a confirmed plan. A revised provision in the bankruptcy code allows those who have experienced financial hardship to extend their plan for up to seven years.

Bankruptcy Discharge Certificate Canada: The Complete Happy Story Of Your Bankruptcy Discharge

- Post author

If you would like to listen to the audio version of this Brandons Blog, please scroll to the bottom and click on the podcast

TheIra Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.We hope that you and your family are safe and healthy.

Read Also: How Many Times Have Donald Trump Filed Bankruptcy

Difference Between Entering A Discharge And Closing A Bankruptcy Case With A Final Decree

When the court enters a discharge in your bankruptcy, it wipes out your personal liability for all debts that were included in the discharge. In Chapter 7 bankruptcy, you normally receive a discharge a few months after filing your case. If you filed for Chapter 13 bankruptcy, you typically have to complete your Chapter 13 repayment plan before the court will grant you a discharge.

Even if you receive a discharge, your bankruptcy remains open until the court enters a final decree or order closing your case. But the court will not close your bankruptcy if the trustee is continuing to administer your case .

Will A Chapter 13 Discharge Remove A Judgment From My Credit Report

Yes! A Chapter 13 removes judgments from your credit report. If you are subject to a judgment lien, you may need to avoid the lien through the Chapter 13 Plan in order to remove it completely. Your Chapter 13 bankruptcy attorney can discuss this with you and determine if you qualify for lien avoidance.

Recommended Reading: How Many Times Has Trump Filed Bankrupt

What Is A Notice Of Dismissal Of Bankruptcy

Bankruptcy is a legal process by which debtors may restructure or obtain relief from overwhelming debts and get a fresh start on building a positive economic future. The bankruptcy court process has stringent rules and timelines to insure the debtor and creditors are treated fairly. Failure to abide by these rules may lead to dismissal of the bankruptcy, but in most instances, the debtor will be allowed to refile.

Your Bankruptcy Case Ends When The Court Closes It Not When You Get A Discharge

Updated By Cara O’Neill, Attorney

Getting a discharge of your debts is a significant step in your bankruptcy, but it is not the end of your case. Your case ends when the court enters an order closing it. In this article, you’ll learn:

- when a Chapter 7 or Chapter 13 case closes

- why the court will reopen a Chapter 7 case, and

- when the court will revoke a Chapter 7 or 13 discharge.

Find out more about the differences between Chapters 7 and 13.

Also Check: How Many Bankruptcies Has Donald Trump Filed

What Happens To Tax Liens In Chapter 13

Tax liens survive Chapter 13. If the tax debt was dischargeable, the IRS will never try to collect on the debt, but the lien will stay attached to your property.

If you have a tax lien, pre-bankruptcy planning becomes invaluable. We can employ some advanced strategies to remove the liens prior to filing the bankruptcy. You can then file your bankruptcy and have the tax debt discharged.

Alternatively, you can elect to pay the lien through the Chapter 13 Plan. You are generally not required to do that though.

Tax debts in bankruptcy are complex. Most bankruptcy attorneys do not even understand them. Since we are also tax resolution attorneys, we deal with the IRS all the time. If you have a tax issue, we will have a discussion about your tax debt prior to filing the bankruptcy.

What Is A Bankruptcy Discharge

The goal of a bankruptcy is to get your creditor to forgive outstanding debt, or at least put you in a position to pay off that debt according to a court-specified plan. Discharge is the legal term meaning youre not legally required to pay the debt, and collectors cant take any further action to collect it.

Following a bankruptcy discharge, debt collectors and lenders can no longer attempt to collect the discharged debts. That means no more calls from collectors and no more letters in the mail, as you are no longer personally liable for the debt.

A bankruptcy discharge doesnt necessarily apply to all of the debt you owe. For example, if you owed $100,000 and get half of your debt discharged, you now owe $50,000. The type of bankruptcy you choose will determine what is discharged and what happens to other property during and after the bankruptcy process.

In 2016, there were 770,846 non-business bankruptcies in the United States. Nearly 62% percent were Chapter 7, 38% were Chapter 13 and less than 1% were Chapter 11. This makes Chapter 7 the most common type of bankruptcy in the U.S. But just because its popular doesnt necessarily make it right for you.

The question of What happens to my property? looms large in many bankruptcy cases. Although youre not personally liable for discharged debts, a valid lien can remain in place even after debt is discharged. That means a secured creditor may still enforce the lien to recover any property that is rightfully owed.

You May Like: Is Taco Bell Filing For Bankruptcy