Filing For Bankruptcy Can Provide Relief From Medical Bills But It Can Also Have Undesirable Consequences For Other Debts Credit Scores And Key Assets Like A House Or Car

If youre considering bankruptcy as a solution for medical debt, youre not alone. Unmanageable medical care debt and the hardships that often come along with it like loss of work or reduced access to credit can be a recipe for financial ruin.

But filing for bankruptcy isnt always an ideal solution. Although bankruptcy can help you manage or eliminate medical debt, its not possible to limit your claim to only one kind of debt during the process. Plus bankruptcy has a long-term negative impact on your credit and can put your assets in jeopardy.

Heres what you should know before you file.

Should I File Bankruptcy For Medical Bills

rebuild your worth, book a free consultation today

As Canadians we assume that all things related to our health care are free and as a result medical bankruptcy does not occur in Canada. Unfortunately, this is only partly true as although hospital visits and doctors bills are covered by Canadas health care system there can be other medical costs and healthcare issues that can cause severe financial challenges.

Other forms of medical costs can be out of pocket costs for medicine and equipment that is not covered by government insurance or work benefit programs. At the same time, you may incur moving expenses or household upgrades to accommodate your medical condition.

At the same time your biggest expense will be a loss of income while you are off work recovering from your medical condition. If your employer does not top up your health insurance wages, sick benefits from Employment Insurance will cover only a portion of your salary. This can put a large strain on your overall living expenses for you and your family.

What you should know before thinking about bankruptcy

If you still are facing debt after making these financial changes, declaring personal bankruptcy could be an option for you.

Medical Debt And Chapter 13 Bankruptcy

Chapter 13, known as the repayment/reorganization plan, is a way to reorganize your debt. As a result, youre able to keep your valuable property that could have been sold in Chapter 7 and pay off what you can over time. Youll be placed in a three to five-year payment plan during which youll pay your debts according to the Bankruptcy Code priority, liquidation analysis, and disposable monthly income analysis.

However, because medical debt is an unsecured or lower priority debt, youll pay those last. On the other hand, first, youll have to pay priority debt, including domestic support obligations, administrative expenses, and taxes.

Eligibility for Chapter 13 is determined by the amount of secured and unsecured debt you are currently carrying. You must also be able to make your monthly payments to creditors. Upon completing your Chapter 13 plan and entering the Chapter 13 discharge, you will eliminate your medical debt.

If you have medical debt and are considering filing for bankruptcy, Mummert Law can help! We are available for a consultation, at which time well sit down together, evaluate your position, and determine the best way to proceed. So dont go it alone when it comes to bankruptcy. Make your appointment with Mummert Law today!

Don’t Miss: How To File For Bankruptcy In Houston Texas

When Should I File Bankruptcy For Medical Bills

Thatâs another hard question. Filing bankruptcy is not right for everyone or in every situation. Some factors to consider are

-

The amount of medical debt: Can you pay it off in a year with monthly payments?

-

Your total debt: Are you juggling multiple debt repayments every month?

-

The amount of money you earn: What type of bankruptcy can you file?

-

The exemptions you can claim to protect your property: Would you lose any property by filing bankruptcy?

A free can help you figure out whether bankruptcy is the best debt relief option for you.

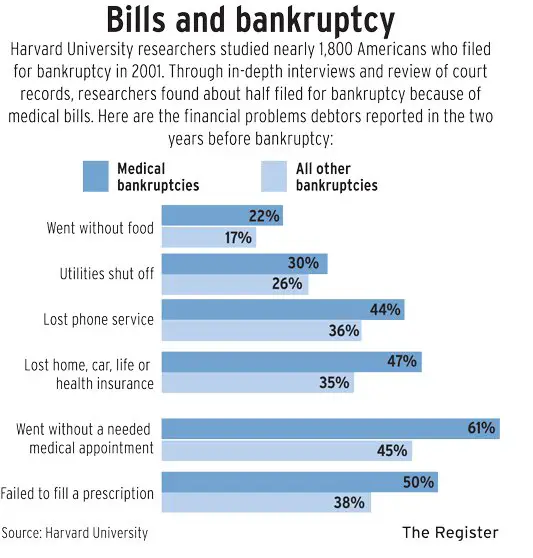

The Facts About Medical Bankruptcies

While a medical bankruptcy isnt an official legal term or type of bankruptcy, many bankruptcies are based on medical-related debts. Medical bills are a huge financial hardship and cause many individuals to file for bankruptcy relief.

Many bankruptcy clients ask if they can include medical debt and the answer is yes. Medical debt is treated as an unsecured debt and it is included within a discharge.

Read Also: How To File Bankruptcy In Mn

Best Time To File For Bankruptcy For Medical Debt

When you file for bankruptcy in New Jersey, all qualifying debt at the time of the filing will be included in your discharge or repayment plan. As a result, it important to take into account whether or not there are other expected huge bills that could disrupt your filing. Note that after you file your bankruptcy petition, all other incoming medical bills will no longer be included for possible discharge or repayment. You will need to take full responsibility in paying for them.

Needless to say, timing is of utmost importance. Careful planning and consideration is necessary to project any huge amount of future debt. For example, a loved one may be facing a serious medical prognosis. This may create a looming costly medical procedures for which you will be responsible. In such cases, it will be best to wait for the procedure to be over before you file for bankruptcy.

Legal Help

Unfortunate circumstances such as loss of a job or grave illness are not reasons enough to lose hope. The debt that follows in their heels may seem unfathomable but there is always a silver lining. Bankruptcy may help in providing debt relief. if you have medical debt and need help.

Alternative Options For Getting Rid Of Medical Debt

You may have alternatives to bankruptcy worth exploring as well. Before throwing in the towel on your medical debt, consider the following steps to reduce it or pay it off:

Also Check: What Is Dti For Mortgage

Can You Discharge Medical Debt In Bankruptcy

Theres no special process that allows filers to discharge just one type of debt. So you may be able to shed medical debt in bankruptcy, and all your other debts may go, too. It depends on the types of debt you have and the type of bankruptcy you file.

Debts in bankruptcy are classified as secured versus unsecured, and priority versus nonpriority. Secured debts are backed by some sort of collateral, such as a car or home, while unsecured debts are not backed by an asset. Priority debtsincluding tax bills, student loans, child support and alimonyare unsecured but get special status.

Medical bills are generally classified as nonpriority unsecured debts, and theyre a type of debt most likely to be discharged, or wiped clean, in a bankruptcy. While a discharge is bad news for creditors, it can be great for the borrower because it means the debt doesnt have to be repaid.

The Basics Of Bankruptcy

Bankruptcy discharges, or forgives, some debts. Certain types of debts, such as student loan debt, cannot typically be discharged. Medical debt and credit card debt from medical bills can typically be discharged. As a result, bankruptcy can be a powerful tool in recovering from medical debt.

Filing for bankruptcy involves submitting a petition for bankruptcy to the clerk of the bankruptcy court. The court will then appoint a trustee to oversee your assets. You, the trustee, and your creditors will meet in a 341 hearing to discuss your finances and develop a repayment plan.

In accordance with the bankruptcy code, the trustee will determine which debts will be discharged and which will be repaid. The bankruptcy procedure depends on the type of bankruptcy for which you have filed. There are two main options for individuals filing for bankruptcy: Chapter 7 and Chapter 13.

Chapter 7 bankruptcy is for people who cannot pay their debts even if given time. It involves liquidation of assets to pay a portion of the debt in question. In Chapter 7 bankruptcy, the trustee will sell off your assets. The trustee will use the money from the sale to pay your creditors.You will get to keep some assets, which are called exemptions. These can include:

- a primary residence

- a portion of wages

- tools required for work

Reaffirming a debt means agreeing to pay creditors more in exchange for getting to keep a non-exempt asset.

Don’t Miss: How Long Does It Take To File Bankruptcy In Colorado

Medical Bills Account For 40% Of Bankruptcies

Exorbitant medical bills in the United States play a huge part in personal bankruptcies, accounting for about 40% of the filings last year, according to a new study.

About 500000 Americans filed for bankruptcy protection in 1999 largely because of heavy medical expenses, according to the study, which is to be published next month in a finance journal, Norton’s Bankruptcy Adviser.

Very little attention has been paid to the number of people who are in bankruptcy because of serious medical problems, said the study’s lead author, Harvard law professor Elizabeth Warren. It’s a reminder that many of the families in bankruptcy have been pressed to the edge by expenses stemming from illness or injury.

Professor Warren and colleagues found that elderly people and women, as well as families headed by single women, were the groups in bankruptcy that were hardest hit by medical expenses. The findings illustrate how fragile middle class status is for many American families, Professor Warren said. These families are just one serious illness away from financial collapse, she said. What a scary way to think about America.

Professor Warren and her colleagues, Teresa Sullivan, dean of graduate studies at the University of Texas, and lawyer Melissa Jacoby, surveyed people who filed for bankruptcy in 1999 in eight judicial circuits nationwide, accounting for about 18% of all filers.

BMJ Publishing Group

Other Formats

Is It The Right Time To File A Medical Debt Bankruptcy

The idea of wiping out thousands of dollars in bankruptcy can be compelling. However, it might not be the right time.

The timing matters because you can only receive so many discharges within a certain period. For instance, after receiving a Chapter 7 discharge, you must wait eight years before receiving another.

Here’s the potential problem.

Suppose you incur more medical bills after your first bankruptcy or some other expensive calamity occurs. You’d be at the mercy of debt collectors until you paid off the obligation or qualified for another discharge.

So before deciding to file, consider asking yourself two questions: “Has my medical condition stabilized? What’s the likelihood that another financial crisis will arise?”

Also Check: Pallets Of Returns For Sale

Do I Really Need To File Bankruptcy To Eliminate Medical Debt

If you dont owe much more than medical debt, and you havent gotten behind on your house or car payments, child support, or alimony, it may not be necessary to file a bankruptcy case. Here are some reasons why:

- Medical creditors are often easier to work with than other creditors with other types of debt.

- Medical accounts will stay with the doctors or hospitals billing department as long as possible before theyre shipped off to a collector.

- Many times your doctor or other health provider will agree to take a very small amount each month, even $5 or $10.

- In some cases, especially if its a public hospital or doctor for a Medicare of Medicaid patient, the providers wont even bother to do much beyond sending a bill.

- Medical creditors seldom belong to credit reporting agencies, so the debt isnt likely to affect your credit score much.

You may be safe trying to work out payment arrangements with your medical creditors instead of filing a bankruptcy case. You wont lose much by trying, but if you cant get any satisfaction from working with your creditors, either Chapter 7 or Chapter 13 will be there to take care of it for you.

Filing Chapter 13 For Medical Debt

Chapter 13 will “discharge” your medical debt by lumping all your bills and debt together, but you still need to pay some of this overall debt back. It requires a repayment plan that is created based on your income, bills, equity, assets, and other expenses. You may not qualify for Chapter 13 if you cannot pay your bills and make monthly payments to your creditors.

Unlike Chapter 7, a Chapter 13 bankruptcy has debt limits. These limits change every few years, but the current debt limit is $419,275 for all unsecured debts . As long as your debt is less than this, you can file for Chapter 13 and have most of your medical debt dismissed while only paying back a fraction of it.

For example, depending on your debt amount, you might have 70% of the debt dismissed but need to pay back 30%. The percentages will change based on your debt, income level, and the bankruptcy courts in your state.

Recommended Reading: How Long To Get Bankruptcy Discharge Letter

Pros Of Clearing Medical Debt In Chapter 7 Bankruptcy

- It’s quick. Most Chapter 7 cases are over in four months.

- It wipes out more than medical debt. You can get rid of an unlimited amount of medical bills, credit card debt, personal loans, past-due utility and rent payments, and even mortgage and car payments .

- You don’t pay creditors. Unlike Chapter 13, you won’t pay into a repayment plan before receiving your discharge.

How Is Medical Debt Treated Under Chapter 13 Bankruptcy

Chapter 13 Bankruptcy can help make repaying your debt more manageable. The court will provide a debt repayment term, which lasts from three to five years. It involves making monthly installments, which are less than 15% of your disposable income.

Unlike Chapter 7, Chapter 13 bankruptcy may last for several years, and it has a limit on secured and unsecured debts, which are $1,257,850 and $419,275, respectively.

You must have a regular disposable income so that you can pay back your loans according to the court-mandated payment plan. Debts are separated into priority secured debts and non-priority unsecured debts. Overdue taxes, domestic support obligations, mortgages, and car loans fall under priority secured debts.

Meanwhile, credit card debt balances and medical-related debt dont receive priority. Since theyre unsecured, you may pay only a portion of them under the Chapter 13 plan. At the end of the repayment period, any remaining balance on your medical debt, unsecured loans , and secured loans will be wiped out.

Also Check: How Do Foreclosed Homes Work

How To Clear Medical Debt

Discharging debt through bankruptcy offers a number of immediate and long-term benefits. When you file for bankruptcy, the automatic stay begins and forces your creditors to halt any attempts to collect these debts. Garnishments, lawsuits, and harassing collection attempts must stop once you file for bankruptcy.

Which Type Of Bankruptcy Chapter Should You Use To Get Rid Of Medical Debt

Before anything else, you need to remember that bankruptcy will leave a significant effect on your credit report, which will last from 7 to 10 years. Its a decision that should not be taken lightly. Chapter 7 and Chapter 13 bankruptcy can help get rid of your medical debt. But the processes involved are different for each type of legal proceeding.

If you dont have a regular or stable income and your assets have little to no equity, a Chapter 7 bankruptcy may be a good option. Theres no cap to the number of debts you need to have. Plus, its a good solution if your goal is to get rid of your medical-related debt.

Meanwhile, Chapter 13 is best if you didnt qualify for a Chapter 7 bankruptcy. If you have a stable income and there are assets that you dont want to lose, then this option is for you.

The bankruptcy court will issue a repayment plan that lets you make affordable payments to your debt, including your medical bills. Once the plan ends, the court will discharge all of your remaining debt.

Read Also: Can A Wife File Bankruptcy Without Husband

File Your Bankruptcy Forms In Court

When you go to your local courthouse, you need to bring your bankruptcy forms and the filing fee, installment plan, or waiver. Your bank statements and other financial documents do not get submitted to the court but go to the trustee assigned to you later on.

The clerk will scan and upload your forms to the courts online system in about 15 minutes. Once the documents are uploaded, the clerk will give you your bankruptcy case number, your bankruptcy trustees name, and the details regarding your meeting with the trustee of your case, otherwise known as the 341 meeting.

Once you have filed, you wont have to worry about collectors or notices reminding you to pay your medical bills. However, your bankruptcy journey is not over yet.

Filing Chapter 13 For Medical Bills

Chapter 13 reorganization may be a viable debt relief option if you are currently unable to pay your medical bills but feel like you could pay some or all of them with more time. Under the Chapter 13 bankruptcy reorganization process, you can modify your existing debt payments by reorganizing eligible debt into a new three to five-year repayment plan.

Recommended Reading: How Long Is Bankruptcy On Public Record