Guilford County Property Tax Deduction

You can usually deduct 100% of your Guilford County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. North Carolina may also let you deduct some or all of your Guilford County property taxes on your North Carolina income tax return.

Has this page helped you? Let us know!

What Is The Guilford County Property Tax

Proceeds from the Guilford County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget.

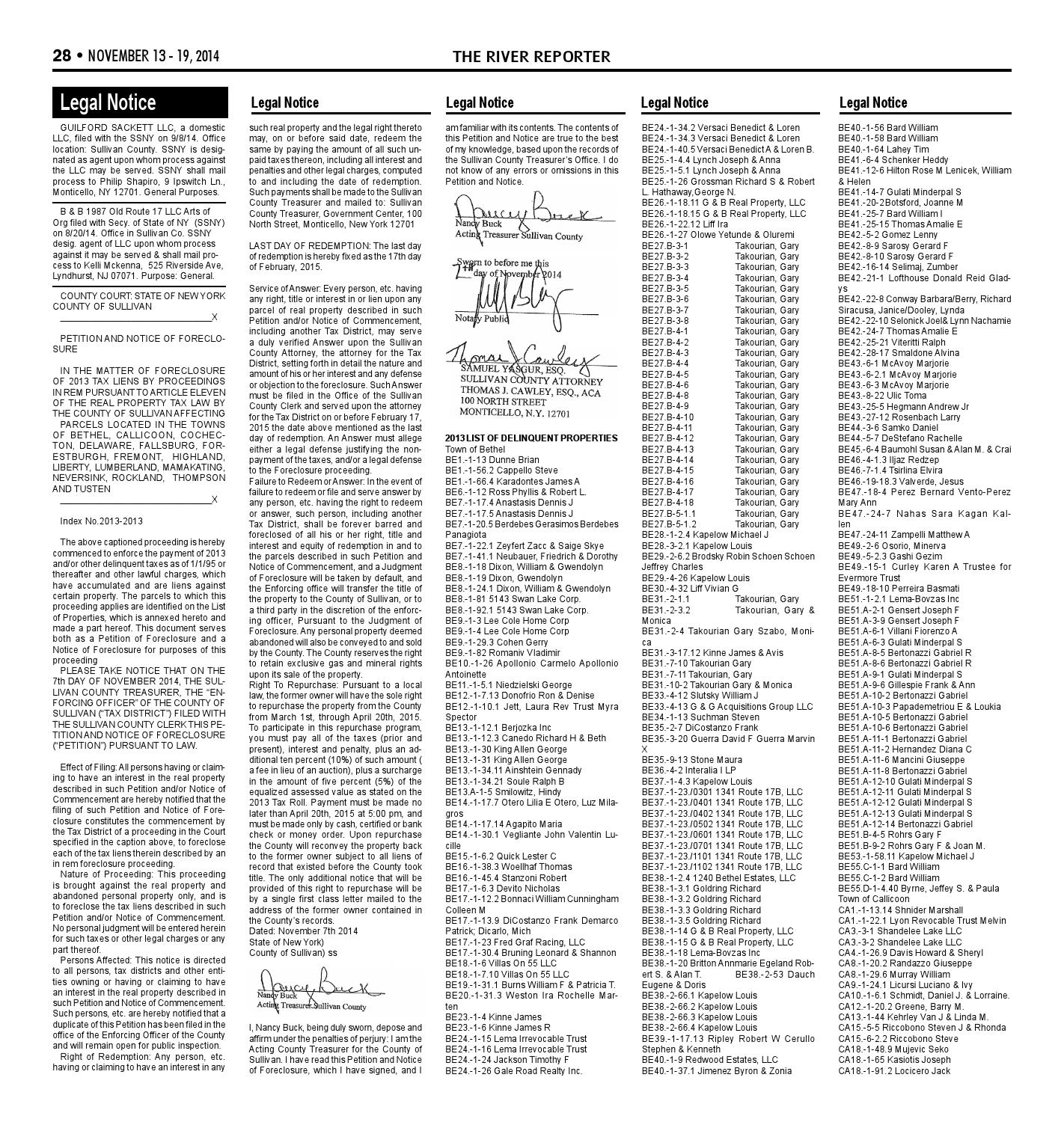

Unlike other taxes which are restricted to an individual, the Guilford County Property Tax is levied directly on the property. Unpaid property tax can lead to a property tax lien, which remains attached to the property’s title and is the responsibility of the current owner of the property. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. Property tax delinquency can result in additional fees and interest, which are also attached to the property title.

In cases of extreme property tax delinquency, the Guilford County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. Proceeds of the sale first go to pay the property’s tax lien, and additional proceeds may be remitted to the original owner.

Guilford County North Carolina Sales Tax Rate2022

| 7% |

|---|

Components of the 7% Guilford County sales tax

The county-level sales tax rate in Guilford County is 2.25%, andall sales in Guilford County are also subject to the 4.75% North Carolina sales tax.Cities, towns, and special districts within Guilford County collect additional local sales taxes, with a maximum sales tax rate in Guilford County of 7%. The total sales tax rates for all sixteen cities and towns within Guilford County are listed in the table below.

| City Name |

|---|

Cities or counties marked with the symbol have a local sales tax levied by that municipality

You May Like: How Often Can You File For Bankruptcy In California

Our Next Tax Foreclosure Sale Will Be Determined At A Later Date Sales Are Always Held At The Historic Courthouse Down Town Graham #1 Court Square Graham Nc At 1: 00 Noon

ALL PROPERTIES ARE SOLD IN AS IS CONDITION. INTERESTED PARTIES ARE ENCOURAGED TO RESEARCH ALL PROPERTIES THOROUGHLY PRIOR TO OUR SALE AND BEFORE BIDDING ON ANY PROPERTY.

THIS IS A BUYER BEWARE SALE. ALL SALES ARE FINAL. THESE PROPERTIES ARE SOLD ON AN AS IS, WHERE IS BASIS. THE COUNTY MAKES NO REPRESENTATION OF WARRANTY, EXPRESS OR IMPLIED. IT IS THE BUYERS RESPONSIBILITY TO INVESTIGATE THE PROPERTY PRIOR TO BIDDING.

- Anyone considering purchasing property at a tax foreclosure sale should be aware that there is a risk. The County does not guarantee or provide any warranty.

- It is important to know that the deed description of the property or properties contained in this ad may or may not be the exact description of what is actually being sold. The property to be sold is that property contained in the deed description SAVE AND EXCEPT ANY CONVEYANCES OF RECORD. In other words, the deed description may include portions of land that have already been sold off by the current owner, portions that are NOT subject to the sale.

- It is the bidders responsibility to check on the status of their upset bid with the Alamance County Clerk of Superior Court.

- Properties that are sold maybe subject to IRS Tax Liens, City/County Taxes for any years not covered under our judgment, and other restrictions of record.

- It is the buyers responsibility to research and obtain information regarding these properties prior to the sale.

Guilford County Still Foreclosing Despite Pandemic

Posted by Scott D. Yost | Nov 21, 2020 | News

A lot of people are being cut some slack when it comes to paying bills during the pandemic, but they arent being shown any sympathy when it comes to Guilford County foreclosing on their property.

According to Guilford County Tax Director Ben Chavis and Guilford County Attorney Mark Payne, the county is continuing its ongoing foreclosure operations as usual on homes and businesses during the pandemic.

About eight years ago, the Guilford County Tax Department and the Guilford County Attorneys Office teamed up to become much more aggressive on foreclosures. At that time, there was a huge backlog of foreclosures from non-payment of taxes, and, in some cases, people hadnt paid property taxes for eight years but still hadnt been foreclosed on.

Now, the average number of years of non-payment before a foreclosure proceeding is about half that time.

While restrictions on evictions have been in effect much of this year during the coronavirus pandemic, Payne said that eviction is not usually necessary when it comes to the county foreclosing on the property. He said that, 99 times out of a hundred, by the time the county is at the point of auctioning off the property to the highest bidder, the house is unoccupied and has been for a good while.

Payne noted that property taxes for 2020 arent yet past due, so no one who cant pay taxes due solely to COVID-19 is going to be subject to a current tax foreclosure.

You May Like: Will My Credit Score Go Up After Bankruptcy Discharge

Guilford County Property Tax Assessor

The Guilford County Tax Assessor is responsible for assessing the fair market value of properties within Guilford County and determining the property tax rate that will apply. The Tax Assessor’s office can also provide property tax history or property tax records for a property. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal.

Most county assessors’ offices are located in or near the county courthouse or the local county administration building. You can look up the Guilford County Assessor’s contact information here .

Find Guilford County Tax Records

Guilford County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Guilford County, North Carolina. These records can include Guilford County property tax assessments and assessment challenges, appraisals, and income taxes. Certain types of Tax Records are available to the general public, while some Tax Records are only available by making a Freedom of Information Act request to access public records.

Learn about Tax Records, including:

- Where to get free Tax Records online

- How to search for Guilford County property Tax Records

- How to challenge property tax assessments

- What Tax Records are public information

- How long to keep tax records for

Read Also: Debt To Income Ratio To Buy House

Historic Property Tax Increase In Greensboros Guilford County

Property taxes on homeowners will increase $418 on average after vote on new $861 million budget

Elections have consequences. Thats what the people of Guilford County are finding out as the County Board of Commissioners recently approved an $861 million budget, which will raise property taxes by $418 on average.

This increase is likely due in part to voter approval of a massive $1.7 billion in school bonds during the primaries on May 17.

The Greensboro News & Record reported: By a vote of 6-3 along party lines, the board approved the fiscal year 2022-23 budget with a tax rate of 73.05 cents per $100 of taxable value. The revenue neutral tax ratewhere the board would raise the same about of money as in fiscal year 2021-22would have been 59.54 cents.

For the average median home valued at $241,750, the property tax bill would increase by $418 under the current tax rate when compared with the revenue-neutral rate.

There will also be a fraction of a penny sales and use tax that will help finance the bond, though it does exclude gas, prescriptions and groceries.

As the country spirals towards recession, this news isnt good for the people of Guilford County.

For most voters, this issue probably sounded like a great idea at the time. Education has become a key factor for many parents and families as they vote, and schools can be in desperate need of funding and support.

So, Guilford County must be experiencing an influx of students, right?

Guilford County Property Tax Appeal

Guilford County calculates the property tax due based on the fair market value of the home or property in question, as determined by the Guilford County Property Tax Assessor. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value.

As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Guilford County Tax Assessor’s office is incorrect. To appeal the Guilford County property tax, you must contact the Guilford County Tax Assessor’s Office.

Are You Paying Too Much Property Tax?

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year.

We can check your property’s current assessment against similar properties in Guilford County and tell you if you’ve been overassessed. If you have been overassessed, we can help you submit a tax appeal.

Is your Guilford County property overassessed?

You will be provided with a property tax appeal form, on which you will provide the tax assessor’s current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate.

If your appeal is denied, you still have the option to re-appeal the decision. If no further administrative appeals can be made, you can appeal your Guilford County tax assessment in court.

Also Check: How Does Filing Bankruptcy Affect Buying A Home

Look Over Our Foreclosure Listings If You Are Interested In Investing

foreclosure listings

We maintain a current list of foreclosure listings in Western North Carolina, and we welcome you to look over these listings for any properties that interest you. If you decide to bid on a property, the bidding process generally takes place on the steps of the County Courthouse or another location. State law is designed to gain as much as possible from the foreclosed property, but most of these properties sell for much lower than market value.

As you look at foreclosure listings, please note that you have no legal right to physically enter the property. However, if the owner is present, they may give you permission to inspect the premises before you place your bid at auction. If you are the winner of the auction, you also have the legal right to sell the property immediately, unless an IRS lien is present.

Guilford County Foreclosure Defense Lawyers

You May Like: Credit Card Debt Assistance

Foreclosures For Sale In Guilford County

There are currently 6 foreclosures for sale in Guilford County at a median listing price of $325K. Some of these homes are “Hot Homes,” meaning they’re likely to sell quickly. Most homes for sale in Guilford County stay on the market for 36 days and receive 2 offers. This map is refreshed with the newest listings in Guilford County every 15 minutes.

In the past month, 571 homes have been sold in Guilford County. In addition to houses in Guilford County, there were also 4 condos, 10 townhouses, and 8 multi-family units for sale in Guilford County last month. Find your dream home in Guilford County using the tools above. Use filters to narrow your search by price, square feet, beds, and baths to find homes that fit your criteria. Our top-rated real estate agents in Guilford Countyare local experts and are ready to answer your questions about properties, neighborhoods, schools, and the newest listings for sale in Guilford County. Redfin has a local office at 1435 West Morehead Street Suites 135 and 235, Charlotte, NC 28208. If you’re looking to sell your home in the Guilford County area, our listing agents can help you get the best price. Redfin is redefining real estate and the home buying process in Guilford County with industry-leading technology, full-service agents, and lower fees that provide a better value for Redfin buyers and sellers.

Foreclosures In Guilford County Nc

Buy foreclosure homes for sale in Guilford County, NC, right now on Foreclosure.com for up to 75% off market value. We currently have 820 of the hottest foreclosure deals in Guilford County, NC, of all prices, sizes and types, including bank-owned, government and many others. Learn how to buy foreclosed homes in Guilford County, NC, with no money down and gain exclusive access to hidden distressed real estate listings in Guilford County, NC, 10 to 180 days before they hit the mass market. Be first with Foreclosure.com find free foreclosure listings in Guilford County, NC, before anyone else. Don’t overpay for your next home in Guilford County, NC. There are 820 discounted homes for sale in Guilford County, NC we think you’ll love.

820 homes available

Your search has been saved!

Access your Saved Searches on your profile page.

Your Search has been saved.

Access your Saved Searches on your profile page.

Please sign in before saving this search. Don’t have an account yet?

In order to save a search you first need to create a profile.You will receive FREE saved search emails directly to your inbox.

Tax foreclosed homes are available for pennies on the dollar – as much as 75 percent off full market price !

Enter an address, city, state or zip code below to view super-saving listings near you:

Be sure to act fast and be persistent because the best tax deals might disappear as soon as tomorrow. These one-in-a-lifetime real estate deals are that good.

Read Also: How To File For Bankruptcy In Ms

Guilford County Tax Records Search Links

The Guilford County Tax Records Search links below open in a new window and take you to third party websites that provide access to Guilford County public records. Editors frequently monitor and verify these resources on a routine basis.

Help others by sharing and reporting broken links.

Guilford County Assessment Rollshttp://taxcama.guilfordcountync.gov/camapwa/Search Guilford County property assessments by tax roll, parcel number, property owner, address, and taxable value.

Guilford County Assessor’s Websitehttps://www.guilfordcountync.gov/our-county/taxVisit the Guilford County Assessor’s website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records.

Guilford County Campaign Reportshttp://candidatereports.myguilford.com/Search Guilford County candidate reports by name, year, for a background check on the candidates you’re eligible to vote.

Guilford County Government Property Recordshttp://taxweb.co.guilford.nc.us/CamaPublicAccess/Search Guilford County Government personal property records by owner and business name, address and parcel and property identification number.

Guilford County Government Websitehttp://www.myguilford.com/tax/View Guilford County Government general information page, including locations, address and telephone number.

Essential Information For Bidders

Tax Foreclosure Sales are conducted a little bit differently in each location. It is important for investors to understand how the process works so that they are well equipped for successful bidding. If you are an investor, please note that county courthouses may have different hours of operation, locations, auction procedures and upset bid requirements. We encourage you to review what the sale process looks like in the location of which you are interested in purchasing property.

Recommended Reading: How Does Bankruptcy Work In Ny

How The Right To Redeem Usually Works

In many states, the homeowner can redeem the home after a tax sale by paying the buyer from the tax sale the amount paid , plus interest, within a limited amount of time. Exactly how long the redemption period lasts varies from state to state, but usually, the homeowner gets at least a year from the sale to redeem the property. In other states, though, the redemption period happens before the sale.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

North Carolina Sales Tax Lookup By Zip Code

Look up sales tax rates in North Carolina by ZIP code with the tool below.Note that ZIP codes in North Carolina may cross multiple local sales tax jurisdictions.

Sales-Taxes.com last updated the North Carolina and Forsyth, Randolph, Sedalia, Greensboro, High Point, Guilford, Summerfield, Wallburg And Rockingham sales tax rate in November 2022 from the North Carolina Department of Revenue

Sales-Taxes.com strives to provide accurate and up-to-date sales tax rates, however, our data is provided AS-IS for informational purposes only.

Please verify all rates with your state’s Department of Revenue before making any financial or tax decisions.

© 2022 Sales-Taxes.com. All rights reserved. Usage is subject to our Terms and Privacy Policy.

Also Check: Buy Through Auction.com