A Private Mortgage Insurance

As mentioned previously, conventional mortgage loans may be available with as little as 3% down payment. However, homebuyers who utilize these mortgage options are likely to pay private mortgage insurance on any loan where they do not contribute at least 20% as a down payment.

The average cost of PMI ranges from 0.58 to 1.86% of the original loan amount. This percentage is added as a line item on the borrowers monthly mortgage statement and added to the required monthly minimum payment.

Some lenders automatically drop PMI when the loan balance is paid down enough to reach 80% or lower of the homes value. Others, however, require an application or refinance to remove PMI once that threshold is met.

Therefore, borrowers need to ensure that the addition of PMI to the monthly mortgage payment is manageable and worth the added cost.

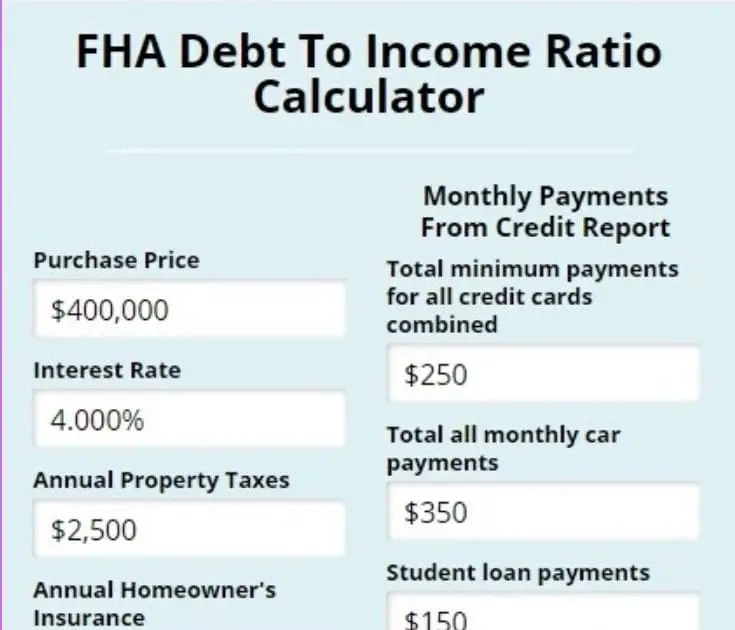

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

Im Ready To Apply For A Conventional Loan

Conventional loans are a great mortgage option for qualifying homebuyers. Depending on your financial situation, its likely a conventional loan will offer lower rates than other types of mortgages. Down payment requirements are as low as 3%, and private mortgage insurance is cancelable when home equity reaches 20%.

Tim Lucas

Editor

Don’t Miss: What Is The Difference Between Bankruptcy And Liquidation

This Weeks Question: I Have The Ability To Pay For My Debts And Im Wondering If A Zero Dti Is Good Im Looking At Buying A House Next July

A 0% debt-to-income ratio means that you dont have any debts or expenses, which does not necessarily mean that you are financially ready to apply for a mortgage. In addition to your DTI, lenders will review your credit score to assess the risk of lending you money. The specific requirements vary from lender to lender. But, most lenders look for a 35% or lower DTI and a minimum credit score above 620 to qualify for a conventional loan. On the other hand, FHA loans have more flexible requirements.

How to calculate your DTI

Your DTI determines the percentage of your gross income used to pay for your debts and certain recurring expenses. There are two types of ratios, the front-end and the back-end DTI, which is what lenders focus on the most when applying for a mortgage. To calculate your front-end DTI, add your home-related expenses such as mortgage payments, property taxes, insurance, and homeowners association fees. Then, divide them by your monthly gross income, and multiply it by 100. Most lenders look for a 28% front-end DTI.

Monitor your credit score

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Recommended Reading: How To Calculate Your Monthly Income

A Conforming Mortgage Loans

Conforming loans are those offered by private lenders that follow the guidelines set by two government organizations Fannie Mae and Freddie Mac. Conforming loans meet specific underwriting requirements set by these associations, including a set loan limit. Any loan exceeding the conforming loan limit is considered a non-conforming or jumbo loan.

Conforming Loan Limits for 2022 / 2023

The most notable criteria for defining a home loan as conforming is the set loan limit. While this changes periodically, adjusted for inflation, the 2022 baseline conforming loan limit is $647,200 and will jump to $715,000 in 2023. This loan limit applies to most areas throughout the United States. In some higher-cost-of-living regions, loan limits may increase to $970,800.

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Recommended Reading: Which Is Better Chapter 7 Or 13 Bankruptcy

And Why Is That Of Interest To A Lender

If your concern is that the borrower may not be able to pay the monthly interest and the principal, youll look for those who are more likely to pay back than not.

One good way is to see what an individuals income is.

Someone whose debt payment is low compared to their income, has more cushion to work with. They have more disposable income and savings very likely. Hence, they will be more likely to make the payment. Theyll also possibly have more savings.

On the other hand, someone who spends most of their income towards debt payments likely has less in savings because most of their income was being used up to make those debt payments.

What Is Included In The Debt Payments

The following items are included when calculating debt payments for DTI purposes.

- Alimony & Child support

- Mortgage loans and home equity loans on other properties you own

For credit cards, only the minimum payment is included if you are making your payments on time. If you have a balance thats overdue, youll likely be paying interest on that. In such a case, your full monthly payment will be included.

If you notice carefully, all the payments listed above are typically those that you regularly have to make every month. That does not mean you have to include all expenses you regularly incur every month. The following payments are NOT included in the DTI ratio calculation:

Recommended Reading: Which Type Of Bankruptcy Results In Liquidation

Loan Type And Interest Rate Impact

We recently published an article relevant to this topic about the best time to buy your first home. In that piece, we discussed three key financial factors in the decisionyour credit, purchase price, and down payment.Your credit is going to determine the types of loans you are eligible for, and it will determine the rates offered on those loans. Ideally, you would want a conventional loan with the lowest interest rate possible. A conventional mortgage typically requires a minimum credit score of 620. The best interest rates are available to borrowers with scores above 760.For example, take a look at this chart from myFICO.com, which demonstrates how a low credit score could lead to a high rate and thus a more expensive monthly payment:

Source: myFICO Mortgage Rate ComparisonsThats not to say you can only buy a home if your credit is in great shape. You could opt for an FHA loan, or a conventional loan with a higher interest rate. You will need to make a personal decision about how important it is to buy right now as opposed to waiting while you improve your credit.

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

You May Like: How To File Bankruptcy On A Student Loan

How Much House Can I Afford

One of the key metrics lenders look at to determine how much house you can afford is your debt-to-income ratio the percentage of your gross monthly income that goes toward paying your monthly debt payments. A low DTI demonstrates that you have a good balance between debt and income, while a high DTI signals that your debt may be too high for your income.

In general, 43% is the highest DTI you can have and still qualify for a mortgage. Most lenders, however, prefer DTIs that are no higher than 36%, with housing expenses representing no more than 28% of that debt .

Another factor that determines how much house you can afford is the amount of money you have available to make a down payment and cover closing costs. Though a larger down payment might mean a bigger mortgage , make sure youll have money left over to furnish the home and live in it.

Of course, just because a lender approves you for a loan doesnt mean you have to borrow the entire amount. A smaller loan payment provides some wiggle room each month, which might come in handy in an emergency or if something unexpected comes up . A lower payment also makes it easier to save for other goals and work on your retirement nest egg.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How Much Do You Have To Owe To Declare Bankruptcy

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Get Clarity On Your Dti With A Pre

At Better, we want you to be as prepared for buying a home and the mortgage process as possible.

Applying for a pre-approval takes as little as 3 minutes and will provide you with a clear picture of how much you can afford. Youll undergo a soft credit check that allows our underwriters to look at your debts, income, and credit in detail to obtain a more accurate picture of your DTI.

Although your DTI ratio is just one important factor to consider when buying a home, carrying less debt relative to your income will make it easier to get a mortgage and help ensure youll be able to afford your home for years to come.

Better Mortgage can help you understand your DTI and the financing options available to you. Start your pre-approval process today.

Read Also: How Long Does A Bankruptcy Stay On Record

How To Lower Your Dti Ratio

If youve run the numbers and youre concerned that your DTI isnt as low as youd like it to be, there are two main ways you can decrease it: reduce your debt or increase your income. Lowering your DTI can make the mortgage process go smoother, so it might be worthwhile if you have time before you apply for a new mortgage or refinance.

Here are a few DTI reduction strategies to consider:

-

Pay down or pay off your car loan before applying for your mortgage.

-

Start paying off your credit cards in full, one by one.

-

If possible, refinance or consolidate current loans to reduce your monthly payments.

-

Consider adding a co-borrower with a low DTI to your loan.

-

Pick up a side gig or part-time job to help pay down debt.

-

Expecting a raise or promotion in the next few months? Consider waiting to apply until it goes through.

-

Consider using some of your down payment savings to pay down debt. Just make sure youll meet down payment guidelines, which can be as little as 3% to 5%.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

You May Like: How Long Bankruptcy Last On Credit Report

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

How Can I Lower My Dti

Lowering your DTI may be necessary in order to qualify for the loan amount you want. Fortunately, there are ways to do so. The easiest method to lower your DTI is by reducing your debt. Since DTI is based on monthly expense, it makes the most sense to pay down the debt with the combination of the lowest balance and highest monthly payment.

Other means of lowering your DTI include, increasing income, avoiding major purchases or in extreme cases, getting help from a financial adviser.

For individuals with an already high DTI, Increasing your income is the most beneficial thing you can do to improve the ratio. This can be done by asking for a salary increase, working overtime, taking on a part-time job, or even making extra money from a hobby. The more you can increase your income without raising your debt payments, the lower your DTI ratio will be.

Read Also: When Does A Bankruptcy Come Off Credit

Tips To Keep Your Debt

Are you worried that your debt-to-income ratio will make you ineligible for a mortgage loan?

You can follow these tips to lower your DTI and improve your chances of mortgage approval:

Even if your DTI is within the good range for mortgage qualifying, it doesnt hurt to try to lower it before you apply.

The lower your existing debts, the more youll be able to spend on your mortgage.

Working to improve your debt-to-income ratio before you apply for a home loan can make you eligibile for a bigger, more expensive home.

Conventional Loans And Recent Bankruptcy

It is possible to be approved for a conventional loan after bankruptcy. There are required waiting periods though, and you must demonstrate youve re-established your credit.The lender must determine the cause and significance of the derogatory information, verify that sufficient time has elapsed since the date of the last derogatory information, and confirm that the borrower has re-established acceptable credit history.

Fannie Mae Guidelines

Required waiting periods after bankruptcy:

- Chapter 7 or Chapter 11: A four-year waiting period, measured from the discharge or dismissal date is required. A waiting period of two years is possible if extenuating circumstances can be documented, such as job loss that is not expected to recur.

- Chapter 13: Two years from the discharge date or four years from the dismissal date. With extenuating circumstances, a waiting period of two years is possible from the dismissal date.

Bankruptcy is never a good thing on your credit report, but it doesnt necessarily disqualify you from ever getting another mortgage.

See if you are eligible for a conventional loan here

Also Check: What Is Your Credit Score After You File Bankruptcy

How To Calculate Debt

Top Ratio

- Add together all of your gross income for the last two years and divide it by 24, as reported on your tax returns.

- Add together all of your proposed monthly housing expenses, including principal, interest, taxes, insurance, mortgage insurance, and HOA dues.

- Divide that your monthly expenses by your average monthly income.

Bottom Ratio

As you can see, Calculating your debt-to-income ratio is an pretty simple thing to do. Your credit report shows what your monthly payments are, which makes them easy to figure. If youre asking yourself what is my debt to income ratio right now, look no further than a debt-to-income calculator.