Bank Mails You A 90 Day Pre

If you dont bring your loan current, then the bank will send you a 90 day notice of default by mail, with an intent to accelerate the debt and call in the full amount of the loan.

The notice itself will need to be on colored paper to clearly separate it from the other papers in the package, and it will have big bold letters stating that this is a 90 day notice.

Essentially, the lender is required to mail you this package at least 90 days before starting a court case against you, and this package will also contain information on how to get help.

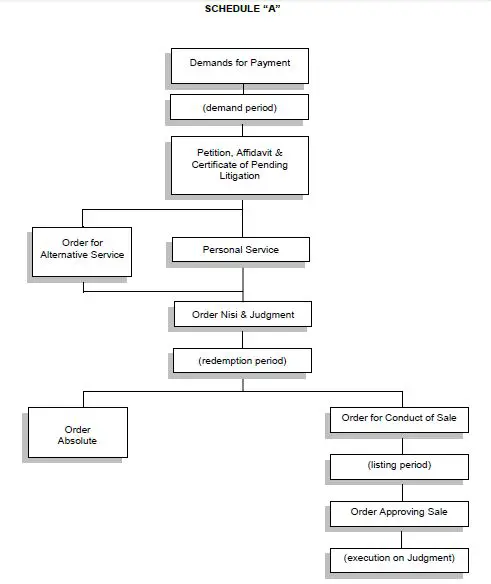

Conclusion Of The Case

Dismissal: This is when the case is canceled. Parties can agree to ask for a case to be dismissed, or a judge can order a dismissal when one party asks for it and the judge agrees that dismissal should be granted.

Judgment: After a trial, the court orders judgment for the plaintiff or judgment for the defendant. The party against whom judgment is entered can file an appeal within 21 days of entry of judgment. The parties can also agree to a judgment , which cannot be appealed.

Step 7-Post Judgment, “Period of Redemption,” and Public Sale When judgment for the plaintiff is entered, a 90-day “period of redemption” begins unless an appeal is filed. This means the homeowner has 90 days to pay the full amount of the judgment to “redeem” the property. The homeowner can stay in the home during this period. After the 90-day redemption period is over, if the homeowner has not paid the amount in the judgment to redeem the property, the lender can then take possession of the property and go forward with a public sale. The lender is allowed to bid on the property at the public sale. See 14 M.R.S. § 6323.

Before You Lose Your Home To A Foreclosure Sale You’ll Get Some Sort Of Notice

Before a bank can sell your house at a foreclosure sale, you’ll get some sort of formal notice about the foreclosure. The kind of notice you’ll get generally depends on whether the foreclosure is judicial or nonjudicial and what your state’s foreclosure laws require.

With both judicial and nonjudicial foreclosures, most people some type of preforeclosure notice, like a breach letter or notice of intent to foreclose. Then, in a judicial foreclosure you’ll get notice of the lawsuit that begins the foreclosure process. In a nonjudicial foreclosure, the notice you’ll get depends on state law, which varies widely.

Also Check: Merchandise On Pallets For Sale

How Does Foreclosure Work

In New York, the judicial foreclosure process is required in order for the lender to take back the home. This means that there is a formal process that must be adhered to whereupon the lender must file a lawsuit. In New York, the judicial foreclosure process requires that every foreclosure must pass through the courts and that only a judge can order and schedule a foreclosure auction to be held. Until then, there are many different steps involved that allow the borrower to protect and defend themselves against foreclosure. Not only does this mean that the foreclosure might not succeed, but it means that the foreclosure may be delayed. This is why hiring an experienced foreclosure attorney to defend against such suits is crucial.

Know And Understand The Six Key Steps

Foreclosure is the process that allows a lender to recover the amount owed on a defaulted loan by selling or taking ownership of the property. Although the foreclosure process varies by state, there are six common phases of a foreclosure procedure.

Read Also: How Long After Bankruptcy Does It Take To Rebuild Credit

What Are The States With The Longest Foreclosure Process

Foreclosure laws. California, Colorado, Minnesota, and Nevada, for instance, all passed laws to increase homeowners protections from foreclosure, which can slow down the process in some cases. Foreclosures can take a long time because lenders and servicers must comply with the requirements under these laws.

Foreclosure Process Step : Notice Of Default

If a borrower cant come up with the funds to pay what he or she owes, a lender will issue a notice of default. This form will be sent to the mortgagee in the mail via a certified letter, and it typically gives a homeowner 90 days to pay off the most recent bill.

This step marks the beginning of the formal and public foreclosure process, Zuetel says.

Theres still time to save your home after a notice of defaultif you can find the cash. One option is a mortgage reinstatement, whereby you reinstate your mortgage by making up all the missed payments at once, plus interest and lender fees. Youll then go back to paying your monthly bill as usual.

Don’t Miss: Debt Consolidation Loans Gov

How To Stop Foreclosure At The Last Minute

There are ways to stop foreclosure at the last minute, or at least postpone it. You may be able to modify your loan or file for bankruptcy. Before bankruptcy, you should consider selling your house as-is to companies that buy houses for cash. If pressed for time, they may be able to pay enough to satisfy your loan. And, they generally close the sale in 7-10 days. By selling your house fast, you can avoid foreclosure and spare your credit.

Tropic Coast Homes pays cash for homes in any condition in Southwest Florida. If you are facing foreclosure, it helps to know all of your options. Contact us today for a no-obligation purchase offer.

The Bank Files A Summons And Complaint And Serves The Borrower

Concurrently with the lis pendens filing, the bank will also file a summons and complaint with the court against the borrower.

The summons essentially explains that the lender is filing a lawsuit against the borrower, and the complaint details the basis for the filing .

Banks will typically serve the borrower with the summons and complaint in person vs mail, due to the liberal nature of the courts in New York. Otherwise, borrowers could very easily claim in the 11th hour that they never received the summons and complaint by mail, and judges will usually buy this story in New York.

Note that it is only the summons and complaint that is usually served by hand, other notices are all typically mailed.

Don’t Miss: How Do You Qualify For Chapter 7 Bankruptcy

Nj Foreclosure Timeline Overview

Although every foreclosure case is different, below are the general steps in the timeline of foreclosure in New Jersey:

Breach Letters And Demand Letters

Most mortgage agreements in Illinois contain provisions that require lenders to notify borrowers that a loan is in default before they can take legal action. This notice is called a breach letter or a demand letter. A breach letter must include several points, including:

- The loan default and the reason for the default

- The action that would resolve the default

- A deadline date for resolving the default, usually at least 30 days from the date of the letter and

- A notice that failure to resolve the default will result in the loan being accelerated and the possible sale of the property.

If the defaulted mortgage is still not addressed, the lender may file a foreclosure action with the court. The action is usually filed in the county where the property is located, but foreclosures can be filed in federal court as well.

Recommended Reading: How To Start Building Credit After Bankruptcy

Official Notice Of A Foreclosure

You’ll definitely get a summons and complaint telling you when a foreclosure action has been filed in the appropriate court. Once you receive notice about the lawsuit, most people have 20 to 30 days to respond to the suit. If you file a response contesting the foreclosure action, it might take a few monthsor even longerbefore a judge rules on whether to grant the foreclosure.

What Happens If A Foreclosed Home Doesnt Sell

If a house isnt sold at auction, the property becomes whats known as an REO, or real estate owned property. But dont assume this is a free pass to stay in the home.

If the bank owns the foreclosure, more often than not, they will arrive at the property shortly after the foreclosure date and kick you out, Blake warns. They might offer the previous homeowners cash for keys or relocation assistance, where the bank offers a certain amount of money to the previous homeowners to vacate the premise.

While you cant count on this money, it cant hurt to ask in case this sum helps you move out, and on with your life.

Don’t Miss: Credit To Debt Ratio Calculator

Right To Challenge The Foreclosure

Regardless of the state that you live in, you are entitled to the ability to challenge the foreclosure in court. If its a judicial foreclosure, you only have to participate in the lawsuit. In the event of a non-judicial foreclosure, however, you will have to file a lawsuit. Such action is necessary if you have reasons to believe that the lender made a mistake or took a step that violated the law.

Why Do Foreclosures Take So Long

Foreclosures can take a long time because lenders and servicers must comply with the requirements under these laws. Mediation laws. Some states, cities, and municipalities have passed foreclosure mediation laws that can delay the foreclosure process.

How long does the foreclosure process usually take?

The length of the entire foreclosure process depends on state law and other factors, including whether negotiations are taking place between the lender and the borrower in an effort to stop the foreclosure. Overall, completing the foreclosure process can take from 6 months to more than a year.

How long does it take to get a deed in lieu of foreclosure?

Lender Negotiations. If a short sale is not possible, the borrower could try to pursue a deed-in-lieu of foreclosure. This process could also take at least 2 months after efforts for a short sale are done. In this process, the borrower voluntarily gives up the property to the lender to avoid foreclosure.

Read Also: Amazon Liquidation Pallets South Carolina

Foreclosure Process Step : Default

A bank cant just start the foreclose process on a home whenever it wants. Homeowners have to first default on their mortgage, failing to pay their required monthly payments. And its rare for lenders to begin the foreclosure process after just one late mortgage payment.

They will usually give the borrower a grace period because they recognize the reality that people face temporary financial hardship at some point in their lives, explains Lisa Blake, a real estate broker and owner of The Blake Team in Aurora, CO.

That said, banks want their money, so borrowers can expect an influx of emails, letters, and phone calls from their lender or bank trying to collect.

Lenders usually offer alternatives during this period, including different payment plans to help the homeowner get back on track, keep their home, and keep paying their monthly mortgage bill. This is partly because its in a lenders best interest to make things workafter all, the lender wants its money. But its also the law in many states, says real estate attorney and broker Bryan Zuetel of Esquire Real Estate in Irvine, CA.

In many states, a lender or servicer cannot file a notice of default until 30 days after contacting the homeowner to assess the homeowners financial situation and explore options to avoid foreclosure, Zuetel explains.

Termed a foreclosure avoidance assessment, this period might include requests for a payment adjustment, interest adjustment, deferral, or other accommodations.

Default And Notice Of Default

The first thing that happens in the foreclosure process is that you enter into default.

Default essentially means you are late on your mortgage payments- what most lenders refer to as delinquent.

The law dictates that a lender must reach out to a defaulter once he or she is 36 days behind on mortgage payments. By 45 days, the lender must provide written notice of the default, including details about any loss mitigation or repayment method the individual may be able to use.

A borrower has to be at least 120 days behind on his or her mortgage for the lender to start the foreclosure process legally. In the case of bankruptcy, you can try to source money from other means like family and friends to pay outstanding debt.

Important: If you receive a notice of default, its important to contact your lender or servicer to discuss potential options as soon as possible.

You may be able to modify your loan, get on a repayment plan, ask for a short sale, or surrender your property instead of foreclosure.

You May Like: Hud Houses For Sale In Michigan

How California Foreclosure Works

When you borrow money and use your house as collateral, you sign a deed of trust. The deed of trust gives the lender the rights of a secured creditor in your house.

The deed of trust contains a clause called a power of sale which entitles the holder of the note to sell the house at a foreclosure sale outside of court. In this way, a California foreclosure is different from judicial foreclosures in other states where the courts are involved in foreclosure.

In judicial foreclosures, the standing of the foreclosing creditor can become an issue in the foreclosure process.

In California, the power of sale in the deed of trust allows foreclosure without the involvement of the courts.

California statutory law provides for two steps in the foreclosure process before the lender can sell the house on the courthouse steps.

Foreclosure Filing And Trial

If you are in a judicial foreclosure state, the next step is the foreclosure filing. The lender will file a foreclosure lawsuit against the borrower, also called a complaint in some states. Lenders need to prove that they offered the borrower loss-mitigation options before filing suit.

The foreclosure suit will go before the court, and borrowers have a right to contest their foreclosure and raise their defenses. If the court rules in favor of the lender, the property can be scheduled for sale.

Read Also: Where Can I Buy Pallets Of Returned Merchandise

Phase : Public Auction

Once the 5 days grace period is over, the home will be auctioned off by the lender of their representative. There will be an opening bid for the property which is determined by your balance, unpaid taxes, any liens, and the cost of the sale.

The property is usually sold to the highest bidder who is then given a trustees deed to certify their official ownership of the property. You will typically have three days to move out after this, failure to which the owner is free to start a formal eviction process.

Click HERE For The Complete Debt Relief Manual

What Happens When You Get A Foreclosure Notice On Your Home

Youll then go back to paying your monthly bill as usual. If the homeowner hasnt come up with the money within 90 days of the notice of default, the lender may proceed with the foreclosure process. Next comes a notice of sale, which will state that the trustee will sell the home at auction within 21 days.

Don’t Miss: How To File For Bankruptcy In Nj Without A Lawyer

Phase : Real Estate Owned

The lender will set a minimum bid, which takes into account the appraised value of the property, the remaining amount due on the mortgage, any other liens, and attorney fees. If the property is not sold during the public auction, the lender will become the owner and attempt to sell the property through a broker or with the assistance of a real estate-owned asset manager. These properties are often referred to as bank-owned, and the lender may remove some of the liens and other expenses in an attempt to make the property more attractive.

I Cant Make My Mortgage Payments How Long Will It Take Before Ill Face Foreclosure

The legal foreclosure process generally cant start during the first 120 days after youre behind on your mortgage. After that, once your servicer begins the legal process, the amount of time you have until an actual foreclosure sale varies by state.

If you are having trouble making your mortgage payments, act quickly. Contact your mortgage servicer to find out if there are options for you to avoid foreclosure. Respond to your servicer if they try and contact you.

You should also contact a HUD-approved housing counselor to get free, expert assistance on avoiding foreclosure. Many mortgage servicers offer programs to help people avoid foreclosure. These programs are called loss mitigation programs. The loss mitigation process can be difficult. A HUD-approved housing counselor can guide you through the process. You can call the CFPB at 411-CFPB to be connected to a HUD-approved housing counselor in your area or you can search online for one near you.

Read this checklist on avoiding foreclosure.

You May Like: How Long Can You File Between Bankruptcies