How Is The Debt

Here’s a simple two-step formula for calculating your DTI ratio.

Keep in mind that other monthly bills and financial obligations — utilities, groceries, insurance premiums, healthcare expenses, daycare, etc. — are not part of this calculation. Your lender isn’t going to factor these budget items into their decision on how much money to lend you. Keep in mind that just because you qualify for a $300,000 mortgage, that doesn’t mean you can actually afford the monthly payment that comes with it when considering your entire budget.

How To Calculate Debt

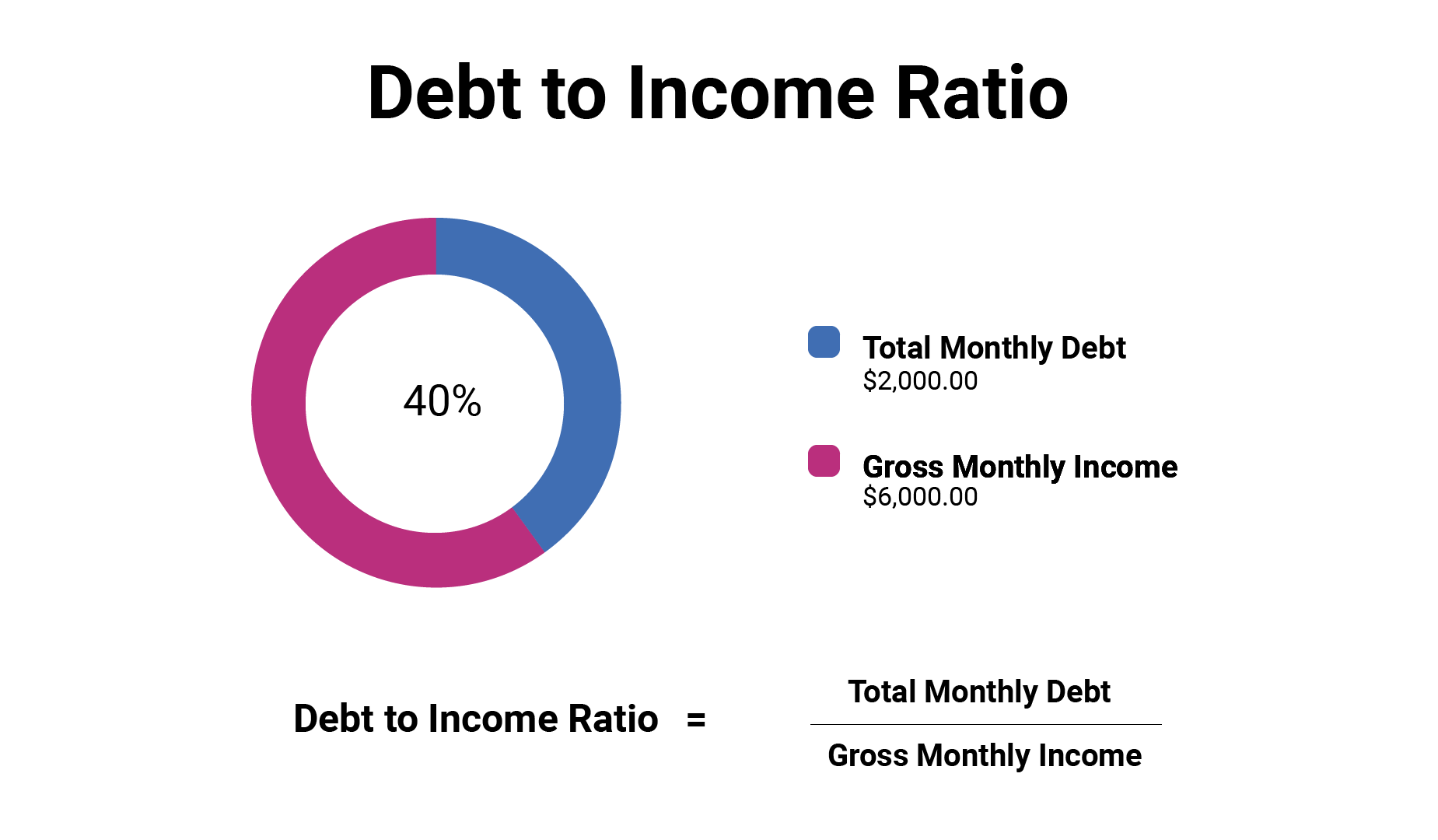

Debt-to-income compares your total monthly debt payments to your total monthly income. You add up all your monthly debt payments, plus insurance, then divide it by your total monthly income and multiply by 100. This gives you your DTI ratio. This calculator will walk you through everything that should be included when calculating your DTI.

What Is A Debt

A debt-to-income ratio is the percentage ofgross monthly incomethat goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 36/43.

Front-end ratio is the percentage of income that goes toward your total monthly mortgage costs, such as:

- Mortgage principal and interest

- Alimony payments

- Vacation/rental property costs

Lenders often look at both ratios during themortgage underwriting process the step when your lender decides whether you qualify for a loan. Our debt-to-income calculator looks at the back-end ratio when estimating your DTI, because it takes into account your entire monthly debt. In addition to your DTI ratio, lenders may look at your credit history, current credit score, total assets andloan-to-value ratiobefore deciding to approve, deny or suspend the loan approval with contingencies.

Don’t Miss: Can Bankruptcy Affect My Job Uk

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

What Is A Good Debt

Buying a home is a huge milestone, yet it can be difficult to determine how much to borrow. Online mortgage calculators can estimate affordability. But to know what you can actually afford, youll need to get pre-approved for a mortgage.

Typically, a monthly mortgage payment should be no more than 28% to 31% of your gross income with a conventional and FHA loan, respectively. But even if you find a property that keeps your payment within these percentages, your debt-to-income ratio ultimately decides how much youre able to borrow.

Also Check: Can You Get A Home Loan After Bankruptcy

Why Is Dti Important

Your DTI is important to both you and lenders because it demonstrates that you have a good balance of debt and incoming funds. It proves to lenders that you are responsible with your money and that you can handle additional debt.

The Consumer Financial Protection Bureau requires that mortgage lenders examine your financial health before you take out a loan to assure that you can afford to repay the money. Calculating your DTI is one of a few ways they go about doing this. If your DTI percentage is low enough, you may qualify for a better loan than you would if you were responsible for more debt. On the other hand, if your DTI is too high, lenders may be unwilling to grant you a mortgage loan, so its important to make sure your DTI is within an acceptable range.

Jeremy Kisner Cfp Cpwa Clu

Director of Financial Planning & Senior Wealth Advisor at Surevest Private Wealth

There has been a shortage of homes for sale for the last few years. This is a trend I predicted would get worse back in 2018. My prediction has been correct, and now the Covid-19 pandemic has greatly accelerated this shortage for a whole host of reasons. As of December 2021 in the Phoenix area , the supply of homes for sale is 67% below normal and demand is 23% above normal. This supply-demand imbalance continues to push prices higher and we may end 2021 with close to 30% year over year appreciation.

This articles point is many folks may be tempted to overspend on a new home purchase, which begs the question: How much home can you afford?

Your mortgage broker needs to know two things in order to tell you how much you can borrow: your income and your recurring monthly debt obligations. These two numbers are used to determine your Debt to Income Ratio . Your DTI includes all loan payments, such as minimum monthly credit card payments, student loans, personal lines of credit, auto loans, and your housing paymentPrincipal, Interest, Taxes, and Insurance .

Read Also: How To File For Personal Bankruptcy In California

Why Does It Matter

Lenders use your DTI ratio to assess your ability to pay for a loan. Lenders like this number to be low. Why? Because evidence from studies of mortgage loans shows that borrowers with a higher debt-to-income ratio are more likely to run into trouble making monthly payments, says the Consumer Financial Protection Bureau .

As a general rule, if you want to qualify for a mortgage, your DTI ratio cannot exceed 36% of your gross monthly income, says David Feldberg, broker/owner of Coastal Real Estate Group in Newport Beach, CA. A higher DTI ratio could mean youll pay more interest, or you could be denied a loan altogether.

Some lenders will loan money to people with DTI ratios exceeding 36%, but its rare. After all, if you default on your mortgage and your lender has to foreclose on your home, your lenders may not be able to recoup their full investment. And its bad for you too: As a borrower, defaulting on your mortgage can destroy your , which would make it more difficult for you to qualify for another mortgage.

To verify income, a mortgage lender will want to see recent pay stubs and W-2 tax forms for the past two years. If youve recently had a change in pay, such as a raise, youll need to get a statement from your boss confirming your new salary. And, if you generate income from a source outside your primary jobsuch as part-time work or side gigs that pay only commissionyoull have to provide W-2 forms for these as well.

Other Financial Calculations Used By Lenders

In addition to the DTI, lenders utilize other financial calculations to determine your ability to repay the loan. The calculations are:

- Loan-to-value ratio : LTV is the ratio of the home loan amount versus the home market value. For example, if the home value is $100,000 and your downpayment is $20,000, the LTV is 80%. In many cases, a lower LTV can result in a lower interest rate since the loan risk is lower.

- FICO score: The score measures how well you have managed your debt payments. Higher scores indicate that you have done an excellent job and consistently paid back your debts.

=====

Your debt-to-income ratio is a vital factor in qualifying for a mortgage. Understanding this calculation will help you get a better idea of your financial situation and how lenders will view your loan application.

Contact us today to learn more and see your home purchase options.

All content has been written and provided by leadpops.com

Recommended Reading: Does Bankruptcy Affect Income Tax Returns

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

Read Also: How To Declare Bankruptcy In Bc

Income Requirements To Buy A Home

Lenders consider much more than just your paycheck when you buy a home. Your debt-to-income ratio and your ability to make mortgage payments are more heavily considered than how much you make. Theyll also consider your credit score and how much you have for a down payment.

A great place to start is to get a preapproval, especially if you arent sure whether you can get a mortgage on your current income. A preapproval is a letter from a mortgage lender that tells you how much money you can borrow. When you get a preapproval, lenders look at your income, credit report and assets. This allows the lender to give you a very accurate estimate of how much home you can afford.

A preapproval will give you a reasonable budget to use when you start shopping for a home. Once you know your target budget, you can browse homes for sale to see what general prices are. Its a good sign that youre ready to buy if you find appealing options at your price range.

So what do lenders look for when you want to borrow? For starters, theyll take a look at your monthly income and your debt-to-income ratio.

How To Improve Your Debt

To be comfortable with your mortgage, look for ways to reduce your DTI before you apply for a mortgage.

Lowering your DTI by paying down credit card balances and then never letting those balances exceed 30% of your is one way to do this, according to Valdes.

Its helpful to come up with a plan to pay down debtlike the debt snowball method, where you tackle your smallest debts one at a time while making minimum payments on the others, she said. Creating a budget and cutting back where necessary can also free up extra funds to pay off debt paying off small debts little by little makes a big difference.

Another tip is to space out your loan applications. For example, Edelstein advised against applying for a mortgage when youre also applying for other types of credit, like a new car loan or lease, because the new credit could lower your credit score and raise your DTI.

Here are a few other ways to improve your DTI before applying for a mortgage:

- Pay down your highest balance credit card, or pay smaller amounts to all of your credit card accounts.

- Consider a debt consolidation loan to combine credit cards or other debts at a single interest rate.

- Avoid incurring new debt during the window of time leading up to applying for a mortgage and before you’ve closed on a home.

- Consider ways you could increase your household income, such as negotiating a raise, taking on a part-time job, starting a side hustle, or seeking a higher-paying role with a different employer.

Read Also: When Does Bankruptcy Come Off Credit Report

What Does Your Debt

| DTI | What it means |

|---|---|

| Less than 36% | You have a good amount of debt relative to your income, which should make it easier to maintain financial stability. If you apply for new financing, you should have little trouble getting approved, as long as your credit score is high enough to qualify. |

| 37-41% | This is within a normal range of how much debt you should have relative to your income. However, you may need to eliminate some debt before you apply for your next loan or line of credit. This will make it easier to ensure you can get approved. |

| 41-45% | Having this much debt will make it difficult to find a lender that will extend you a new line of credit. You should take action to reduce debt and stop making new charges on your credit cards until youve paid off some of your balances. Consider options, like debt consolidation, that can make it easier to pay off your balances. |

| More than 50% | This much debt is bad for your financial health and you need to get help immediately. This much debt may make it difficult to pay off on your own, since you have too much debt to qualify for do-it-yourself options, like debt consolidation loans. Call to review your options for relief with a trained credit counsellor. |

How lenders use debt-to-income ratio during loan underwriting

Talk to a trained credit counsellor to find the best way to eliminate debt for your needs and budget.

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

Also Check: Can You File Bankruptcy On Credit Card Debt Alone

What Should My Debt

Asked by: Jonatan Torphy

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. 12 For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Read Also: How Many Times Did Trump File Bankruptcy

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

How To Get Around A High Dti

The easiest way to lower your debt-to-income ratio is to pay off as much debt as you can but many borrowers dont have the money to do that when theyre in the process of getting a mortgage, because much of their savings are tied up in a down payment and closing costs.

If you think you can afford the mortgage you want but your DTI is above the limit, a co-signer might help solve your problem. Unlike with conventional loans, borrowers can have a relative co-sign an FHA loan and the co-signer wont be required to live in the house with the borrower. The co-signer does need to show sufficient income and good credit, as with any other type of loan.

Sometimes, though, a co-signer isnt the answer. If your DTI is too high, for example, you should consider focusing on improving your financial situation before committing to a mortgage.

Recommended Reading: How Long Does Bankruptcy Last Uk

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.