Beware Of Debt Settlement Scams

Some companies offering debt settlement programs may engage in deception and fail to deliver on the promises they make for example, promises or guarantees to settle all your credit card debts for, say, 30 to 60 percent of the amount you owe. Other companies may try to collect their own fees from you before they have settled any of your debts a practice prohibited under the FTCs Telemarketing Sales Rule for companies engaged in telemarketing these services. Some fail to explain the risks associated with their programs: for example, that many consumers drop out without settling their debts, that consumers credit reports may suffer, or that debt collectors may continue to call you.Avoid doing business with any company that promises to settle your debt if the company:

- charges any fees before it settles your debts

- touts a “new government program” to bail out personal credit card debt

- guarantees it can make your unsecured debt go away

- tells you to stop communicating with your creditors, but doesnt explain the serious consequences

- tells you it can stop all debt collection calls and lawsuits

- guarantees that your unsecured debts can be paid off for pennies on the dollar

Contact Your Credit Card Lender

Get in touch with your lenders hardship department. Tell them youre in financial hardship and why youre struggling to make repayments.

In most cases the lender will help you with a repayment arrangement based on what you can afford. They may be able to:

- Stop charging you interest

Useful tools to help you work out what you can afford are MoneySmarts Budget Planner and

Does Carrying A Balance Help Your Credit Score

You may have heard you should carry a small balance on your cards to help your score, but that is simply not true. The FICO algorithm will not punish you for not carrying a balance on your cards. Not having a balance or paying one off in full is just fine with the score.

Along those same lines, if you simply bring your account balances down to about 20 percent or less, you will see a credit score increase. You can then try to pay off the remaining balance over the next six to nine months. Without a plan to pay your cards off entirely, you may keep a balance longer than you need to.

Recommended Reading: How Much Does Filing Bankruptcy Hurt Your Credit

Option : Consolidate The Debt With A Low

Like a balance transfer, a personal debt consolidation loan is usually only a viable solution for consumers who have a good credit score. The higher you score, the lower the interest rate you can qualify for on the loan. APR of 5% is ideal, but anything below 10% may be enough to provide the relief you need. If you cant qualify for a rate below 10%, look for other options.

How It Works:

Essentially, you use the money from the loan to pay off your credit card balances and other debts. You can pay off things like medical bills, too.

When using this option, you want a loan with a term of five years or less. Any more than that means your total repayment costs will be too high. Just keep in mind that a shorter term means higher monthly payments. Calculate carefully to make sure you can afford the payments.

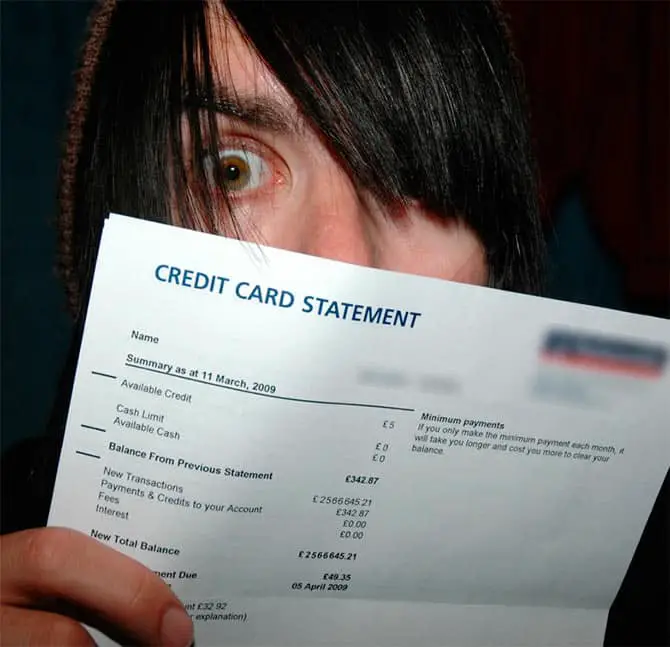

Pay More Than Minimum

Credit card issuers give you a monthly minimum payment, often 2% of the balance. Remember, though: Banks make money off the interest they charge each billing period, so the longer it takes you to pay, the more money they make. Look on your credit card bill for a Minimum Payment Warning, which will have a table showing how long it would take to pay off your balance if you paid only minimums and how much interest you’d pay.

You May Like: Foreclosure Process In Nc

A Debt Consolidation Loana Balance Transfer Could Also Be A Good Option

When used correctly*, debt consolidation loans, balance transfer credit cards and balance transfers are excellent ways to get out of debt.

Consider consolidating your debts with a consolidation loan or transferring your credit card balances to a low rate balance transfer credit card. However, make sure you understand the terms, conditions, any hidden balance transfer fee, and the overall interest savings you should get before signing anything.

Cut up and cancel your credit cards if you choose this option. If you dont, you might be tempted to continue using them and further increase your debt load and make your debt even worse than before.

*Unfortunately, debt consolidation loans dont help most people. When people get these loans but dont change the habits that got them into debt in the first place, they just dig themselves deeper into debt. To get ahead using a debt consolidation loan, make sure you track your spending for at least 2 weeks. You also need to create a budget and follow it so that youre not spending more than you earn. Dont become someone who needs another debt consolidation loan to pay off your first one.

Balance Transfer Your Existing Credit Card Balance

Top tip

Make sure you pay off your debt before the 0% introductory deal ends, otherwise you might have to pay a high rate of interest on the remaining debt.

One option for borrowers with existing credit card debt is to move it to a 0% balance transfer credit card.

These cards offer a period in which no interest will be charged on that debt. This means every penny of your repayments goes directly towards reducing the size of your original debt.

Youll usually need to pay a fee to transfer your debt over usually around 3% of the balance transferred . So if your outstanding balance is £1,000, it could cost you £30 to switch.

These cards are usually only an option if you have a good credit rating.

If you dont qualify for a 0% deal, look for a card with as low a rate as possible . But remember to look at the balance transfer interest rate, not the APR .

Find and compare balance transfer cards on the MoneySavingExpert website

Recommended Reading: Liquidation Stores Charlotte Nc

For Credit Scores Of 690 Or Higher

A balance transfer credit card: When other issuers wouldnt offer budget-friendly terms, Zook transferred debt from high-interest credit cards to low-interest credit cards. Like Zook, you may have to pay the 3% to 5% balance transfer fee generally charged by most cards, but it could be worth the short-term cost to get a long-term break on interest payments. The ideal balance transfer credit card has a $0 annual fee and a lengthy introductory 0% APR. You might even be able to find one that charges no balance transfer fees within a certain time frame.

» MORE:NerdWallet’s best no balance transfer fee credit cards

Debt consolidation loans for multiple credit cards: If your debt is spread across multiple credit cards, it might be easier to explore a debt consolidation loan. It allows you to combine high-interest debts into one low-interest fixed payment, making it much easier to manage.

Tap Into Your Home Equity

If you have equity in your home, you may be able to use it to pay down card debt. A home equity line of credit may offer a lower rate than what your cards charge. Be aware that closing costs often apply.

If you do consolidate, keep in mind that its important to control your spending to avoid racking up new debt on top of the debt youve just consolidated.

Recommended Reading: Foreclosed Homes Under 10k

% Balance Transfer Credit Card

It might seem counterintuitive to apply for a credit card when your main goal is to get out of credit card debt, but 0% balance transfer cards can help save you money in the long run. Find a card that offers a long 0% introductory period preferably 15 to 18 months and transfer all of your outstanding credit card debt to that one account. You’ll have one simple payment each month, and you wont pay interest.

Cultivate A Healthy Credit Lifestyle

Often, we drive ourselves to learn about credit only when we realize we have credit problems. As you look to pay off your credit card debt, you can begin to understand the best ways to sustain a healthy and affordable credit lifestyle. This can help you avoid a credit crisis, but it can also drive your credit score higher so you can obtain attractive terms for the loan or line of credit that you may need in your future.

Read Also: What Can A Bankruptcy Trustee Do

Personalized Tips For Paying Off Credit Card Debt

If youre overwhelmed by your current financial circumstances or have difficulty maintaining a monthly budget, we can help you by providing personalized tips for paying off credit card debt. Well review your financial situation with you and explore all the different ways you can get rid of your debt. There are even debt relief and debt repayment programs that might help.

Get Some Help Its Free

Get a free appointment to explore your options and get back on track.

Alternatives To Debt Settlement

Michael Bovee, a debt settlement coach and a frequent critic of his industry , advises erasing your debt through Chapter 7 bankruptcy and starting again, if you have the option.

For borrowers who are overwhelmed by unsecured debt such as credit cards, consider how your options compare, like debt settlement vs Chapter 7 bankruptcy. A Chapter 7 bankruptcy is almost always a better option. Yes, a bankruptcy will sully your credit history for years, but the rebuilding process can begin immediately. Consultations with a bankruptcy attorney are typically free, though youll pay legal and filing fees if you choose this route.

If you can erase your debts in a Chapter 7 bankruptcy, thats a much better option than trying to negotiate settlements, says NerdWallet columnist Liz Weston, author of Your Credit Score and Deal With Your Debt. Only if Chapter 7 isnt an option you refuse to file for bankruptcy, or you can only qualify for a Chapter 13 repayment plan should you consider debt settlement.

If you dont qualify for a bankruptcy or dont want to file one, consider a debt management plan offered through a nonprofit . Going that route will not typically reduce the amount you must repay, but it may reduce your monthly payments by stretching them out or by reducing your interest rate. It will have less impact on your credit than either bankruptcy or a debt settlement.

Don’t Miss: Credit Counseling For Bankruptcy

Researching Debt Settlement Companies

Before you enroll in a debt settlement program, do your homework. Youre making a big decision that involves spending a lot of your money money that could go toward paying down your debt. Check out the company with your state Attorney General and local consumer protection agency. They can tell you if any consumer complaints are on file about the firm youre considering doing business with. Ask your state Attorney General if the company is required to be licensed to work in your state and, if so, whether it is.Enter the name of the company name with the word “complaints” into a search engine. Read what others have said about the companies youre considering, including news about any lawsuits with state or federal regulators for engaging in deceptive or unfair practices.

Dont Hesitate To Get Help Paying Off Your Debt

Consulting a can provide help, if only to help you best understand your options. They can help you with the basics of finance, deal with creditors or craft and get through a payment plan.

Although the strategies listed above have proven histories, you might want help deciding which one fits you best. A credit counselor is a good place to start.

About The Author

Read Also: Bankruptcy Attorney Wichita Ks

Get Your Spending Under Control

Sometimes people get into credit card debt due to unexpected medical or emergency expenses. Other times, the source of debt is chronic overspending, which often means youre spending more than youre saving or more than you have in your account. To gain full insight into how much youre spending, making a reasonable budget is the next best step toward alleviating that debt.

Matt Kelly, owner of Momentum: Personal Finance Coaching in Durango, Colorado, recommends that your budget account for the following:

- Basic necessities: rent/mortgage, utilities, groceries and gasoline

- Obligations: minimum payments on credit cards and other debt

- Nice-to-haves: restaurants, coffee and entertainment costs

- Irregular recurring expenses: insurance, car repairs, tires, haircuts, vitamins, toiletries, vet bills, holiday gifts, travel, weddings and gifts

Its the last category that often trips people up and becomes the source of credit card debt, Kelly says. These little and not-so-little expenses go onto the card and are hard to pay off.

Once youve put your expenses down on paper or entered them into a spreadsheet, go through each item and find ways to free up enough money each month to pay off all your debts in 12 to 18 months, he says.

- Who this strategy is good for: Anyone lacking a sufficient budget

Get Banked To Speed Refunds With Direct Deposit

The fastest way to get a tax refund is by filing electronically and choosing direct deposit. Direct deposit is faster than waiting for a paper check in the mail. It also avoids the possibility that a refund check could be lost, stolen or returned to the IRS as undeliverable.

Don’t have a bank account? Learn how to open an account at an FDIC-Insured bank or through the National Credit Union Locator Tool. Veterans should see the Veterans Benefits Banking Program for access to financial services at participating banks.

Prepaid debit cards or mobile apps may allow direct deposit of tax refunds. They must have routing and account numbers associated with them that can be entered on a tax return. Taxpayers can check with the mobile app provider or financial institution to confirm which numbers to use.

You May Like: Does Filing Bankruptcy Erase Student Loans

Potential Hurdles And Drawbacks Of A Hardship Program

In addition to meeting hardship requirements, you might have other hurdles to clear, depending on the issuer, such as:

-

Proving your hardship, which may require documentation.

-

Meeting with a credit counselor or completing a debt management program.

-

Signing an agreement.

-

Setting up automatic withdrawals from your bank account.

At Affinity Federal Credit Union, for example, cardholders must prove their hardship by meeting with a credit counselor who will give them a budget. The credit union will then refer to that budget to work with them if theyre eligible, Williams-Barrett says.

Your credit card issuer may also take actions on your credit card account once you accept the terms of a hardship plan, including:

-

Freezing your credit card account.

-

Closing your credit card account.

-

Lowering your credit limit.

A closed account or a lower credit limit could hurt your by affecting your length of credit history and/or your . But that alone shouldn’t keep you from using a hardship program if you need one. The impact on your credit won’t be as bad as the aftermath of defaulting on your bills.

Even if your credit card issuer doesnt take any actions on your account when you enroll in a hardship program, you should abstain from using your credit card so that you can work toward paying it off.

» MORE:3 steps to spring-clean your credit card debt

For Debt On One Card: Consider A 0% Balance Transfer Credit Card

A 0% balance transfer credit card can be an important tool for people looking to pay off credit card debt that is all or mostly on one card. Some credit card products offer 0% interest for introductory periods as long as 24 months. However, most charge transfer fees of from 3% to 5% of the amount you transfer. They also tend to have high variable interest rates once the introductory period ends. Of course, that wont apply if youre able to fully pay the transferred balance before then. Zero-interest balance transfer cards typically require good to excellent credit scores. You may want to do some math to compare the savings from paying no interest to the cost of the balance transfer fee.

Don’t Miss: What Happens After Bankruptcy Petition Is Filed

Keep Old Accounts Open

A minor credit scoring factor is known as This measures the number of accounts you have and the average age of those accounts. Someone with older accounts shows they have experience managing debt over time. That results in a higher credit score.

For this reason, you want to keep old credit card accounts that are in good standing open and active. Find a small use for an old credit card, so you can use it periodically. This will help you avoid a credit card company closing your account due to inactivity.

What Can My Creditors Do To Me If I Dont Pay Them

Most people want to pay their bills on time and take pride in doing so. The thought of not paying can cause panic. But heres the good news: Credit card companies are limited in what they can do if you default on your debt. They cant take your house or car away. They cant garnish your unemployment check . They cant put a lien on your wages, because you dont have any.

That said, creditors arent toothless. They can, and often do, sue those who default. If you are sued for credit card debt, immediately review the filing to make sure its accurate. Often the plaintiff isnt the credit card company but another a collection agency that bought your debt and will try various tactics, including a lawsuit to recoup at least part of what you owe. If you determine that the lawsuit is accurate, you need to defend yourself, which means you likely will need a lawyer.

If you get calls from your creditors, calmly explain that youve lost your job and youll catch up once youre re-employed. Sometimes you can stall and reach a settlement agreement before a suit is filed.

You May Like: Who Can File Chapter 7 Bankruptcy