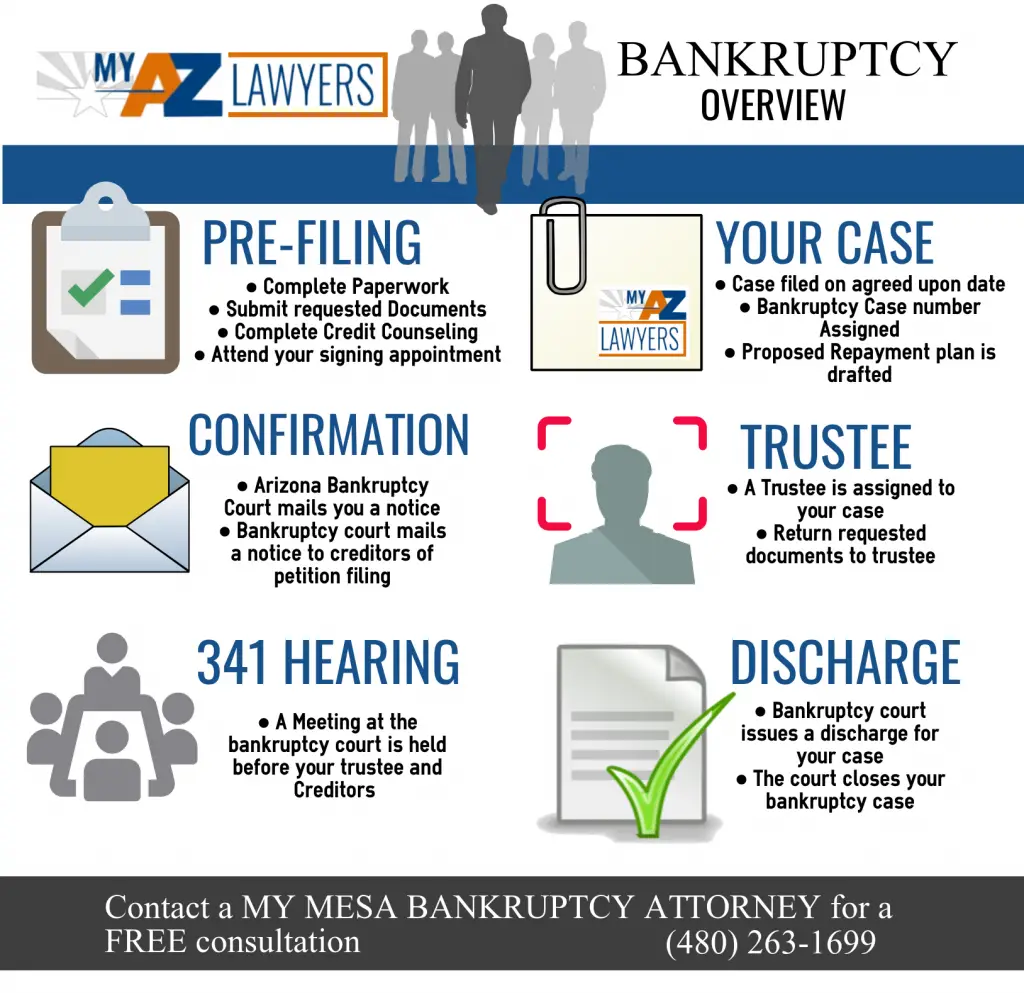

Attend Your 341 Meeting

The 341 meeting, also called a meeting of creditors, is one of the most stressful parts of a Chapter 7 bankruptcy case. After all, you have to go to court to answer questions under oath.

In reality, as long as you spend just a little bit of time preparing for it and don’t forget your IDs at home, it will be over before you know it. Most folks walk out of their 341 meeting not only relieved, but also surprised about how quick and painless it was.

Under federal law, your creditors may attend this meeting to ask you questions, but that does not happen very often. The meeting is recorded, so make sure you answer loudly and clearly. Additionally, even though you may already know what the trustee is going to ask you, having seen others who are in a Chapter 7 bankruptcy in Arizona, answer the exact same questions just minutes earlier, let the bankruptcy trustee finish each question before speaking. Otherwise, you end up speaking over them, making it difficult for the recording to catch what everyone is saying.

Legal Guidelines For Conducting Employee Evaluations

Dec 21, 2015 This exercise should be helpful in addressing common questions or concerns of evaluators. Also, group training helps the employer lessen the;

Feb 7, 2019 To keep performance appraisals from going wrong, take these steps into in a performance appraisal are those that may spell legal trouble;

Mar 14, 2018 Yes. Just like an employer cannot discriminate in other aspects of your employment, an employer may not discriminate when conducting performance;

Mar 22, 2021 Legal issues in performance management Claims may arise out of any stage of a performance management process. The most common claim arising;

Apr 9, 2015 Performance appraisal is a highly effective way to nip potential problems in the you can avoid creating unnecessary liability concerns:.

Property Exemptions In Arizona For Bankruptcy

Like every other state, Arizona has its own set of property exemptions. Thus, someone filing for bankruptcy in Arizona must be mindful of the property exemptions for the state of Arizona.

In Arizona, you must use the states exemption list; although some states allow debtors to choose between the state list and a federal list, Arizona isnt among them.

Arizona provides a generous homestead exemption that protects up to $150,000 in equity in a house or other real property. Arizona law also allows debtors to keep food and fuel for up to six months, and up to $6,000 equity in a vehicle.

Don’t Miss: Chapter 7 Falls Off Credit Score

Should I Answer A Lawsuit Complaint If Ive Filed For Bankruptcy

The law presumes that if you don’t answer the complaint, you agree with the allegations of the lawsuit. Consider answering the lawsuit if you have a defense or you want to buy time to consider your options. Consult with the Phoenix, Arizona bankruptcy attorneys at Arentz Law Group, PLLC to further discuss your situation.

Pitfalls Of Bankruptcy In Arizona

by John Skiba, Esq. | Sep 1, 2016 | Bankruptcy, Bankruptcy A to Z, Chapter 13 Bankruptcy, Chapter 7 Bankruptcy |

Bankruptcy is a powerful tool that can once and for all eliminate your debt problems. And while bankruptcy is a lot less painful than most imagine, there are certain pitfalls that can make the process a whole lot more complicated. ;In this post I am going to discuss 13 pitfalls of bankruptcy most of which can be avoided with a little planning.

Here we go

Read Also: How To File Bankruptcy In Wisconsin

Filing Bankruptcy In Arizona

Youll notice from the table of the contents that we focus specifically on Chapter 7 and Chapter 13 bankruptcy. Why? Because these two types of bankruptcy are the most common bankruptcy in America . There are other types such as the Chapter 11 and Chapter 11 subchapter 5 bankruptcies, but these are far less common for consumers .

Chapter 7 bankruptcy is also known as the liquidation bankruptcy. Chapter 13 bankruptcy is also known as wage earners plan. We will cover these in greater detail

How To File Bankruptcy In Arizona

There are several things that are related to financial matters. A few common reasons include;unmanageable debt, divorce, sudden illness, foreclosure, or sudden unemployment.

In fact, the average credit card debt in Arizona is a whopping $4,919 per person. In addition, foreclosure rates are also as staggering, one out of every 2,609 AZ homes is currently in foreclosure.

If you find yourself struggling with similar situations, then you are more than likely facing other personal issues that come with dealing with debt. The fear of losing your vehicle, home or your money can drain a person physically. You may have even considered Filing Chapter 7 or Chapter 13 Bankruptcy .

If you are thinking Should I File Bankruptcy? you are definitely not alone. Almost 1 million people file bankruptcy each year in America. Bankruptcy is a tool provided by the US Government to help struggling Americans find relief from heavy debt. You may want to consider personal bankruptcy if its best for you.

Recommended Reading: What Is A Bankruptcy Petition Preparer

Chapter 7 Vs Chapter Bankruptcy Filing

After conferring with an attorney and assessing your debt situation, if declaring bankruptcy is the best means for your case, choose the best chapter of BK that is best for your financial goals.

With the assistance of an experienced debt relief law firm, review all your options, and begin the process toward a fresh start.; Therefore, there are different reasons why clients file Chapter 7 or Chapter 13 BK.;

Therefore, each chapter provides different protections and protections when eliminating debt.; However, these variances within the bankruptcy chapters are best explained by knowledgeable Phoenix bankruptcy lawyers.

Contact My Arizona Lawyers to schedule a FREE DEBT EVALUATION and CONSULTATION with an attorney experienced in Chapter 7 and Chapter 13 Arizona bankruptcy law. An attorney will hep you establish which chapter filing is best for your specific debt situation.

Take Bankruptcy Course 2

One of the final hurdles you will have to clear before the court can grant you a bankruptcy discharge is the financial management course. The court will even send you a notice about this course shortly after your case is filed, although you can’t actually take this course until after your case has been filed.

In fact, it doesn’t even have to be completed before the meeting of creditors, but it makes sense to get it out of the way. This way, you know you are completely done with all of the minimum requirements when you are done with your creditors’ meeting.

You have to make sure that you go to a company approved to offer this course to folks filing bankruptcy in Arizona. If you liked the company you used for your first class, you may want to find out right then and there if they are approved to offer this second course, too. You may even be able to get a package deal!

You May Like: What Is Epiq Bankruptcy Solutions Llc

Previously Filed Chapter 13 And Filing Chapter 7 Now

If you received a discharge from Chapter 13,;you will need to wait six years from the date you filed that case before you filing Chapter 7. It should be noted that there is an exception to this rule. The six-year limit does not apply if, during the Chapter 13 you did the following:

- paid back all of your unsecured debts, or

- paid back at least 70% of unsecured debts and your plan was proposed in good faith and your best effort.;

Filing Bankruptcy Without Your Spouse In Arizona

Spouses typically apply for loans and credit cards jointly, in both of their names. This makes each of them contractually liable for the debt. But occasionally debt is taken out in only one spouses name during marriage. In these situations, the spouse named on the debt is contractually liable for the debt, and the other spouse is not. People often mistakenly assume this means the un-named spouse has no liability for the debt, and therefore need not consider filing bankruptcy if the debt isnt paid. Unfortunately, that is not a correct assumption here in Arizona.

Don’t Miss: How To File Bankruptcy In Wisconsin

Objections To Your Discharge

A creditor could object to your bankruptcy release in a few circumstances. This right is extended to your institutions that are financial offer payday advances.

Using an online payday loan soon before doing the bankruptcy filing can lead to an objection. The creditor may argue which you took the mortgage because of the intention of never ever paying it back once again. The Arizona bankruptcy court will need to examine the full instance to ascertain whether or not the objection is legitimate.

Previously Filed Chapter 13 And Filing Chapter 13 Again

If you received a discharge in Chapter 13,;you will need to wait two years from the date you filed that case before you can file another Chapter 13 and receive a discharge.;It usually takes three to five years for the repayment plan in a Chapter 13 to be discharged. Because of this, once your first Chapter 13 is closed, you can immediately be eligible for discharge in a second Chapter 13 filing.

Recommended Reading: How Many Donald Trump Bankruptcies

Protecting Marital Assets In An Az Chapter 7 Bankruptcy

If you are filing Chapter 7 bankruptcy as a married individual in Arizona, you will need to apply exemptions to your assets. If you fail to do so, the trustee may seize these assets, sell them at auction, and use the proceeds to pay off your creditors. The asset must be worth less than the relevant exemption if owned outright, and have less equity than the exemption if financed. Assets your spouse has acquired in their own name during the marriage are still community property, and must be protected by bankruptcy exemptions. Your spouses separate property doesnt need to be protected by bankruptcy exemptions.

In Arizona, the exemption for motor vehicles is $6,000 for one vehicle. For a married couple, this increases to $12,000 for one vehicle or $6,000 each for two vehicles. The Arizona homestead exemption is $150,000, which doesnt increase for a married couple. The exemption for household goods and furnishings is $6,000, which also doesnt increase for a married couple. One of the trickier exemptions in Arizona is the bank account exemption. On the date of filing, your account must be at or below $300, which increases to $600 for a married couple. You will need to make sure your case isnt filed on either your pay day or your spouses pay day.

Chapter 7 Bankruptcy Arizona

As Chapter 7 is the most common consumer bankruptcy filing, we will cover this bankruptcy first. In order to file Chapter 7 bankruptcy, you have to go through means-testing. The means test was added to the Bankruptcy Code in 2005 to prevent bankruptcy fraud. The income requirement for Arizona helps ensure that a person with a sufficient income to pay back some of the debts may file a Chapter 13 instead of Chapter 7.

Read Also: Filing For Bankruptcy In Wisconsin

If You File Under Chapter 7 You Must Also File:

- If necessary, Chapter 13 Calculation of Your Disposable Income

- Chapter 13 Plan . If Official Form 113 is not effective when you file, many bankruptcy courts require you to use a local form plan. Check the local courts website for any specific form that you might have to use. Go to http://www.uscourts.gov/courtlinks.)

Other Useful Forms

Glossary of Bankruptcy Terminology

The U.S. Federal Bankruptcy Courts website offers a fairly decent, plain-English glossary of bankruptcy terminology, which can be helpful when reading local rules and forms.

Can Someone Lose Their Home If They File For Chapter 7 Bankruptcy

A person can lose their home if they file for Chapter 7 bankruptcy protection. But dont panic. In Arizona, it is rare to see a person lose his home because he filed for Chapter 7 bankruptcy protection. This is because the homestead exemption most people in Arizona is $150,000. What this means is if your equity in the property is less than $150,000, theres a good chance that youll be able to keep your house. However, if your equity is higher than $150,000, you could lose the house. You must be residing in the house in order to get the homestead protection. If you reside elsewhere or have a second home, you cannot apply the homestead to more than one of the properties.

Another problem arises when a person is behind on payments in a Chapter 7 bankruptcy. If that happens, the creditor will file what is called a motion to lift the automatic stay. The automatic stay is the protection that automatically goes into effect in Chapter 7 cases when the case is filed. It prevents the creditor from suing the debtor, maintaining an already-filed lawsuit, garnishing wages or bank accounts, foreclosing on real estate, etc. The creditor will ask the judge for permission to pursue a foreclosure action even though the Chapter 7 case has been filed. The judge will almost always say yes.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

How Do I Rebuild Once My Chapter 7 Bankruptcy Is Over

Rebuilding Your Credit;Immediately after your bankruptcy, some simple steps can be taken to;start rebuilding your credit.

How Long do I Have to Wait to Buy a House or Car?;Your bankruptcy will be listed on your credit report for some years to come, but that does not mean you will not be able to purchase a new car or home.

You can usually purchase a car right after your bankruptcy.;You might be required to jump through some extra hoops approval wise, and you might not get the best interest rate, but most clients are able to purchase a vehicle right away. If you work on rebuilding your credit after the bankruptcy, then you will be able to purchase a car at a better interest rate fairly quickly.

Qualifying for a home after bankruptcy takes a little more time and effort. You should be taking all the steps necessary to help rebuild your credit as soon as possible. You should also get a copy of your credit report soon after your bankruptcy and check to be sure that all discharged debt is removed. Sometimes a mortgage expert can even help you with this process. If you diligently do these things, you often will;qualify for a home in as little as two years;after your bankruptcy.

How Can An Arizona Bankruptcy Attorney Help

If youve fallen behind on credit card payments, are struggling with unpaid medical bills, or are underwater in your home, contact a bankruptcy specialist at Lerner and Rowe Law Group. Our Arizona bankruptcy lawyers have helped hundreds of clients get a fresh financial start. Call to schedule an initial consultation at no cost to you. Well explore your legal options and help you make the right decision for you.

Reach us by phone at in Tucson, Phoenix, and throughout Arizona. You can also chat with a live representative online now, or submit the details of your case to our legal team using our secure contact form.

Lerner and Rowe® Law Group is owned and operated by attorneys Glen Lerner and Kevin Rowe. Sean Forrester is the criminal defense managing attorney of Lerner and Rowe Law Group and is a licensed attorney in the state of Arizona. Andrew Nemeth is the bankruptcy managing attorney of Lerner and Rowe Law Group and is licensed in the state of Arizona.

Voted Best Best Criminal Defense and Bankruptcy Law Firm in the Valley in 2016, 2017, 2018, 2019, 2020 and 2021 in AZ Foothill Magazine independent reader polls.Awarded membership with Arizonas Finest Lawyers through peer-review for demonstrating leadership and professional standards consistent with AFLs criteria and guidelines.

Being a client of one firm does NOT create any attorney client relationship with the other.

Also Check: What Is Epiq Bankruptcy Solutions Llc

How Does Bankruptcy Affect Joint Accounts And Cosigners

Filing for bankruptcy protects the filer, but does not protect the holder of a joint credit card account or the cosigner of a loan. Therefore, when the bankruptcy court issues the automatic stay against the bankruptcy filer, the creditor does not have to sit back and wait for the debt to be discharged. Instead, the creditor can go after the cosigner for the whole amount. This is less of an issue in Chapter 13, where the debtors share of the obligation can be factored into the payment plan. However, it is a major issue in Chapter 7, where the bankruptcy filer can skip out on the debt, leaving the cosigner obligated for the entire amount. One way to avoid this unfair result is for the debtor to reaffirm the obligation so that debt does not become part of the bankruptcy estate and is not discharged.

Free In-Depth

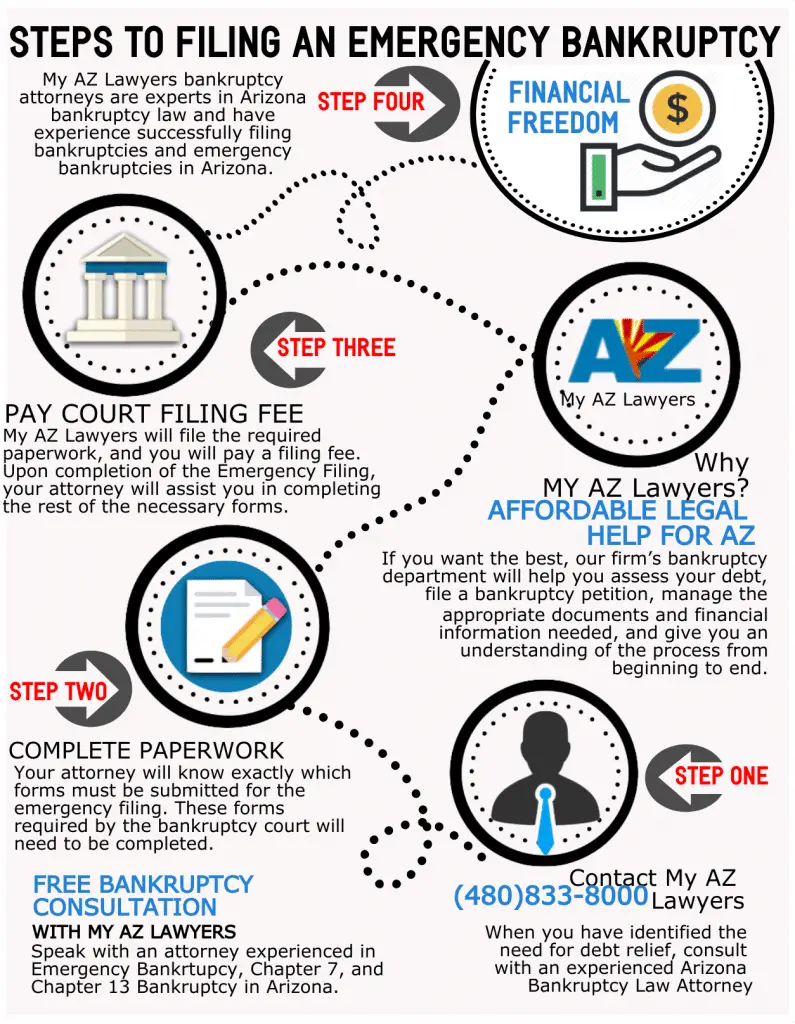

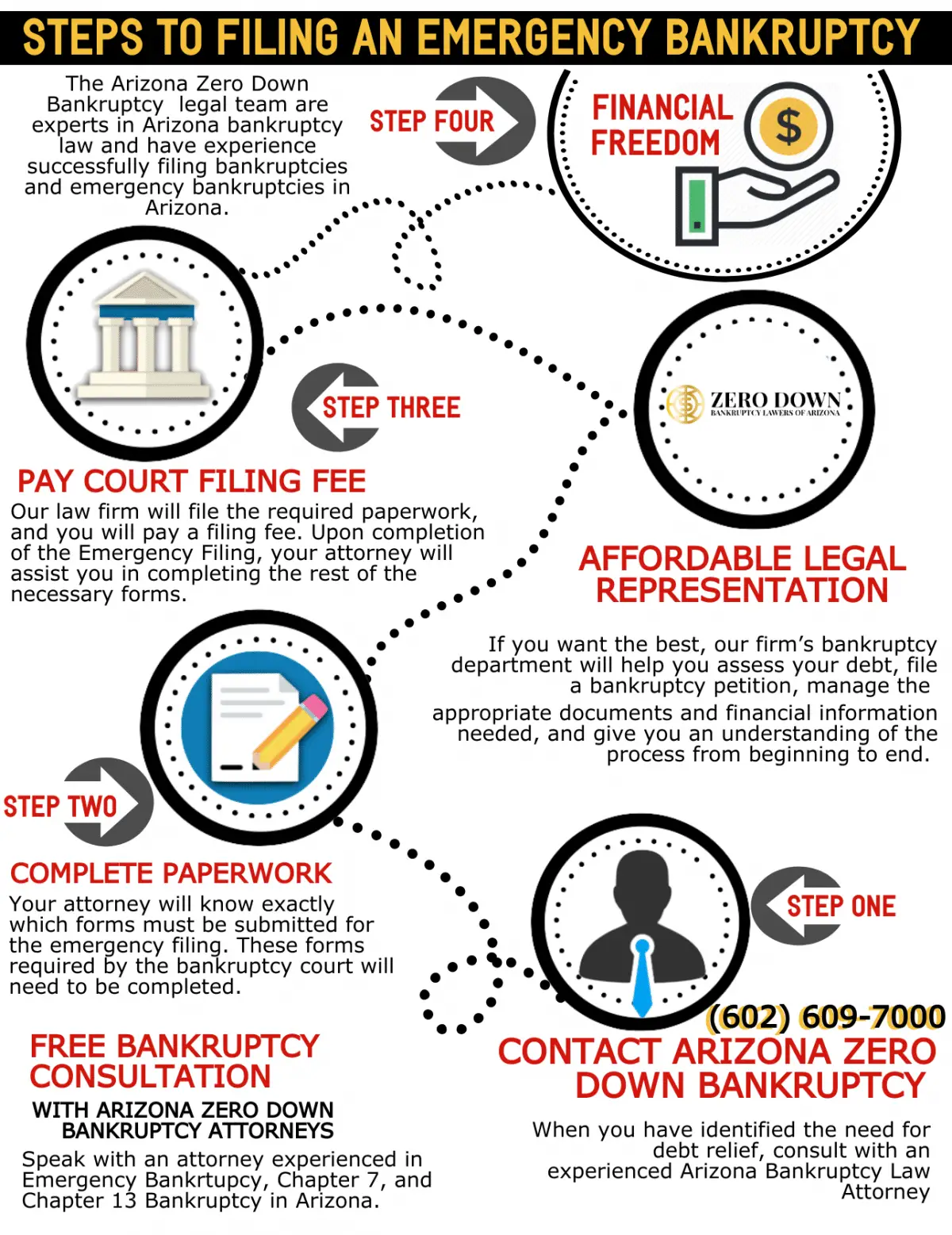

How To File For Bankruptcy In Arizona

Before filing for bankruptcy it is important to seek legal counseling with our bankruptcy attorney in Phoenix for the best options for your situation. Typically filing for bankruptcy consist of the following steps:

- 1.Forms – Gather the proper filing forms

- 2.Counseling – You must take a credit counseling before filing a case.

- 3.Complete Forms – Ensure that you are properly filling out forms with a bankruptcy attorney and avoid delays.

- 4.Print & File – File your forms by going to a Court house in Phoenix.

- 5.Mail Documents to Trustee – Depending on your case, you will receive a letter from a trustee handling your case with a questionnaire you will need to respond to.

- 6.Bankruptcy Course & 341 Meeting – You will need to take a final financial management course and attend a meeting of creditors .

Overall the journey may seem long and complex but with our bankruptcy lawyer at the Law Office of Harold E. Campbell P.C, we will provide professional guidance.

Read Also: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy?