Building Credit After Chapter 7 Bankruptcy

Most can rebuild their credit rating and have a better score than ever within 1 – 2 years after they file Chapter 7 bankruptcy. But, you canât take this for granted. To get the full benefit of your bankruptcy filing, youâll have to make an effort to improve your credit score.

Getting new credit after filing bankruptcy – itâs easier than you might think!

One of the biggest surprises for many bankruptcy filers is the amount of car loan and credit card offers they receive – often within a couple of weeks of filing their case. Itâs a lot! Why?

Filing Chapter 7 bankruptcy makes you a low credit risk

The Bankruptcy Code limits how often someone can file a bankruptcy. Once you get a Chapter 7 bankruptcy discharge, youâre not able to get another one for 8 years. Banks, credit card issuers and other lenders know this.

They also know that, with the possible exception of your student loans, you have no unsecured debts and no monthly debt payment obligations. This tells them that you can use all of your disposable income to make monthly payments.

Beware of high interest rates

Pay close attention to the interest rates in the new credit offers you receive. Credit card companies and car loan lenders have the upper hand here. They know you want to build your credit rating back to an excellent FICO score. And they know that youâll be willing to pay a higher interest rate than someone with perfect credit and no bankruptcy on their record.

Shop around

Ask The Courts How The Bankruptcy Was Verified

Next, you will need to contact the courts that were specified by the credit bureaus.

Ask them how they went about verifying the bankruptcy. If they tell you they didnt verify anything, ask for that statement in writing.

After you receive the letter, mail it to the credit bureaus and demand that they immediately remove the bankruptcy as they knowingly provided false information and therefore are in violation of the Fair Credit Reporting Act.

If all goes well, the bankruptcy will be removed.

Removing A Bankruptcy Filing From Your Credit History

A bankruptcy discharge can be removed from public records if you prove it was misreported.

You should be wary of mistakes such as:

- Incorrect information on your credit report

- Individual accounts staying on your credit report longer than 7 or 10 years

- Incorrect bankruptcy filing dates

- Discharged debts still showing on your report

- Incorrect names, addresses, contact information, or dates

- Bankruptcy appearing on your report when it wasn’t your responsibility

In some cases, a bankruptcy can appear on your report because of mistaken identity, identity theft, administrative mistakes, or a completely random error. These are less common, but you may need an attorney to prove it is not your responsibility.

Also Check: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy

Will A Bankruptcy Ruin Your Credit Forever

No, a bankruptcy will not ruin your credit forever. When you first file for bankruptcy your credit score will take the biggest hit. As the bankruptcy ages, your credit score will improve so long as you responsibly borrow and make timely payments. Also, a bankruptcy only remains on your credit report for 10 years. After the 10 year period, the bankruptcy will be removed and your credit score will increase.

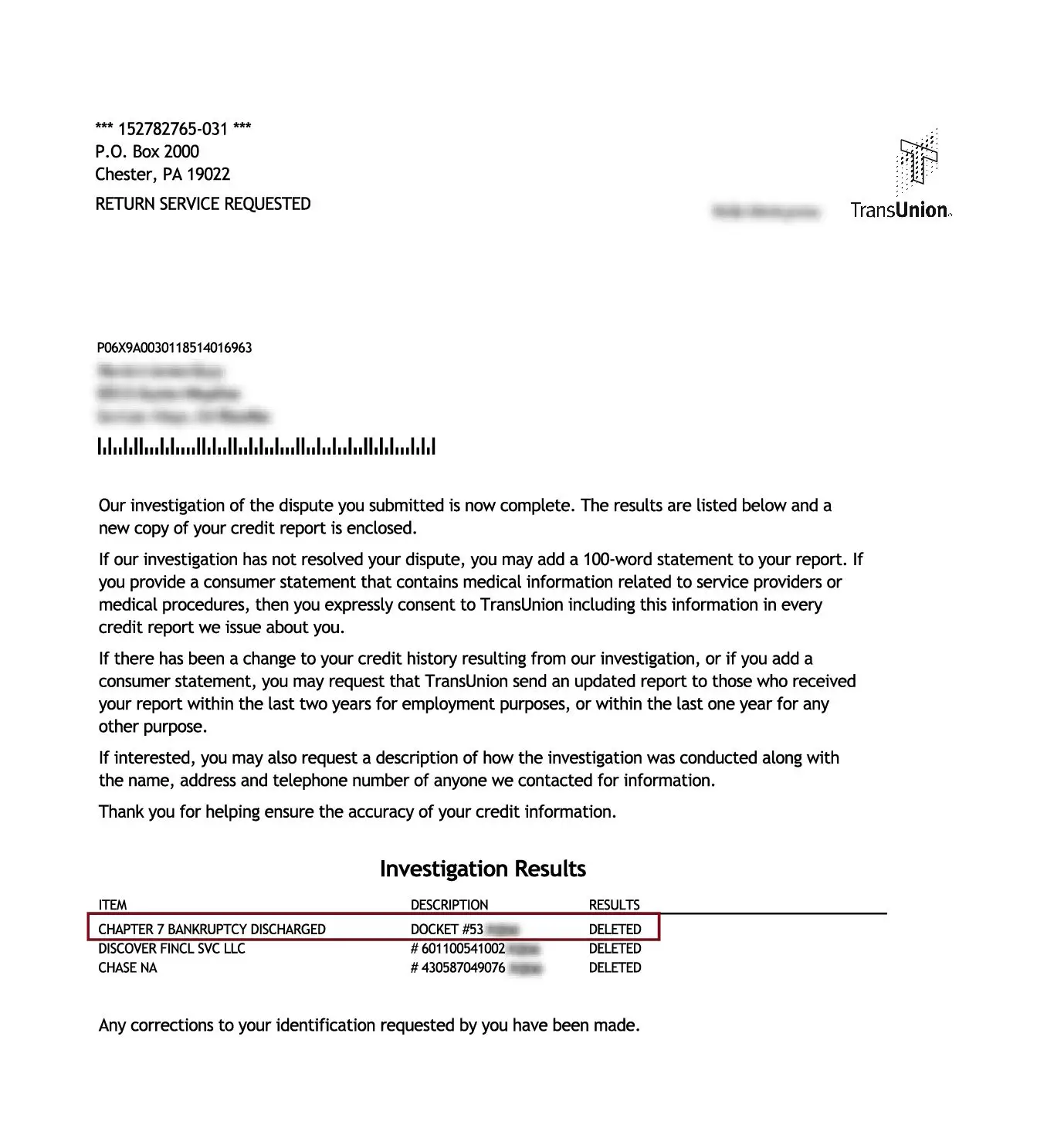

S: How To Remove Bankruptcy From Credit Reports

![How to Remove a Bankruptcy from Your Credit Report [See Proof] How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.bankruptcytalk.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

Do you feel overwhelmed by your past financial decisions? Do you wish you knew how to remove bankruptcy from your credit report?

Understanding . Let’s make it simple. So, are you ready to take the next steps to help your credit get healthy?

We have talked to multiple friends and family who have struggled with bankruptcy. It has become a widespread occurrence in today’s society.

Let’s make your experience with credit accessible and straightforward.

We have gathered the best tips and tricks on how to remove bankruptcy from credit reports so you can improve your credit and improve your life.

Recommended Reading: How Many Bankruptcies Did Trump File

Can You Remove A Bankruptcy On Your Own

Like all negative item disputes, its entirely possible to complete the process on your own. However, removing a bankruptcy from your credit report early can be a lengthy and tedious process that doesnt guarantee results.

You can dispute the bankruptcy either by stating an inaccuracy of the information on your credit report or by asking the credit bureau how it verified your bankruptcy. As with any dispute, they must respond to your procedural request letter within 30 days.

In most cases, theyll say that they verified it with the courts, but this is unlikely. You must then contact the court to ask how they verified your bankruptcy.

If they respond that they never verified it, you should get that statement in writing, send it to the credit bureau, and ask them to remove the bankruptcy.

This method isnt guaranteed, but it might be worth trying. Otherwise, enlist the help of a credit repair company to navigate the process for you.

Credit repair companies are highly experienced at disputing negative items on your credit reports. They specialize in getting bankruptcies deleted from your credit report. They also work to remove other negative information included in the bankruptcy, like charge offs and collections.

Can A Bankruptcy Come Off My Credit Report Early

A legitimate bankruptcy record cannot be removed from your credit report, but a bankruptcy can come off your report if it is inaccurately entered or otherwise incorrect.

The FCRA makes provisions for challenging anything on your credit report that is incorrect, has remained on your credit report beyond the maximum time allowed, or cannot be substantiated by the creditor who reported it.

In the case of bankruptcies especially because they remain on the credit report for so many years its not uncommon for errors to creep in.Some of the most common errors we find include:

- Debts that were discharged in the bankruptcy are still showing a balance.

- Individual accounts included in the bankruptcy are still appearing on the report after seven years. In both Chapter 7 and Chapter 13 bankruptcies, the individual affected accounts can only impact your report for seven years starting from original delinquency date, not the filing date of the bankruptcy in which they were discharged.

- The bankruptcy is still showing up on a report more than 10 years after the filing date.

- Any sort of material error in how the bankruptcy was reported, from the spelling of names to accurate addresses, phone numbers, dates, etc.

If any of these or other errors appear on your credit report, you have the right to challenge those errors. The reporting agency must remove them if the reporting agency cannot substantiate the item.

Also Check: How Many Times Did Donald Trump File For Bankruptcy

How To Get A Dismissed Bankruptcy Off Your Credit Report

read more How To Get A Dismissed Bankruptcy Off Your Credit Report

Uncover A couple of Crucial Information When selecting A personal bankruptcy Attorney

If you’re planning on getting a bankruptcy lawyer, you need to make sure of a couple of things which means you understand that you earn the best choice. After all, you shouldn’t leave finances in the hands of just any person. Find out some specifics that you can consider when searching for your firm which addresses your own situation.

You need to 1st determine if this kind of subject matter will be the only 1 handled through the attorney. You will want professional, certainly not somebody who dabbles in a bit of everything. This means you may need to look for a bankruptcy attorney especially, not necessarily somebody that furthermore deals a great deal along with divorce, criminal defense, as well as levy regulations. You may be shocked what number of legal professionals often undertake all kinds of situations. Even though it is wonderful so that you can get tips on several themes just a single firm, it’s best to find a consultant given that they may execute a best wishes in your a bankruptcy proceeding scenario, not merely the alright work on many instances for a similar person. You can find out this kind of depth on-line since most legitimate websites mention which apply places the legal professionals tend to be familiar with.

How To Get A Dismissed Bankruptcy Off Your Credit Report

How To Get Proof You’ve Been Discharged

Your discharge from bankruptcy will happen automatically, so you won’t necessarily get proof sent to you.

Email the Insolvency Service to get a free confirmation letter. You should only ask for this after the discharge date.

If you ask for a confirmation letter, you must include your:

- full name

- National Insurance number

- court reference number

If youre applying for a mortgage, youll need a Certificate of Discharge. If you originally applied for bankruptcy through a court then youll need to ask them for a certificate. This costs £70 and £10 for extra copies.

If you originally applied for bankruptcy online, email the Insolvency Service for a certificate. Theres no fee for a Certificate of Discharge if you applied online.

You May Like: How To Get Out Of Bankruptcy Chapter 13 Early

Myths About Credit Score After Bankruptcy

Everyone wants to know when considering bankruptcy: How long does bankruptcy affect my credit? What will my credit score be after bankruptcy? Will I ever be able to apply for a credit card again without being credit-shamed? There are a few myths about credit scoring and credit post-bankruptcy filing that we like to debunk to give our clients some peace of mind.

One is that you cant get a loan or credit card after filing for bankruptcy. This simply is not true. While Visa and Mastercard may not be sending you offers with frequent flier miles for a while, many clients successfully apply for secured cards to help them restore their credit faster. These cards require collateral, are available for people with damaged credit, and help build credit like any other card.

Another myth is that bankruptcy will ruin your credit forever. In fact, some imagine a dramatic movie where a character realizes they are bankrupt and yells Im ruined to the heavens. But this is also a myth and not reality. Although bankruptcy will damage your credit in the short term, its impact will absolutely be gone from your credit report after no more than ten years. And there are opportunities to practice good financial habits along the way, such as paying bills on time and avoiding purchases you do not have the income to pay for, which will make your credit stronger than ever.

Does A Dismissed Bankruptcy Still Show Up On Your Credit And Affect Your Score

Submitted by Rachel R on Thu, 04/30/2015 – 10:06am

How bankruptcy can affect your credit score

Image Source: Flickr User GotCredit

Not every bankruptcy filing is seen all the way to its conclusion. For instance, if you file a Chapter 13 to try and stop a foreclosure while you refinance your home, you may not want to stick with the filing once your mortgage crisis resolves. Many consumers file to save their home, and then work things out or decide to give up on the home and then let the Chapter 13 bankruptcy fall by the wayside and stop making payments. It’s important to understand that this bankruptcy will still affect your credit. Here’s what you need to know.

How Bankruptcy Affects Your Credit Score

When you file bankruptcy, your credit score will take a hit. That’s a fact. However, if you’re deep in debt you can’t pay, your credit score is already taking a beating every month you miss payments to creditors. It will be further impaired if a creditor sues you and obtains a judgment. The bottom line is, wallowing in a debt crisis will see your credit on a decline to rock bottom. When you file bankruptcy, your then will begin to rebound because you won’t have delinquent accounts dragging it down every month. From there, you can rebuild your credit strategically. This is often a better outcome than continuing to stay in endless debt with no resolution in sight.

How a Dismissed Bankruptcy Affects Your Credit Score

How Long Does a Bankruptcy Entry Affect Your Credit?

Don’t Miss: Cost To File Bankruptcy In Wisconsin

Causes Of Bankruptcy Dismissal

Here are some specific reasons your bankruptcy case might be dismissed:

- Failure to comply with court rules

- Procedural violations

- Fraud against creditors, lenders, or courts

- Failure to make court appearances or attend creditors meetings

- Failure to pay filing fees or installment payments

- Prior cases, prior dismissals, and prior discharges

- Failure to make timely plan payments in a Chapter 13 case

Hire A Credit Repair Specialist To Deal With The Bankruptcy

This is obviously a lot of work, and it may seem a bit overwhelming. You may feel like its too much to handle with everything else going on in your life.

In that case, you may want to procure the services of a quality credit repair company. You could also hire a good bankruptcy attorney.

Granted, its never a good feeling when you pay out of pocket to fix something that wasnt your fault.

Taking it on by yourself can be a big challenge, though. It will cost you in terms of time and money.

Someday, fraud and cybercrime might be a thing of the past. But, for now, its a part of life that many of us have to deal with at one time or another.

Read Also: Can You Rent An Apartment While In Chapter 13

Filing A Chapter 7 Case After A Dismissed Chapter 13 Case

If you have a dismissed Chapter 13 case, you might be able to re-file under Chapter 7 as long as youâre under the income limits. Youâll also want to make sure that available bankruptcy exemptions protect all of your property since thatâs not typically an issue in Chapter 13. Barring any problems, you might be able to file a Chapter 7 case to get rid of unsecured debts even though you have a dismissed Chapter 13 case.

Because you are filing under Chapter 7, you might be able to file without an attorney since you will not need to file a Chapter 13 repayment plan. You do need to make sure that the automatic stay will go into effect and that youâre not barred from filing another bankruptcy case because of the reason for your dismissed Chapter 13 case.

Professional Help From A Credit Repair Company

Any time you try to dispute a negative item on your credit report, whether its a bankruptcy or a credit card late payment, its bound to be a long, arduous journey.

To save yourself a major headache, consider hiring a professional credit repair company. Theyll not only review your bankruptcy entries, but everything else on your credit report as well, so you can benefit from a holistic strategy for repairing your credit.

Also Check: Dave Ramsey Engagement Ring

What Should You Do To Improve Your Credit Score After A Bankruptcy

After you have filed for bankruptcy, it will be very difficult for you to be approved for any type of credit, including regular unsecured credit cards. So, you should ease back into borrowing money by applying for a secured credit card. A secured card is just as good for your credit as is an unsecured credit card, but there is a difference. With a secured credit card, your credit limit is determined by a security deposit that you give the issuer.

For example, if you want a $500 credit limit, the card issuer will ask you for a $500 deposit. The security deposit is kept by the bank as collateral in the event that you fail to repay your credit card. Usually, if you use the credit card and make all of your payments on time, the card issuer will return the security deposit to you within 12 to 18 months.

Dont be discouraged from applying for a secured credit card after your debt has been discharged. Its one of the greatest ways to build a good credit history after bankruptcy. That said, make sure to make all of your payments on time and dont fall back into the bad habits that cause you to file for bankruptcy the first time.

Here are some quick tips on improving your credit score:

How Long Does A Bankruptcy Stay On My Credit Report

There are differences in severity between a Chapter 7 and a Chapter 13 bankruptcy. According to the Fair Credit Reporting Act , a Chapter 7 bankruptcy can remain on your credit history for up to 10 years from the filing date and a Chapter 13 bankruptcy can remain for a maximum of 7 years.

The FCRA states only the legal maximum amount of time bankruptcies can appear on your report and not the minimum. This means a bankruptcy can be removed earlier than the legal maximum, but it must be proven that it is misreported, unsubstantiated or otherwise found inaccurate. A bankruptcy cannot be removed simply because you do not want it there.

Don’t Miss: How To Claim Bankruptcy In Massachusetts

Converting To A Chapter 7 Case To Avoid A Dismissed Chapter 13 Case

Depending on why youâre at risk of having your Chapter 13 case dismissed, you may be able to convert it to a Chapter 7 case. Most bankruptcy courts allow you to do so by filing a simple ânoticeâ and paying a small conversion fee.

Whether conversion is an option depends on your situation. For example, if youâre unable to stay in the Chapter 13 payment plan because youâve lost your job and itâs not looking like youâll be able to get anything comparable anytime soon, you likely qualify for Chapter 7 relief even if you didnât when the case was first filed.

Of course, you want to make sure that you will not have any other problems when converting to a case under Chapter 7 to avoid a dismissed Chapter 13 case. If youâre behind on your mortgage payments or have property with non-exempt equity, you could face losing this property in a Chapter 7 case.