How Does This Affect My Credit Score

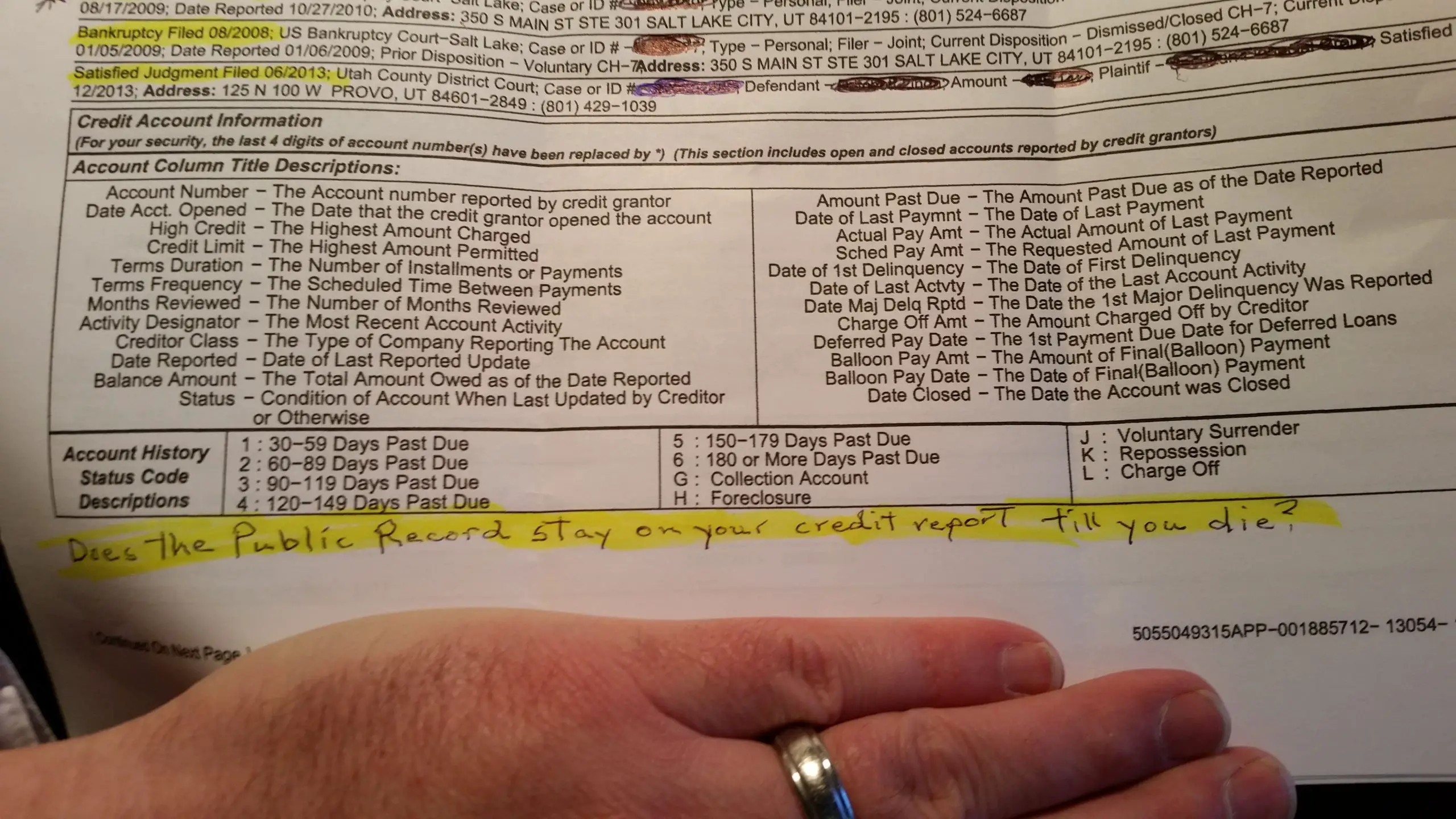

Bankruptcy stays on your credit report for up to ten years. This negative information will impact your credit score, sometimes called your FICO score, less over time. In most cases, a personâs credit score is better within two years after the bankruptcy filing date, than it was the day before they filed bankruptcy. This is because the most important factors in a credit score involve your financial situation. If youâre overwhelmed with debt, you will have a difficult time paying your bills. Bankruptcy fixes this problem. If you take the necessary steps to build credit after your bankruptcy, such as getting a secured credit card, the bankruptcy notation on the credit report will have little impact in most cases. The notation will let lenders know that you canât file another bankruptcy for a period of time. This actually lowers the risk to the bank considering giving new loans to you. Still, the bankruptcy notation can be a factor when you apply for a mortgage anytime within the first four years after filing. This depends on what type of mortgage you apply for and what type of bankruptcy you filed. Under certain circumstances, a lender will approve a mortgage for you while you’re still in bankruptcy.

Are Bankruptcy Filings Public Records

If youre struggling to repay your outstanding financial obligations, you might be considering bankruptcy as a debt solution. But youre probably wondering if anyone is able to find out about it.

Do you know what information is put on record for bankruptcy filings, and who can access those records?

Read on to learn exactly what happens with your information when you file for bankruptcy.

Are There Any Employment Restrictions

The Bankruptcy Act 1966 does not impose any restrictions on employment, either during or after bankruptcy. However some trades or professions may impose restrictions.

We recommend you contact the relevant agency or association to see if your bankruptcy will impact your employment. Common professions that bankruptcy may affect are listed under employment restrictions.

You May Like: How Many Times Has Trump Declared Bankruptcy

What Happens After I Have Scanned My Id

The ID will be automatically verified by the InstantID technology and the information will undergo an internal review and verification by the National Crime Check Compliance and Verification team prior to submitting your police check application for processing.

This usually occurs on the same business day or the next business day. This is just to ensure that the information is accurate and meets the set police check lodgement requirements.

What happens if my ID gets declined?

Please check if your ID is readable and fulfils the required criteria. Try to scan the ID again, or upload it manually. If you are experiencing difficulties please email our support team with your first name, surname and date of birth. One of our compliance team will assist in your support inquiry.

How To Cancel Attachment Orders Or Direct Debits

Once you have entered NAP you need to cancel any direct debits, unless the type of debt isnt included in your procedure e.g. court fines, Child Support. The Official Assignee cannot cancel the direct debit for you. You will need to contact your bank.

If you have an attachment order over your wages for a debt that is included in your NAP, your creditor should tell your employer to stop making the deductions once they receive the report from the Official Assignee. If this does not happen you need to take a copy of your NAP acceptance letter to the District Court that made the order and ask them to cancel the order.

Recommended Reading: How Many Times Has Trump Declared Bankruptcy

Is This The Right Type Of Check For Me

Most likely yes. In most cases a Criminal Record check is the only type of check that anyone can legally request of you. However there are two other types of check that you may hear about – the Full Criminal Record check and a Police Vetting check . Neither us, nor any other supplier, can provide you with either of these checks.

Complain To Your Current Credit Provider The Listing Creditor Or Credit Reporting Body

If you send a complaint to a credit reporting body, make sure you also send a copy to any relevant creditor. Remember to date, sign and keep a copy of your letter.

If a credit reporting body or credit provider refuses to correct your credit file, they must provide the reasons why and evidence proving the correctness of the information. If you are not happy with the result of step 1, you can take step 2.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed

How Does A Debt Agreement Work

A Part 9 Debt Agreement offers you an option to have one affordable repayment towards your unsecured debts. All Debt Agreements are tailored around affordability.

With a Debt Agreement:

- the interest on your unsecured debts included in the agreement are frozen provided obligations are met and discharged

- you negotiate with your creditors to pay a percentage of your combined debt, based on what you can afford, over an agreed period of time

- you make one regular repayment either weekly, fortnightly, or monthly

- you make your repayments to a Debt Agreement administrator, such as Debt Negotiators, instead of paying your creditors individually

- a portion of your debt may be legally written off by your creditors

Once youve completed your payments, the agreement will end. Your creditors cannot try to recover the rest of the money you owe.

A Debt Agreement is not an agreement to borrow money or a consolidation loan and cannot release you from all types of debts. There are some debts youll still need to pay.

Debt Negotiators are experienced administrators and can help negotiate Debt Agreements on your behalf and can help you identify whether this is the right debt solution for you.

How Can I Remove A Bankruptcy From My Credit Report Early

You canât get the bankruptcy off your credit report until the credit bureau decides to take it off or the ten years allowed by law has run. Some credit repair companies will urge you to file a dispute with the credit bureaus claiming that you never filed bankruptcy. But, itâs very simple for the credit bureau to check and see that you did file bankruptcy. The credit bureaus do have PACER accounts. They can check to see if you have filed bankruptcy in less than thirty seconds. By lying to the credit bureaus, you have lost credibility with them should you have a real dispute. If a credit bureau refuses to fix one of its real errors and you sue it, its lawyers will let the court know that you lied about another error. Judges frown on known liars. Since you may have problems fixing future errors if caught lying, it will be more difficult to rebuild your credit.

Recommended Reading: Bankruptcy Petition Preparer

Is A Debt Agreement Right For Me

If you enter into a debt agreement, youll be able to make periodic payments, or lump sum payments, in a way that suits you, and your debt will often be reduced to an agreed amount.

Wile Debt Agreements still have negative financial implications they can be a better alternative to declaring bankruptcy. However, Debt Agreements are a solution that should only be considered in times of extreme debt. Debt Negotiators can help you to reach a debt agreement, and settle your debt with creditors. Contact us today for advice, or to arrange a consultation.

Under What Circumstances Can I Select The Volunteer Check Type

Volunteer checks may only be requested if you:

- Perform the role on a voluntary basis for the benefit of the community or

- Not be an employee, contractor, subcontractor, staff member or officer of an organisation or

- not be entitled to a salary or any other entitlements or benefits associated with the position or role or

- be a student undertaking a compulsory vocational placement as a requirement of an Australian-based academic institution or training course.

You May Like: How Many Times Has Trump Declared Bankruptcy

If Creditors Keep Chasing You

You can check your estate details on our website to make sure we’ve been told about the creditor.

If the creditor is not listed against your estate, give your estate officer their details so that they can be contacted and given a chance to file a claim.

If creditors that are included in the NAP keep chasing you for payment, give them your estate number and ask them to contact your estate officer. They can also search for your insolvency details on our public register.

Surviving Bankruptcies In Australia

Surviving Bankruptcies in Australia

Surviving Bankruptcies in Australia

Filling for bankruptcy certainly feels like you have hit rock bottom in your finances. While it does help you get rid of your debt, the bankruptcy still stays on the credit report for a few years. However, it is also a chance to start from a clean slate.

You can still improve your situation and be in control from the beginning to avoid going once again into financial troubles. There are various ways of surviving bankruptcy in Australia. Lets have a look.

Recommended Reading: How To Buy A New Car After Bankruptcy

How Much Debt Do You Have To Have To Declare Bankruptcy

There is no minimum debt amount required in order for you to declare bankruptcy. However, if you have more than $10,000 in debt with a particular creditor, and the creditor has unsuccessfully tried to recover the debts you owe them, they can force you into bankruptcy.

The types of debt that you can include in your bankruptcy include:

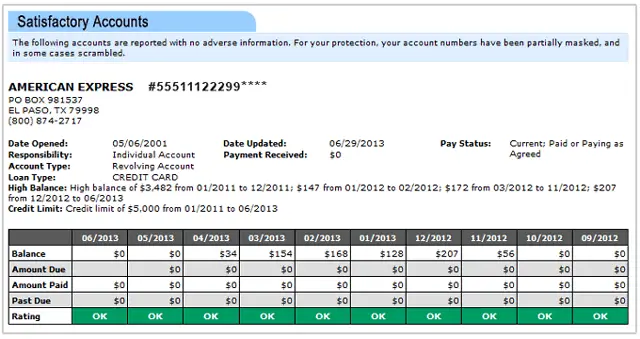

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Recommended Reading: What Does Dave Ramsey Say About Bankruptcy

What Does It Cost To Go Bankrupt

There is no cost for a debtor to file a bankruptcy petition.

If a debtor is discharged from bankruptcy without paying any payments toward their debts, no fees are payable.

Where a bankrupt’s trustee collects money through either the recovery or sale of assets or through contributions, fees and percentages are payable to the Official Trustee. The administration charges are set out on the Fees and charges page of the AFSA website.

Private trustees’ fees are based on an hourly rate and can be very expensive. A small debt may be dramatically increased if a person is made bankrupt unnecessarily.

A who issues Court proceedings to make a person bankrupt must pay a Court filing fee as well as meet the cost of preparing the documents, and appearing in Court. This cost is recoverable from the bankrupt’s estate, but only if there are sufficient assets available to meet the claims of creditors. The cost can be significant, and it is prudent for a creditor to undertake investigation of the debtor’s assets prior to spending money on a creditor’s petition.

What Will I Lose If I Am Bankrupt

Any property that you own will vest in the trustee. It is only your share that vests, so if you own a house jointly with another person, the trustee becomes the joint owner with the other person.

The other person may be asked to sell the property, or buy out your interest. If there is a mortgage and little equity, you may be able to negotiate with the trustee to keep the property as long as you maintain payments.

If your car is worth more than the threshold amount, it may be sold subject to any outstanding loan. Again, if you are paying it off and there is little equity, you may be able to retain it as long as payments are being made.

After-acquired assets are things like an inheritance, gift or lottery win. The trustee may claim after-acquired assets for a period of time even after you have been discharged.

A court or the trustee can review the sale or disposal of assets prior to bankruptcy and can set aside the transaction.

You May Like: How Many Times Did Trump Declare Bankrupcy

How Does Bankruptcy Work

There are several ways in which bankruptcy can be declared. You can enter into voluntary bankruptcy through a debtors petition, or your creditors may apply to bankrupt you through a court, which is called a creditors petition.

Once you have been declared bankrupt, you can nominate a trustee or the Australian Financial Security Authority will appoint one for you to manage your finances.

You will be classified as bankrupt for three years, and your bankruptcy will be publicly registered on the NPII, National Personal Insolvency List.

Should You Invest $1000 In Bhp Right Now

Before you consider BHP, you’ll want to hear this.

Motley Fool Investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and BHP wasn’t one of them.

The online investing service hes run for nearly a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.* And right now, Scott thinks there are 5 stocks that are better buys.

You May Like: Do It Yourself Bankruptcy Chapter 7 Software

Who Will Be Able To See My Id Once I Upload It

Only National Crime Checks internal compliance and verification staff will be able to view your ID. The ID is 100% secure.

The ID is being used solely to verify your proof of identity requirements as part of your police check application.

Upon successful lodgement of your police check information, National Crime Check will securely purge your ID in line with the ACIC accreditation compliance requirements and will no longer be accessed.

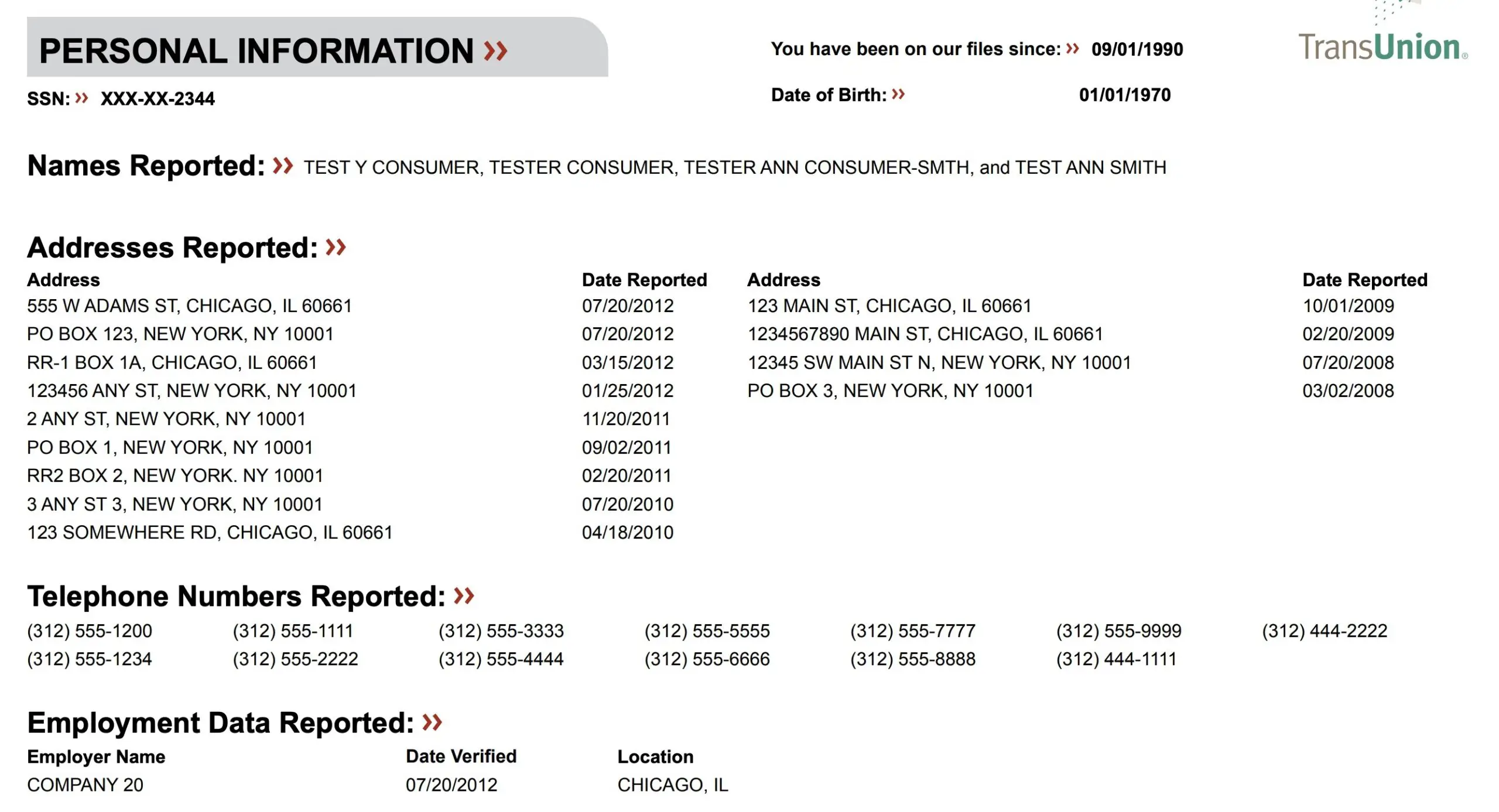

Who Can Access My Bankruptcy Records

Anyone is able to conduct a search after paying a $15 fee, and access personal bankruptcy information.

The NPII is available on the Australian Financial Security Authoritys website, and includes search tips and results.

You can search via the name and/or date of birth of an individual, or via the administration reference number. You then choose whether you want to receive either an extract or a result report . You are able to then download and save this information for your own reference.

Also Check: How Many Times Have Donald Trump Filed Bankruptcy

I Need To Make A Complaint About The Service

National Crime Check provides the service as an accredited agency of the National Police Checking Service which resides within the Australian Criminal Intelligence Commission .

The ACIC is a national division of the Department of Home Affairs that accredits all brokers.

When your check has been flagged for further review, this is done by the ACIC who then manages this in partnership with the police services. National Crime Check has no control over which checks are flagged and which are not. Once submitted to the National Police Checking Service, National Crime Check has NO control over how long they take to process your police check. We rely on the ACIC to manage this process in consultation and partnership with the state-based police services.

If you feel that your check has taken too long please contact us first. You can contact us via email on . If after this you are still not satisfied with the response given to you by National Crime Check, you can submit a complaint directly to ACIC via the contacts page on the website

Alternatively, you can make a complaint to your local MP or the Minister for DHA, Karen Andrews.

Prior to making a complaint or instigating a legal dispute it is recommended you obtain prior legal advice in relation to the Federal Governments liability in the provision of this Service. Applicants can contact Department of Home Affairs as the ACIC is part of this portfolio.

How To Request The Permission To Destroy Your Records Before The End Of Their Retention Period

If you want to destroy your books of account and records earlier than the retention period specified in How long to keep your records, you first must get written permission from the CRA.

To get this permission, you or your authorized representatives can do either of the following:

- apply in writing to your tax services office

If you destroy paper or electronic records without the CRA’s permission, you may be prosecuted.

The CRA’s permission only applies to records you have to keep under legislation it administers. The CRA is not authorized to approve the destruction of records you have to keep under other federal, provincial, territorial, or municipal laws.

Read Also: How To Buy A New Car After Bankruptcy

What Information Do I Have To Disclose When Applying For A Debt Agreement

You will need to disclose all your debts, both secured and unsecured, any leases, hire purchases and any rentals. A Debt Agreement will only deal with the provable unsecured debts.

You will also need to disclose all income that you receive such as your paid employment, any Centrelink or Child Support that you receive, any income you receive from investments and any interest earned.