Will I Have To Go To Court

Yes. About 30 to 40 days after filing the bankruptcy petition, you will have to attend a First Meeting of Creditors presided over by your bankruptcy trustee. The trustee is not a judge, but a person appointed by the United States Trustee to oversee bankruptcy cases.

At the First Meeting of Creditors, the trustee will ask you questions about your bankruptcy papers, your assets, debts and other matters. Creditors will also be permitted to ask you questions. However, usually creditors do not attend these meetings if you have filed for Chapter 7 bankruptcy. If you file for a Chapter 7 Bankruptcy, you normally do not need to return to court. If you filed for a Chapter 13 Bankruptcy, you will need to return to court for a confirmation hearing before the bankruptcy judge.

Chapter 7 Bankruptcy Involves A Lot Of Paperwork

- Assets and liabilities

- Executory contracts

- Unexpired leases

You must also supply your case trustee with all relevant and recent tax returns and might also be required to provide proof of credit counseling and information on state or federal student debt. The forms that create your official petition include:

- Complete list of creditors and amounts owed

- Statement of income sources and amounts

- Complete list of all debtor property

- A detailed list of all monthly living expenses

Because each individual filer will have a unique set of assets, debts, and financial challenges, the process of discharging debt through bankruptcy can be varied and complex. A lawyer in your area might be able to help you compile the right schedules and documents, submit them on time, and stay by your side as you navigate the bankruptcy court system.

For a legal consultation, call

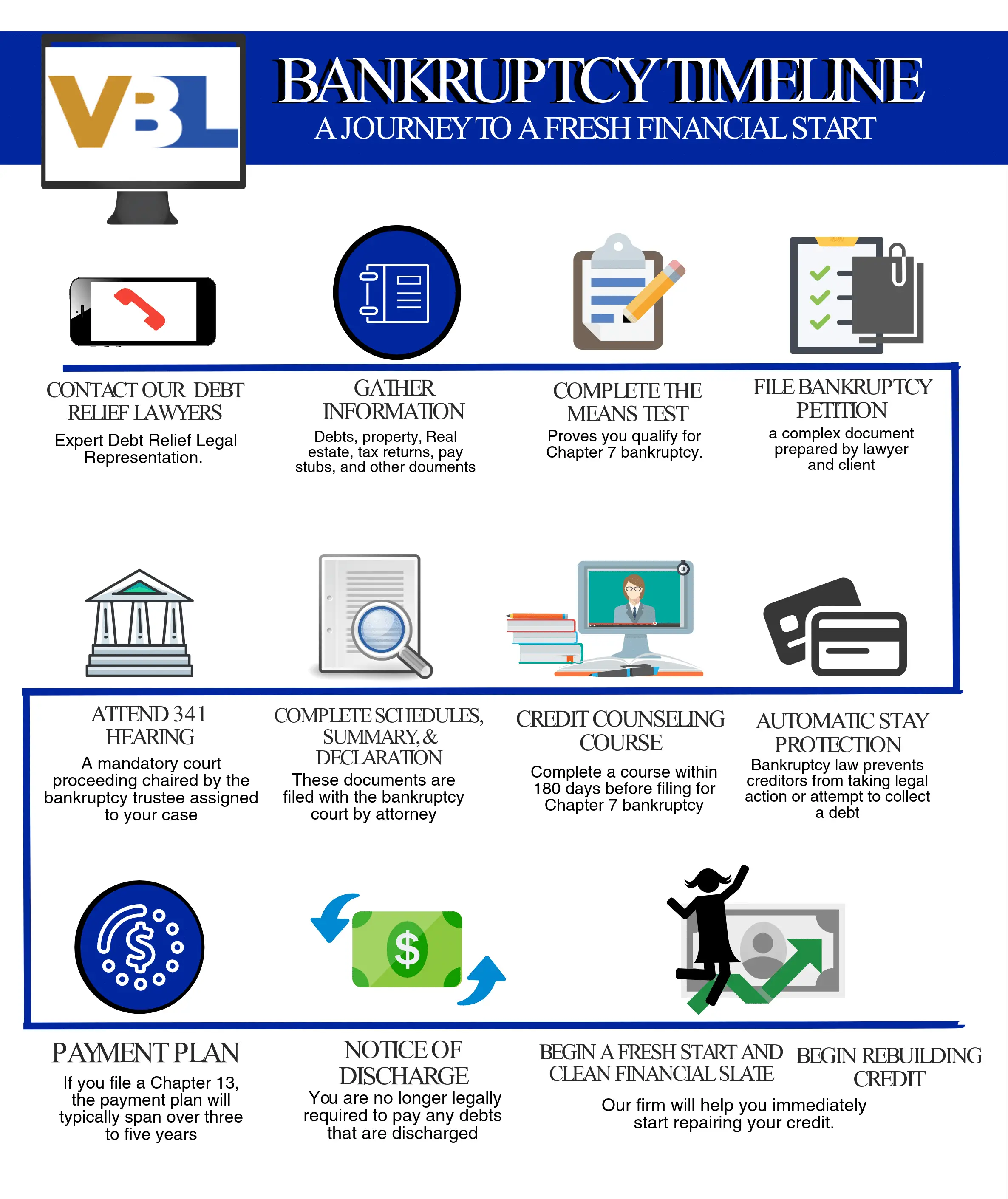

Summary Of Bankruptcy Steps

Overall, the process to file bankruptcy in Orlando includes the following steps:

Read Also: How Many Times Did Donald Trump File For Bankruptcy

The Normal Automatic Discharge

The vast majority of bankruptcies in Canada are automatically discharged after a period of nine months. Thus, most people can get on with their lives rather quickly after filing for bankruptcy. If you do not qualify for an automatic bankruptcy discharge either because you are required to pay surplus income or because you have been in bankruptcy before, your time in bankruptcy will be longer. Based on certain criteria, the automatic discharge of your bankruptcy may also be extended even though you are in bankruptcy for the first time or do not have to pay a surplus income.

What Debts Are Discharged In Chapter 7 Bankruptcy

A Chapter 7 bankruptcy will generally discharge your unsecured debts, such as credit card debt, medical bills and unsecured personal loans. The court will discharge these debts at the end of the process, generally about four to six months after you start.

Some types of unsecured debts usually aren’t discharged through a Chapter 7 bankruptcy, including:

- Child support

- Personal injury debts you owe due to an accident while you were intoxicated

- Unsecured debts that you intentionally left off your filing

Your creditor could also object and keep certain debts from getting discharged. For example, a credit card company could object to the debt from recent luxury goods purchases or cash advances, and the court may decide you still need to repay this portion of the credit card’s balance.

Additionally, a Chapter 7 bankruptcy may discharge the debt you owe on secured loans. Secured loans are those backed by collateral, such as your home for a mortgage, or when a creditor has a lien on your property. However, even if the debt is discharged, the creditor may still have the right to foreclose on or repossess your property.

You May Like: Filing For Bankruptcy In Iowa

How Can I Get A Copy Of My Credit Record

There are two ways to get your credit report : either through the mail or via the internet. If you want to obtain your credit report for free, you must use the mail. It is also important to do what you can to make sure your credit report shows a history of reliable credit repayments, and as few unfavorable repayment incidents as possible.

For more detailed information related to credit reporting, visit Equifax Canada or Trans Union website. Talk to a licensed trustee today. We have trustees everywhere from Calgary to Montreal and more. Get a free consultation today!

Filing Under Different Chapters: The Order Matters

Here are the waiting periods when a second bankruptcy case is a different chapter than the one you received your first discharge in.

Chapter 13 before Chapter 7

- If the court granted your first discharge under Chapter 13 bankruptcy, you’d need to wait six years before filing for a Chapter 7 discharge. You won’t have to wait that long however, if you paid unsecured creditors in full in the Chapter 13 case, or if you paid at least 70% of the claims, the plan was proposed in good faith and was represented your best effort.

Chapter 7 before Chapter 13

- If the court granted your first discharge under Chapter 7, you’d have to wait four years from the Chapter 7 filing date before filing a Chapter 13 case.

Also Check: How Much Does It Cost To File Bankruptcy In Iowa

Chapter 7 Notice Of Bankruptcy Case Filing

Your Notice of Bankruptcy Case Filing is an important form the court issues after we have filed your bankruptcy petition. This Notice contains your case number, district information as well as the date the petition was filed and often, your Trustees information. You can use this document to prove to anyone that you have filed bankruptcy and are under the protection of the Automatic Stay, which prohibits any creditors from contacting you or continuing with any collection actions.

Your case number will be important when you go to register for the second online credit course.

The Court will mail the Notice of Filing to all the creditors you listed in your bankruptcy, but it does take a few days for them to receive that notice. In the meantime, if you get a phone call from a creditor after we file, just let them know you have filed and provide your case number and our offices contact information.

Chapter 7 Bankruptcy Discharge Timeline

While it’s possible that you could receive a discharge within as few as 82 days after filing your case, it would be unusual. The court usually needs an additional twenty days to accommodate scheduling and other procedural requirements.

So that you’ll know what to expect, the Chapter 7 discharge timeline below covers all aspects of a typical bankruptcy filing, from the initial gathering of documents up until receiving the discharge, and should help clarify how long it will take to get a Chapter 7 discharge:

- Gathering documents. You’ll start by locating financial information, such as bills banking, retirement, and investment account statements paycheck stubs and tax returns.

- Preparing the paperwork. You’ll disclose all aspects of your finances on official bankruptcy forms. Once completed, the average bankruptcy petition, including schedules and other required documents, will be between 35 and 50 pages.

- Completing the credit counseling course. If you’re an individual bankruptcy debtor, you’ll also need to take a credit counseling course from an approved provider. Business entities are exempt from this requirement. Most courses can be completed online within a few hours.

- Passing the deadline for creditors to object. Creditors can object to the court discharging its debt but must do so within 60 days of the first day set for the 341 meeting of creditors. The court will wait until this deadline passes before issuing the discharge.

Read Also: Bankruptcy Software For Petition Preparers

What Assets Are Exempt From Bankruptcy In Ontario

When you file for bankruptcy in Ontario, you dont need to be concerned that you will lose everything. These assets are exempt under federal and provincial law:

Will Your Discharge Be Opposed

The discharge from bankruptcy is usually granted if you are earning only enough income to keep yourself and your dependants reasonably provided for, and if you have received .

Occasionally, creditors, the Trustee, or the Superintendent of Bankruptcy oppose a bankrupts discharge. When this happens, the matter goes to mediation or is heard in Court. Opposition to discharge is not common, but can happen if it is believed that you did not deal honestly with your creditors or with the Trustee, or if you have not completed your duties in bankruptcy.

You May Like: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy

Making Changes To Your Bankruptcy Forms

Your bankruptcy forms are signed under penalty of perjury. When you file, you’re declaring that the information in your bankruptcy forms is true and correct to the best of your knowledge. If you accidently leave something out or make a mistake, you’ll need to make changes to your forms.

This is done by filing an amendment with the court. You might need to file an amendment because you forgot to list an asset or a , you need to add information that was originally missed, you change your mind about signing a reaffirmation agreement, or the trustee requests that forms be amended.

How Long Does It Take To File Chapter 13 Bankruptcy

The decision to file bankruptcy is a weighty one. And if youre unsure how it works, starting the process could be both intimidating and overwhelming. So how long does it take to file Chapter 13 bankruptcy? And what can you expect during the timeline?

A Charlotte NC bankruptcy attorney at the Law Office of Jack G. Lezman, PLLC can guide you through the process and explain your options.

Read Also: Can I Get A Bankruptcy Removed Early

Bankruptcy Timeline: How Long Does It Take

Most people struggling beneath mountains of debt just want to be free. Thats because paying down high-interest credit cards and loans is almost impossible on monthly minimum payments alone. But how long does it take to complete the process from start to finish once you declare bankruptcy? Of course, like most things, the answer is: It depends. Well explain how the bankruptcy timeline works below, depending on whether you file for Chapter 7 or Chapter 13.

How Long Bankruptcy Remains On A Credit Report

Bankruptcies will remain on a credit report for seven to 10 years, depending on if Chapter 7 or Chapter 13 was filed .

- Chapter 13 bankruptcy is deleted from your credit report seven years from the filing date.

- Chapter 7 bankruptcy is deleted 10 years from the filing date.

Consumers do not have to contact a credit agency to have their bankruptcy removed. Whether it is a Chapter 7 or 13 bankruptcy, they are automatically removed after seven or 10 years.

Don’t Miss: How To Access Bankruptcy Court Filings

The Benefits Of Hiring A Bankruptcy Lawyer

While the USC states that you may represent yourself when declaring bankruptcy, there are benefits to hiring a bankruptcy lawyer. Those benefits may include a lawyers ability to:

- Weigh the benefits and limitations of filing bankruptcy

- Recommend the best bankruptcy chapter for your financial situation

- Provide information on dischargeable and nondischargeable debt

- Review the bankruptcy consequences for your vehicle, home, and other property

- Define the effect filing bankruptcy might have on your taxes

If you opt to hire a bankruptcy lawyer, they will help you complete, and file necessary forms, advise you about continuing to pay debts, and familiarize you with relevant laws and procedures. A bankruptcy lawyer will also represent you at the Chapter 7 meeting of creditors and at any court hearing held in your case.

When Are Multiple Bankruptcy Filings Abusive

The term abusive bankruptcy filing can refer to a Chapter 7 filing that doesn’t meet the means testthe qualification standard that determines a filer’s right to a debt discharge. But it can also describe a case filed by someone who inappropriately uses the bankruptcy process to evade a creditor or buy time in a collection action, such as a foreclosure or lawsuit.

Simply put, the court frowns on debtors who file with no intention of following through with the case. Repeat filers face the consequences for using such tactics, such as a lack of protection from collections or the denial of a discharge.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Read Also: Will Bankruptcy Stop A Judgement

Approximately 15 Days After Filing

Within approximately 15 days after filing, the court will send out the Notice of Commencement of Case to you. All of the creditors listed in your petition will also receive this Notification. This notice will state the date set by the court for the meeting of your creditors. It also includes deadlines for your creditors to object to your case and file their claims against you.

Can A Judge Turn Down A Bankruptcy Petition

A judge may decide that you have enough income or assets to repay your debts under Chapter 13 rather than eliminate your debts under Chapter 7. The judge may dismiss your Chapter 7 bankruptcy case in the following cases:

- If you are not eligible for Chapter 7 bankruptcy relief AND do not convert to Chapter 13, or

- If you do not qualify for bankruptcy relief due to a previous case being dismissed. 11 U.S.C. § 707

- You received a discharge under Chapter 7 within 8 years prior to the date of filing your new Chapter 7 case. 11 U.S.C. § 727

A trustee is assigned to each bankruptcy case and will determine if you can pay back some of the debt that you owe.

Don’t Miss: Toygaroo

Complete The Bankruptcy Form And Pay The Fee

To apply to go bankrupt you need to fill in an online application. You or someone helping you can fill in the form on the GOV.UK website. You can save and come back to it later if you need to.

You will need to pay a total fee of £680 to apply to go bankrupt. You won’t get this back unless you decide to cancel your application before submitting it.

You can pay the bankruptcy fee online when you fill in the form with a credit or debit card. If you pay online you can pay in instalments. The minimum online payment amount is £5 and can be paid in as many instalments as you need.

You can also pay by cash at a bank. You’ll be told which bank to use when you fill in the form. You cant pay by instalments if you pay in cash.

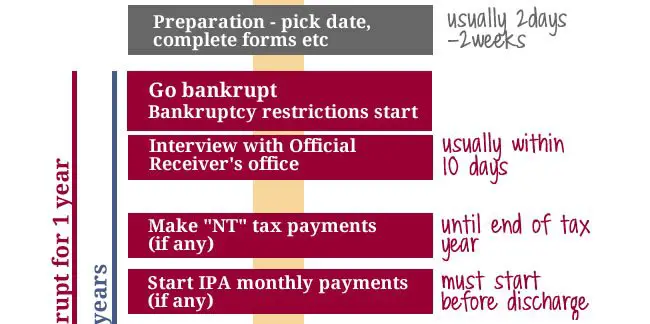

How Long Does A Bankruptcy Case Take

Whether a case is a Chapter 7 or Chapter 13, the basic steps in the process are the same. Generally, a Chapter 7 bankruptcy case will take approximately 4 to 6 months from the date when the case is filed until the case is closed. A Chapter 13 case will typically last 36 to 60 months from the date of filing.

The sequence of events in a typical Chapter 7 case include the following:

- Consultation.

- Client completes the first consumer credit counseling course.

- Bankruptcy documents reviewed by clients and attorney.

- Case filed.

- Meeting scheduled with Trustee approximately 20 days after case is filed and Clerks Office mails the notice of the meeting of creditors.

- Client and attorney attend meeting of creditors together.

- Client completes the second consumer credit counseling course.

- Approximately 90 days after the meeting of creditors the Clerks Office will mail the discharge order demonstrating the termination of any personal liability on the debts included within the bankruptcy documents.

- Approximately 14 days after the discharge order is issued, then the Clerks Office will mail the final decree that signals the end of the bankruptcy case.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed