Can You Buy A House With Foreclosure On Your Credit

It can be hard, if not next to impossible, to get a new mortgage with a foreclosure on your record. But there are ways you can try for a new mortgage. If you can prove you lost your home due to extenuating circumstances , you may be able to qualify sooner than the seven years the foreclosure is on your record. You may also only have to wait half the time for a loan if youre a veteran or a first-time home buyer.

What Are Derogatory Credit Entries

John Ulzheimer is an expert on credit reporting, credit scoring, and identity theft. The author of four books on the subject, Ulzheimer has been featured thousands of times in media outlets including the Wall Street Journal, NBC Nightly News, New York Times, CNBC, and countless others.With over 30 years of credit-related professional experience, including with both Equifax and FICO, Ulzheimer is the only recognized credit expert who actually comes from the credit industry.He has been an expert witness in over 600 credit-related lawsuits and has been qualified to testify in both federal and state courts on the topic of consumer credit. In his hometown of Atlanta, Ulzheimer is a frequent guest lecturer at the University of Georgia and Emory Universityâs School of Law.

Edited by: Ashley Dull

Ashley has managed content initiatives for BadCredit since 2015, having worked closely with the worlds largest banks and financial institutions, as well as press and news outlets, to publish comprehensive content. Her credit card commentary is featured on national media outlets, including CNBC, MarketWatch, Investopedia, and Readerâs Digest.

Your credit reports are loaded with information, including personal data, employment information, public records, collections, credit inquiries, and your accounts.

Lets dive deeper into derogatory credit entries and how much trouble they can cause you.

Review Your Credit Reports

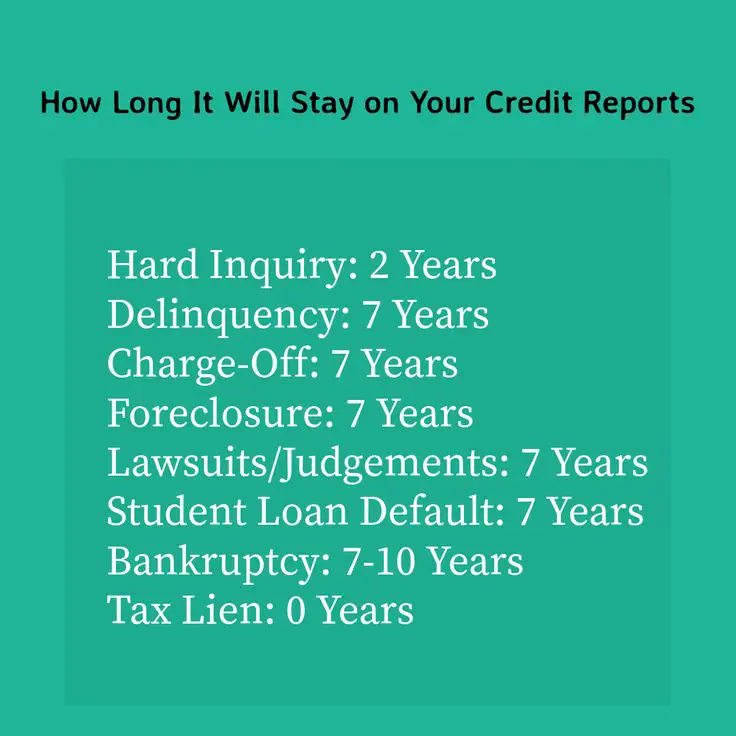

Chapter 13 bankruptcies and foreclosures can remain on your for at least seven years Chapter 7 bankruptcies can linger on credit reports for up to 10 years. Unfortunately, you cant do anything to remove those negative marks sooner. But its important to monitor your credit reports during this time.

First, review your credit reports from each of the three major credit bureaus. Check to see that all of the accounts that were included in your bankruptcy filing are being reported properly. If you went through foreclosure, make sure thats being reported properly as well.

Next, look for any errors or inaccuracies. Even a small error could cost you points from your . If you spot an error, you have the right to initiate a dispute with the credit bureau thats reporting the information. Equifax, Experian, and TransUnion allow you to initiate disputes online.

If the credit bureau determines that an error or inaccuracy exists, theyre required to either correct it or remove it from your report. Either one could help to raise your score, which could improve your chances of getting a mortgage later.

Also Check: Is My Ira Protected From Bankruptcy

Length Of Credit History

One factor that makes a foreclosure especially damaging to your credit is the hit it takes to your credit history. A foreclosure can stay on your credit report for up to seven years, making it hard to qualify for new lines of credit. And even after the foreclosure is off your report, it can still have an indirect impact on your score by virtue of its effect on your credit history.

The Impact Of A Foreclosure On Your Credit Score

When you default on your mortgage payments and your lender forecloses on your home, the foreclosure appears on your credit report. This can have a major impact on your credit score, making it difficult to qualify for new financing in the future.

The good news is that the effects of a foreclosure on your credit score will lessen over time. The bad news is that a foreclosure can remain on your credit report for up to seven years, making it one of the most damaging items you can have.

During the first two years after a foreclosure, your score will likely fall by 100 points or more. This can make it difficult to get approved for new financing, especially if you have other negative items on your report.

The good news is that the impact of a foreclosure will lessen over time. After two years, the negative impact will start to decrease. After seven years, the foreclosure will be removed from your report entirely.

While the effects of a foreclosure will eventually go away, its important to remember that they can have a major impact on your ability to get new financing in the meantime. If youre considering purchasing a home in the near future, its best to wait until after the foreclosure has been removed from your report.

Also Check: Has Tom Steyer Ever Filed Bankruptcy

Ways To Start Rebuilding Your Credit Scores

Fortunately, the impact on your credit scores doesnât have to last forever. Rebuilding your credit scores will take time and consistent responsible credit use, but you can start straight away. Here are some ideas how:

1. Catch Up on Overdue Bills

If youâve struggled with making mortgage payments and paying other bills on time, youâre certainly not alone. A survey by the CFPB found that in May 2019, more than 40% of Americans had a hard time paying a bill or expense in the previous year. In many cases, the difficulty involved mortgage payments.

With that said, your payment history is an important factor in calculating your credit scores. And consistently paying bills on time is the best way to start getting your payment history back on track. As well as creating a budget, you could think about setting up automatic payments or reminder alerts to help you.

2. Start With a Secured Credit Card

If your financial situation permits, a secured credit card can be a good tool for rebuilding credit. As with any credit card, getting approved for a secured card isnât guaranteed. Aside from a security deposit, there may be additional approval requirements.

With consistent responsible use over time, a secured cardâlike the Capital One Platinum Secured cardâmight be able to help you rebuild credit. Thatâs as long as it reports to at least one of the three major credit bureaus.

3. Seek Help From a Professional

To find a credit counseling agency in your area, you can:

Foreclosures And Your Credit Report

When a foreclosure gets reported to the credit bureaus, you can expect your credit score to drop by as much as 150 points. In most cases, borrowers who have dealt with foreclosure are granted subprime status, which means they arent eligible for attractive interest rates in the near future.

Like bankruptcy, a foreclosure is considered to be a serious delinquency and will stay on your credit report for up to seven years from the date of filing. Even when you meet a lenders requirements based on a past foreclosure, an underwriter will still see you as a risky candidate for another mortgage and you may find it very difficult to get the loan you want.

It is possible to have the foreclosure removed from your credit report, but this can be a very lengthy process and will require some strong negotiation skills.

When you have bankruptcy or a foreclosure in your credit history, its even more important to make sure you are keeping up with other bills and working towards repairing your credit.

You may need to wait several years before your credit score improves after the negative impact from these credit problems, but you will be able to remove them from your credit history completely within seven to ten years.

Read Also: How To Claim Bankruptcies In Canada

Do Not Move Out Too Soon

While some homeowners want to wipe their hands clean of their house as soon as they receive a foreclosure notice, others will cling to the property until the bitter end. The process can be lengthy, so be careful when you choose to move out. For example, homeowners sometimes vacate early in the foreclosure process, only to find that months or even years later, the lender has not completed the trustee sale. In those instances, you’re still responsible for expenses like homeowners association dues, and youll be liable if someone injures themself on the property. If, however, the home is sold in a foreclosure or a short sale , you will need to move out quicklyoften with only five business days to vacate once the sale is complete.

How Does A Foreclosure Affect Your Credit

You can expect to lose anywhere from 85-160 points on your credit score when the foreclosure first hits your credit report. If your credit score was good to start with, expect a much sharper drop than if your credit was already poor or average.

In most cases, you will not be able to qualify for a new credit card, auto loan, or mortgage immediately after a foreclosure. In addition, you may also see the interest rates on your current credit cards rise due to the drop.

Don’t Miss: Amazon Liquidation Pallets Houston

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Find Errors On The Credit Report Listing

First, grab a copy of your free credit report from each of the major credit bureaus Equifax, Experian, and TransUnion. Once you have copies of your three credit reports in hand, look at each detail of the foreclosure entries.

Check the foreclosure balance, any dates associated with the account, your account number, and the name of your mortgage lender. If you find any of the information to be incorrect or questionable, you can dispute it.

Another big mistake to avoid?

Dont assume that all three credit report entries are the same. There are three separate credit reporting agencies that compile information in different ways. Check each one for inaccurate information.

If you find an error concerning the foreclosure, you can file a dispute with all three credit bureaus. First, send a dispute letter, and you should receive a response within 30 days. Within that time frame, the credit bureaus need to verify the information within the entry and correct it, or ideally, remove it altogether.

Recommended Reading: What Does Bankruptcy Do To My Credit

Contact Your Loan Servicer At The First Sign Of Problems

When you find yourself behind on your mortgage, the first thing you should do is reach out to your loan servicer. Explain why youre having trouble making your mortgage payments and ask what options might be available.

Depending on your situation and the reason for your financial woes, you might be a candidate for forbearance, which allows you to skip a mortgage payment or two and add the amount to the balance of your loan. The loan servicer might consider offering forbearance if the problem was a one-time issue and you need a bit of breathing room, provided your income and expenses are steady enough that youll likely be able to catch up.

Refinancing your mortgage at a lower interest rate might be a viable solution if you still have solid credit scores. Another option, which doesnt necessarily require high credit scores, is a loan modification, in which you stretch out the length of your loan to bring the payments in line with your monthly budget.

What Happens When You Have A Bankruptcy And A Foreclosure

It is possible to file for bankruptcy and keep your home out of foreclosure by the bank. You may be able to keep your home if you file for bankruptcy depending on the type of bankruptcy and if you have equity in your home. Of course, if your home goes into foreclosure and then you file for bankruptcy, you may lose your home.

Don’t Miss: How To File For Bankruptcy In Maryland

Dmitriy Fomichenko President Sense Financial

A foreclosure can remain on your credit report for 7 years. However, some of the negative effects may diminish over the years. If you can keep other debt obligations in good status , your score can improve and rebound much earlier.

How long after foreclosure can I buy a house?

I am sorry to hear that you are going through a foreclosure. Theres no question that losing a home is a financial earthquake. Whatever the short term effect on your credit, in the long run you can take comfort that you can eventually recover.

A foreclosure will be reflected on your credit report for seven years. Initially this has quite a negative affect on your credit, and makes it unlikely that you would qualify for a new mortgage or other types of credit during the first few years following a foreclosure. However, the iread full answermpact of the foreclosure on your FICO score lessens over time. If it is an isolated event and not part of a larger pattern of credit problems, the impact will generally begin to lessen after about two years.

To recover from a foreclosure, the most important thing is to avoid any negative credit events in the future. Pay your bills on time, keep low or no balances on your credit cards, work to clean up mistakes and past negative items on your credit report and avoid taking out new sources of credit.

Is It Possible To Remove A Foreclosure From A Credit Report

A credit bureau should automatically remove a foreclosure from your credit report on its own once the seven-year credit reporting clock expires. But there are a few circumstances under which you might be able to remove a foreclosure from your report earlier than expected.

In the situations above, you could dispute the foreclosure with the credit reporting agencies, either on your own or with the help of a credit repair professional. If the lender doesnt verify the foreclosure as accurate, the credit reporting agencies should delete it from your report.

You May Like: Buying Houses In Foreclosure

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Will Foreclosure Affect My Credit

Just one missed payment can drop your FICO score by 100 points. But not everyones credit score is affected the same. FICO penalizes higher credit scores more than lower ones, so the higher it was before foreclosure, the more your credit score will drop and the longer it will take to bounce back. Another impact is that lenders may charge higher interest rates and add extra fees, so using credit will get more expensive.

Read Also: Can You Keep Your Car If You File Bankruptcy

Can I Buy A House After Foreclosure

As far as buying a new house after foreclosure, you wont be able to qualify for a new mortgage for at least 2 years and possibly longer. This is the case even if you have the financial means to pay for a less expensive home.

Once you do qualify for a mortgage, expect to have to pay more in interest and fees. Additionally, youll most likely be expected to put a much higher amount towards the down paymentsomewhere around 20% or more.

Reduce The Credit Score Impact Of A Foreclosure

However, even though your late payments and foreclosure remain on your credit report for seven years, the passage of time reduces the impact on your credit score.

If you want to reduce the impact of the foreclosure, develop other credit habits that can show a pattern of general improvement. Make other payments on time, including your credit card and personal loan obligations. You can also reduce your debt, paying down any credit cards.

These moves will be more recent, and count for more than a past transgression as the foreclosure recedes in your financial rear view mirror.

Eventually, youll even be able to buy a new home. Depending on the type of loan you get, you might be able to qualify for a home loan as soon as three years after the foreclosure. Some lenders might require you to wait longer before getting a new mortgage, but if youve made progress and can show your situation has changed, you might be able to get a new home loan sooner than you thought.

Recommended Reading: How Does Filing Bankruptcy Affect Child Support

How Long Does It Take For A Short Sale To Come Off Your Credit Report

You wont find the term short sale on a credit report. Rather, the account will show that you settled your home loan for less than you owed.

Like a foreclosure, a short sale settlement can stay on your credit for up to seven years. The credit reporting clock begins on the original delinquency datethe first late payment that leads to the short sale. However, if you were never late on your mortgage prior to the short sale, the account can stay on your report for up to seven years from the settlement date.