What Form Of Bankruptcy Is For Businesses

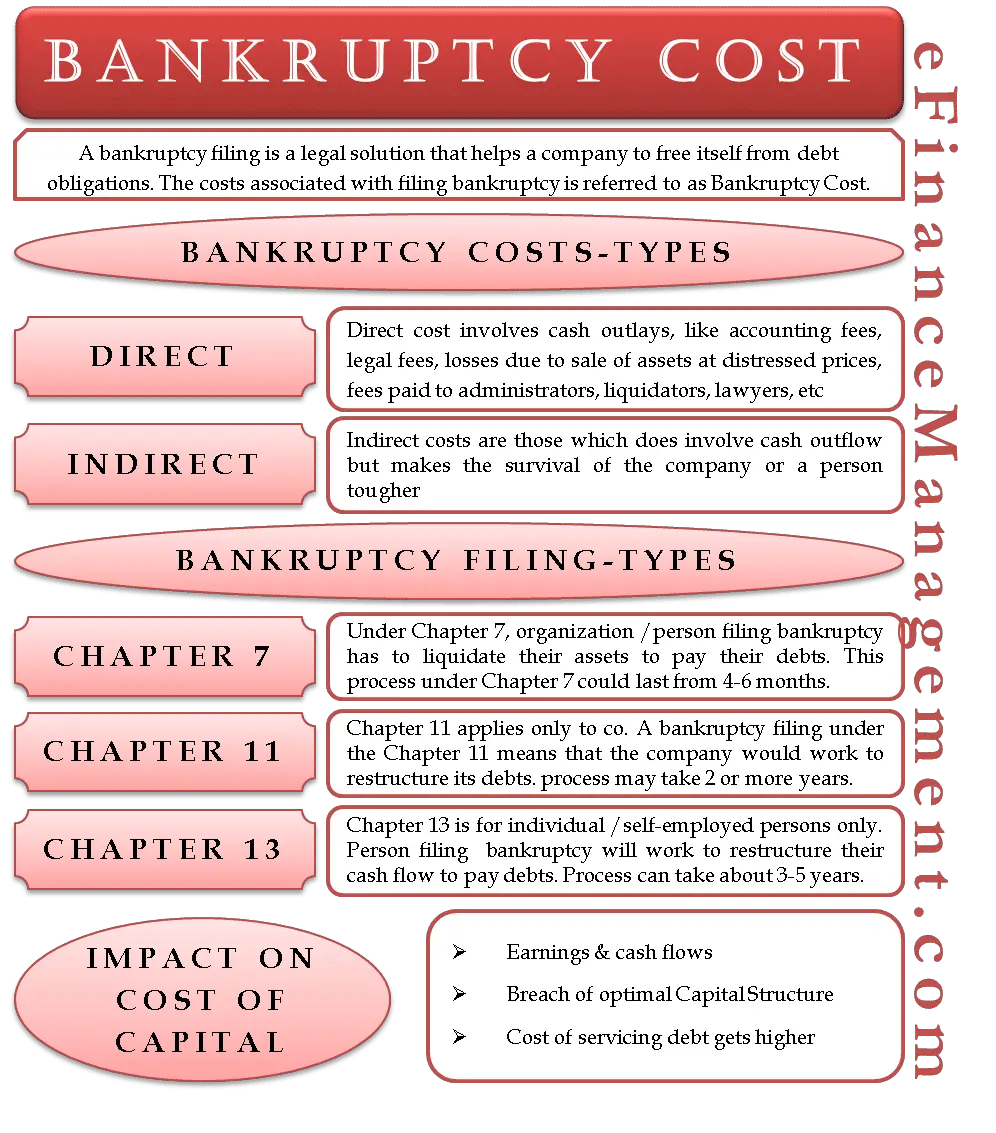

Some key points are highlighted. When a company cannot pay its debts, it can file for Chapter 7 or Chapter 11 bankruptcy. The only difference between Chapter 7 and Chapter 11 is that Chapter 7 liquidates the companys assets, whereas Chapter 11 allows the company to continue to operate.

Bankruptcy: A Fresh Start

Types Of Business Bankruptcy

By AllBusiness Editors | In: Finance, Financing & Credit, Legal

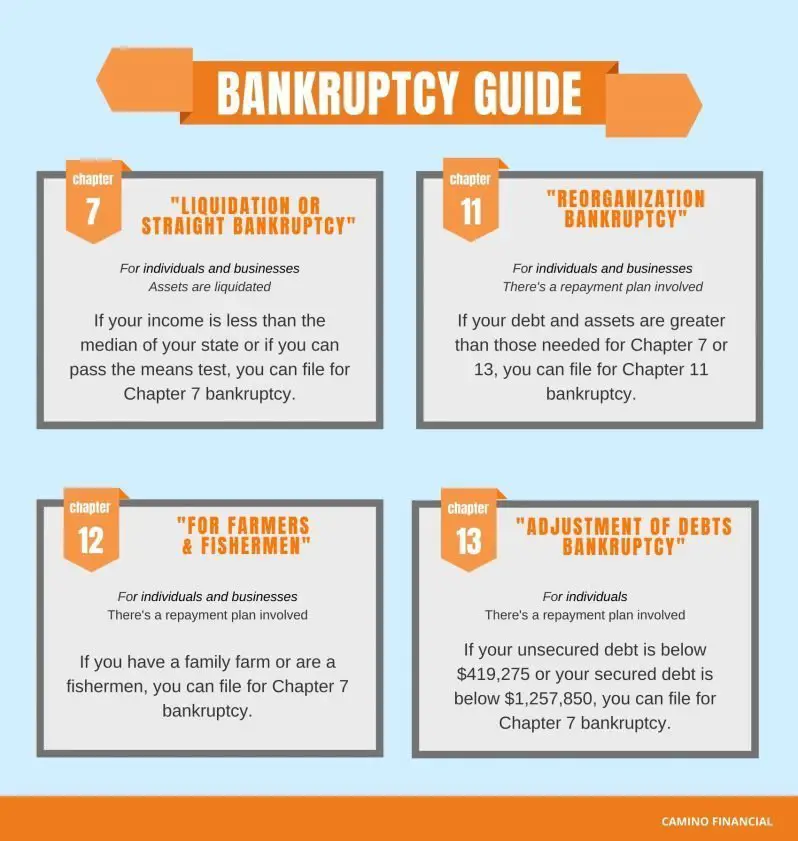

When a business prepares to file for bankruptcy, it needs to decide which specific chapter of the law to file under: Chapter 7, Chapter 11, or even in some cases Chapter 12 or Chapter 13. Businesses considering bankruptcy should carefully explore their options with the help of an experience bankruptcy lawyer. Here are the four types of bankruptcies available to a business in serious financial trouble.

How Does Bankruptcy Work

Bankruptcy is a method to eliminate or at least reduce your debt when bills pile up beyond your ability to repay them. It should be viewed as a last resort to be considered only when all other potential courses of action to get back on track have been exhausted.

Individuals filing for bankruptcy mostly use either Chapter 7 or Chapter 13. The biggest difference between the two is what happens to your property:

- Chapter 7, which is known as liquidation bankruptcy, involves selling some or all of your property to pay off your debts. This is often the choice if you dont own a home and have a limited income.

- Chapter 13, also known as a reorganization bankruptcy, gives you the chance to keep your property if you successfully complete a court-mandated repayment plan that lasts between three and five years.

Depending on where you live and your marital status, some of your property may be exempt from being sold when you file Chapter 7 because of state-specific and federal exemptions. With exemptions, whether they be your home equity, retirement accounts or even personal possessions such as jewelry, you receive the allowed exemption amounts, and the rest of the proceeds will be used to pay off debts. You can read more about potential exemptions, and check out this chart for a quick rundown on the two types:

| Chapter 7 |

|---|

You May Like: How Do You Buy Foreclosed Homes

Chapter 13 Bankruptcy: Modification Of An Individuals Debts As Per Regular Income

Chapter 13 Bankruptcy is made for persons who possess a steady income source and wish to pay off all their debts however, it is incapable of doing so. The Bankruptcy Chapter 13 might be desirable to Chapter 7 science Chapter 13 typically lets the debtor hold on to a precious asset, for example, an individuals house. The debtor is empowered to place and suggest a key strategy in front of the court under Bankruptcy Chapter 13. The strategy describes how the debtor would reimburse creditors with time over a period ranging from three to five years. Finally, the Court should later approve of this strategy.

Suppose the Court accepts the strategy, the debtor would need to pay the creditors via a trustee. Any outstanding debt would be discharged upon the successful plan completion. Hence, the debtor gets protected from all the actions taken by creditors that include an actual agreement with that debtor for the entire strategys life, wage garnishments, and lawsuits.

Chapter 13 Bankruptcy Eligibility:

- Overall debt should not be extremely high.

- The Bankruptcy filing candidate must be current on their income tax reporting.

Chapter 13 Bankruptcy Example

Under this situation, since Josh successfully meets all the conditions of filing a Chapter 13 petition, he subsequently decides to hire a lawyer and file a Chapter 13 Bankruptcy petition to get some financial respite.

All Businesses In Chapter 11 Bankruptcy

Partnerships, corporations, and LLCs must file a Chapter 11 bankruptcy instead of a Chapter 13 bankruptcy to reorganize debts and stay in business. A sole proprietor can file a Chapter 11 bankruptcy, as well.

Chapter 11 bankruptcy is similar to Chapter 13 bankruptcy in that the company keeps its assets and pays creditors through a repayment plan. However, a straight Chapter 11 t is usually a lot more complicated when compared to a Chapter 13 bankruptcy because the business must file continuing operating reports, and creditors must approve the plan. It’s also prohibitively expensive for most small businesses.

Fortunately, small businesses can now use Chapter 11, Subchapter V, a relatively new bankruptcy reorganization that’s easier and cheaper because it’s more like Chapter 13. To learn more about bankruptcy for your small business, see Small Business Bankruptcy.

Learn more about Chapter 7 vs. Chapter 11 Bankruptcy.

Read Also: When Does Bankruptcy Fall Off Credit Report

The Different Types Of Business Bankruptcy

For small business owners, bankruptcy can feel like an obscenity to say out loud. When you read about big corporations going bankrupt in the news or hear entrepreneur friends share that their small businesses filed for bankruptcy, it sounds like theyve reached a tragic end.

The truth is that bankruptcy doesnt mean youll never work againit doesnt even mean that your business has to shutter for good. While the bankruptcy process for small businesses can be traumatic, expensive, and financially damaging, there are ways to mitigate the stress of bankruptcy as well as methods to protect your business and your assets during the process.

Knowing the different options available for small businesses considering bankruptcy is the first step. Before you contact a lawyer or your creditors, think about which type of bankruptcy might fit your situation best.

What Happens When A Business Files For Bankruptcy

It depends. Businesses are limited to filing either Chapter 7 or 11, but sometimes it’s possible for a business owner, rather than the business itself, to use Chapter 13 effectively. Before diving into the details, it’s a good idea to familiarize yourself with these basics.

- Businesses in Chapter 7 bankruptcy.Chapter 7 is a “liquidation” bankruptcy. The trustee appointed to the case sells property and disperses the proceeds to creditors. Almost all businesses that file for Chapter 7 bankruptcy are closed when they file or shut down during the process. Chapter 7 is the quickest and most cost-effective bankruptcy type.

- Businesses in Chapter 11 bankruptcy.Chapter 11 is a “reorganization” bankruptcy. You and your creditors create a plan to pay bills in a manner that allows the company to remain operational. Chapter 11 is lengthy and costly. Chapter 11, Subchapter V is a cheaper, more efficient version available to small businesses.

- Owners in Chapter 13 bankruptcy.Chapter 13 is also a “reorganization” bankruptcy, but other than sole proprietors, businesses can’t file for Chapter 13 because it’s intended for individuals. Chapter 13 can help an owner reduce personal debt, such as credit card balances, which can help a business stay open.

To illustrate this, we’ve outlined important points in the “When a Business Files for Bankruptcy” chart below. Consider referencing the chart while reading about your bankruptcy options.

You May Like: What Assets Are Exempt In Chapter 7 Bankruptcy

When Company Files Chapter 7 Or Chapter 11 Investors Often Lose Out

If a company you’ve invested in files for bankruptcy, good luck getting any money back, the pessimists sayor if you do, chances are you’ll get back pennies on the dollar. But is that true? The answer depends on a number of factors, including the type of bankruptcy and the type of investment you hold.

Do You Need A Licensed Insolvency Trustee

Since Bankruptcy is a legal process, you must file through a Licensed Insolvency Trustee. In Canada, they are the only people qualified to help you through this legal process. Although Bankruptcy is a viable option, its not your only choice and, indeed, may not be the best one for you.

Your LIT can help you make the right decision. It is their job to protect your interests and help position you for future success. As well, they help ensure that your creditors are treated equitably so that they can continue to serve businesses such as yours in the long run.

Read Also: What Credit Cards Can You Get After Bankruptcy

How To Select A Bankruptcy Type

Choosing a chapter to file under is, within limits, up to the debtor. It depends on your needs.

Generally, Chapter 7 is best for those with limited income and few assets who want to conclude matters as quickly as possible. But those who want to file under Chapter 7 must pass a means test. In short, if you have too much income, the court may deny a Chapter 7 liquidation petition or switch it to a Chapter 13 bankruptcy.

Chapter 13 may be better suited to someone who wants to hang onto as many possessions as possible and has the income to support repayment.

Meanwhile, businesses that aim to stay in business may want to choose Chapter 11.

Many filers, especially in complex cases, are represented by bankruptcy attorneys who guide the decision about how to file. Professional organizations, such as the National Bar Association or your local bar association, can be sources of referrals to competent lawyers, as can personal recommendations from friends and family. If finances are tight, you can often find an affordable attorney by contacting your local legal aid society.

Business Bankruptcy Chapter : Liquidation

Chapter 7 bankruptcy is the most common type of bankruptcy, making up about 80% of consumer filings. Chapter 7 bankruptcy is available to consumers and all types of businesses.

Generally, this type of bankruptcy is the most suitable option if you do not have the means to keep your company running, and are unable to pay off your businesss current debts. The result of a business bankruptcy Chapter 7 filing is the liquidation of the businesss assets and closure of the business.

Linda Worton Jackson, a partner at commercial law firm Pardo, Jackson, Gainsburg, PL explains:

Once a business files for Chapter 7, the company shuts down the officers, directors, and employees are dismissed and a court appointed trustee takes over to liquidate the company for the benefit of creditors. The company does not continue operating under Chapter 7, except in very rare circumstances where the trustee allows it to do so temporarily.

Individuals who file for Chapter 7 bankruptcy need to show that their income is low enough to qualify. Filers who are seeking to discharge business debts do not need to meet income requirements.

This being said, if you have multiple creditors who you havent paid back, the trustee will divide up your assets among those creditors. Certain assets that fall under bankruptcy exemption laws are safe from creditors. For instance, there are usually federal and state laws that provide some protection for a filers home.

Also Check: Credit Card Debt Relief Government Program

What Is Small Business Bankruptcy

Bankruptcy is a legal process available if you are unable to repay your debts. Through business bankruptcy, eligible companies debts are eliminated or put on a repayment plan. Creditors receive a portion of debt repayment through the debtors available assets.

Both individuals and businesses can file for bankruptcy. In 2020, there were 22,482 business bankruptcies and 659,881 non-business bankruptcies for a total of 682,363.

Bankruptcy has the potential to wipe out all the debts you list when filing. But, not all debts are eligible to be forgiven through bankruptcy. Debts you may still owe after successfully filing for bankruptcy include tax claims.

Consumer Bankruptcy Differences: Chapter 7 Vs Chapter 13

Most consumer bankruptcy cases are filed as either a chapter 7 or chapter 13 case. Depending on your circumstances, one may be a better fit for you than the other. Here are just a few of the differences in the common consumer bankruptcy cases filed under chapter 7 vs chapter 13.

- Debt Limits: In a chapter 7 bankruptcy proceeding, there are no debt limits. A person can file for bankruptcy relief whether they have $1,000 in debt, or if its $1,000,000 in debt. The chapter 13 bankruptcy process, however, is subject to debt limits. There is a debt limit for both unsecured debt as well as secured debt in a chapter 13 case. A debtor filing bankruptcy under chapter 13 must pass BOTH debt limits. If not, either the bankruptcy court, the bankruptcy trustee, or a creditor may file a motion to dismiss your case.

- Repayment Plan: The biggest difference between chapter 7 and chapter 13 is that in chapter 7 there is no expectation that you will pay any of the debt back , while the premise of a chapter 13 case is that you will propose a repayment plan where you agree to make a monthly payment to the chapter 13 trustee to go towards your debts.

- Time for Bankruptcy Discharge: Chapter 7 bankruptcy proceedings are much faster than chapter 13 bankruptcy proceedings. The chapter 7 bankruptcy process is usually over about 90 120 days after the petition is filed.

Also Check: Are Tax Debts Discharged In Bankruptcy

Is Bankruptcy Only For Business

Bankruptcy is a legal process that provides debt relief for individuals and businesses. Although it is most commonly associated with businesses, individuals may also file for bankruptcy. There are several types of bankruptcy, each with its own benefits and drawbacks.

If you decide to file bankruptcy, deciding whether to do so is a difficult decision. It is not the intent of filing for bankruptcy to completely dissolve your business. Companies are frequently protected from certain risks in some types of contracts. In general, there are three types of bankruptcy: Chapter 7 Chapter 13 and Chapter 8. If you are the sole proprietor of a company, Chapter 7 may be beneficial to your business. A bankruptcy must be filed on behalf of your business if it is a separate legal entity such as a corporation or LLC. Before you file for bankruptcy, you should consider some strategies to ensure you are not overdrawn.

Chapter 11 is a legal procedure that allows an organization to reorganize its debt and financial obligations. There is no doubt that it is difficult to complete, but it is not always fatal to a company. Businesses can survive the process and reorganize successfully in many cases. Businesses usually go bankrupt voluntarily, according to popular belief. If a business makes a proposal to its creditors that they do not agree with, or if the creditors file a petition with the court, the business may become bankrupt.

How A Business Bankruptcy Now Can Affect Your Business

For some businesses, filing for bankruptcy becomes an option to financial woes. If your business is in financially difficulty and is struggling to pay its debts, bankruptcy may be an option for you. Although itâs not a popular or exciting topic, you should understand the fundamentals of bankruptcy.

What is Bankruptcy?Bankruptcy is a federal court procedure for individuals and businesses who cannot pay their debts. The process eliminates any debts and pays them while protecting the individuals and/or businesses in bankruptcy court. The bankruptcies are often referred to as liquidation or reorganization. As a business owner who needs to file for bankruptcy, there are a few different types of bankruptcies. The type that you should file will depend on your particular situation.

Types of BankruptcyChapter 7 â This type of bankruptcy is referred to as liquidation. Chapter 7 bankruptcy filing is suitable for a business that does not plan on staying open. This is because this type of filing does not include any type of repayment plan. This is the suitable choice for sole proprietors and small businesses. It becomes the responsibility of the trustee to sell any of the businessâs assets and satisfy the payment of the debts. However, the bankruptcy code allows for the debtors to keep some âexempt property.â But with this type of filing, it is expected that there will be some sort of loss of property.

2. The trustee has not appointed a creditors committee.

You May Like: Which Is Better Chapter 7 Or 13 Bankruptcy

Reasons To File Business Bankruptcy

If your business is failing, bankruptcy might be your best option. You might file for bankruptcy to:

So, what causes bankruptcy in business? You may be left with small business bankruptcy as a result of:

- Poor market conditions

What Are The Six Different Types Of Bankruptcy

The federal Bankruptcy Code provides for multiple different types of bankruptcy for debtors. The different types, or chapters, are available to different debtors depending on the nature and the means of the debtor as well as the type and amount of debt involved. Read on to learn about the types of bankruptcies and their uses, and call a dedicated and understanding Poughkeepsie bankruptcy lawyer to explore your options for debt relief.

Don’t Miss: Can Filing Bankruptcy Stop Car Repossession

Which Type Of Bankruptcy Is Best For You

When evaluating the different types of bankruptcies as an individual, youre most likely going to settle for either Chapter 7 or Chapter 13.

Each type of bankruptcy offers alleviation from at least a partial amount of your debt through a bankruptcy discharge. However, each carries its own drawbacks.

Chapter 7 bankruptcy is usually a faster affair, resolving itself within half a year, and you dont need to deal with trustees since there isnt a repayment plan. The major drawback, if you have anything of value that is non-exempt, then its most likely going to be liquidated to repay the creditors.

Chapter 13 bankruptcy can be long and drawn out, most likely ending after five years from the submission of the petition. You will need to deal with trustees going over your spending since youll be under a new payment plan to reimburse your creditors. However, unlike Chapter 7 bankruptcy, youll be able to retain your property.

When choosing between the two forms, keep in mind that some types of debt cant be discharged by a bankruptcy judge. Debt such as alimony, child support, student loans, and income tax needs to be paid regardless of the Chapter you file.