Bao Lu Th Tnh Trng Ph Sn Vn Cn Trn Bo Co Tn Dng Ca Bn

Phá sn là mt th tc pháp lý có th xut hin trên các báo cáo tín dng ca bn trong ti a mi nm sau khi các khon n ca bn ã c thanh toán và vic phá sn ã c hoàn tt. Tuy nhiên, khong thi gian nó s xut hin trên các báo cáo tín dng ca bn c xác nh mt phn bi loi phá sn mà bn tuyên b.

Ngay c khi phá sn có th kéo dài trong các báo cáo tín dng ca bn ti mi nm, tác ng ca nó i vi các khon tín dng ca bn có th gim dn theo thi gian trc khi bin mt hoàn toàn. Phá sn có th gây hi cho bn im s tín dng và ngn bn vay thêm tin vì nhng ngi cho vay s u t vào tt c nhng ngi có xu hng chm thanh toán.

| Loi file | |

| Tài khon ang hot ng ã thanh toán | Min là tài khon c m |

Mc dù các trng hp v n trong h s tín dng ca bn s luôn c tính vào im tín dng ca bn cho n chng nào chúng vn còn trong lch s ca bn, thì nh hng i vi lch s thanh toán ca bn s gim dn sau mi nm trôi qua. Vì vy, mc dù bn có th thy im tín dng ca mình gim áng k trong tháng sau khi np n phá sn, nhng nó có th ít nh hng hn vào u nm và có th ít liên quan hn trong nhng nm tip theo so vi nm u tiên.

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

How Long Does A Bankruptcy Stay On Your Credit Report

The length of time youll see a bankruptcy stay on your credit report depends on what type it is. For example, a Chapter 7 bankruptcy stays on your credit report for 10 years from the date the bankruptcy was filed. On the other hand, a Chapter 13 bankruptcy remains on your credit report for just seven years from the filing date.

However, contrary to popular belief, you can remove a bankruptcy from your credit report early, and you can get credit after a bankruptcy. You do NOT have to wait seven or ten years after the bankruptcy filing date to get a mortgage, car loan, or any other type of credit again.

In fact, it usually only takes a couple of years to get access to loans and credit cards again. However, once you do start to qualify again, you may be paying extraordinarily high interest rates.

Rather than getting stuck with high interest rates and low balance maximums, work on negating the effects of bankruptcy as much as possible. Then, by disputing the bankruptcy and taking action to rebuild your credit history, you can get much better credit card and loan offers.

One mistake doesnt have to set you back financially for the next ten years. Find out how to remove a bankruptcy from your credit report and other ways to recover from bankruptcy.

Read Also: When Will My Bankruptcy Be Discharged

Early Removal Of A Bankruptcy From Your Credit Report

When you file for bankruptcy, it will appear on your credit history. Chapter 7 bankruptcy cases stay on your credit report for 10 years and Chapter 13 cases stay on for seven years. After this time passes, the bankruptcy should disappear from your credit report automatically.

Creditors are required by law to only report accurate information to credit bureaus. This requirement protects consumers from having any inaccurate information on their reports that would unfairly harm their credit. But this also prevents information from being removed when it is correct. So when you have a bankruptcy case on your credit report and itâs accurate, it canât be removed early.

That said, if the bankruptcy entry has incorrect information or has been wrongly entered, you have the right to dispute it. The Fair Credit Reporting Act gives you the legal right to dispute inaccuracies and errors on your credit report. If you challenge an entry and the agency that reported the entry canât defend it, then theyâre required to remove it.

Lauren Smith Wallethub Staff Writer

@laurenellesmith12/09/22 This answer was first published on 12/09/22. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

A bankruptcy stays on your credit report for 7 to 10 years. The record of a Chapter 7 or Chapter 11 bankruptcy remains on your credit report for 10 years, while Chapter 13 bankruptcies are typically reported for 7 years from the filing date.

You cannot remove the record of a bankruptcy from your credit report unless the information listed is entirely incorrect. However, the impact will lessen over time. If there is an error on your credit report, you can file a dispute with the three major bureaus to remove the error. The bureaus typically respond to disputes within 30 to 45 days.

You can check your and as well as get personalized credit-improvement tips for free here at WalletHub.

Read Also: Free Listing Of Homes For Sale

Get Your Bankruptcy Removed Today

If youre looking for a reputable credit repair company to help you dispute your bankruptcy and repair your credit, consider working with Lexington Law.

Give them a call at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

Bankruptcy Will Relieve Your Financial Stress And Time Will Heal Your Credit

A common question people ask their bankruptcy attorney when considering bankruptcy is, how will bankruptcy affect my credit report? A bankruptcy filing is certainly going to have a negative impact on your credit report however, if you have already been missing payments and have negative accounts on your report, your credit report is already hurting you.

A bankruptcy will remove the burdens of most debts and free up money for savings and essential items, so that you do not have to rely on credit. You should benefit immediately from your bankruptcy, when you are not strapped down with excessive debt. You will continue to benefit as more time passes from your bankruptcy filing allowing you to improve your overall credit score.

It is important to remember that nothing on your credit report is permanent!

Also Check: Can One Spouse File Bankruptcy Without The Other

Can You Remove A Bankruptcy From Your Credit Report

You may have heard that you can dispute information on your credit reports, but keep in mind that the dispute process only works for mistakes and misreported information. A bankruptcy will not be taken off your record through this process, so you are better off using your time and energy to improve your credit instead.

Also, be aware that after youve waited either seven or 10 years, depending on the type of bankruptcy, you wont need to do anything to have your bankruptcy removed from your credit reports. The details will be removed automatically by the credit bureaus.

Consumers who have filed bankruptcy are right to worry about just how long bankruptcies linger on their credit reports, but its important to note that you may see less impact to your credit as time goes by. Generally speaking, newer bankruptcies wreak the most havoc on your credit score, so a bankruptcy filed three months ago is much more damaging than one filed eight years ago.

How Much Will Credit Score Increase After Bankruptcy Falls Off

Your credit score will increase by 50 to 150 points after a bankruptcy is removed from your credit report. The removal of bankruptcy can dramatically increase your credit score because bankruptcy is the most negative item that can appear on your credit report. The amount of points your credit score will increase depends on other items you have on your credit report.

If you have other negative items bringing down your credit score, you might not see a huge increase. But if nothing else is affecting your credit score, the removal of bankruptcy will likely result in a huge increase in your credit score.

If, after filing for bankruptcy, you open new accounts, make all of your payments on time, you should see a substantial increase in your credit score once the bankruptcy is removed from your credit report.

Many people have reported that their credit score has increased by 50 to 150 points after the bankruptcy fell of their credit report. That said, some saw a 50 point increase, others saw a 91 point increase, and others experienced a 150 point increase. So, your point increase will vary depending on the information in your credit report.

If, after filing for bankruptcy, you opened new credit cards, racked up a lot of new debt, and missed payments on your account, you will be hurting your credit score and the removal of a bankruptcy would have little to no impact on your credit score because the new derogatory information will drag your credit score down.

You May Like: How Long Does Bankruptcy Stay On Your Record

How Long Does A Chapter 13 Bankruptcy Take

A Chapter 13 bankruptcy involves a repayment plan, so it takes quite a bit longer to complete. Typical Chapter 13 bankruptcy cases last 3 to 5 years. As part of the repayment plan, secured debts, like car loans are paid off. Depending on the type of debt you have, this type of bankruptcy may provide more debt relief than a Chapter 7 filing. Its always best to speak to a bankruptcy attorney about a Chapter 13 filing, as there are many moving parts in the Chapter 13 bankruptcy process.

Checking A Credit Report For Accuracy

It’s prudent to review your credit report from time to time, even if you aren’t considering bankruptcy. One way to check is by taking advantage of the free copy from each of the three major credit bureausExperian, TransUnion, and Equifaxthat you’re entitled to once per year at no cost. The website for ordering your credit reports is www.annualcreditreport.com.

It’s important to review all three carefully because not all creditors report to all three agencies. A few months after filing your bankruptcy, each of your creditors should notate that the account was included in bankruptcy. If not, it’s a good idea to have that corrected because any line item that appears open but unpaid could lead a potential lender to believe that you’re still responsible for paying that debt.

Your credit report should also identify whether your Chapter 7 bankruptcy case was discharged or dismissed. A successful bankruptcy that leads to a discharge has a different effect on a potential lender’s decision to grant you credit than if the bankruptcy had been dismissed, leaving your account liability intact.

It’s a good idea to address any errors you see as soon possible. You can do this by disputing the item, either through the credit bureau’s website or by sending a letter directly.

Also Check: Calculating Debt To Income Ratio

What Is A Bankruptcy

Bankruptcy is an official court order to dismiss or rearrange your debts when you cant keep up with them. It may eliminate debts or restructure them in a more affordable payment and structure.

Either way, bankruptcy has serious effects on your and should be taken seriously. Knowing how it affects your credit and how long it follows you is important before you decide.

Related: What Affects Your Credit Score?

How Does A Bankruptcy Affect Your Credit Score

Having a bankruptcy on your credit report can be devastating to your credit scores. According to FICO, for a person with a credit score of 680, a bankruptcy on your credit report will lower your credit score by 130-150 points.

For a person with a credit score of 780, a bankruptcy will cost you 220-240 points. Your credit score will drop several categories lower after that one event. The higher your credit score is, the more it falls.

You may not be eligible for future loans or credit cards, and if you are, youll most likely end up paying much higher interest rates. Furthermore, the amount you can borrow will probably become limited.

While filing for bankruptcy may be the best financial decision at this point in your life, its important to understand how and why it affects your credit score.

Also Check: Wholesale By The Pallet

How Will Bankruptcy Affect My Credit In 2021

5 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so well never ask you for a credit card. Explore our free tool

In a Nutshell

Filing bankruptcy does not ruin your credit forever! If you need debt relief but are worried about how a bankruptcy affects your credit rating, this article is for you.

How Long Until Bankruptcy Falls Off Your Credit Report

Talk to different bankruptcy attorneys and credit professionals, and youre sure to get just as many answers about the length of time the bankruptcy stays on your credit report before it is removed.

According to Experian, the credit reporting agency:

The bankruptcy record from the court is deleted either seven years or 10 years from the filing date of the bankruptcy depending on the chapter you declared.

Chapter 13 bankruptcy is deleted seven years from the filing date because it requires at least a partial repayment of the debts you owe. Chapter 7 bankruptcy is deleted 10 years from the filing date because none of the debt is repaid.

Individual accounts included in bankruptcy often are deleted from your credit history before the bankruptcy public record. Usually, a person declaring bankruptcy already is having serious difficulty paying their debts. Accounts are often seriously delinquent before the bankruptcy.

All delinquent accounts are deleted seven years from the original delinquency date, which is the date the account first became delinquent and was never again current. Declaring bankruptcy does not alter the original delinquency or extend the time the account remains on the credit report.

If the account was delinquent before being included in the bankruptcy, it will probably be deleted before the bankruptcy public record because the original delinquency date is typically earlier than the bankruptcy filing date.

Recommended Reading: How Long Does Ch 13 Bankruptcy Stay On Credit Report

Can You Remove Bankruptcy From Your Credit Report

In most cases, no: You cannot remove a bankruptcy from your credit report. Remember, it will be removed automatically after seven or 10 years, depending on the type of bankruptcy you filed.

In the rare case that the bankruptcy was reported in error, you can get it removed. Its fast and easy to dispute your information with TransUnion. If you see a bankruptcy on your credit report that you didnt file, heres how to dispute your credit report.

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Don’t Miss: How Does Bankruptcy Affect My Job

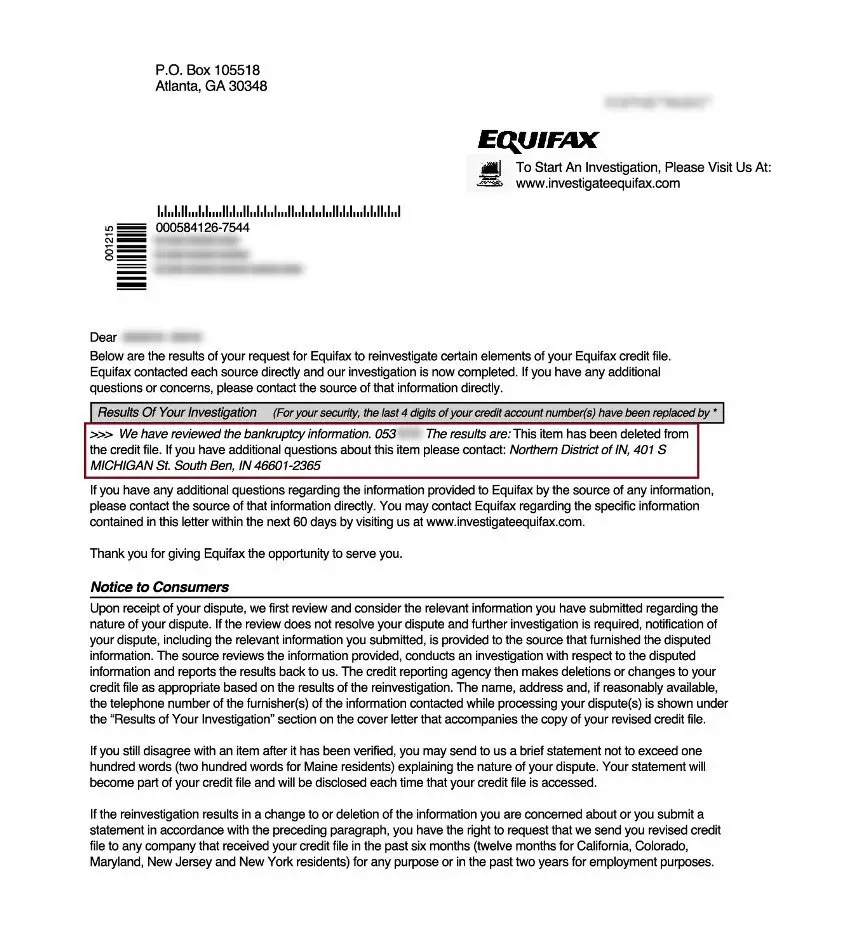

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isnt a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

How Long Does A Bankruptcy Stay On My Credit Report

Home » Blog » How Long Does a Bankruptcy Stay on my Credit Report?

Reading time: 4 minutes

2015-03-23

I am often asked how long a bankruptcy or consumer proposal remains on a credit report.

In Canada there are two large credit reporting agencies, or credit bureaus, Equifax and Trans Union, and they each report bankruptcies and proposals differently.

Bankruptcy is a legal process that helps you eliminate debt you cant repay. Thats the positive side of bankruptcy, but I know people are worried about the impact bankruptcy will have on their credit report and their ability to get a loan after bankruptcy. Im Doug Hoyes, a Licensed Insolvency Trustee with Hoyes, Michalos & Associates. Well, lets look at how bankruptcy appears on your credit report.

Bankruptcy will appear in two sections of your credit report the legal or public record section, and the individual account section which is a list of all of your debts. When you file bankruptcy, the Office of the Superintendent of Bankruptcy will send information to the credit bureaus who will put a note in the legal section that states you filed a bankruptcy proceeding and the date you filed.

The next update happens when you are discharged. The Office of the Superintendent of Bankruptcy will notify the credit bureaus when your bankruptcy is finished, which is when you get your discharge. This discharge date is added to the legal section in your credit report.

Equifax

TransUnion

Summary

Read Also: How To Declare Personal Bankruptcy In Usa