You Can Improve Your Credit After Bankruptcy

Dont give up after youve filed for bankruptcyyou can improve your credit score. But be patient, because it could take some time. If you want a little extra help, sign up for our free , or consider ExtraCredit. Restore It, a feature on ExtraCredit, gives you an exclusive discount to one of the leaders in credit repair. They can help you work to get your score where you want it to be after youve filed for bankruptcy.

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

Get Yourself A Secured Credit Card

These types of credit cards are specifically designed for people with bad credit scores. They often have high annual fees and interest rates, but they give you a chance to repair your low credit score.

But there are some rules you should follow if you go this route.

Dont just take your card and start spending. You should never spend any more than 30 percent of your limit. And whatever you spend, you should pay back each month to keep you from increasing your debt.

Don’t Miss: How To File Bankruptcy In Iowa

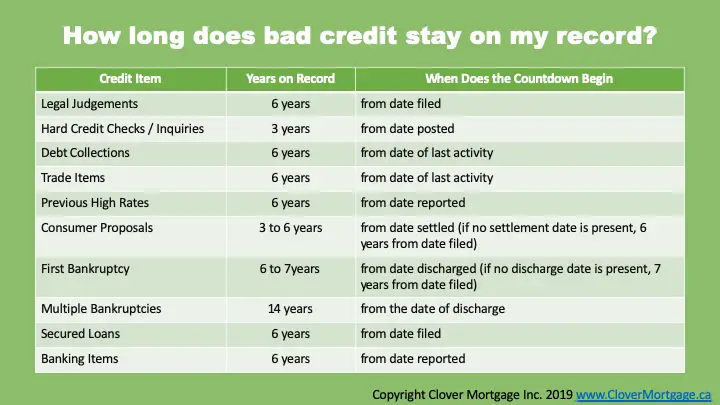

How Long Does A Bankruptcy Or Consumer Proposal Stay On My Credit Report

How long bankruptcy stays on your credit report in Canada will depend on the credit bureau that is reporting.

The largest credit bureau in Canada, Equifax, maintains this record on your credit report for a period from the date of your discharge or last payment:

- A first bankruptcy for six years from the date of your discharge.

- A second bankruptcy for 14 years.

The TransUnion web site states that they keep a bankruptcy on your credit file for six to seven years from the date of discharge or fourteen years from the filing date .

At this point the bankruptcy will leave the credit report and you will need to start to rebuild your credit.

How long a consumer proposal stays on your credit report again depends on the credit bureau that is reporting.

With Equifax, a consumer proposal is reported for three years after your last payment.

How To Build Your Credit After Bankruptcy

A bankruptcy is a devastating and life-altering event that can leave some serious emotional scars. But just because youve got bankruptcy or other negative info clouding up your credit history, it doesnt mean your life is over. You can come back from a bankruptcy, and it starts with dusting yourself off and learning from your mistakes. Here are some ways to help rebuild your financial stability after a bankruptcy.

You May Like: Has Mark Cuban Ever Filed For Bankruptcy

Why Is A Bankruptcy Public Record

The simplest answer is that bankruptcy cases are also court proceedings, and all court proceedings are public record. Unless a judge orders your records sealed, they are public record. However, there are parts of your bankruptcy that do not fall under the umbrella of public record. Sensitive information, such as your social security number, are always redacted in order to protect both the information and you. Additionally, only your birth year is shown from your birth date. As we stated above, PACER allows the public to view federal court proceedings. Because bankruptcy courts are part of the federal court system, they are public record. Most PACER users are either bankruptcy attorneys or their colleagues.

Not long ago, newspapers included legal notices sections. These notices often included bankruptcy filings. However, as bankruptcy filings have become more common since the 1970s, these notices are increasingly rare. Except in the case of businesses filing for bankruptcy, many newspapers do not include personal bankruptcies. Even when newspapers report on these business bankruptcies, they often only report on large businesses that affect a significant number of jobs.

Checking Credit Report Accuracy After Bankruptcy

You’re entitled to get a free credit report from the three major credit reporting agencies each year. You can claim your reports by visiting www.annualcreditreport.com.

Instead of getting them all at once, a prudent approach is to claim one report three months after receiving your bankruptcy discharge. That should allow enough time for creditors to report the bankruptcy information.

Thoroughly review each listed debt for accuracy. Also watch out for unfamiliar creditor names or debts, as they might be discharged debts that were bought and sold to a third party, but are not accurately reflected as having been discharged. To make changes, follow the instructions under the “Correcting Misreported Discharged Debt” heading.

You’ll want to claim each of the remaining two credit reports at three-month intervals. Each time, check to see if the credit report reflects the previously requested changes, and, take steps to correct any remaining inaccurate information. This approach should allow you to clean up your credit report at no cost to you.

Also Check: How To File Bankruptcy Yourself In Texas

Path To Credit Recovery

If you are avoiding talking to a bankruptcy trustee because you are concerned about how your credit will be affected, its important to consider two factors:

If debt is holding you back from rebuilding your credit, talk with a Licensed Insolvency Trustee about how to eliminate your debt. We provide free, no-obligations consultations during which we will conduct a full debt assessment and provide you with options to get out of debt so you can build a stronger financial future.

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

Don’t Miss: How Many Times Has Trump Filed For Bankruptcy

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit report’s negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

Myths About Credit Score After Bankruptcy

Everyone wants to know when considering bankruptcy: How long does bankruptcy affect my credit? What will my credit score be after bankruptcy? Will I ever be able to apply for a credit card again without being credit-shamed? There are a few myths about credit scoring and credit post-bankruptcy filing that we like to debunk to give our clients some peace of mind.

One is that you cant get a loan or credit card after filing for bankruptcy. This simply is not true. While Visa and Mastercard may not be sending you offers with frequent flier miles for a while, many clients successfully apply for secured cards to help them restore their credit faster. These cards require collateral, are available for people with damaged credit, and help build credit like any other card.

Another myth is that bankruptcy will ruin your credit forever. In fact, some imagine a dramatic movie where a character realizes they are bankrupt and yells Im ruined to the heavens. But this is also a myth and not reality. Although bankruptcy will damage your credit in the short term, its impact will absolutely be gone from your credit report after no more than ten years. And there are opportunities to practice good financial habits along the way, such as paying bills on time and avoiding purchases you do not have the income to pay for, which will make your credit stronger than ever.

Read Also: How Many Times Trump Filed For Bankruptcy

Can You Remove A Bankruptcy From Your Credit Report

Unfortunately, if a bankruptcy that’s appearing on your credit report is legitimate and is being reported accurately, it’s highly unlikely that a creditor or credit bureau would agree to remove it.

However, you’ll want to check your credit report to make sure that the right accounts were reported as being involved in the bankruptcy. You’ll also want to make sure that all the accounts that were part of the bankruptcy are showing a balance of zero.

If accounts that weren’t part of the bankruptcy are being reported as included, you can dispute the errors to have them removed. Or if included accounts are still showing an outstanding balance, you can dispute this as well.

Why Is A Bankruptcy Part Of The Public Record

Bankruptcy cases are court proceedings. Court proceedings are always matters of public record unless a judge orders the sealing of the records. Itâs unlikely that a bankruptcy judge will order your records sealed, but itâs possible when access to these records could present a threat to your personal safety. You would have a very high burden to prove to the satisfaction of the court that your safety is at risk due to your full court record being public.

There are parts of your bankruptcy that are not part of the public record. Bankruptcy Form B-21 is the form that contains your full social security number. This is the only information kept on this form. Even your attorney canât view a record of it through the courtâs PACER site, where they have access to all other documents filed in your case. Understand that some of your bankruptcy information is always redacted to protect sensitive information about you. Such redacted information on bankruptcy forms is all but the last four digits of your social security number and financial account numbers. Minor childrenâs names can only appear as initials. For your birthday, the forms can only show your birth year.

Read Also: What Is Epiq Bankruptcy Solutions Llc

What Is Your Credit Score After Bankruptcy

Bad news first: filing for bankruptcy can put a crater-sized dent in your credit score, causing it to plummet more than 200 points. But while this is happening, you are working on having debts you would never be able to pay off discharged, and/or reorganizing your ability to pay back those debts.

Soon, you will be either free of debts or making positive payments on those debts , and your score will begin to rise. The relative impacts of filing for bankruptcy on your credit score are short compared to ones lifespan.

How Long Does Bankruptcy Stay On Public Record

A Chapter 13 bankruptcy stays on your report for 7 years after the date of filing.

A Chapter 7 bankruptcy stays on your record for 10 years after the date of filing.

It is possible, though difficult, to remove it earlier by disputing any inaccuracies in your paperwork with the three credit bureaus .

Don’t Miss: Virtual Bankruptcy Petition Preparer

How Long Does Chapter 7 Bankruptcy Stay On Your Credit Report

Filing a chapter 7 bankruptcy can damage your credit score. But how long does chapter 7 bankruptcy stay on your credit report? Click here and find out.

You might think filing for bankruptcy means your financial life is over.

But its not.

In fact, to go bankrupt doesnt have to be a bad thing at all. It can actually be a very helpful tool for people who struggle with a large amount of debt.

That said, bankruptcy stays on your financial record for a long time.

How Long Does It Take To Remove A Bankruptcy

If you are on the verge of bankruptcy or just had to file, you may be wondering how long youll deal with the aftermath of your decision. This all depends on when you actually filed for bankruptcy, as well as the type of bankruptcy you filed for.

Heres how long bankruptcy stays on your credit reports:

- Chapter 7 bankruptcy, which lets low-income people liquidate their possessions and eliminate debt, stays on your credit report for ten years.

- Chapter 13 bankruptcy, which allows consumers to organize and repay some of their debts while eliminating the rest, stays on your credit report for seven years.

Note that these timelines start on the filing date for your bankruptcy, and not from the date your bankruptcy is discharged.

Consumers who have filed bankruptcy are right to worry about just how long bankruptcies linger on their credit reports, but its important to note that you may see less impact to your credit as time goes by. Generally speaking, newer bankruptcies wreak the most havoc on your credit score, so a bankruptcy filed three months ago is much more damaging than one filed eight years ago.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

The Individual Insolvency Register On Annulment

Once notice of the annulment is received your bankruptcy will be removed from the Individual Insolvency Register after:

- 28 days if the bankruptcy order shouldnt have been made

- 3 months if the debts were paid in full or an IVA has been agreed

If an IVA has been agreed, details of this will appear on the register.

How Can I Remove A Bankruptcy From My Credit Report Early

You canât get the bankruptcy off your credit report until the credit bureau decides to take it off or the ten years allowed by law has run. Some credit repair companies will urge you to file a dispute with the credit bureaus claiming that you never filed bankruptcy. But, itâs very simple for the credit bureau to check and see that you did file bankruptcy. The credit bureaus do have PACER accounts. They can check to see if you have filed bankruptcy in less than thirty seconds. By lying to the credit bureaus, you have lost credibility with them should you have a real dispute. If a credit bureau refuses to fix one of its real errors and you sue it, its lawyers will let the court know that you lied about another error. Judges frown on known liars. Since you may have problems fixing future errors if caught lying, it will be more difficult to rebuild your credit.

Recommended Reading: What Is Better Bankruptcy Or Debt Consolidation

Read Also: Do It Yourself Bankruptcy Software

How To Reestablish Your Credit

After declaring bankruptcy, you’ll want to look at ways you can earn a score in a range that will qualify you for better financing options and that begins with rebuilding your credit.

You may not be able to immediately qualify for the best credit cards, but there are others that apply to people with less-than-stellar credit.

Secured credit cards require a deposit that acts as your credit limit. If you make your credit card payments on time and in full on this new secured card, you then have a greater chance at qualifying for an unsecured credit card in the near future.

The Capital One® Secured has no annual fee and minimum security deposits of $49, $99 or $200, based on your creditworthiness. Those who qualify for the low $49 or $99 deposits will receive a $200 credit limit. Cardholders can obtain a higher credit limit if they make their first five monthly payments on time.

The Citi® Secured Mastercard® is another option with no annual fee. There is a $200 security deposit required, which would mirror your credit limit. Cardholders can also take advantage of Citi’s special entertainment access, which provides early access to presales and premium seating for concerts and games.

Once you add this new credit car, make sure you pay your monthly bills on time and in full to quickly work your way toward better credit.

Editorial Note:

Can You Get Credit After A Bankruptcy

Myth: You cant get a credit card or loan after bankruptcy.

The truth: Credit cards are one of the best ways to build credit, and there are options out there for those with a checkered credit history. Secured credit cards, which require an upfront security deposit, have a lower barrier of entry but spend and build credit just like a traditional card.

Similarly, there are loans availablesuch as passbook, CD or that are secured with a deposit or collateral and help you build credit as you pay them off. Like secured credit cards, these loans are much easier to come by because the lender is protected in the event you cant pay. Do note that you may need to get permission from the court to take on new debt during a Chapter 13 repayment plan.

Also Check: How Many Times Did Donald Trump File For Bankruptcy