Bankruptcy Discharge Certificate Canada: How Long Does My Credit Score Take To Recover From Bankruptcy

Your bankruptcy will stay on your for 6 years from the date your bankruptcy discharge certificate Canada is issued. If you have actually been bankrupt more than once, then it might be reported for approximately 14 years from the date of your discharge.

Having actually removed your financial obligation problems by getting your bankruptcy discharge certificate Canada, most individuals see they now have the ability to construct a more powerful financial future. Unless you urgently need to purchase a house for the very first time or buy an auto, you need not also bother with getting approved credit to take on debt right away. Many find they have the ability to live without credit considering that they have a more powerful cash flow than prior to bankruptcy. They are now able to start saving.

While you remain in bankruptcy, you are learning to live your life without credit. You are living essentially on a cash basis. You are not spending more than you make. Your Trustee is advising you to do so on an after-tax basis so that you will not have a nasty surprise when tax time comes.

Document Signing And Filing

Time: Same Day

- After the petition, schedules, statements and Chapter 13 plan are prepared, the debtor and attorney meet to go over these documents.

- Once the debtor certifies that everything is accurate, the debtor signs all of the documents.

- Shortly thereafter , the bankruptcy case is filed with the bankruptcy court, sometimes referred to as the filing date or petition date.

- At the time of filing, the automatic stay goes into effect, which keeps from attempting to collect from the debtor.

What Does Case Closed Without Discharge Mean

If a bankruptcy case is closed without a discharge because an individual debtor did not timely file a Certificate of Completion of Instructional Course Concerning Personal Financial Management, a debtor must file a Motion to Reopen the Case. Closing does not necessarily mean that all adversary proceedings are finished.

Also Check: How Many Bankruptcies Has Donald Trump Filed

What Happen If Litigation Occurs

Two kinds of litigation can delay the closing of your bankruptcy case.

- Determining the dischargeability of a debt. If you or one of your creditors files a lawsuit asking the court to determine if one of your debts is dischargeable or not, the court will keep your case open until it decides the fate of that debt. This kind of lawsuit will not usually interfere with your general discharge unless the trustee or the creditor challenges your right to discharge all your debts.

- Trustee’s litigation to gather assets. Sometimes a trustee will have to file a lawsuit against a third party to get access to your nonexempt property. For instance, if you sold a car for half its value to your cousin a month before you filed your bankruptcy case, the trustee may have a right to the full value of the car. If your cousin refuses to turn over the car or pay the full value, the trustee may have to file a lawsuit. Or, the trustee could file a lawsuit to get back an unusually large payment you made to a favorite creditor before you filed your Chapter 7 case. Your duty to cooperate also applied when the trustee files one of these lawsuits.

Find out more by reading What Is Bankruptcy Litigation?

How A Bankruptcy Filing Affects Your Credit Score

When you file for bankruptcy, your credit score will drop. The range of the drop is usually 130 to 240 points. Typically, people who have a higher credit score of over 700 points lose more points. If you already have a poor credit score, the deduction of these points may not really affect you that much.

When you have a bankruptcy on your credit score, it can be difficult to get approval for new credit and get the best deals people with excellent credit scores enjoy. For example, if you are planning to get a cell phone plan with bad credit, you will not be eligible to get the best deals available that require no deposit or no upfront fees. If you have bad credit due to a bankruptcy, you may have to settle for a no credit check cell phone plan where you have to buy the device in full and prepay your usage.

Don’t Miss: Bankruptcy Petition Preparer

What Happens To Liens In A Chapter 13

The general rule is that liens are retained in Chapter 13. That means if you have a consensual lien such as a mortgage or a car loan, the lien stays attached to the property. There are exceptions though:

- You can sometimes avoid liens in Chapter 13. This means you can remove the lien.

- You can sometimes strip liens such as second mortgages in Chapter 13. That means that the debt is treated as unsecured and is satisfied upon discharge.

- As it pertains to vehicles, you can sometimes cram down liens and pay less than the full amount.

The lien rules are complex, but Chapter 13 gives you a number of solutions to deal with liens.

What Is Chapter 7 Bankruptcy

Itâs a type of bankruptcy that erases your debts, to give you a fresh start. To file bankruptcy under Chapter 7 of the United States Bankruptcy Code you have to pass the means test. The means test shows the bankruptcy court that youâre eligible for debt relief because your monthly income isn’t enough to pay your unsecured debts in a Chapter 13 bankruptcy. Unsecured debt includes credit card debt, medical bills, and personal loans. Not all unsecured debts are dischargeable. Filing Chapter 7 does not erase child support or alimony. Student loans are only dischargeable if an undue hardship exists. If you own nonexempt property, the Chapter 7 trustee sells it and uses the funds to pay your creditors. Most peopleâs belongings are fully protected by the state or federal bankruptcy exemptions. Nothing is sold and no money is paid to creditors. Thatâs called a no-asset case.

Read Also: How To Buy A New Car After Bankruptcy

What Happens On The Day The Case Is Filed

The day you submit your bankruptcy forms to the court, sometimes called the filing date or the petition date, sets a few things in motion. For one, the automatic stay is triggered. This stops creditors from trying to collect a debt from you and even stops a garnishment. First, the clerkâs office assigns a case number, a judge, and a bankruptcy trustee to the case. Then it schedules the 341 meeting of creditors. The date of the 341 meeting determines a number of important deadlines for the bankruptcy case.

I Had My 341 Meeting Now What

3 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

The court will grant your bankruptcy discharge 60 – 90 days after the meeting. If the trustee filed a no-asset report, the case will be closed pretty soon after the discharge is entered. Until your case is closed, make sure to keep an eye on any mail from the court or the trustee so you donât miss anything important.

Written byAttorney Andrea Wimmer.

First of all, congratulationsð! Youâve made it through the most stressful parts of your case and are in the home stretch. There are two things left in your case:

The court grants your bankruptcy discharge, and

The bankruptcy trustee completes their work

In most cases, these two things happen independently. In other words, itâs possible youâll get your discharge before the trustee finishes up their work.

You May Like: How To File Bankruptcy In Iowa

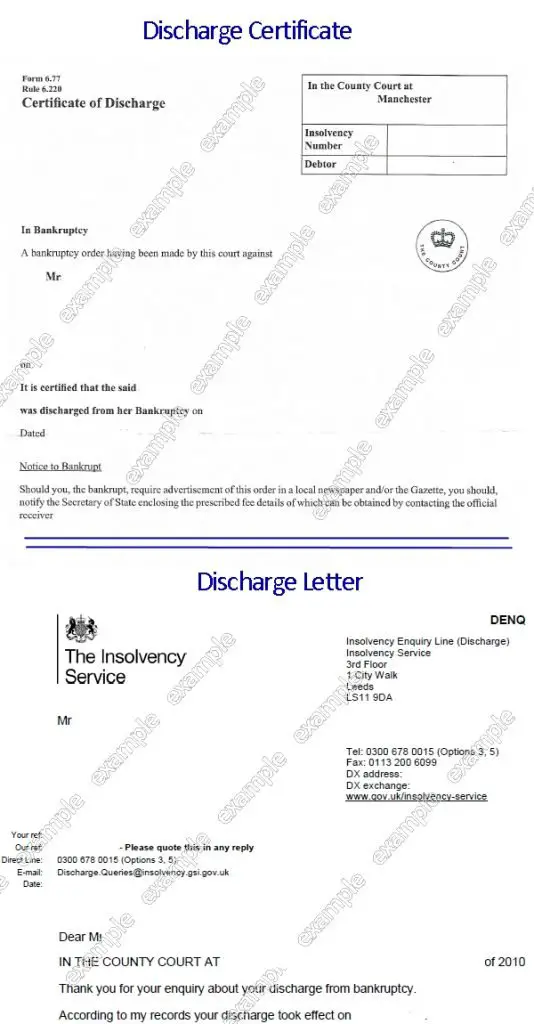

How Do I Get My Discharge

If you are discharged automatically, you do not have to do anything to get your discharge. If you wish, you can obtain a certificate of discharge. A certificate is not necessary in most cases, but if you need one you should write to the High Court. There is a £93 fee payable to the court for issuing a certificate of discharge.

Do not write sooner than two weeks before your discharge date. Give your name, address and court number . The court may check with the Official Receiver that you are entitled to an automatic discharge. You should receive a certificate confirming your discharge within about four weeks.

If you write to the Official Receiver, he will provide a letter, at no charge, confirming your date of discharge. You can also ask for the Official Receiver to advertise your discharge, but you will have to pay the costs of this before it is done.

You will not get your discharge automatically if your discharge period has been suspended, for example because you have failed to co-operate with the Official Receiver or trustee.

How Long Does It Take For Bankruptcy To Be Discharged

Once filed, a Chapter 7 bankruptcy typically takes about 4 – 6 months to complete. The bankruptcy discharge is granted 3 – 4 months after filing in most cases. Written by Attorney Andrea Wimmer. Most Chapter 7 bankruptcy cases take between 4 – 6 months to complete after filing the case with the court.

You May Like: How To Buy A New Car After Bankruptcy

What Is The Automatic Stay

Automatic stay puts an immediate halt to any impending legal action, and most actions by creditors or collection agencies. An automatic stay is a very strong shield that is put up around you once you have filed bankruptcy to stop your creditors from having any sort of contact with you. Automatic stay takes effect immediately once you have filed bankruptcy. Creditors must stop any and all communication with you including phone calls, letters, emails, or text messages. Once you have filed for bankruptcy and your creditors receive notification of the bankruptcy, it is illegal for them to contact you in any way. Should a creditor not cease contacting you, they may face penalties and fines from the court. Read more about automatic stay here.

Does A Chapter 13 Remove Negative Items From My Credit Report

Yes! One of the best parts about Chapter 13 bankruptcy is that negative items are removed from your credit report. This allows you to build credit quickly after your Chapter 13 plan confirmation. Weve discussed this in our article what does bankruptcy do to my credit? Many times, your credit report begins to show these items as removed within a month or two of filing bankruptcy. This causes many of our clients to see their credit score go up as much as 50 points after filing a bankruptcy!

Read Also: Average Interest Rate Car Loan After Chapter 7

Planning For A Better Financial Future

Set up a savings plan. In other words, pay yourself first. Even if it is only a few dollars per pay period, try to put aside a little for emergencies as soon as you are able. For many people who have been out of work or are otherwise financially devastated, it can be hard to imagine being able to save again. Still, a small amount can add up over the long run.

Ideally, you should eventually save six months of living expenses. However, having even a modest amount set aside in savings can help when the unexpected comes up. Start small and aim for a month’s salary in savings, then work up from there. Arranging for this money to be transferred directly from your paycheck to your savings account, so you never see it, will make it easier to save.

Quick Note: Never rely on credit as an emergency fund: If you have a savings plan, you can avoid one of the most destructive financial habits: using credit as an emergency fund. It is better to take a little money out of savings to replace the flat tire or the washing machine that died suddenly than taking on new debt.

Contribute to a retirement plan. If you already have a 401k or other retirement plan, try to contribute as much to it as possible. At the very least, kick in as much as your employer matches. Of course, if you can max out your contributions, so much the better. However, as with general savings, even small contributions add up over time.

Respond To Lender Inquiries

Once you submit your preapproval application, the rest is in your lenders hands. Your lender will review your income, assets, debt and credit to see if you qualify for a mortgage. If you seem like a good candidate, your lender will send you a preapproval letter. You can use your letter to start shopping for a home.

Your lender might need to contact you to ask questions about items on your credit report. This is especially common after an adverse financial event like bankruptcy. Be honest and respond to your lenders inquiries quickly to improve your chances of approval.

Also Check: Can You Lease A Car After Filing Bankruptcy

The Average Chapter 7 Bankruptcy Case Takes About Four To Six Months To Complete

By Cara O’Neill, Attorney

The coronavirus pandemic has financially impacted millions. If bankruptcy might be inevitable, think twice before using retirement funds to pay bills. Most people can keep their retirement account in bankruptcy. Learn about your options in Laid Off Due to the Coronavirus ? Bankruptcy Can Help.

COVID-19 Update: Courts are holding 341 creditor meetings telephonically or by video appearance unless an in-person meeting is necessary and local public health guidelines can be followed. On August 28, 2020, the U.S. Trustee stated that this order will end 60 days after the termination of the President’s Proclamation on Declaring a National Emergency Concerning the Novel Coronavirus Disease Outbreak. Visit the U.S. Trustee’s 341 meeting status webpage or your court’s website for details.

Most Chapter 7 cases take from four to six months to complete. It might take longer if any number of things happen, such as:

- you need to provide more information or documents

- the bankruptcy trustee must sell property, or

- you’re involved in a bankruptcy-related lawsuit.

In this article, you’ll learn more about the time it will take to get through the Chapter 7 bankruptcy process.

You’ll find a complete overview of the bankruptcy process in What You Need to Know to File for Bankruptcy in 2021.

Will A Chapter 13 Discharge Remove A Vehicle Repossession From My Credit Report

Yes! A Chapter 13 will remove any negative items regarding your repossession. It will remove the indication of the repossession itself, but also the missed payments leading up to the repossession. The Chapter 13 will also prevent you from being sued for a deficiency judgment and will prevent you from being taxed on any deficiency that is forgiven.

Moreover, a Chapter 13 can help you save a car from repossession! A Chapter 13 allows you to repay missed car payments through the Chapter 13 Plan. Or if youd prefer, you can get a new car loan! Its unbelievable to a lot of my clients, but as soon as your Chapter 13 plan is confirmed, you may be able to get a new car loan.

You May Like: How Many Bankruptcies Has Donald Trump Filed

What Is A Bankruptcy Discharge

A discharged debt literally goes away. It’s no longer collectible. The creditor must write it off. Debts that are likely to be discharged in a bankruptcy proceeding include credit card debts, medical bills, lawsuit judgments, personal loans, obligations under a lease or other contract, and other unsecured debts.

That might seem too good to be true, and there are indeed some drawbacks. Filing for bankruptcy and receiving a discharge will seriously impact your credit, and you must establish to the court’s satisfaction that the discharge is financially necessary. You can’t simply ask the bankruptcy court to discharge your debts because you don’t want to pay them.

You must complete all the requirements for your bankruptcy case to receive a discharge. The court can deny your discharge if you dont take a required financial management course.

Can A Chapter 13 Discharge Divorce Settlements

Yes! Unlike a Chapter 7 discharge, a Chapter 13 can discharge divorce settlements or divorce awards. The caveat here is that if the divorce settlement is for support or maintenance, the bankruptcy court may treat it like alimony and may find it non-dischargeable. It really depends on the nature of the settlement.

Don’t Miss: How Many Times Has Donald Trump Filed Bankruptcy

How Long Does It Take To File A Chapter 7 Bankruptcy Case

There are a few things youâll have to do before you can file bankruptcy. How long this takes depends entirely on how quickly you move through the steps. Some people take weeks or even months to get ready others get it done in the span of a week. Hereâs a breakdown of these pre-filing steps:

-

Gathering information: Youâll need to collect some documents, like your tax returns and paycheck stubs so you can submit them to the court and/or the trustee. But, youâll also need to have information about how much you spend on living expenses, what your assets are and how much theyâre worth.

-

Taking credit counseling: This course has to be completed in the 180 days before your bankruptcy petition is filed with the court. It usually takes only 1 hour.

-

Completing the bankruptcy forms: This is often the longest part of the process. Folks working with a law firm wait for the lawyerâs office to complete this step. Once done, they’ll meet with the bankruptcy lawyer to sign their forms. Folks filing on their own can take several hours to fill out the bankruptcy forms. Upsolve users typically take a total of about 3 hours to provide the information needed to generate their forms.

-

Filing the forms with the court: How long this takes depends on whether you go to the bankruptcy court in person or mail it in. Due to COVID-19, some courts have started accepting forms through electronic means, like sending an email or uploading the documents through a portal.