Chapter 11 Vs Chapter 13

Both allow businesses to continue operating under reorganization plans. But as stated earlier, your bills cant exceed $1,184,200 in secured debt and $394,725 in unsecured debt in order to qualify for a Chapter 13.

That doesnt mean you have to file a Chapter 13 if your debts are lower than those thresholds. But most businesses choose Chapter 13 since it is simpler and less expensive.

Unlike Chapter 11, a trustee is always appointed in a Chapter 13 case. He or she reviews the proposed reorganization plan and makes recommendations to the court on how to proceed.

The trustee also collects the payments and distributes them to creditors. If the debtor fails to meet the repayment requirements, the trustee can ask the court to dismiss the case or convert it to a Chapter 7 liquidation.

The approval process is less complicated than a Chapter 11, since creditors dont get to vote on the reorganization plan. Chapter 13 cases usually take three to five years to complete.

High Level Overview: Chapters 7 13 And 11

A customer that files for bankruptcy is called a debtor. Persons and businesses that have claims, usually for money, against the debtor are called creditors. Creditors can be secured, where their claims are secured by collateral, or unsecured. The Bankruptcy Code treats secured and unsecured creditors differently.

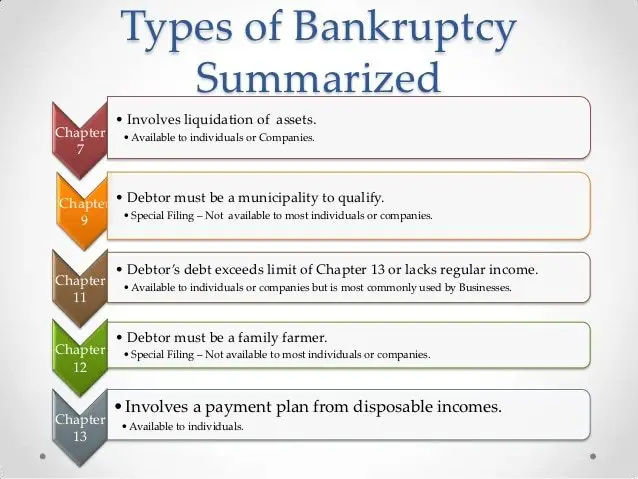

The Bankruptcy Code has multiple chapters under which debtors may file for relief. The most common chapters are 7, 13 and 11.

Chapter 7 bankruptcy is a liquidation. This chapter is most often used by businesses that are no longer operating or individuals who either have very few assets or wish to liquidate their assets to repay creditors. If Chapter 7 debtors have assets that can be liquidated, the assets are sold by a bankruptcy trustee, and the proceeds from the sale are given to creditors. Typically, Chapter 7 cases last about 90 days, but cases that involve liquidation and sale of assets may continue for longer and involve litigation. Chapter 7 debtors usually receive a discharge of their debts at the end of a Chapter 7 case.

How Many Types Of Bankruptcy Are There

There are 6 different types of bankruptcy according to the United States Bankruptcy Code. Each one of them is named after the chapter in the code where it is described. Hence, we have the following bankruptcy types: Chapter 7 , Chapter 9 , Chapter 11 , Chapter 12 , Chapter 13 and Chapter 15 . These chapters apply to different circumstances and entities. The most common bankruptcy types people usually resort to are Chapter 7 and Chapter 13 for individuals and Chapter 7or Chapter 11 for companies. In this post, we are going to summarize the most common aspects related to each bankruptcy option.

Also Check: Toygaroo Failure

How To Prevent Bankruptcy

Bankruptcy is generally a last resort, for businesses and individuals alike. Chapter 7 will, in effect, put a business out of business, while Chapter 11 may make lenders wary of dealing with the company after it emerges from bankruptcy. A Chapter 7 bankruptcy will remain on an individuals credit report for 10 years, a Chapter 13 for seven.

While bankruptcy may be unavoidable in many instances , one key to preventing it is borrowing judiciously. For a business, that could mean not using debt to expand too rapidly. For an individual, it might mean paying off their credit card balances every month and not buying a larger home or costlier car than they can safely afford.

Before filing for bankruptcy, and depending on their own internal legal resources, businesses may want to consult with an outside attorney who specializes in bankruptcy law and discuss any alternatives that are available to them.

Individuals are required by law to take an approved credit-counseling course before they file. Individuals also have other resources available to them, such as a reputable debt relief company, which can help them negotiate with their creditors. Investopedia publishes an annual list of the best debt relief companies.

Choosing The Right Type Of Bankruptcy

Your income and assets will determine the bankruptcy chapter you file. For instance, too much income might preclude you from filing a simple Chapter 7 case. Or, if you have property you’d lose in Chapter 7 that you’d like to keep, you can protect it in Chapter 13.

In Chapter 7 bankruptcy, the bankruptcy trustee has the power to sell your nonexempt property to pay back your creditors. As a result, Chapter 7 might be costly if you own a lot of assets. By contrast, Chapter 13 bankruptcy allows you to keep all of your property in exchange for paying back a portion or all of your debts through your repayment plan.

Further, if certain conditions are satisfied, Chapter 13 bankruptcy offers debtors additional benefits that aren’t available in Chapter 7 such as the ability to:

- save a home subject to foreclosure–or a car from repossession–by catching up on missed payments

- reduce the principal balance of your car loan or investment property mortgage with a cramdown, or

- eliminate your second mortgage or another unsecured junior lien through lien stripping.

Here are a few scenarios that explore which bankruptcy strategy would be best:

Also Check: How To Get Out Of Bankruptcy Chapter 13 Early

Why Do Chapter 13 Bankruptcies Fail

Things like not paying the court filing fee, not properly preparing for and attending the meeting of creditors, and not filing all required bankruptcy forms. Other reasons why a Chapter 13 bankruptcy case may be dismissed are: Failing to pay the Chapter 13 payments. Failing to meet certain deadlines

Chapter 1: Business Reorganization

For a business, bankruptcy does not necessarily mean ruin. If it did, there would be three fewer major air carriers , two fewer car manufacturers , and no Marvel Universe.

Chapter 11 filings which surged during the coronavirus shutdown in 2020 allow troubled businesses to protect themselves from creditors while they reorganize their business operations, debts, and assets.

If all goes well, the business re-emerges a few years later oftentimes smaller, sleeker, more efficient, profitable and creditors have enjoyed a more satisfactory return than they would have if the business ended operations and was liquidated.

Sometimes, however, Chapter 11 buys only time. The reorganization plan fails, and liquidation results. The 2011 demise of Borders Books, once the nations No. 2 bookseller, is a prominent example.

Read Also: Trump Number Of Bankruptcies

Social And Economic Factors

In 2008, there were 1,117,771 bankruptcy filings in the United States courts. Of those, 744,424 were chapter 7 bankruptcies, while 362,762 were chapter 13. Apart from social and economic factors such as education and income, there is often also a correlation between race and bankruptcy outcome. For example, for personal bankruptcy claims, minority debtors had an approximately 40% decreased chance of receiving a discharge in Chapter 13 bankruptcy. These racial disparities are aggravated by the fact that many minority debtors lack appropriate attorney representation.

| This section needs expansion. You can help by adding to it. |

Personal bankruptcies may be caused by a number of factors. In 2008, over 96% of all bankruptcy filings were non-business filings, and of those, approximately two-thirds were chapter 7 cases.

Although the individual causes of bankruptcy are complex and multifaceted, the majority of personal bankruptcies involve substantial medical bills.Personal bankruptcies are typically filed under Chapter 7 or Chapter 13. Personal Chapter 11 bankruptcies are relatively rare.The American Journal of Medicine says over 3 out of 5 personal bankruptcies are due to medical debt.

There were 175,146 individual bankruptcies filed in the United States during the first quarter of 2020. Some 66.5 percent were directly tied to medical issues. Critical illness insurance Association report June 2, 2020

The 5 Different Kinds Of Bankruptcy

- 9Shares

Sometimes debts can spiral out of control. Both consumers and businesses are faced with the fact that this no way they can pay back what they owe. Thats when filing for bankruptcy becomes their only option.

Understandably, the government made provisions on different bankruptcy proceedings that a person or a group can acquire to protect themselves from creditors. This way, lawsuits that creditor are bound to file against the borrower would be avoided. They will also have a chance to protect their properties of retain possession of their assets.

However, it is important to remember that . Also, a person may not use bankruptcy as a reason to excuse himself of his financial obligations for his children or alimony.

There are many different kinds of bankruptcy. Here are some basic points about some of the more common types of bankruptcy that are available to the public.

Read Also: Getting Personal Loan After Bankruptcy

Chapter 11 Personal Bankruptcy

So why would an individual choose Chapter 11? Its a viable option if they A) dont want to liquidate all their assets in Chapter 7, or B) have too much debt to qualify for a reorganization plan under Chapter 13.

Your debts cant exceed $1,184,200 in secured debt and $394,725 in unsecured debt in order to qualify.

Thats why celebrities and pro athletes often file Chapter 11. Real estate investors also find it handy since it allows assets to be written down.

For instance, if you own a property worth $98,000 but owe $150,000 on the loan, you can reduce the principle balance of the mortgage to the value of the property. So your new mortgage number would be $98,000.

Chapter 11 also allows you to reduce the interest rate and extend repayment terms. That would mean lower monthly payments.

Are There Advantages To Filing Chapter 11

The biggest advantage is that the entity, usually a business, can continue operations while going through the reorganization process. This allows them to generate cash flow that can aid in repayment process. The court also issues an order that keeps creditors at bay. Most creditors are receptive to Chapter 11 as they stand to recoup more, if not all, of their money over the course of the repayment plan.

Recommended Reading: How Many Times Has Donald Filed Bankruptcy

How To Get Out Of Debt Keep The House Car Retirement Savings And Finally Get A Fresh Start

Filing Bankruptcy Cases Under Different Chapters

If youre filing under a different chapter the second time around, the following rules apply:

- Chapter 7 after Chapter 13 According to Title 11 Section §727 of the U.S. Code, if your first filing was under Chapter 13, you will not be granted a discharge under a Chapter 7 until at least six years has passed from the date you filed your Chapter 13.

- Chapter 13 after Chapter 7 According to Title 11 Section §1328 of the U.S. Code, if your first case was a Chapter 7, you only have to wait four years before filing a Chapter 13.

Filing for Bankruptcy for Reasons other than Discharge

Keep in mind that the time limits discussed only pertain to discharges, not to filings. There is no limit to amount of times you can actually file. While seeking a discharge of debts is the most common reason to file for bankruptcy, its not the only reason.

Some file for the automatic stay which prevents creditors from collecting on debts. Depending on your circumstances, this could help you stop collection efforts and catch up on your payments.

Running into Difficulties with Repeat Bankruptcy Filings

There may be no legal limit on how many times you can file for bankruptcy in Texas but the courts will take a good look at why the debtor is filing for a subsequent bankruptcy. First, lets review why bankruptcies were written into American law.

Discuss Your Options with a Bankruptcy Attorney

What If You Need To File Again

Since the goal of filing for bankruptcy is to attain a fresh financial start, the question isnt how many times can you file bankruptcy? instead, how often will your filing receive a successful discharge of debts? You can file bankruptcy as many times you need, but the timing between discharges matters. The Bankruptcy Abuse Prevention and Consumer Protection Act is a law that prevents consumers from abusing the bankruptcy process by ensuring people were not merely using it to get out of debt quickly. Before the BAPCA, one could file for Chapter 7 bankruptcy and immediately liquidate their assets regardless of income level.

The BACPA now states that individuals can only file a Chapter 7 if they fall within a certain income bracket depending on the state they file in or pass a means test that shows they cannot afford a payment plan for their debts. If the individual is unable to pass either of the above requirements, they must file for Chapter 13 bankruptcy.

This law limits how often one can file for bankruptcy by stipulating the amount of time between filings. While you are able to file for bankruptcy as many times as you need to, you will not receive a second discharge unless the appropriate amount of time has passed. The law does not limit the order in which chapters are filed, making it possible to file Chapter 7 bankruptcy followed by Chapter 13 or vice versa as the situation permits.

See If Our Program Is Right For You

Also Check: What Is A Bankruptcy Petition Preparer

Think Before You File & Hire Legal Support

How often you can file for bankruptcy depends on the type of bankruptcy. It is therefore essential that you know the different conditions of each. But understanding everything by yourself can be a tough task.

To understand your options, you can seek help from a bankruptcy lawyer to help you choose the best course of action to take. Especially if youre in Dallas or Fort Worth, get in touch with Leinart Law Firm if you need help with your bankruptcy case.

Free Bankruptcy Evaluation

Discuss your situation and your options with an experienced bankruptcy lawyer.

Chapters 11 12 And 1: Reorganization

Chapter 11, Title 11, United States CodeChapter 12, Title 11, United States CodeChapter 13, Title 11, United States CodeTitle 11 law library

Bankruptcy under Chapter 11, Chapter 12, or Chapter 13 is more complex reorganization and involves allowing the debtor to keep some or all of his or her property and to use future earnings to pay off creditors. Consumers usually file chapter 7 or chapter 13. Chapter 11 filings by individuals are allowed, but are rare. Chapter 12 is similar to Chapter 13 but is available only to “family farmers” and “family fisherman” in certain situations. Chapter 12 generally has more generous terms for debtors than a comparable Chapter 13 case would have available. As recently as mid-2004 Chapter 12 was scheduled to expire, but in late 2004 it was renewed and made permanent.

Also Check: Did Dave Ramsey File Bankruptcy

Should You File An Individual Or Joint Bankruptcy

If you are married, you can choose to file for bankruptcy jointly with your spouse or individually. In general, filing for bankruptcy together makes sense if you have a lot of joint debts and your state allows you to double your bankruptcy exemptions in a joint filing.

However, individual bankruptcy might be in your best interest if:

- only one spouse has debt

- one spouse has nonexempt separate property that may be at risk in bankruptcy , or

- your state doesn’t allow married couples to double their exemptions in a joint case.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Stop Foreclosure On Your Are There Different Types Of Bankruptcies

Pass a means test to prove your income is less than the average state income for an individual there are many consequences to think about. Chapter 7 and chapter 13 are the most common personal bankruptcies that are filed. Some may have heard of the third most common type of bankruptcy, especially recently as a certain mr. Debts that do not come under the purview of bankruptcy. Questions like, am i qualified to file bankruptcy , how hard is it to file on my own bankruptcy, how. This is because there are many moving parts and one small clerical error can lead to your case being. What most people are unaware of is that there are several other types of bankruptcy that can be used by parties in certain situations. I’m sure you have many questions about filing bankruptcy. Chapter 7 bankruptcy is designed for someone who doesn’t have sufficient disposable income to repay creditors for chapter 13 bankruptcy you must prove you have regular income, and you can’t have more than i actually did not know there were different kinds of bankruptcy that could be filed. This type of bankruptcy can be used by individuals, and is done through liquidation. Filing for bankruptcy may help you eliminate the legal obligation to pay most or all of your debts How to find a chapter 13 bankruptcy attorney? That is because there are no debt limitations under chapter 11.

Read Also: What Is Epiq Bankruptcy Solutions Llc