The Trustee Will Question You At The Meeting Of Creditors

Everyone who files for bankruptcy must go to the bankruptcy court at least once to attend a creditors’ meeting. You’ll be placed under oath, and the trustee will confirm your identity.

Then the trustee asks each filer the same set of standard questions, such as whether you:

- reviewed the petition before signing it

- need to change your paperwork

- reported all of your income and assets, and

- expect to receive money from any source.

The trustee will also ask you specific questions about any unusual issues in your particular petition. Once complete, creditors in attendance can ask questions about your financial situation however, it’s rare for a creditor to appear.

What Does The Bankruptcy Trustee Investigate

For instance, Bankruptcy Rule 2004 authorizes the bankruptcy trustee to examine: the acts, conduct, property, liabilities or financial condition of the debtor. any matter which may affect the administration of the bankruptcy estate, or. any matter which may affect the debtor’s right to a discharge.

Gold Award 2006-2018

11 Year Winner in all Categories:Forms, Features, Customer Service

How Far Back Are Bank Records Checked

For taxes, many people and some experts started to expect to be asked for two years prior filings. For the rest, it appears that about three months of prior records are what is likely to be requested. Again, this is typical. Of very special note, everyone stated to remember that in all dealings with the court, judges, appointed officials, you are under oath. When you file for bankruptcy and deliver requested documents, you file them while you are under oath. This means two things:

The penalty for deceit, not just an honest mistake, is possible fraud and perjury charges.

The courts and their officials may start asking for many more months of documentation to determine fraud and its extent.

Several people had some good experiences as advice, but also had one oddity that struck a chord that needed mentioning. Depending on whom your circle of friends and business dealings are, consider if you have had any financial conflicts or bad feelings around financial dealings.

Read Also: Can You Get A Personal Loan After Bankruptcy

Getting A Lawyer To Help You With Your Bankruptcy

Bankruptcy is a specialized area of law that is very complex. And the issues are not always apparent or simple. The bankruptcy laws changed in October 2005 to discourage many people from filing for bankruptcy. So the law became more complicated. And there are more situations where a mistake can result in your case getting dismissed. If your case is dismissed, the bankruptcy court often imposes a penalty of 180 days before you can refile, and in this time period a lot can happen. This is why it is so important to have a lawyer advise you and help you with your bankruptcy.

Find a lawyer who can help you work through the issues, alternatives you may have, and consequences of your choices.

- Pick a lawyer with whom you are comfortable, one who will allow you to ask questions and give you responses that you can understand.

- Pick a lawyer who either specializes in bankruptcy or does a large part of his or her practice in the field.

- Ask questions until you understand what your choices are.

- Don’t be afraid to interview a lawyer and leave without hiring him or her.

If you decide to represent yourself in bankruptcy court, read a guide for Filing for Bankruptcy Without an Attorney.

To find a good bankruptcy lawyer:

- Check state bar groups and specialization/certification programs for bankruptcy lawyers in your community.

- Ask other lawyers or tax preparers you know for recommendations.

Youll Need To Verify Your Identity

Every bankruptcy attorney and trustee has their stories about mistaken identities, and the issues that follow. Although the bankruptcy system is built on trust, it is also built on verification. The trustee is required to verify your identity.

Bring photo identification, and a document showing your social security number such as your social security card, or a pay stub.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Sample Trustee Questions At Your 341 Meeting Of Creditors

QUESTIONS THE TRUSTEE IS REQUIRED TO ASK YOU AT YOUR BANKRUPTCY HEARING 341 MEETING OF CREDITORS)

After a bankruptcy petition is filed, the Court will schedule a Creditors Meeting under Rule 341 of the Bankruptcy Code. While your creditors may appear, generally only the Trustee and perhaps a U.S. Trustee representative is present to ask you questions about your petition and decision to file bankruptcy. This debtors examination is under oath and you should review your petition and the following sample questions to be best prepared. Your attorney will also be present at the meeting but they cannot answer the questions for you although they may assist in cases of misunderstandings, clarification or objections. Youll need to bring your picture ID and social security number card for review.

What Happens At The Meeting Of Creditors

During this meeting, the trustee will verify your government-issued photo ID and Social Security card or proof of Social Security number. The trustee will also need your proof of income, bank statements and other financial documents, like tax returns and loan statements.

It is the trustees job to ask you questions under oath and verify that your financial information is complete and accurate.

Also Check: What Is Epiq Bankruptcy Solutions Llc

Does A Bankruptcy Trustee Check Bank Statements

When you file for bankruptcy protection, the trustee effectively puts your life under a microscope at least any part of it that has to do with your finances. He must have a complete picture of your income, assets and debts so he can so he can manage your case. He can ask for your bank statements, and if he does, you are obligated to turn them over.

Tips

-

It is the responsibility of your bankruptcy trustee to examine all relevant financial documents that can help them effectively manage your particular case. With that in mind, it is highly likely that the trustee assigned to you will review all of your bank statements in order to gain a better understanding of your financial habits

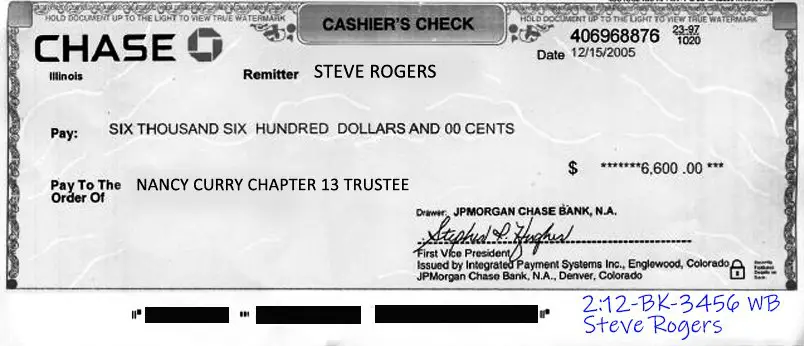

Spending While In Chapter 13

If you file a Chapter 13 bankruptcy petition and your case is confirmed, you have shown the court and the Trustee that you have sufficient income to pay your ongoing expenses and also repay your creditors in part. The money you make after the filing date should first be used to make your monthly plan payment to the Trustee. After that, your money is yours to do with as you please, up to a point: if you need to make a large purchase such as a car or a house, you might need the courts permission. Consult with your attorney.

Recommended Reading: Trump Declared Bankruptcy

The Trustee May Ask Additional Questions

The trustee may have discretionary questions. These questions are usually intended to determine whether you might have any nonexempt assets that could be claimed by the trustee, or whether there were payments to creditors or transfers of property made before the bankruptcy filing that might be recovered by the trustee.

he trustee may, for example, ask:

· How did you value your home?· How did you value your car?· Do you have any claims against anyone?· Are you expecting an inheritance?· Have you transferred any assets?

When You Lose Your Money

Some people carry a balance in their bank account to cover emergencies or to avoid banking fees. This amount of money could be considered an asset of your estate and subject to seizure by your bankruptcy trustee. In addition, savings accounts and unprotected funds outside of any provincial bankruptcy exemption limits are also at risk.

Don’t Miss: Has Mark Cuban Ever Filed For Bankruptcy

How Do I Get Bankruptcy Records

Interested persons can access bankruptcy records in the following ways:

- From the Clerk Office or divisional office

- Through the Public Access to Court Electronic Records

- Via Voice Case Information System

- From the National Archive and Records Administration

Obtaining bankruptcy records from the Clerk Office or divisional office:

Certified and informational copies of bankruptcy records may be available at the Clerk Office of the court that heard the specific case. Interested persons may make requests in person or mail request letters containing a description of the needed documents with adequate case details like the case number, docket number, filing date, and party’s name. Persons may send the requests to the appropriate clerk or divisional office. Furthermore, individuals may view bankruptcy case information for free in any Bankruptcy Court divisional office through the public access terminal.

Obtaining bankruptcy records through the Public Access to Court Electronic Records :

Obtaining bankruptcy records Via Voice Case Information System :

Obtaining bankruptcy records from the National Archive and Records Administration :

Records of closed bankruptcy cases may be available at the National Archives and Records Administration. Interested persons can order copies of bankruptcy case files online by:

What Happens To Your Bank Account

When the bankruptcy order is made, you must:

- make sure you dont use your bank account

- give your cards and cheque books to the trustee

Your bank account will be frozen. Any money in your account will be an asset and claimed by the trustee. The trustee can ask to release some money:

- for your daily living needs

- to the other person in a joint account

The bank is allowed to use money from one of your accounts to pay your debts on another account you hold with them. This is called set off.

Otherwise, money owed to the bank is a bankruptcy debt, so you cant pay this to the bank directly. The exception is if the bank has a charge on your home .

Open a new account

You can open a new bank account after the date of the bankruptcy order but you must tell the bank or building society that youre bankrupt. Some banks will let you use your old account after theyve spoken to the trustee.

Also Check: Leasing A Car After Chapter 13

What Are Bankruptcy Exemptions

Bankruptcy exemptions prevent debtors from losing all their assets to the bankruptcy process. These exemptions help the debtor maintain ownership of all or certain parts of specific assets required to maintain a basic standard of living.

Bankruptcy law provides several federal exemptions. However, states also offer varying exemptions to resident petitioners. Regardless, the requirements for applying these exemptions may differ between states. For instance, many states allow debtors to choose between federal and state exemptions but disallow a combination of both. Petitioners in states like Kentucky, New York, and New Hampshire may abandon federal exemptions in favor of state options and vice versa. However, states like California, Louisiana, and Colorado do not recognize federal exemptions.

Every three years, the amounts allowed under federal exemptions are adjusted due to changes in the Consumer Price Index. As of April 1, 2019, the following federal exemptions and amounts apply:

Homestead Exemption

Under federal law, a debtor can protect up to $25,150 of equity in their principal place of residence. The residential property may be a house, another type of dwelling, or personal residential property, such as a residential trailer. The homestead exemption only applies if the debtor lives on the property. This exemption is not usable on rental properties or other related investments.

Wildcard Exemption

Personal Property Exemptions

Benefit and Support Exemptions

Preparing For A Bank Setoff

One way to make sure you arent short on the funds youll need to pay living expenses after filing for Chapter 7 or Chapter 13 Bankruptcy is to stop all automatic drafts of payments on bills, for utilities, and similar.

If you are unable to stop auto payments before you file for bankruptcy, you can notify an important creditor yourself that you have filed for bankruptcy and ask them to stop drafting automatic payments from your bank. Your attorney can help you draft formal notices in this regard to send to your creditors and your banks.

Another strategy is to move your checking, savings, and other financial accounts to a new bank before filing for bankruptcy. Although you are required to disclose these funds, this will stop the bank from freezing them if the bank is a creditor entitled to a setoff.

Don’t Miss: Epiq Bankruptcy Solutions

What Is Exempted Under California Code Section 703

Some of the items permitted under Californias 703 exemptions include:

- Homestead Exemption: Debtors may exempt up to $29,275 in interest for property used as a residence

- Tools of the trade: California allows for the exemption of professional books, implements, or other tools of the trade up to $8,725.

- Wild card exemption. Debtors may protect assets in any class up to a total of roughly $30,000 .

- Household and furnishing goods: Residents may protect goods, furnishing, appliances, or apparel up to $725 per item

- Retirement accounts

What Is Bankruptcy Protection In California

Bankruptcy protection is a court action that protects debtors by placing an “automatic stay” on the collection of all debt. It provides an individual or company in California with more time to reorganize or restructure debt payments. The court order freezes the actions of most creditors and collectors, including evictions, vehicle repossessions, collector calls, letters, wage garnishments, legal proceedings, and some tax actions. The bankruptcy court mails the order to all creditors or any party seeking payment, informing them of the decision. Depending on the case, bankruptcy protection may last anywhere from 90 days to 63 months. Creditors who violate the courts automatic stay order risk facing severe penalties such as:

- Paying court costs and attorney fees

- Sanctions and fines from the court

- Paying punitive damages

Also Check: Bankruptcy Software For Consumers

There Will Be Several Meetings Of Creditors Scheduled At The Same Time As Your 341 Meeting

The time set for the meeting of creditors will be used for a number of individual meetings of creditors. It is not unusual for ten or twelve meetings to be scheduled for the same time. Cases are called one by one, and the parties and their bankruptcy lawyer will sit at a table with the bankruptcy trustee.

It is a public meeting, with maybe twenty-five or thirty debtors and attorneys in attendance. Everyone is there for the same reason, and everyone shares the same concerns and apprehension, but the 341 meetings are conducted quickly, and with respect and courtesy.

How Far Back Are Bank Records Checked When Filing For Bankruptcy

When one files for bankruptcy, that person knows or should know, that the court will be looking at the debtors life very closely and the debtors bills and payment records even closer. Under normal conditions, a Chapter 7 bankruptcy trustee or a Chapter 13 court official will want to review your bank account records and your credit loans and card account records, and your tax filings, and other financial dealings. What the inquirers are looking for are hard cash and saleable assets that can be seized to pay the debt. They will also be looking for evidence of any income or assets that are by law are exempt. Just like the debtor, the court-appointed people and the creditors are bound by both federal and state laws.

Having your records available and organized tells the court and its officials that you are ready to cooperate. Although it is a difficult situation, having a good attitude and showing a willingness to work with the court officials often work in your favor when discussing hardships, seizures, and exemptions. Several people have noted a favorable result from being forthright and open.

Recommended Reading: How Many Times Has Donald Trump Filed For Bankruptcy

In A Chapter 13 Bankruptcy

A Chapter 13 trustee is responsible for overseeing your repayment plan. That includes

- Making sure your plan is reasonably affordable

- Collecting your payments according to the plan

- Distributing payments to your creditors

The trustee also holds the meeting of creditors in a Chapter 13 bankruptcy.

The 341 Meeting Of Creditors Is Not A Court Hearing

The bankruptcy law prohibits the bankruptcy judge from attending the meeting of creditors. Although the meeting of creditors is serious business, it is not a court hearing. No legally binding decisions can be made for you, or against you.

Nevertheless, the 341 meetings are recorded. Be careful and thoughtful with your answers, and dont guess as to facts you dont know.

You May Like: How To Buy A New Car After Bankruptcy

The Bankruptcy Trustee Reviews Your Bankruptcy Papers Carefully To Look For Hidden Assets Avoidable Transfers Improper Exemptions And More

By Cara O’Neill, Attorney

COVID-19 Updates: Retirement and Stimulus Fund Protections Safe Filings.

If you’re one of the millions laid off due to COVID-19, bankruptcy can erase bills while keeping most retirement accounts intact. And you don’t need to worry about losing your stimulus fundsthe new bankruptcy “recovery rebate” law protects stimulus checks, tax credits, and child credits. Bankruptcy lawyers will consult with you virtually, and courts continue to hold 341 creditor meetings telephonically or by video appearance unless an in-person meeting is necessarysee the U.S. Trustee’s 341 meeting status webpage for details.

Streamline your researchtake our bankruptcy quiz to identify potential issues and learn how to best proceed with your bankruptcy case.

One of the primary duties of the bankruptcy trusteethe official appointed to oversee your caseis to find money to repay creditors.

In Chapter 7, the trustee looks for property to sell or additional income to justify converting the case to Chapter 13. In Chapter 13, the trustee checks whether you couldor shouldbe paying more to creditors than what you’ve proposed.

In both cases, the bankruptcy trustee will:

- review the exempt property list to determine whether you can keep all of your assets

- compare your income to the financial documents provided

- inspect your budget for reasonableness, and

- look for signs of transferred or hidden assets.