Personal Loan Rates Are Reasonable

Take a look at the chart below of rates for personal loans and credit cards. Its clear that getting a personal loan is much cheaper.

For a personal loan, take a look at Credible, my favorite online lending market place where pre-qualified lenders compete for your business. You can get real quotes for free in a matter of minutes.

If you can borrow at a reasonable rate, it may be better than going through a foreclosure or short-sale. Let me explain more below.

How To Build Credit While In Chapter 13 Bankruptcy

Chapter 13 | November 2, 2020 | Christopher Ross Morgan

The popular myth is that filing bankruptcy ruins your credit. As experienced Chapter 13 Bankruptcy attorneys, we can tell you thats normally not true. Most bankruptcy debtors have credit scores in the mid-500s. In many cases, thats not much lower than their pre-bankruptcy scores. So, it is easier to rehabilitate your score than you might have thought. And, you do not need to wait until after the discharge to begin the rebuilding process.

As a side note, the benefits of bankruptcy far outweigh the drawbacks. Bankruptcys Automatic Stay halts adverse action, giving your family the breathing room it needs. Furthermore, Chapter 13s protected repayment plan allows debtors to gradually erase secured debt delinquency, such as past-due mortgage payments, over a period of up to sixty months.

An experienced Athens bankruptcy lawyer helps families take full advantage of the benefits of bankruptcy and minimize the drawbacks as much as possible. If creditors try to take away your rights, an attorney stands up for you in court. Additionally, largely through a network of professional partnerships, an Athens bankruptcy attorney helps families quickly recover from bankruptcy, so they can make the most of their fresh starts.

What’s A Credit Score

A credit score is a number that supposedly summarizes your credit history and predicts the likelihood that you’ll default on a debt. Lenders use credit scores to decide whether to grant a loan and at what interest rate.

FICO scoresthe most common type of credit scorerange from 300 to 850. A FICO score is based on the information in your credit report, including:

- your debt payment history

- how much debt you currently have

- your different types of credit

- how long you’ve had credit, and

- whether you have new credit.

A high FICO score generally means that you’re good at managing your finances, while a low FICO score usually means that you have been delinquent with credit payments, have high unpaid debt balances, gone through a foreclosure, filed for bankruptcy, or experienced other problems repaying debt.

Read Also: Can You Get An Sba Loan With A Bankruptcy

How To Build Back Your Credit After Bankruptcy

Rebuilding your credit after filing for bankruptcy can seem daunting, but there are some steps you can take to help your credit history begin to recover:

- Make sure all payments are on time going forward. Sometimes, the bankruptcy court will allow you to keep certain accounts open. If you still have open and active accounts that were not included in bankruptcy, be sure to make every payment on time.

- Open a new account. If you are starting from scratch with no remaining open accounts, it can be difficult to qualify for new credit after bankruptcy. Consider opening a secured credit card, getting a , or asking a friend or family member to add you as an on their credit card. Making small purchases and then paying the balance in full each month will help build a positive payment history, which in time can help offset the negative impact of the bankruptcy.

- Check your credit report frequently. Stay on top of your credit situation by reviewing your credit report often. You can also request your free credit score from Experian, which will include a list of the top risk factors impacting your scores.

- Sign up for Experian Boost. Adding your on-time cellphone, utility and streaming service payments with Experian Boost can help you increase your credit score so you can start to rebuild after bankruptcy.

Can You Get A Credit Card After Filing For Bankruptcy

Yes, you can get a credit card after filing for bankruptcy. That said, a bankruptcy will make it very difficult for you to get a regular unsecured credit card, however, you can apply for an unsecured credit and build good credit history for that account. The only difference between a regular credit card and a secured credit card is that to get a secured credit, you need to pay a security deposit and the deposit that you pay will be your credit limit.

You May Like: Can You Rent An Apartment After Bankruptcy

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Closing A Credit Card

While it may seem like a good idea to close a credit card that has a balance left on it to avoid spending additional money, that is not typically the case. Remember that a portion of your score is calculated based on your debt to credit ratio. If you close a line of credit and still have debt on the card, you are going to negatively impact your debt to credit ratio.

Also Check: How Much Does It Cost To File Bankruptcy In Wisconsin

Maxing Out Your Credit Card

Using too much of your debt to credit ratio can have a negative impact on your credit score. If you intend to use more of your credit balance in the future, you may want to increase your line of credit in advance to avoid making your score drop. You should always be aware of how much credit is available to you and keep your balances as low as possible.

Can I Rebuild My Credit After Bankruptcy

You can rebuild your credit after bankruptcy, but its a long process. Your options will be limited at the start, but it is key to not get discouraged. As time goes on, if you consistently pursue a credit rebuilding strategy, your reports and scores can improve.

Here are some recommendations to start with:

- Understand the cause: Identify, accept, and learn from the root causes of your bankruptcy so you wont find yourself in the same position down the road.

- Stick to a budget: Re-evaluate your finances and see where you can cut expenses and save more money if you can.

- Start establishing a new credit history: No, this does not mean using an alias . It means starting fresh with whatever credit you can obtain.

This may mean settling for an extremely high-interest rate, taking on a co-signer, depositing cash into a secured credit card, or other options that have been designed specifically to help you re-establish a positive credit record.

Use these credit options sparingly and never put more on a card than you can pay off by the end of the month so your credit improves over time.

Don’t Miss: Has United Airlines Filed For Bankruptcy

How Long Does It Take To Rebuild Your Credit After Chapter 7 Bankruptcy

A Chapter 7 bankruptcy stays on the borrowers credit report for 10 years. This means that after 10 years, all records of the bankruptcy must be removed from your credit report. That said, the impact the bankruptcy has on a credit score decreases as time passesdue in part to the immediate reduction in the consumers debt-to-income ratio, which is how much you owe in relation to the amount of available credit you have. Because of this, you may start to see improvements in as little as one to two years after discharge.

How Much Will A Foreclosure Hurt My Credit Score

Updated: by Financial Samurai

If you are one of the millions of people considering foreclosure or a short sale, you need to read this post first and understand all the consequences before proceeding. A foreclosure will hurt your credit score. The question is: how much will a foreclosure hurt my credit score?

How much a foreclosure will hurt your credit score will depend on the following:

- Your current credit score the higher it is, often the bigger the hit

- Your credit history and whether youve had prior foreclosures, late payments, or non-payments

- The amount of mortgage you are foreclosing on compared to your overall debt and net worth

My sincerest home is that you do not foreclose on your home. Mortgage rates are low. The Fed is being very accommodative. The Federal government is providing stimulus and the job market is coming back.

Its best to try and hold on during the global pandemic until the times get better. If you can, refinance your mortgage so you can lower your payments.

You can find a competitive mortgage rate with Credible, my favorite online lending marketplace where qualified lenders compete for your business. Youll get no-obligation, free quotes in minutes based on your situation. Mortgage rates are at all-time lows. Take advantage.

Recommended Reading: How To File Bankruptcy In Tennessee

How Does Bankruptcy Help Improve My Credit Score

You may be wondering how filing for bankruptcy can increase your credit score if you have a credit score that is less than 600. There are a few reasons. First, wiping your slate clean makes creditors realize that youâre more likely to pay them back. Just think of two different people, John and Sam. John is $40,000 in debt and owes three hospitals, four credit card companies, and five friends money. Sam, on the other hand, just filed for bankruptcy so he does not owe anybody.

Who are you more likely to give a loan to because you think theyâll pay you back? If you give a loan to Sam, you are going to be the 13th creditor that he owes. If you give a loan to John, you are going to be the only creditor that he owes. Of course, you are more likely to give the loan to John, even if he just filed for bankruptcy. The takeaway is that lenders look at your credit score to determine how risky you are as a borrower and how likely they are to lend you money.

How Long Does It Take To Repair Credit After Bankruptcy

Some have reported obtaining a credit score in the high 600s to low 700s within two years after filing for bankruptcy. The best way to repair your credit after filing for bankruptcy is to open a secured credit card and establish a good payment history. Within a year apply for another credit card and maybe take out an auto loan. Make all of your payments on time and you should have a fair credit score within 24 months of filing for bankruptcy.

Recommended Reading: Do Married Couples Have To File Bankruptcy Together

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Check Your Credit Report

Check your credit report every few months to be aware of the factors influencing your credit score. Compare each entry in the report to your own financial records to ensure that debt balances and account histories are accurate. Dispute any inaccurate or fraudulent listings in your report as quickly as possible to avoid negative impacts. Personally contact any companies that have legitimately listed defaults or missed payments, and work with them to establish repayment plans to avoid further negative reports. Read More:How Long Does a Foreclosure Stay on Your Credit Report?

Don’t Miss: Can You Rent An Apartment After Filing For Bankruptcy

Dear Speaking Of Credit I Was Wondering By How Many Points I Might Expect To See My Credit Score Increase When My Chapter 13 Debt Is Discharged Next Month

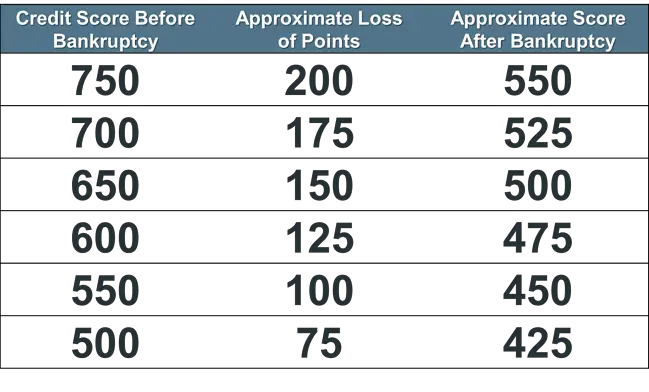

Your credit score is going to drop whether you give up your car voluntarily or it’s repossessed, but you may be able to prevent having to give your vehicle up if you take action early enough. If your credit score wasn’t great before filing, then you may only see a modest drop in points. A chapter 7 bankruptcy will remain on your credit reports and affect your credit scores for 10 years from the filing date In 2010, fico released information about how bankruptcy and other credit mistakes affect your credit score. Sometimes managing credit and monitoring your credit score can feel like a game of chess. The sliding scale system will generally knock your credit points however much it takes to show you have poor credit. This is enough to take a good credit rating down to a fair or poor one. After all, if the collection knocked your 710 score down by 100 points, you can expect to see many of those points return it’s been removed from your report. A person with an average 680 score would lose between 130 and 150 points in bankruptcy. This difference is 60 points after four quarters. But a person who has a credit score of 780 prior to a bankruptcy loses 220 to 240 points. Using a mock scenario with two different credit profiles, fico showed a bankruptcy could cost up to 240 points for someone with a 780 credit score and 150 points for someone with a 680 credit score. That could move you from a very good to fair credit range.

How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

Also Check: Can Restitution Be Included In Bankruptcy

How Does Bankruptcy Affect Your Credit Score

You may be wondering how big of a hit your credit score will take if you file for bankruptcy. Theres no one-size-fits-all answer here. The exact score impact will depend on a number of personal factors, including the amount of debt discharged during your bankruptcy proceedings and the ratio of positive and negative accounts on your report. However, you can expect to see a drop between 130-200 points on your credit score, according to FICO.

If you file for Chapter 7 bankruptcy, the public record will stay on your credit report for a full 10 years. The good news however is that the following items will fall off your report after seven years:

- Trade lines that state account included in bankruptcy

- Third-party collection debts, judgments, and tax liens discharged through bankruptcy

- Chapter 13 public record items

Most people believe that bankruptcy means their financial life is ruined, and while it should only be considered as a last resort, the impact is limited to only 10 years. If you focus on a clean slate of making sound financial decisions, youll emerge a decade later with a rejuvenated credit score.

After bankruptcy, you can take proper steps to improve your credit by paying your bills on time, not carrying a balance on any open credit cards, and keeping your low.

Can A Chapter 7 Be Removed From Credit Report Before 10 Years

A chapter 7 bankruptcy can only be removed from your credit report before the 10 year period if there are any inaccuracies in the information thats reported. You cannot remove a bankruptcy from your credit report simply because you dont want it to be there. Most people will have to wait the 10 years before the bankruptcy falls off their credit report on its own.

Don’t Miss: How Many Bankruptcies Has Donald Trump Filed