How Can I Improve My Credit Score After Bankruptcy

There are several deliberate steps that you can take to improve your credit score after bankruptcy. As long as youâre thoughtful about your finances after bankruptcy, you should be able to access new credit in a timely manner.

Unfortunately, despite the data behind the benefits of bankruptcy, many low-income Americans are still afraid to file due to misinformation. As a result, people who decide not to file even though it would improve their credit scores end up having difficulty getting credit cards and bank accounts. In many cases, they continue to deal with wage garnishment and have a tough time finding jobs.

We encourage you to take a look at the data and decide for yourself whether you believe bankruptcy will improve your financial situation. You can find more information in our Learning Center, file Chapter 7 bankruptcy for free with our online filing tool, or get advice from an experienced bankruptcy lawyer.

Upsolve Co-Founder Jonathan Petts explains bankruptcy basics in the video below â¬ï¸

Why You Need To Work On Your Credit Asap

If you have a 550 credit score, borrowing is going to be challenging. A credit score of 550 or lower is usually too low to qualify for a mortgage. However, youre not that far off from the score you need to qualify for this good debt. With FHA financing options, you only need a 560-600 to qualify. Of course, if you want to use traditional financing options, you generally need at least a 600 credit score.

However, besides loan approvals there are other concerns that come with a low score:

So, is bankruptcy bad for your credit? Yes. But it might not be as bad as you think. And there are financing options specifically designed to help people in your situation. For instance, there are solutions for buying a car after bankruptcy.

What Is A Soft Inquiry

A soft inquiry happens whenever you check your credit report, or when a lender checks your credit report without your knowledge or permission.

Soft inquiries have no effect on your credit score. Lenders cant even see how many soft inquiries have been made on your credit report.

Here are some examples of a soft inquiry:

- Inquiries made by lenders to make you a pre-approved credit offer .

- Inquiries that come from employers.

- Checking your own .

- Inquiries made by a lender whom you already have an account with.

Recommended Reading: Trump How Many Bankruptcies

How Long Does Bankruptcy Affect My Credit Report

There are two main credit reporting agencies in Ontario: Equifax and Trans Union. Information about your bankruptcy or consumer proposal is reported to these agencies by the Office of The Superintendent of Bankruptcy , not your trustee. The OSB will advise these agencies when you file a bankruptcy or proposal and when you receive your discharge.

If you file ANY of a bankruptcy, consumer proposal, debt management plan or do a debt settlement, a not will appear on your credit report that can negatively impact your credit. In general:

- a first bankruptcy will remain on your credit report for six years or seven years after you are discharged

- a consumer proposal (or debt management or debt settlement plan will remain on your credit report for three years after all of your payments are completed.

Bankruptcy does not mean you cannot borrow for six or seven years. This just means that the note will remain on your report, however there are many other factors that affect your ability to get credit.

If you have a job, and if you have a down payment or security deposit, it is possible to repair your credit sooner. Many people are able to buy a car or a house in less than seven years after their bankruptcy ends, if they are able to save money and begin repairing their credit. Here are some ways you can improve your credit after filing for bankruptcy:

How Many Points Do I Lose On My Credit Report When I File Chapter 13 Bankruptcy

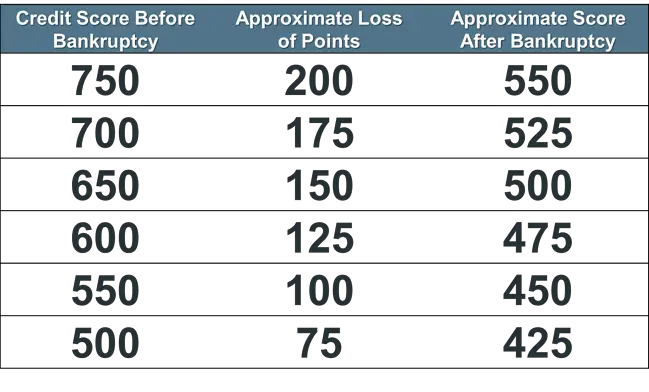

The average drop in credit score after filing Chapter 13 depends on what your credit score was before filing bankruptcy.

Typically, individuals with higher credit scores who file Chapter 13 experience a larger drop in their credit scores compared to individuals who have good to poor credit ratings when they file their bankruptcy petition. Some sources estimate claim that a credit score can drop as much as 200 points if you have excellent credit when you file for bankruptcy relief. However, if you have poor credit, you may only see a 100 point or less drop in your score if you file Chapter 13.

The good news is that your Chapter 13 bankruptcy case remains on your credit report for only seven years . However, you can take some steps to improve your credit score during your Chapter 13 case.

Another piece of good news is that many debtors experience an increase in their credit score within a year or two after filing for bankruptcy relief, which helps them on their roads to financial recovery.

You May Like: What Is Epiq Bankruptcy Solutions Llc

How Does Chapter 13 Affect Your Credit

- Bankruptcy

- How Does Chapter 13 Affect Your Credit

You may be considering bankruptcy after a recent financial hardship and wondering how a Chapter 13 bankruptcy will affect your credit. Fear of a bad credit score keeps many people from considering Chapter 13 as a way to get out of debt. Unfortunately, by the time many people consider bankruptcy as a debt-relief option, their credit score has already been harmed because of late payments, debt collections, and other adverse credit actions. However, how does Chapter 13 affect your credit?

How Do Bankruptcies Affect Your Credit Score

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This post has been updated with new information.

Before starting on a pursuit to accumulate points and miles, its important to understand how your credit score is calculated and mistakes you should be careful to avoid. Your credit report follows you around for a long time, and you should only consider opening credit cards if youre able to manage them responsibly.

With every credit card Ive opened, Ive become even more attentive to paying my bills on time and monitoring my accounts for fraud. However, its possible that before you found the world of points and miles, you may have made some mistakes such as missed payments, carried a balance, or even had to declare bankruptcy. Today, were going to take a look at how bankruptcy affects your credit score and what you can do about it.

The contents of this post are not meant to represent legal or financial advice, and you should consult with a lawyer and/or financial professional before making decisions regarding a bankruptcy filing.

Read Also: How To Become A Bankruptcy Lawyer

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

Tips For Credit Rebuilding

Ironically, the only way to fix your credit score is to start borrowing money again. If you are in a consumer proposal, think carefully about the purpose of this process, and how to avoid new problems with your credit. Even though it feels good to be offered new credit, or be accepted for a new card, be sure not to overextend your ability to make regular payments. Go slowly. You do not need to borrow large amounts to rebuild your credit. Making all your payments on time is the key. In addition, pay attention to the interest rates and fees charged on credit products you apply for as there are some lenders who may not have your best interests in mind.

Here are some tips for rebuilding your credit.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Establish Two Or More New Lines Of Credit

There are two main types of credit available to consumers:

- Revolving Credit.Revolving credit is credit that is constantly available to use, and includes credit cards, lines of credit, and store cards. Lenders typically update your payment history on these sources of credit every month.

- Installment Credit. Installment credit is defined as a payment arrangement with a lender over a set period of time. This type of credit includes mortgages, car loans, chattel loans, and other types of loans. Unlike revolving credit, there is no capacity to borrow on demand, like there is with a revolving credit product. Installment credit can be pricey, as rates are based on your credit score.

An example of installment credit is a car loan, where the lender will approve a loan and record the car as collateral. The set payment of the loan will be reported to the credit bureau every month, and your credit score will begin to improve.

RRSP loans are also installment credit. Banks or lenders are often very approachable regarding these, as they get a good interest rate and their money is secure.

It is recommended that you open two or three credit accounts to rebuild your credit rating. Some sources state that at least one account should be installment credit, but it is possible to rebuild your credit with credit cards alone as long as your new payment history is perfect!

Become An Authorized User On A Credit Card

If you dont want to take out a secured credit card, you can ask a family member or friend who has good credit to add you as an on one of their credit cards. You may see an increase in your credit score if the issuer reports the cards positive payment history to the three main credit bureaus. However, your score could take a dip if the primary cardholder makes a late payment or maxes out their credit limit.

Don’t Miss: How Many Times Did Trump File Bankruptcy

How Bankruptcy Can Help You Anyway

If you find yourself in a position where you must file bankruptcy, then your credit score is not as important as the reasons for having to file bankruptcy. Getting a new loan or credit card is not as pressing as, for instance, a pending wage garnishment or mortgage foreclosure. Nevertheless, after you have obtained bankruptcy relief, you may find that the bankruptcy may actually help your credit. This is so even though the bankruptcy will remain on your credit report for up to ten years.

How Does Bankruptcy Affect My Credit Rating

Your credit report is maintained by one of two major credit rating agencies in Canada: Equifax and Trans Union. When you apply for a loan, whether a credit card or a mortgage, your lender will review your credit report. This report contains information about whether or not you have unpaid bills, how much credit you have outstanding and even how many times you have applied for credit.

If you file for bankruptcy a note will appear on your credit report indicating that you have done so. This information is provided to the credit bureau by the federal Superintendent of Bankruptcy. Each month they provide a list to the credit reporting agencies of everyone who has filed or a . It is important to understand that it is not your trustee advising the credit bureau of your bankruptcy, or your discharge. Rather it is part of the process completed by the Office of the Superintendent of Bankruptcy. They also provide a list of people who have been discharged.

Read Also: How Many Times Has Trump Filed Bankrupcy

Work With Your New Creditors

If you ever have to miss a debt payment due to unforeseen financial hardship, contact your creditor long before your next due date. Work with the creditor to establish a future payment arrangement, and ask a service representative or manager to note your account with a “promise to pay.” Specifically request that the creditor not report the missed payment to credit bureaus, and check your credit reports after a few weeks to ensure that it did not.

References

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Recommended Reading: Toygaroo Failure

How To Reestablish Your Credit

After declaring bankruptcy, you’ll want to look at ways you can earn a score in a range that will qualify you for better financing options and that begins with rebuilding your credit.

You may not be able to immediately qualify for the best credit cards, but there are others that apply to people with less-than-stellar credit.

Secured credit cards require a deposit that acts as your credit limit. If you make your credit card payments on time and in full on this new secured card, you then have a greater chance at qualifying for an unsecured credit card in the near future.

The Capital One® Secured has no annual fee and minimum security deposits of $49, $99 or $200, based on your creditworthiness. Those who qualify for the low $49 or $99 deposits will receive a $200 credit limit. Cardholders can obtain a higher credit limit if they make their first five monthly payments on time.

The Citi® Secured Mastercard® is another option with no annual fee. There is a $200 security deposit required, which would mirror your credit limit. Cardholders can also take advantage of Citi’s special entertainment access, which provides early access to presales and premium seating for concerts and games.

Once you add this new credit car, make sure you pay your monthly bills on time and in full to quickly work your way toward better credit.

Editorial Note:

Derogatory Items And Credit Reporting Dates

| Derogatory item |

ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary website’s rules and the likelihood of applicants’ credit approval also impact how and where products appear on the site. CreditCards.com does not include the entire universe of available financial or credit offers.CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

You May Like: Donald Trump Number Of Bankruptcies

Keep Your Oldest Accounts Active

Since many people who declare bankruptcy previously had good credit, older items on their report can help their credit scores even if they later declare bankruptcy. The length of credit history factor, which makes up about 15% of your score, is generally not affected by declaring bankruptcy. In other words, keep these older accounts active and in tact whenever possible to maintain the length of your credit history.

How Much Does Bankruptcy Affect Security Clearance

Lets look at the statute. Someone who is in debt might resort to illegal acts in order to pay off their debts. Engaging in those illegal acts might be espionage, or acts that could put them at risk of extortion. When it comes to bankruptcy, three conditions could apply.

- Not meeting financial obligations

- Inability or unwillingness to satisfy debts

- Financial problems traced to gambling, drug and alcohol abuse, or other issues of security.

The debt issues also have mitigations as below.

- The issue was not recent.

- The issue was an isolated incident.

- The issue was beyond your control loss of employment, medical issues, loss of revenue to a business, death of a spouse, or divorce/separation.

- Receiving or previously received counseling for behavior that precipitated the issue, with indications that the behavior is under control.

- There was a good-faith effort to resolve your debts, payments were made to the creditors, or the debts were dismissed as improper, or were legally resolved in bankruptcy.

If you are thinking of applying for a job that requires a security clearance, then it pays to get your finances in order. This financial cleaning might be getting a grip on student loans, or a bankruptcy that lets you breathe with the automatic stay.

Dont Miss: How Does A Bankruptcy Affect Credit Score

Read Also: How Many Times Has Trump Filed For Bankruptcy