How To Use Your Debt

The DTI is a very useful tool because it lets you know how much debt you currently have and how much more debt you can safely take on. You can also use the information to strategize about how to reduce your debt. Use this formula before deciding whether to make a new purchase using credit. For example, if you estimate that an extra $50 in monthly credit card payments will increase your DTI above 20 percent, you may want to wait to buy that new item until your net income goes up or your total monthly debt payment goes down.

Remember, not all debt is bad! Some debt, such as student loans are necessary for some people. However, you need to be a smart borrower so you don’t wind up with more debt than you can handle. Calculate your DTI and estimate how taking on more debt will change before borrowing money or purchasing on credit.

Check If A Dmp Is Right For You

If youre thinking about getting a DMP its important to know:

- it doesnt usually include priority debts so might not help you if youre struggling with your rent or council tax, for example

- it can take a long time to pay off your debts if youre only making small payments

- your creditors dont have to agree to the plan and they can stop accepting it or ask for more money at any time – it isnt a legal agreement

- your creditors can still contact you about the debts you owe

- it could make it harder for you to borrow money in the future – check how a DMP might affect your credit rating

Check If You Can Get A Debt Relief Order

If you get a DRO, you wont pay anything towards the debts in the order for 12 months. At the end of the 12 months you’ll no longer owe those debts. While the DRO is in place your creditors cant ask you to pay any debts included in it or start any action against you.

You might be able to get a debt relief order if:

- you owe £30,000 or less

- you have £75 or less left over each month after paying your living costs

- you dont own your home

- you have £2,000 or less in savings and other assets

- you havent been given another a DRO in the last 6 years

- youve lived or worked in England or Wales for the last 3 years

If you have a vehicle worth less than £2,000, you dont have to include it in your assets. If your vehicle is worth more than £2,000, you don’t have to include it in your assets if it’s been adapted because you have a disability. You can only exclude 1 vehicle from your assets and you can’t exclude it if you only use it for work.

You might find it harder to get a DRO if in the last 2 years youve made payments to one creditor but ignored others, given away valuable things you own, or sold things you own for less than they were worth.

If its found that you made your situation worse, or acted dishonestly, you might be given a debt relief restrictions order . A DRRO will extend your debt relief order so the restrictions last longer than 12 months. Read more about debt relief restrictions orders.

Read Also: How To File Bankruptcy Chapter 7 Online

When Should You Start To Worry

There are many different factors that you have to take into account when considering how much debt is too much. Reports state that the average person in the UK doesnt begin to worry about their debt until it is at least in excess of £6k.

Its also reported that one in six adults would have to owe more than £10k before they start to worry and consider whether that amount of debt is too much. While this varies for different people who might be under different circumstances, it is interesting to note that £10k seems to be when people realise that their debt is too much.

What The Banks Say Is Too Much

Here is how the bank looks at your debt: when you add up all of your monthly debt payments along with heating and taxes for your house, this number should not exceed 40% of your income. So when you add up your monthly credit card payments , line of credit payment, car payment, mortgage payment and payments for heat and taxes, the total of all of these payments should not exceed 40% of your monthly income . Lenders call this your Total Debt Servicing Ratio . If your TDSR is 40% or greater, they will not lend you any more money .

Banks also will not give you a mortgage if your Gross Debt Servicing Ration exceeds 32%. GDSR is the ratio of your shelter costs to your income. Your GDSR is your mortgage payment plus heating and taxes. So this means that banks will not lend you money if the cost of owning your home exceeds 32% of your income.

There are some subprime lenders who will lend to people with TDSRs that exceed 40%, but this is often not a very good idea. Anyone who is using 40% of their income to pay their debts and is surviving and paying taxes out of the remaining 60% is generally forced to live a very frugal life. Most people do not like to live this frugally, but it is necessary if you choose to borrow the maximum amount of money that the banks will lend you. The best idea is to borrow according to what your budget says you can afford rather than what the bank will permit.

Also Check: Pallets Of Items For Sale

Make Sure That No More Than 36% Of Monthly Income Goes Toward Debt

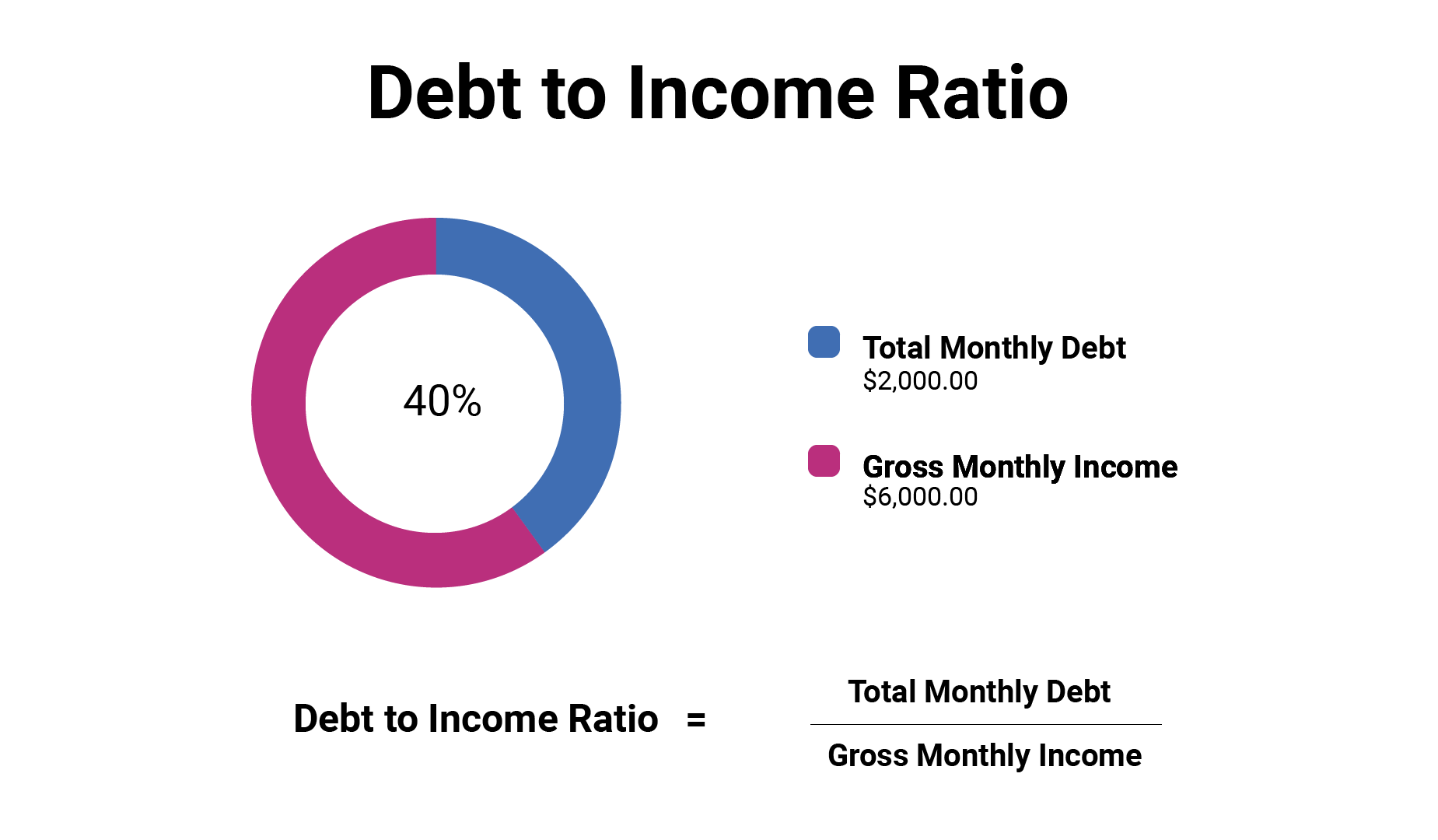

Financial institutions look at your debt-to-income ratio when considering whether to approve you for new products, like personal loans or mortgages. To calculate this number, divide your total monthly debt payments by your gross monthly income . Then multiple by 100 to get the percentage.

For example, say your gross monthly income is $6,000 and you have $2,000 in debt payments each month across your mortgage, auto loan and student loans. Your debt-to-income ratio is 33%.

“From a lender’s standpoint, they typically don’t want to see more than 36% of gross monthly income being spent on debt,” says Douglas Boneparth, CFP, president of Bone Fide Wealth and co-author of The Millennial Money Fix.

Don’t stress too much if your debt-to-income ratio is higher than 36% if you factor in your mortgage you’re not alone. Data shows consumers are spending close to that just on non-mortgage debt.

The latest findings from Northwestern Mutual’s 2021 Planning & Progress Study reveals that among U.S. adults aged 18-plus who carry debt, 30% of their monthly income on average goes toward paying off debt other than mortgages. By far, the top source of debt after mortgages is , accounting for more than double any other debt source.

Like most rules of thumb in personal finance, Boneparth warns that how much you spend each month to pay off your debt is ultimately subjective. You should consider your income, the type of debt you have, your savings and your broader financial goals.

Consumer Proposal Debt Requirements

In order to qualify for a consumer proposal, you must have at least $1,000 worth of unsecured debt and no more than $250,000 worth of unsecured debt as a single person. If you and your spouse, who file your income taxes together, want to file a consumer proposal you can have up to $500,000 worth of unsecured debt.

While its required that you owe at least $1,000 worth of unsecured debt, we do not recommend that you file a consumer proposal for this amount. Depending on your trustee, if you have significantly less than the maximum amount of unsecured debt allowed, they may suggest a less drastic debt relief option like a debt management program.

Want to pay off your consumer proposal and start building credit faster?

You May Like: How Can Bankruptcy Be An Advantage To A Creditor

Common Warning Signs Of Problem Debt

-

Your debt balance is not going down despite regular payments.

-

Youre living paycheck to paycheck, with no money at the end of the month.

-

Youre not contributing to an employer-sponsored retirement plan because you need the money.

-

Youre unable to build an emergency fund of at least $500 to buffer against financial shocks.

-

Youre using credit cards for cash advances.

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when theyre considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This could put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Recommended Reading: How To Declare Bankruptcy Without A Lawyer

You Get Eaten Alive By Your House

Here again, dont buy more home than you can afford just because credit is cheap. Even with a cheap fixed-rate mortgage, many experts advise you should keep your mortgage costs to 28% or less of your gross income. If youre buying a house in your 40s or 50s, consider a 15-year loan so you have it paid off by the time you retire.

How Much Debt Can You Afford The 28/36 Rule

- 28%An industry rule of thumb suggests that no more than 28 percent of your pretax household income should go to servicing home debt .

- 36%No more than 36 percent of your pretax income should go to all debt: your home debt plus credit card debt and auto loans.

As you look ahead, I think you should be even more conservative. While these percentages may be manageable when youre working, I suggest keeping debt much lower in retirement.

Safe Debt Guidelines

Read Also: How To Find Out When You Filed Bankruptcy

How Much Debt Is Too Much

You want your debt to be as low as possible so you can remain financially flexible for emergencies and your future goals. Youre likely to hit your debt capacity when you struggle to make monthly payments. How much debt is a lot? The Consumer Financial Protection Bureau recommends you keep your debt-to-income ratio below 43%. Statistically, people with debts exceeding 43 percent often have trouble making monthly payments.

The highest ratio you can have and still be able to obtain a qualified mortgage is also 43 percent. If you want to purchase a house soon, and a monthly mortgage payment would push you past 43%, you should lower your debt before you start house hunting.

Beyond your DTI ratio, you should consider how your debt load impacts your finances. If youre having trouble paying your bills and relying on credit due to expenses that arent factored into your DTI, you could still be buried in too much debt. If youve recently missed a payment or two and your credit score is in the trenches, chances are youre in too much debt, even if your DTI is below 43 percent.

Only being able to afford the minimum payments on your credit cards is another tell-tale sign of having too much debt. The reality is youll keep the accounts in good standing, but the balances could take some time to decrease, and youll spend a fortune in interest.

How Much Total Credit Should You Have

The amount of total credit you should have depends on your situation.

Some people like the idea of using their credit card as a de-facto emergency fund, and so they prefer to have enough credit to pay for three months worth of living expenses. Keep in mind, its much better to have an emergency fund tucked away safely in a savings account because youll earn interest on your savings rather than pay interest to a lender later. But if you dont have that yet, this could be a decent plan during a temporary setback.

Other people prefer to have a smaller amount of total credit so theyre not tempted to rack up a big balance. Remember, though, its not the total amount of credit you have that mattersits how much of your total credit you use. If you opt for this approach, its still a good idea to keep your balances low relative to your total credit limit. You can request the card issuer to lower the available credit during the time you are approved for a card.

Read Also: Bulk Lots For Sale

Make Your Debt Repayment More Manageable

If you’re struggling with debt, there are steps you can take to make it more manageable, including refinancing your student loans, taking our a debt-consolidation loan or using a balance transfer credit card.

A balance transfer credit card can help you pay down your credit card balances faster by giving you an introductory interest-free period. The U.S. Bank Visa® Platinum Card offers 0% APR for the first 20 billing cycles on balance transfers so you have over a year to pay off your credit card debt without accruing more interest . The 0% introductory APR applies to balance transfers made within 60 days of account opening.

For a balance transfer card that also offers rewards, the Citi® Double Cash Card comes with 0% APR for the first 18 months on balance transfers . Balance transfers must be completed within four months of opening an account. Cardholders can also benefit from earning 2% cash back: 1% on all eligible purchases and an additional 1% after paying their credit card bill.

This Is How Much Debt Is Normal For Your Age

Looking for a signal that things are getting back to normal as the pandemic recedes? Heres a classic sign of normal life in Canada debt levels are rising again.

Debt levels consistently grew in the years before the pandemic, then took a hiatus as the economy locked down. Now, debt growth is back. The credit reporting company Equifax Canada says total non-mortgage debt levels jumped 8.6 per cent in the first three months of the year compared to the same period of 2021. It was the first year-over-year quarterly increase since 2019.

The average amount of non-mortgage consumer debt as of the end of March was $20,774. But evaluating debt levels is best done when looking at people of a similar age. Here are Equifax numbers on the average first-quarter debt levels by age group, with year-over-year comparisons:

| Average Debt | |

|---|---|

| $20,744 | 1.54% |

Young adults, hard hit in pandemic economic lockdowns, are still in debt-reduction mode. But all other age groups, even seniors, have started to increase debt again. This trend is happening as the Bank of Canada aggressively increases interest rates to cool inflation. Rising rates mean its not a good time to not borrow, but theres a lot of pent-up demand to spend because of the pandemic.

Robs personal finance reading list

Ask Rob

Read Also: How To File For Bankruptcy In Nc

How Much Debt Is Too Much Uk Stats

For free and impartial money advice and guidance, visit MoneyHelper, to help you make the most of your money.

Debt in the UK is more common than you think. Its estimated that almost 27 million adults in the UK have debts hanging over their heads thats more than half. With these kinds of figures in the debt collection world, you realise that youre not alone. But how much debt is too much?

Estimates claim that around 9 million adults in the UK will owe debts between £2k and £10k, but the more sobering thought is that nearly double this amount of people are thought to owe debts as high as £100k. With the most common type of debt being credit card debt, we take a look at how much debt is too much.

The Simplest Way To See If You Have Too Much Debt

If you are wondering if you have too much debt, you probably do. However, the easiest way to figure out if you have too much debt is if more than half of your income goes to paying your debts. If this is true for you, then you are quite possibly in over your head, and you need to do something about this quickly. If you are using more than half of your income to pay your debts and you think you still have your situation under control, you may be fooling yourself. Check out the warning signs to see how close you are to the edge. If you know that you are on the edge, .

Don’t Miss: How To Get A Copy Of Your Bankruptcy Discharge

Check If You Can Get A Debt Management Plan

If you get a debt management plan you agree to pay off your debts with one monthly payment to a DMP provider. The DMP provider is an independent company. Theyll deal with your creditors for you and make your payments.

How long your DMP lasts will depend on how much debt you have and how much you can pay off each month.

Anyone can get a DMP – it doesnt matter how much debt you have. You might be able to get a DMP if:

- you can pay your priority debts but youre struggling to pay other debts like credit cards and loans

- you can pay at least £5 a month towards each of your debts

You can change your DMP at any time, for example if your income increases and you can afford to pay more.

You can cancel your DMP at any time if you decide its not the right debt solution for you or youre struggling to pay. If you havent finished paying off your debts youll need to contact your creditors to arrange another way to pay.