What Are The Negative Consequences Of Declaring Bankruptcy

While the main benefit of bankruptcy is the removal of certain debts, the negative consequences are quite damaging. The most obvious is an immediate large and negative impact on one’s credit score, and bankruptcy will remain on your credit report for 7-10 years. This means that it may be difficult, more costly, or even impossible to borrow money for things like a business or home. There is also the social stigma of bankruptcy, where people may equate it with a lack of character or untrustworthiness.

Advantages Of Chapter 13

Chapter 13 offers individuals a number of advantages over liquidation under chapter 7. Perhaps most significantly, chapter 13 offers individuals an opportunity to save their homes from foreclosure. By filing under this chapter, individuals can stop foreclosure proceedings and may cure delinquent mortgage payments over time. Nevertheless, they must still make all mortgage payments that come due during the chapter 13 plan on time. Another advantage of chapter 13 is that it allows individuals to reschedule secured debts and extend them over the life of the chapter 13 plan. Doing this may lower the payments. Chapter 13 also has a special provision that protects third parties who are liable with the debtor on “consumer debts.” This provision may protect co-signers. Finally, chapter 13 acts like a consolidation loan under which the individual makes the plan payments to a chapter 13 trustee who then distributes payments to creditors. Individuals will have no direct contact with creditors while under chapter 13 protection.

What To Do If You Dont Qualify For Bankruptcy

Asset value is a big consideration for bankruptcy, but it doesnt apply when you file a consumer proposal. If you dont qualify for bankruptcy because you dont meet the asset value requirement, the Licensed Insolvency Trustee may recommend a consumer proposal.

For this solution, the Trustee determines how much of your debt you can reasonably afford to repay. Then they set up a repayment plan that both you and your creditors must adhere to. As with bankruptcy, you will only repay a portion of what you owe. Then your remaining balances will be discharged.

Don’t Miss: How Long Does Bankruptcy Show On Credit Report

Work Through The Bankruptcy Process And Fulfill Your Personal Bankruptcy Duties

There are a few main duties that you will need to fulfill as part of your bankruptcy filing in Canada. Your Licensed Insolvency Trustee will help guide you through the process and will be available for ongoing support through the proceeding.

These required duties generally include:

- Completing a monthly Statement of Income & Expenses budget form tracking the income and expenses of your household and paying any surplus income calculated.

- Your payments in personal bankruptcy are set by a government tariff and are primarily based on your household size, certain allowable expenses and national low-income guidelines. We will review these guidelines with you in detail and explain how they impact the payment you will make in your personal bankruptcy. Most people will pay $200 per month for the duration of their bankruptcy.

Most personal bankruptcies last for only nine months from the date of signing bankruptcy documents until you are discharged from bankruptcy.

Role Of The Case Trustee

When a chapter 7 petition is filed, the U.S. trustee appoints an impartial case trustee to administer the case and liquidate the debtor’s nonexempt assets. 11 U.S.C. §§ 701, 704. If all the debtor’s assets are exempt or subject to valid liens, the trustee will normally file a “no asset” report with the court, and there will be no distribution to unsecured creditors. Most chapter 7 cases involving individual debtors are no asset cases. But if the case appears to be an “asset” case at the outset, unsecured creditors must file their claims with the court within 90 days after the first date set for the meeting of creditors. Fed. R. Bankr. P. 3002. A governmental unit, however, has 180 days from the date the case is filed to file a claim. 11 U.S.C. § 502. In the typical no asset chapter 7 case, there is no need for creditors to file proofs of claim because there will be no distribution. If the trustee later recovers assets for distribution to unsecured creditors, the Bankruptcy Court will provide notice to creditors and will allow additional time to file proofs of claim. Although a secured creditor does not need to file a proof of claim in a chapter 7 case to preserve its security interest or lien, there may be other reasons to file a claim. A creditor in a chapter 7 case who has a lien on the debtor’s property should consult an attorney for advice.

Don’t Miss: What Does Filing Bankruptcy Do To Your Credit

Are You Considering Filing For Bankruptcy We Can Help

Being unable to meet your expenses or facing lawsuits for unfulfilled financial obligations is a tough situation to be in and one that you think you cant get out of. Bankruptcy Canada understands your predicament and is committed to helping you resolve your debt issues.

If youre looking for an effective debt relief solution that is best for your financial situation, Bankruptcy Canada can help. Our knowledgeable and highly experienced Licensed Insolvency Trustees will thoroughly evaluate your financial condition and recommend a solution that will best meet your needs. Meanwhile, also feel free to go through our extensive database of relevant articles to find the answers youre looking for.

To consider your options and take the next step towards debt relief, contact us by submitting a short form and one of our Licensed Insolvency Trustees will get in touch with you within 24 hours.

The Chapter 13 Plan And Confirmation Hearing

Unless the court grants an extension, the debtor must file a repayment plan with the petition or within 14 days after the petition is filed. Fed. R. Bankr. P. 3015. A plan must be submitted for court approval and must provide for payments of fixed amounts to the trustee on a regular basis, typically biweekly or monthly. The trustee then distributes the funds to creditors according to the terms of the plan, which may offer creditors less than full payment on their claims.

There are three types of claims: priority, secured, and unsecured. Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. Secured claims are those for which the creditor has the right take back certain property if the debtor does not pay the underlying debt. In contrast to secured claims, unsecured claims are generally those for which the creditor has no special rights to collect against particular property owned by the debtor.

The plan must pay priority claims in full unless a particular priority creditor agrees to different treatment of the claim or, in the case of a domestic support obligation, unless the debtor contributes all “disposable income” – discussed below – to a five-year plan.11 U.S.C. § 1322.

You May Like: How To Find Out When Bankruptcy Was Discharged

A Bankruptcy Must Be Discharged Before You Can Apply For A New Card

You cannot apply for any new lines of creditincluding a credit cardwhile your bankruptcy proceedings are in progress without court approval. The amount of time it takes to settle and complete your bankruptcy proceedings will determine when you can apply for a credit card.

A Chapter 7 bankruptcy takes approximately four to six months after the initial filing to be completed and your debts discharged. After that, you can apply for a credit card.

A Chapter 13 bankruptcy, however, can take between three to five years as its a restructuring of your debt that you pay off over time. Only after youve made your last payment will your bankruptcy be discharged. Until then, youll have to receive approval from the court.

Where Does Rule 2004 Come From

Rule 2004 exams come from Rule 2004 of the Federal Rules of Bankruptcy Procedure. Most civil cases in federal court, in contrast to bankruptcy court, are limited to the discovery procedures contained in the Federal Rules of Civil Procedure . Rule 2004 allows investigation into a wider range of topics than whatâs permitted under the FRCP. Because of this broad scope, people sometimes refer to Rule 2004 exams as âfishing expeditionsâ because the party requesting the exam can cast a wide net of questioning just to see what information they reel in.

Testifying or producing documents under Rule 2004 is not optional. The rule gives the bankruptcy judge authority to issue a court order compelling anyone with relevant information to comply with the examination notice. This authority extends beyond the parties to the bankruptcy case. A bankruptcy judge may use the subpoena power of FRCP 45 to order anyone to testify or deliver documents.

Also Check: Do You Lose Your Home When You File Bankruptcy

Bankruptcy Basics: When Should You File For Bankruptcy

Sometimes, theres no other option than to file for bankruptcy. But before you do, make sure to assess your situation accurately.

Bankruptcy is a scary proposition. The word bankruptcy itself sounds so ominous. The media bombards us with nightmare tales of seemingly solid business giants going from bedrock to bankrupt. Gossip columns never tire of dishing on the latest celebrity inches from bankruptcy. You might even fear that youre a few steps from going under. But, just how can you tell when its time to throw in the towel and declare bankruptcy?

Read Also: Dave Ramsey And Bankruptcy

The Bankruptcy Filing Process

There are a number of legally required steps involved in filing for bankruptcy. Failing to complete them can result in the dismissal of your case.

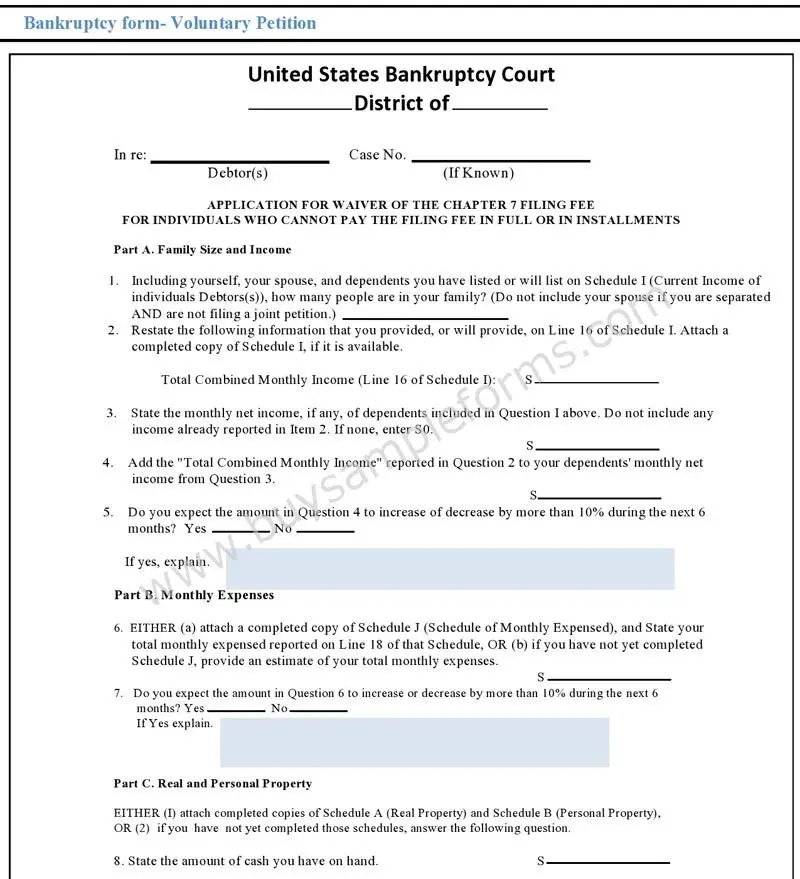

Before filing for bankruptcy, individuals are required to complete a credit counseling session and obtain a certificate to file with their bankruptcy petition. The counselor should review your personal situation, offer advice on budgeting and debt management, and discuss alternatives to bankruptcy. You can find the names of government-approved credit counseling agencies in your area by calling the federal bankruptcy court closest to you or by visiting its website.

Filing for bankruptcy involves submitting a bankruptcy petition and financial statements showing your income, debts, and assets. You will also be required to submit a means test form, which determines whether your income is low enough for you to qualify for Chapter 7. If it isnt, you will have to file for Chapter 13 bankruptcy instead. You will also need to pay a filing fee, though it is sometimes waived if you can prove you cant afford it.

You can obtain the forms you need from the bankruptcy court. If you engage the services of a bankruptcy lawyer, which is usually a good idea, they should also be able to provide them.

Assuming the court decides in your favor, your debts will be discharged, in the case of Chapter 7. In Chapter 13, a repayment plan will be approved. Having debt discharged means that the creditor can no longer attempt to collect it from you.

Read Also: How Does Filing Bankruptcy Affect Student Loans

After You Declare Bankruptcy

When you declare bankruptcy AFSA appoint an Official Trustee to administer your bankruptcy. If youre applying for voluntary bankruptcy, you may nominate a registered trustee. Once a trustee has been appointed youre then protected from any legal action against you from creditors.

At this stage the trustee may sell your assets and take any income you earn over a certain amount to try to pay off all your debts.

You also have a duty to provide information to your trustee such as:

- changes to your conditions

Before You Decide To File Talk To A Trained Credit Counsellor

Bankruptcy is a tough, life-changing decision to make. You deserve to understand all your available options before making this difficult choice. Talk to a trained credit counsellor for free to discover if a less drastic debt relief choice can work for you so you can avoid bankruptcy.

Talk to a trained credit counsellor today to better understand your options for debt relief before you decide.

Read Also: How Long Does Bankruptcy Discharge Take

Alternatives To Chapter 7

Debtors should be aware that there are several alternatives to chapter 7 relief. For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Such debtors should consider filing a petition under chapter 11 of the Bankruptcy Code. Under chapter 11, the debtor may seek an adjustment of debts, either by reducing the debt or by extending the time for repayment, or may seek a more comprehensive reorganization. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code.

In addition, individual debtors who have regular income may seek an adjustment of debts under chapter 13 of the Bankruptcy Code. A particular advantage of chapter 13 is that it provides individual debtors with an opportunity to save their homes from foreclosure by allowing them to “catch up” past due payments through a payment plan. Moreover, the court may dismiss a chapter 7 case filed by an individual whose debts are primarily consumer rather than business debts if the court finds that the granting of relief would be an abuse of chapter 7. 11 U.S.C. § 707.

Debtors should also be aware that out-of-court agreements with creditors or debt counseling services may provide an alternative to a bankruptcy filing.

Chapter 7 Bankruptcy: Exempt And Non

For many individuals experiencing financial hardship, bankruptcy is the best option to get back on the road to recovery. Many people consider bankruptcy a last resort and dont fully understand how bankruptcy can help their situation. Some may believe that bankruptcy allows you a completely fresh start others may think that they will lose all of their assets if they file for bankruptcy. Neither in fact is true.

Bankruptcy is a way to help an individual get back on firm financial ground, and in most cases, they keep all of their property. Bankruptcy protects some individuals property with laws known as exemptions. In Chapter 7 bankruptcy, any property that is not protected with these exemptions must be turned over to the trustee, so it can be liquidated and the proceeds dispersed to creditors. The remaining debts may be discharged.

In Michigan, an individual filing for Chapter 7 bankruptcy can elect to use either state or federal exemptions to protect their assets. Each system of exemptions lays out certain items that may be protected from liquidation in a Chapter 7 bankruptcy. The individual generally chooses either state or federal exemptions depending on which system will offer the best protection of assets.

Read Also: Buy Pallets Of Stuff

Understanding Surplus Income In Bankruptcy

Surplus income is any income you make over the amount that the Canadian Government claims an individual or family needs to live. According to the Office of the Superintendent of Bankruptcy Canada , the current income standards in 2021 are:

- $2,248 for a single-person household

- $2,799 for a two-person household

- $3,441 for a three-person household

- $4,178 for a four-person household

- $4,739 for a five-person household

- $5,345 for a six-person household

- $5,950 for a seven-person or more household

Receiving Your Bankruptcy Discharge

In order to be released from your legal obligation to repay debt that existed at the date of your bankruptcy you need to receive your bankruptcy discharge.

In order to receive your bankruptcy discharge you must complete all of your duties and make the required payments.

A bankruptcy discharge can be received in as little as nine months if you are a first time bankrupt with no surplus income.

Need Help Reviewing Your Financial Situation?Contact a Licensed Trustee for a Free Debt Relief Evaluation

Read Also: What Does Chapter 11 Bankruptcy Mean

Attend Your 341 Meeting

Your 341 meeting, or meeting of creditors, will take place about a month after your bankruptcy case is filed. Youâll find the date, time, and location of your 341 meeting on the notice youâll get from the court a few days after filing bankruptcy. Due to the COVID-19 pandemic, all 341 meetings are held either by video conference or via telephone until at least October.

The main purpose of the 341 meeting is for the case trustee to verify your identity and ask you certain standard questions and most last only about 5 minutes. Your creditors are allowed to attend and ask you questions about your financial situation, but they almost never do.

ââ You must bring your government-issued ID and social security card to the meeting. If you donât bring an approved form of both, the trustee canât verify your identity and the meeting cannot go forward. You should also bring a copy of your bankruptcy forms to the meeting, along with your last 60 days of pay stubs, your recent bank statements, and any other documents that your trustee has asked for. ââ

What Happens When You File For Bankruptcy

If bankruptcy is the option you choose, you will work with the LIT to complete the required forms. The LIT will then file these documents with the OSB and you will be formally declared bankrupt.

From that point on, the LIT will deal directly with your creditors on your behalf. Once you have been declared bankrupt

- you will stop making payments directly to your unsecured creditors

- any garnishments against your salary will stop and

- any lawsuits against you by your creditors will also be stopped

Also Check: How To Declare Personal Bankruptcy In Usa

Before You File Chapter 7 Or Chapter 13 In Michigan

If and when you decide that filing for bankruptcy is the best option, here are some information to keep in mind before filing in the state of Michigan:

-

DO Continue making payments on vehicles you intend to keep.

-

DONT Borrow or withdraw from your 401K, IRA, or ERISA qualified savings and retirement plans to pay bills. If you do, you may be liable for penalties and taxes that are not protected by the bankruptcy filing.

-

DO Give friendly creditors a security interest in non-exempt property. If you have to borrow money from a friend or relative you could give that creditor a security interest in the property which you own. This will possibly make it less likely that a trustee will take the property.

-

DONT Borrow money on your home to pay unsecured bills, such as credit card, utility, or medical bills.

-

DO Reduce the amount withheld from your pay for taxes.

-

DONT Pay $600 or more back to relatives or business associates from whom you have borrowed money.

-

DONT Put property you own into someone elses name to avoid it being taken by creditors or the trustee. This is considered fraud.

You May Like: If You File Bankruptcy Can You Rent An Apartment