You Will Fully Disclose Your Finances

You will have to disclose your income, assets, debts, and even some financial transactions to your Licensed Insolvency Trustee. This is necessary to complete a Statement of Affairs. Both the trustee and the court will know everything about your finances.

You will also have to submit your tax documents and pay stubs during the bankruptcy process to prove your income. This is how the trustee knows if you have surplus income.

Bonus Myth : Mortgage Shortfalls Cant Be Included In Bankruptcy In Canada

Wrong. Mortgage shortfalls certainly can be included in a bankruptcy . But it only matters in the provinces with power of sale legislation: Ontario, Newfoundland, New Brunswick and PEI. Let me explain by way of some background.

In Canada, certain provinces have power of sale legislation in place. In that system, a lender will commence proceedings when the homeowner defaults on their mortgage. The borrower remains responsible for any losses the lender may incur from the sale, and the lender will then commence legal action to recover the shortfall.

A bankruptcy stops or prevents any legal action taken against a homeowner for the shortfall incurred by the lender. It becomes a debt fully dischargeable in bankruptcy or via a completed proposal. This includes any type of mortgage . The secured debt gets paid out as much as possible from the propertys sale, and any shortfall is unsecured, and therefore eligible for discharge in any insolvency proceeding.

So if you are upside down on your mortgage , you could file a bankruptcy or proposal and include that shortfall amount amongst your other unsecured debts in that insolvency. That is a sizeable advantage to a debtor versus being on the hook for any loss in a foreclosure.

ScottTerrioisManager,ConsumerInsolvencyatHoyesMichalos& AssociatesInc.,LicensedInsolvencyTrusteesatHoyes.com. Follow him on Twitter @ScottTerrioHMA

You May Lose Some Assets In A Bankruptcy

The final cost of a bankruptcy is the assets that you lose when you go bankrupt. In order to be absolved of your debts, you will need to surrender certain assets to your bankruptcy trustee.

Even in bankruptcy you dont lose everything. Just like with your income, the government created rules of what you can keep, and what your creditors can have. Some assets are exempt from seizure by a bankruptcy trustee. Read more about bankruptcy exemptions in our article about bankruptcy and assets.

In Ontario, the assets you will be required to surrender are:

- Equity in your house if it is greater than $10,000

- The value of a car with no loans

- Investments

- Tax refunds for prior years that you havent yet filed and for the entire year that you are bankrupt

- Any RRSP contributions that you have made in the last year prior to filing bankruptcy.

The bankruptcy trustee is required to realize on your assets, which means turn them into cash. The trustee is not required to seize your assets and sell them they are only required to turn them into cash. So, for example, if you have contributed $1,000 to your RRSP in the prior year, you could offer to pay an extra $1,000 to the trustee to keep your RRSP. The trustee and the creditors receive the cash, and you keep your asset.

If you have a lot of assets or a high income, you should talk to your trustee about a consumer proposal. You can negotiate a plan to settle your debts and keep your assets.

Recommended Reading: How Many Times Has Trump Declared Bankruptsy

Pros And Cons Of Claiming Bankruptcy

The best and most desirable effect of claiming a bankruptcy in Ontario, is that it gives an individual with overwhelming debts the opportunity for a fresh financial start. It does this by eliminating debt, stopping collection calls and ending wage garnishment orders.

However, not all debts can be eliminated. It is very important to ensure that you know which of your debts will be absolved before declaring bankruptcy.

Bankruptcy is also not without some consequences. While the pros of claiming bankruptcy means that your debts will be eliminated, you need to balance this against any cons of bankruptcy including any assets you may lose and the effect on your credit score.

Ontario Bankruptcy And Insolvency Statistics

- 38,856 consumers in Ontario were insolvent in 2018

- 38% of those consumers went on to declare bankruptcy

- Average assets at the time of filing: $30,774.14

- Average liabilities at the time of filing: $98,577.12

- With an average household income of $74,287 in Ontario, the average filer effectively owed $1.33 for every dollar they earned

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

Your Documents Are Filed And Your Creditors Notified

Your trustee will electronically file your completed and signed documents with the federal government Once these forms are filed with the Official receiver, you will be considered bankrupt. Your trustee will immediately receive a notification and you will be assigned a file number.

Next, your trustee will notify your creditors, electronically by mail or fax. The process of creditor notification is generally quite fast and collection calls and other actions should stop within a very short time frame. If they do not, speak to your trustee right away about how to proceed.

If your wages are being garnished your trustee will also immediately notify your employer and the garnishment should also stop as soon as possible.

Receivers And Secured Creditors

Receivers are required to collect and remit the applicable RST on the sale of the debtor’s assets. Unless receivers obtain a valid PEC from the purchaser, they must collect and remit the applicable RST, using the debtor’s existing RST Vendor Permit number. Refer to RST Guide 204 – Purchase Exemption Certificates for more information.

A claim for RST collected or collectable plus penalties and interest accrued after January 1, 1998 takes full priority over all security interests, whether or not the security interest was acquired before that date. All security interests are affected, including, but not limited to, an interest created by, or arising from any of the following:

- a debenture

- a charge, deemed or actual trust, or

- an assignment or encumbrance.

You May Like: How Many Bankruptcies For Trump

Schedule A Free Meeting With A Licensed Insolvency Trustee Near You

Start by finding a trustee in your area to arrange a risk-free consultation meeting that carries no strings attached or obligations.

Our Licensed Insolvency Trustees are regulated and licensed by the government and they are experts in the Ontario bankruptcy procedures.

LITs are well trained debt consultants who offer many different debt relief services.

Trustees are bound by a strict code of ethics and will always treat you with respect and answer all of your questions.

At your consultation meeting the trustee will listen to your situation and ask you relevant questions so they have a full understanding of your debt situation.

There are always options available, which the trustee will review with you.

There are alternatives to an Ontario bankruptcy that you might like to explore.

The trustee can explain how each situation will deal with your debt.

During this process make sure you ask lots of questions.

If you choose to pursue bankruptcy to get out of debt, the trustee will review the Ontario bankruptcy process with you.

The LIT will make sure you understand how the bankruptcy laws will apply to you, including how the bankruptcy exemptions will or will not protect your assets.

Most trustees will advise against going bankrupt if you have assets you would lose unless there is no other viable alternative.

How Should I Prepare For My Meeting With a Trustee?

To prepare for your consultation meeting with the trustee we recommend:

Sale Of Your Assets If Required

After your LIT files your paperwork, the third step involves them selling your assets, where your assets exceed those exempted by provincial and federal laws, and holding the proceeds in trust for distribution to your creditors. This includes all existing assets as well as those acquired prior to the discharge of your bankruptcy. Also, during the bankruptcy, you may also be required to make payments to your LIT for distribution to your creditors. These payments are called surplus income payments. The LIT determines how much you may be required to pay. This is calculated by taking into account your total income, income standards issued by the OSB, and your personal and family situation.

Gifts and transfers of property before filing for bankruptcy

Any gifts or transfers of property that you may have made just prior to filing for bankruptcy need to be divulged to your LIT and can be reversed by the court. Any transfers you made in the year before you filed for bankruptcy will need to be reviewed by your LIT. You will also need to tell your LIT if you made any payments or gave preferential treatment to any of your creditors in the three months before declaring bankruptcy .

Don’t Miss: How To Claim Bankruptcy In Massachusetts

You Will Be Discharged From Bankruptcy

A discharge releases you from the legal obligation to repay the debts you had as of the date you filed for bankruptcy, except for specific types of debts that are excluded by law. These include alimony and child support payments, student loans , court-ordered fines or penalties, and debts arising from fraud.

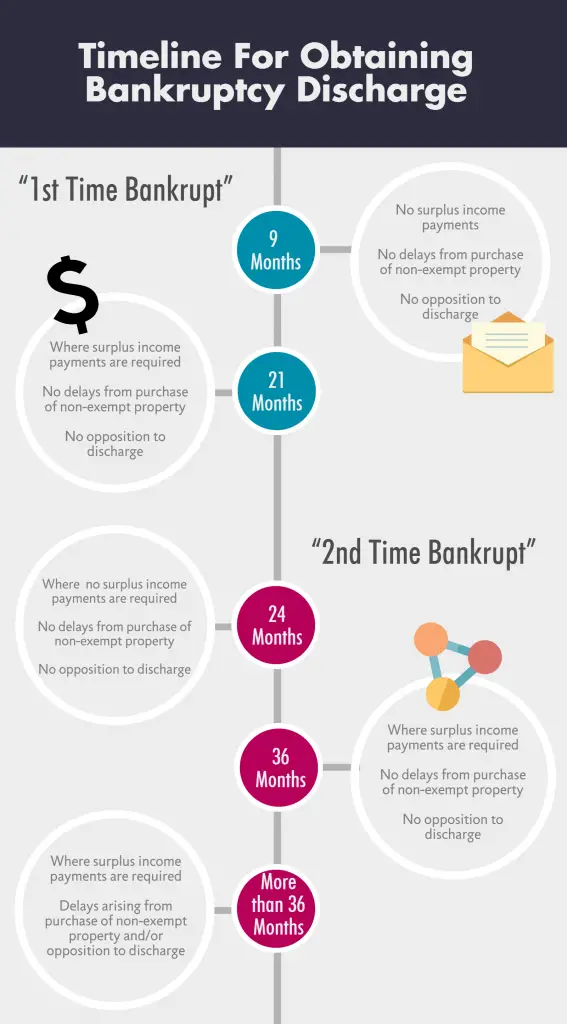

The timing of your discharge depends on a number of factors, including whether this is your first bankruptcy, and whether you are required to make surplus income payments.

Timing of your discharge from bankruptcy

If this is your first bankruptcy and you are not required to make surplus income payments , you will be eligible for an automatic discharge from bankruptcy in nine months. If your surplus income is higher, your bankruptcy will be extended to 21 months and you will be required to make payments from your surplus income.

Your discharge from bankruptcy will happen automatically if

- the discharge is not opposed by the LIT, a creditor or the Office of the Superintendent of Bankruptcy

- you have attended the mandatory financial counselling sessions and

- this is your first or second bankruptcy.

To ensure that a greater percentage of debts is repaid to creditors, the following standards set out when an automatic discharge will occur.

Timing of your discharge from bankruptcy , First Bankruptcy| First bankruptcy |

|---|

| Surplus income is greater than $200 per month | 36 months after filing |

Discharge hearing

Print Your Bankruptcy Forms And Bring Them To Court

Once you have prepared your bankruptcy forms, you will need to print them out for the court.You must print them single-sided. The court wonât accept double-sided pages.

You will also need to sign the forms once they are printed.

Most bankruptcy courts require just 1 copy of the petition, but some courts like thebankruptcy court in Manhattanrequire 4 copies. So call your local bankruptcy court to find out how many copies you will need to bring.

Recommended Reading: Can You Rent An Apartment After Bankruptcy

What Do You Have To Do During Your Bankruptcy

As your bankruptcy proceeds, you have a list of obligations as a bankrupt known as bankruptcy duties.

Out of these tasks, the most common include:

- Sending your trustee proof of your income every month

- Paying your trustee if you have surplus income

- Completing two credit counselling sessions

- Going to a creditor meeting or attending bankruptcy court

If you do not fulfill your duties as described, then there are serious consequences. Your trustee has the option to oppose your bankruptcy discharge and apply for a hearing in court. Failing to complete your duties means your debts will not be eliminated.

What Assets Are Exempt From Bankruptcy In Ontario

When you file for bankruptcy in Ontario, you dont need to be concerned that you will lose everything. These assets are exempt under federal and provincial law:

You May Like: How Long Before My Bankruptcy Is Off My Credit Report

How Long Does Bankruptcy Last

Bankruptcy lasts approximately 9 months, provided that it is your first bankruptcy and you complete all of the duties assigned to you. Your bankruptcy may last up to 21 months if you have to pay surplus income, which is calculated according to standards established by the Office of the Superintendent of Bankruptcy Canada and coordinated by your trustee after examining your income, expenses, and dependents in your household.

If it is your second bankruptcy, you will be bankrupt for 24 or 36 months. If you have been bankrupt more than once previously, have not complied with your duties, or have committed one or more bankruptcy offences, your bankruptcy timeline will be determined by the court.

After you have received an Absolute Discharge from your bankruptcy, you will no longer be responsible for any of the discharged debts. However, the fact that you filed a bankruptcy will appear on your credit rating for 6 to 7 years, depending on the province you live in.

Filing For Bankruptcy In Ontario Summary

I hope you found this Brandons Blog on filing for bankruptcy in Ontario useful. Sometimes things are too far gone and more drastic and immediate triage action is required.

Do you have too much debt? Are you in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. We can help with your personal debt situation. We can also help with insolvency for business.

However, more importantly, we understand the needs of the entrepreneur or the person who has too much personal debt. You are worried because you are facing significant financial challenges.

It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding bankruptcy. We can get you debt relief freedom.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems financial and emotional. The way we take the load off of your shoulders and devise a debt settlement plan, we know that we can help you.

for a free consultation. We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

Read Also: How Long To Keep Bankruptcy Papers

During The Ontario Bankruptcy Process

The action of filing bankruptcy does not eliminate your debt or release you from the legal obligation to pay your debts.

It is important that you understand this.

To have your debts legally eliminated you must receive your bankruptcy discharge.

To get your discharge you must complete the duties and obligations required of a bankrupt.

The LIT will have explained all the duties you are required to complete at the initial consultation so you should be aware of what is expected of you.

Duties that are required of a bankrupt include attending financial counseling sessions and reporting your income and expenses to the trustee on time each month.

Non Profit Bankruptcy Information & Credit Counselling Advice In Ontario

Get answers to your questions about joint debts or debts remaining after a divorce, find out why someone should not file for bankruptcy, or learn more about bankruptcy alternatives from one of our Debt & Credit Counsellors! They are experts in helping people find solutions to their debt and money problems, and theyd be happy to give you with the information you need to make choices that will benefit your financial future.

Your Counsellor will:

Also Check: Who Is Epiq Corporate Restructuring Llc

Are You Considering Filing For Bankruptcy We Can Help

Being unable to meet your expenses or facing lawsuits for unfulfilled financial obligations is a tough situation to be in and one that you think you cant get out of. Bankruptcy Canada understands your predicament and is committed to helping you resolve your debt issues.

If youre looking for an effective debt relief solution that is best for your financial situation, Bankruptcy Canada can help. Our knowledgeable and highly experienced Licensed Insolvency Trustees will thoroughly evaluate your financial condition and recommend a solution that will best meet your needs. Meanwhile, also feel free to go through our extensive database of relevant articles to find the answers youre looking for.

To consider your options and take the next step towards debt relief, contact us by submitting a short form and one of our Licensed Insolvency Trustees will get in touch with you within 24 hours.

What Assets Can I Keep If I Go Bankrupt

It is important to know that when filing for bankruptcy you do not lose all of your assets. Bankruptcys purpose is to help you get out of debt, and leave you in a better position financially.

Upon making the assignment into bankruptcy, all unencumbered assets vest in the Trustee, meaning the Trustee can sell these assets to increase the payment available to your creditors, subject to certain Federal and Provincial legislation.

Some of the more common assets and how they are dealt with in the bankruptcy are as follows:

Assets exempt from seizure from the Trustee:

- Employer Pension Plans

- RRSPs

- Self-directed RRSP contributed over 12 months ago

- Life insurance policies

- Personal effects such as clothing to a maximum exemption amount of $5,650 per family

- Household furniture to a maximum exemption amount of $11,300 per family

- Tools of the trade used to earn income to a maximum exemption amount of $11,300

- Automobile maximum of one unencumbered vehicle to a maximum value of $5,650

Assets available to your Trustee for seizure:

- RESPs

- Stocks and bonds, Canada Savings Bonds, and publicly traded shares

- House equity on your personal residence

- Recreational equipment, including but not limited to boats, trailers, and snowmobiles

- Self-directed RRSP contributions made in the 12-month period prior to bankruptcy

Don’t Miss: Is Taco Bell Filing For Bankruptcy