Other Factors That Matter When Qualifying For A Mortgage

Income isnt the only thing that matters when you buy a home. You should be mindful of other factors lenders take into consideration when qualifying borrowers for a home loan:

- Most mortgage programs have a minimum credit score requirement, which can range from 580 to 620 for an FHA and conventional loan, respectively and 640 for USDA loans. VA loans dont have a set credit score minimum

- Your recent credit history also determines whether you qualify for a home loan. Most programs dont allow more than one 30-day late payment within the previous 12 months. You can also expect a waiting period after a foreclosure or bankruptcy, which can range from two to seven years depending on the home loan

- Down payment The size of your down payment also affects your qualifying amount. Borrowers with a bigger down payment have greater purchasing power

- Existing debt load Too many existing debts also reduces purchasing power. Paying down a car loan, a student loan, and credit cards can increase affordability.

- Assets/cash reserve Your cash reserve amount also affects qualifying. You must have enough funds in reserves for your down payment and closing costs

My Take: Somewhere In Between

Not everybody is as debt-averse as Ramsey. And his one-size-fits-all advice might shut out a huge segment of Americans from ever realizing their homeownership dreams.

Good luck finding a mortgage in California that you can pay off over a 15-year term, with monthly payments at less than 25% of your after-tax income. That approach will be unrealistic in a number of regional American housing markets with high home prices.

If I had to set a rule, it would be this:

- Aim to keep your mortgage payment at or below 28% of your pretax monthly income.

- Keep your total debt payments at or below 40% of your pretax monthly income.

Note that 40% should be a maximum. I recommend striving to keep total debt to a third of your pretax income, or 33%.

As some commenters have pointed out, while it may be possible to buy a decent home in a small midwestern town for $100,000 , buyers in New York or San Francisco will need to spend five times that amount just to get a hole in the wall. Yes, people tend to earn more in these high-cost-of-living areas, but not that much more. Does it mean they shouldnt buy a home? Not necessarily. Theyll simply have to make trade-offs to buy in those areas.

Why It’s Smart To Follow The 28/36% Rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses, and no more than 36 percent on total debt. The 28/36 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month.

For example, lets say you earn $4,000 each month. That means your mortgage payment should be a maximum of $1,120 , and your other debts should add up to no more than $1,440 each month . What do you do with whats left? Youll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement.

You May Like: Can You Get An Sba Loan With A Bankruptcy

How Lenders Decide How Much You Can Afford

Lenders use a few different factors to see how much home you can afford. They use your debt-to-income ratio, or DTI, to make sure you can comfortably pay your mortgage as well as your other debt. This includes credit cards, car loans, student loan payments and more.

You can calculate your DTI ratio by adding up all your debt payments and dividing it by your gross monthly income. Say your monthly income is $7,000, your car payment is $400, your student loans are $200, your credit card payment is $500 and your current home payment is $1,700. All that together is $2,800. So, your DTI ratio is 40% since $2,800 is 40% of $7,000.

In general, a good DTI to aim for is between 36% and 43%. Some lenders will go higher, but the lower your DTI, the more likely you are to be pre-approved for a mortgage. Different lenders have different DTI requirements, though, so compare multiple mortgage lenders to find one that works for you.

Analyze Your Monthly Expenses

When estimating what you can afford, its also important to have a clear view of your monthly expenses. These can be hard to track and will likely vary based on the size of your household and your spending habits. According to the Bureau of Labor Statistics, the average individual has monthly expenditures that include:

- Cell phone: $120

For an individual, these expenses add up to a monthly total of $2,463. Some of these items are discretionary and will fluctuate based on your lifestyle, city, the size of your home, and the size of your family. The goal is to estimate how much money youll need to spend each month after you pay your mortgage and other debts.

Don’t Miss: How Long Does Bankruptcy Show Up On Credit Report

Know How Much House You Can Afford

Terri Williams is an expert in mortgages, real estate, and home buying. As a journalist she’s covered the “homes” corner of personal finance for more than a decade, with bylines in scores of publications, including Realtor.com, Bob Vila, Yahoo, Time/Next Advisor, The San Francisco Chronicle, Real Homes, and Apartment Therapy.

The 28/36 rule of thumb is a mortgage benchmark based on debt-to-income ratios that homebuyers can use to avoid overextending their finances. Mortgage lenders use this rule to decide if theyll approve your mortgage application.

Heres how the 28/36 rule of thumb works, as well as what it includes and excludes, plus example calculations and some caveats for using the rule.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Read Also: When You File Bankruptcy Who Pays The Debt

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Which Dti Ratio Matters More

While mortgage lenders typically look at both types of DTI, the back-end ratio often holds more sway because it takes into account your entire debt load.

Lenders tend to focus on the back-end ratio for conventional mortgages loans that are not backed by the federal government.

For government-backed mortgages, such as FHA loans, lenders will look at both ratios and may consider DTIs that are higher than those required for a conventional mortgage.

Recommended Reading: How Long Does Bankruptcy Last In Australia

What Does It Mean To Be House Poor

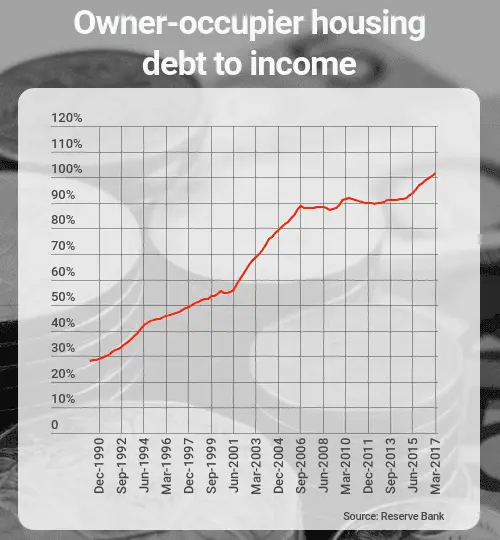

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

Recommended Reading: Do It Yourself Bankruptcy Chapter 7 Forms

Is There A Minimum Income To Buy A House

Home buyers need to meet certain standards to get a mortgage. There are minimum credit scores, employment requirements, and more.

But many first-time home buyers dont realize theres actually no minimum income required to buy a home.

Instead, you must earn enough to qualify for the requested mortgage amount. And the money your earn must be an acceptable type of income .

Heres how to determine if your income will qualify for a mortgage.

In this article

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: How To File Bankruptcy In Wisconsin

Your Mortgage And Your Overall Budget

The question isn’t how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio . Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income.

Extend Your Mortgage Term

Choosing a longer mortgage term spreads your loan balance over more total payments, reducing the amount of each payment individually.

But remember, extending your term comes at a cost, as youll ultimately pay more in cumulative interest over the life of your loan.

Read more:15-Year Mortgages vs. 30-Year Mortgages

Read Also: Which Of The Following Statements Is True Regarding Bankruptcy

Your Debt And Salary Limit What You Can Afford

Besides showing you how much income you need to afford the home you want, this calculator also shows how your debts can compromise your chance for a mortgage. You can see how paying down debts directly affects your buying power. The fewer debts you have, the more of your salary can go toward the home, allowing you to afford a more expensive property. At the same time, more debts mean less money available, based on your current salary, to pay for – and qualify for – the home you want.

You can use this calculator to visualize how a higher or lower salary could change your ability to afford the home of your dreams. What if you got a raise? Or took a weekend job? You can vividly see how you could afford different homes with more income, or less.

How Much House Can I Afford Based On My Salary

To find out if a house might be affordable for you, estimate your total housing expenses. Housing expenses include the principal and interest you pay on your mortgage. They also include mortgage insurance, property taxes, homeowners insurance and homeowners association fees, if you pay them.

Next, divide that number by your gross monthly income. For example, if youre thinking of a total monthly housing payment of $1,500 and your income before taxes and other deductions is $6,000, then $1,500 ÷ $6,000 = 0.25. We can convert that to a percentage: 0.25 x 100% = 25%. Since the result is less than 28%, the house in this example may be affordable.

In addition to deciding how much of your income will go toward housing, you should also consider how much a mortgage would add to your existing debts. You can then decide if youd be able to keep up with all of your debt payments, and if youd have enough room left over in your budget for food, healthcare and other spending categories.

Read Also: Can Just One Spouse File Bankruptcy

What Are The Most Important Factors That Help Determine How Much House I Can Afford

Figuring out how much you can spend on a home comes down to a few key figures: How much money you earn, how much money you can contribute to a down payment and how much money youre spending each month on other debts. When you apply for a mortgage, a lender will scrutinize every aspect of your personal finances to assign a level of risk on whether youll be able to pay the loan back. The more you can lower your debt-to-income ratio and increase the size of your down payment, the better.

How To Calculate Your Debt

To find your debt-to-income ratio, first add together all of your monthly debt payments. For example, if you pay $200 each month on a student loan, $400 on a personal loan and $500 on an auto loan, your total debt payments are $200 + $400 + $500, which equals $1,100.

Next, determine your gross monthly income.

Take your total debt payments and divide that number by your gross monthly income. Lets say for this example that your monthly income is $4,000. Then your total monthly debt payments divided by your gross monthly income is $1,100 ÷ $4,000, or 0.275. We can convert the result to a percentage: 0.275 x 100% = 27.5%.

Don’t Miss: Government Help For Mortgage Payments

Time Spent On Processing

The processing time for a home loan is three to four weeks. However, if the necessary papers are missing or the builder lacks the appropriate qualifications, the procedure may be further delayed.

E-banking has sped up the disbursement of a personal loan even more. A personal loan may be authorised immediately or within minutes, for new clients and delivered within 24 hours.

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Read Also: Where To File For Bankruptcy

How To Lower Your Monthly Mortgage Payment

Your monthly mortgage payment is going to take up a good chunk of your overall debt, so anything you can do to lower that payment can help. Consider some options, like:

- Find a less expensive house. While your lender might approve you for a loan up to a certain amount, you donât necessarily have to buy a home for the full amount. The lower the home price, the lower your monthly payments will be.

- Boost your down payment. The higher your down payment, the lower your monthly payment will be. So, if you can, save up so you can secure that lower payment.

- Get a lower interest rate. Most of the time, your interest rate is based on your credit score and DTI. Try to pay down outstanding debt, like credit cards, car loans or student loans. This not only lowers your DTI, but could also improve your credit score. A higher credit score means you could get a lower interest rate offered by your lender.

Can My Fha Monthly Payment Go Up

Yes. Here are a few instances when your monthly payment can go up, even after youve closed the loan and moved in:

-

If you have an adjustable-rate mortgage, your interest rate can rise after your initial fixed-interest rate term ends.

-

Escrow items built into your monthly payment, such as property taxes or homeowners insurance premiums, are likely to go up over time. While you can’t do much about property taxes aside from moving to a different area you can always shop around for a new homeowners insurance policy.

-

If you run behind on making a monthly payment, you can expect a late payment fee.

Also Check: Can You File Bankruptcy More Than Once

Borrow Up To 8 Times Your Salary With A Big Down Payment

Lets assume you can make a $160,000 down payment maybe by using equity youve built up over many years in previous homes, or maybe because youve had a windfall of cash.

With such a hefty down payment, how many times your salary can you borrow for a mortgage?

- Value of the home you can afford $790,800

- Monthly payment $2,700

Again, your total monthly housing costs havent changed. But the value of the home you can afford is nudging $800K because youre making a big down payment.

Make Yourself A Competitive Buyer

Don’t spend all your time daydreaming about listings you find on Zillow. Do research to learn what kinds of mortgage loans are out there, including FHA, conventional, VA and USDA loan programs. Get pre-approved by a lender before you start shopping, so you know your price range, and you’ll be ready to make an offer on the spot if need be.

It’s also important to know your credit score. Having a score of 760 or higher will qualify you for the best mortgage rates, so take a few months and build your credit if you can. And then do everything you can to keep it in good standing.

If you’re not sure where your credit score currently stands, sign up for a free or paid to check your score.

is a free credit monitoring service that anyone regardless of whether they are Capital One cardholder can use. Receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time. Use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score. In the months leading up to applying for your mortgage, you’ll want to be extra careful about closing accounts and racking up debt, as it can decrease your score and make your mortgage more expensive.

Don’t Miss: How Soon After Bankruptcy Can You Apply For Credit