How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

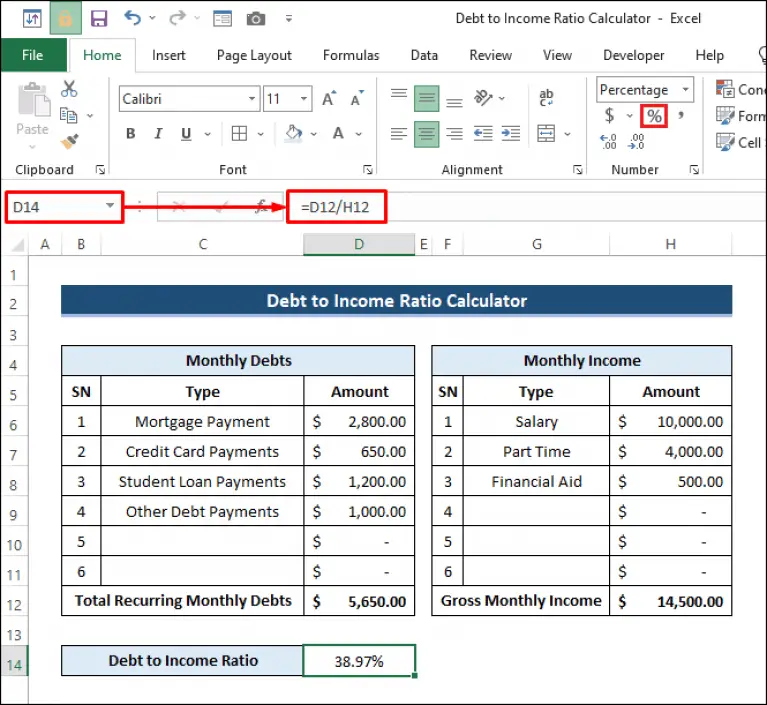

Debt To Income Ratio Example

Hannah, an office worker, wants to apply for a loan to one of the banks that provides lending products. The bank needs to implement analysis to indicate the creditworthiness of Hannah, debt to income is one of the instruments used.

Hannah currently needs to pay $1,250 a month as mortgage fees for her house and her car. Furthermore, she also has a monthly credit card payment of $200, $150 for insurance, and $400 of additional debt. Her monthly wage before tax is $6,500. What is her debt to income ratio?

Lets break it down to identify the meaning and value of the different variables in this problem.

- Monthly Debt Payments = 1,250 + 200 + 150 + 400 = 2,000

- Gross Monthly Income = 6,500

Now lets apply the values to our variables and calculate the debt to income ratio:

In this case, the debt to income would be 30.77%.

From this result, we can see that Hannahs DTI is still generally within the acceptable range. However, to accept her application, the bank wont just use DTI to measure the credit risk of Hannah. They will need to further analyze her credit history.

Example To Understand Debt

The Debt-To-Income ratio concept and DTI calculation can be better understood with the help of an example.

Example: A person has an annual gross income of INR 12,00,000. Each month, they are liable to pay an EMI of INR 18,000 as their education loan and INR 7,000 as credit card payment.

Gross Monthly Income = 12,00,000 / 12 = 1,00,000

Total Monthly Debt Payment = 18.000 + 7,000 = 25,000

Debt-To-Income ratio calculation = Total Monthly Debt Payment/Gross Monthly Income*100 = * 100 = 25%

Here, the borrower has a DTI ratio of 25% which means they have good control over the debt repayment with their given income. The financial institutions or banks will be happy to provide them with a loan.

Recommended Reading: What Happens To Your Car If You File Bankruptcy

How To Improve Dti Ratio

The DTI ratio calculation considers all financial obligations equally, irrespective of the factors influencing repayment behaviors. For example, the repayment terms for student loans and credit card payments are different. The former is available at lower interest ratesInterest RatesAn interest rate formula is used to calculate loan repayment amounts as well as interest earned on fixed deposits, mutual funds, and other investments. It is also used to calculate credit card interest.read more, while the latter is at a higher interest rate. However, they are all considered equal while making DTI ratio calculations.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Debt to Income Ratio

Thus, borrowers should maintain proper repayment behavior. In addition, it lets lenders trust them for approval of their future loan applications. It, in turn, will keep their DTI ratio balanced. Let us look at some of the ways of improving the DTI ratio:

Why Use The Return On Equity Metric

Simply put, with ROE, investors can see if theyre getting a good return on their money, while a company can evaluate how efficiently theyre utilizing the firms equity. ROE must be compared to the historical ROE of the company and to the industrys ROE average it means little if merely looked at in isolation. Other financial ratios can be looked at to get a more complete and informed picture of the company for evaluation purposes.

In order to satisfy investors, a company should be able to generate a higher ROE than the return available from a lower risk investment.

Recommended Reading: Can Filing Bankruptcy Clear Irs Debt

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Don’t Miss: Max Debt To Income Ratio

What Is The Dti Preferred By Lenders

The maximum DTI ratio varies from lender to lender. Lenders generally may set a front-end ratio at no more than 28% and the back-end ratio at 36% or lower.

Major lenders often use the following guidelines for DTI ratios:

-

35% or less: This ratio reflects that your debt is manageable and you likely will have money remaining after paying monthly bills.

-

36% to 49%: Your DTI ratio is adequate but you have room for improvement. Lenders might ask for other eligibility requirements.

-

50% or higher: The ratio reflects that you may have limited money to save or spend. As a result, you wont likely have money to handle an unforeseen event and will have limited borrowing options.

However, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios depending on the type of loan youre applying for. Keep in mind that the lower your DTI ratio, the better your chances of being approved for a loan.

Dont Miss: How Much Is It To File Bankruptcy In Oklahoma

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt-to-income ratio means.

Also Check: Is Liquidation Com Legit

Why Does It Matter

If you are concerned with your financial health, then you will want to control your debt-to-income ratio. If you maintain a high DTI ratio throughout your life, it will be very hard for you to save enough money for retirement and accomplish your financial goals. You dont want to remain enslaved to your debt all your life.

If you are just starting out and purchased a house or condo especially in an expensive market like Vancouver, Toronto or Montreal it is normal to have a higher DTI ratio for some time. However, you should strive to lower it over time either by paying off debt or by increasing your income.

Having a low DTI ratio will also make you more attractive to lenders because they will see you as a less risky borrower. Your DTI ratio is reflected in your credit score: a high level of debt will negatively impact your credit score because it increases the likeliness that you will default on your minimum payments. A good credit score and a low DTI is the recipe to get approved by lenders.

Debt To Income Ratio Explained

If the ratio obtained is higher than expected, the banks and financial institutionsFinancial InstitutionsFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations. read more do not agree to offer finances in such a scenario. A higher DTI ratio indicates the debts and liabilities are considerably higher, and another loan would be difficult to manage for a borrower. On the other hand, when the debt to income ratio for mortgage is low, lenders know they will receive payments on time.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Debt to Income Ratio

The DTI ratios are of two kinds front-end ratios and back-end ratios. The front-end ratios include the portion of the gross monthly income used for repaying mortgage installments, rent, property taxes, insurance, etc. On the contrary, the back-end ratios mark all recurring payments that borrowers are liable to pay, including those under the front-end ratios category.

You May Like: What Do You Lose When You File For Bankruptcy

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

What Is A Good Debt

In addition to your , your debt-to-income ratio is an important part of your overall financial health. Calculating your DTI may help you determine how comfortable you are with your current debt, and also decide whether applying for credit is the right choice for you.

When you apply for credit, lenders evaluate your DTI to help determine the risk associated with you taking on another payment. Use the information below to calculate your own debt-to-income ratio and understand what it means to lenders.

Also Check: Houses In Foreclosure In My Area

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

Don’t Miss: How To File Bankruptcy Yourself In South Dakota

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.

Return On Equity Formula

The following is the ROE equation:

ROE = Net Income / Shareholders Equity

ROE provides a simple metric for evaluating investment returns. By comparing a companys ROE to the industrys average, something may be pinpointed about the companys competitive advantage. ROE may also provide insight into how the company management is using financing from equity to grow the business.

A sustainable and increasing ROE over time can mean a company is good at generating because it knows how to reinvest its earnings wisely, so as to increase productivity and profits. In contrast, a declining ROE can mean that management is making poor decisions on reinvesting capital in unproductive assets.

Also Check: How Much Money Is Us In Debt

How Pacific Debt Relief Can Help

If you have too much debt and are having trouble making even minimum monthly payments, Pacific Debt Relief may be able to help you.

Are monthly payments compressing your lifestyle? Do you need to adjust your debt-to-income ratio drastically? Then take advantage of increasing cash flow by utilizing Pacific Debt Relief.

Some of our clients find themselves getting in front of credit card payments while decreasing other monthly debt, and with other debt payments reduce debt drastically. With an expanded income ratio and a personalized debt relief plan, clients find that paying other obligations, such as auto loans, rent payments, and other monthly debts becomes less of a hassle. It’s beneficial both financially and emotionally.

Pacific Debt Relief is one of the leading debt settlement companies in the US. We work directly with your creditors to reduce your existing debt, often for substantially less than you owe. We work with most major credit card companies and know which ones tend to settle.

Get yourfree consultationtoday. Your initial phone call is 100% free, and our debt experts will explain your options, so you fully understand them.

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

Also Check: Average American Credit Card Debt

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

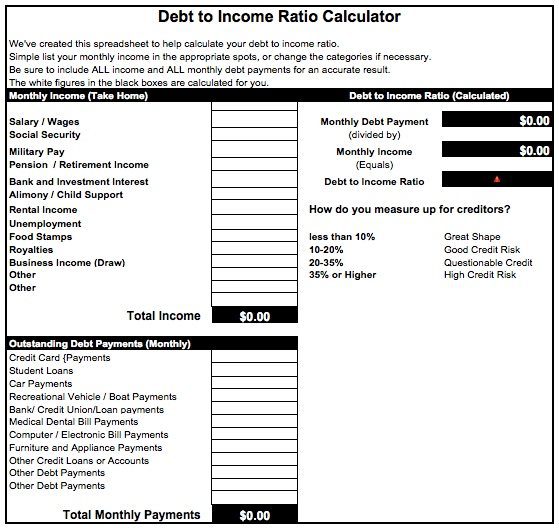

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.