Losing Nonexempt Property In Chapter 7 Bankruptcy

The Chapter 7 bankruptcy trustee overseeing your case can’t sell your exempt property in Chapter 7. But the trustee can sell nonexempt property. Even so, the trustee won’t bother selling an asset that isn’t worth much. The trustee will first decide if the property will bring a reasonable amount for creditors.

For instance, assume you owe $4,500 on a second car worth $5,000. You already used your state’s motor vehicle exemption to protect the equity in your first car, so your $500 in equity on the second car is nonexempt.

Nothing would remain for creditors after paying storage fees, sales costs, and the amount owed to the lender because trustees must pay off car loan liens in Chapter 7 when selling property. The trustee would likely abandon the car, and you’d get to keep it.

Sometimes a filer wants to keep property that a trustee could otherwise sell for a reasonable amount. In that case, many trustees will sell it to the filer at a discounted priceusually about twenty percent less. The deal will depend on the amount the trustee would save on sales costs.

Learn how to file for bankruptcy and keep a car in Chapter 7 bankruptcy, or keep a car in Chapter 13 bankruptcy.

Whats The Difference Between Chapter 7 And Chapter 13

If youre thinking about filing bankruptcy, its important to understand your options. Chapter 7 bankruptcy and Chapter 13 bankruptcy are the bankruptcies that people most frequently seek out.

Chapter 7 bankruptcy is also known as total bankruptcy. Its a wipeout of much of your outstanding debt. Also, it might force you to sell or liquidate some of your property in order to pay back some of the debt. Chapter 7 is also called straight or liquidation bankruptcy. Basically, this is the one that straight-up forgives your debts .

Chapter 13 bankruptcy is more like a repayment plan and less like a total wipeout. With Chapter 13, a borrower files a plan with the bankruptcy court detailing how they will repay their creditors. The borrower will pay some debts in full while paying otherspartially or not at all, depending on what they can afford. Chapter 7 = wipeout. Chapter 13 = plan.

Chapter 7 Wont Help With Past

If your home has a lot of equity, chances are the bankruptcy trustee will be able to sell it and use the proceeds to pay other debts. And, if youre behind on mortgage payments, a Chapter 7 could mean losing the asset. In either case, Chapter 13 might be the better option if you want to keep your house.

You May Like: What Happens When Chapter 13 Bankruptcy Is Dismissed

How Can A Homestead Exemption Protect Home Ownership

You can use a homestead exemption to protect at least some of the home’s equity from creditors if the house is your primary residence. However, you can’t use it to help you keep other real property, like a commercial building, rental unit, or vacation property you stay at occasionally.

This rule is universal across almost all states. You’ll also need to be a resident for a particular time before using the state’s exemptions. However, other aspects of the homestead exemption will vary by state, and the differences can be striking. Watch for these things.

Amount. Some states’ homestead exemptions are meager, while others let you protect equity up to $500,000 or more. Most fall somewhere between the two extremes.

Property size. Some states include size and acreage limitations in the homestead exemption law. For instance, farming states often limit the number of acres of farmland you can protect. Or you might live in a state that allows large landholdings in rural communities but much smaller city parcels.

Spousal doubling. If you and your spouse own your home together and file a joint bankruptcy, you might be able to double the homestead amount and protect twice as much equity.

How Foreclosure Prolongs A Mortgage Waiting Period

Sometimes a bankruptcy isnt the only financial setback a potential mortgage borrower is dealing with. The bankruptcy may have been preceded by foreclosure on a mortgage.

Having both a foreclosure and bankruptcy may prolong the mortgage process more than just a bankruptcy, and may add other requirements.

The following chart shows the length of time after a foreclosure a potential borrower may apply for a loan:

| FHA |

|

Also Check: Can You File Bankruptcy Without An Attorney

Are You Current On Your Mortgage

If you’re behind on your mortgage and facing foreclosure, you may want to consider Chapter 13, especially if your home equity is not completely protected by an exemption in your state.

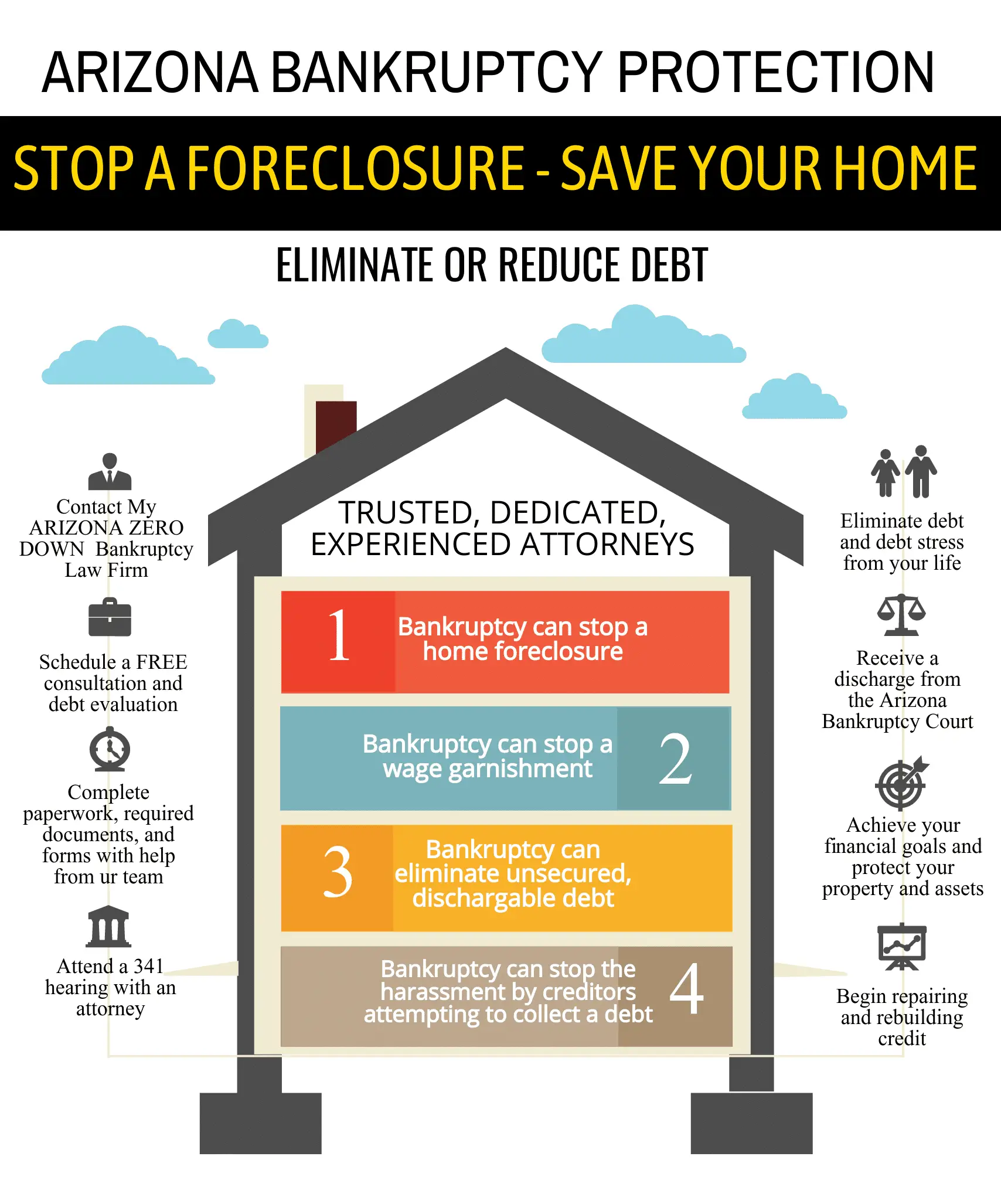

A Chapter 7 bankruptcy cannot stop a lender from foreclosing on your house, but a Chapter 13 bankruptcy can. In fact, preventing foreclosure is a major reason people end up filing Chapter 13 bankruptcy if they are in such a situation, because Chapter 13 law has specific provisions designed to help cure mortgage arrears or deal with large balloon payments by spreading them over a five year repayment plan, rather than all at once.

In Many Cases You Can Keep Your Home In Chapter 7 Bankruptcy Learn More Here

You won’t necessarily lose your home in Chapter 7 bankruptcy, especially if you don’t have much home equity and your mortgage is current. But it can happen. Whether you’ll lose your home after filing for Chapter 7 bankruptcy will depend on the following factors:

- whether your mortgage is current

- if you can continue making the payments after bankruptcy

- the amount of your home equity, and

- whether your state’s homestead exemption will protect all of the equity.

If you’re behind on your payment, in foreclosure, or can’t exempt all of your home equity, you’ll have a better chance of keeping your home using Chapter 13 bankruptcy. Filers faced with those circumstances should learn more about choosing between Chapter 7 or Chapter 13 when keeping a home.

- Get answers to questions about bankruptcies.

Also Check: What Is Bankruptcy And Insolvency Act

Can I Keep My Car If I File Chapter 13 Bankruptcy

Readers who filed for Chapter 13 bankruptcy were also very likely to keep their cars. If youre behind on your vehicle loan, you can use a Chapter 13 plan to catch up with your overdue payments , but you also have a couple of other options that dont apply to house loans. In Chapter 13, you might be able to stretch out the car payments over a longer period. Or, if the car loan is old enough, you might even be able to lower the balance on the principal and your interest rate.

I wish wed known that it would hurt us to sell a car before entering bankruptcy.

Sally, 48, Illinois

Will You Be Able To Afford To Make The Loan Payments After The Bankruptcy

When you file your reaffirmation agreement with the court, you will have to determine whether the assumption of the loan creates a presumption of undue hardship. This is done by subtracting your monthly expenses, including the loan payments, from your monthly income.

If you do not have enough monthly income to pay for your monthly expenses , then the court will presume that reaffirming the loan creates a hardship for you. If this is the case, you will have to appear in court and explain to the judge how you expect to be able to make monthly loan payments after bankruptcy. The judge will then determine whether to allow the reaffirmation agreement.

If there is no presumption of undue hardship or if the judge allows the reaffirmation agreement despite the presumption of undue hardship, you will be able to keep the property after your bankruptcy.

About the author

Kevin OâFlaherty is a graduate of the University of Iowa and Chicago-Kent College of Law. He has experience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation.

What to Expect From a Consultation

The purpose of a consultation is to determine whether our firm is a good fit for your legal needs. Although we often discuss expected results and costs, our attorneys do not give legal advice unless and until you choose to retain us. Although most consultations are complimentary, some may carry a charge depending on the type of matter and meeting location.

Read Also: National Debt By Year

Bankruptcy Exemptions In Chapters 7 And 13

Exemptions work differently in Chapters 7 and 13. In Chapter 7 bankruptcy, you lose property not covered by an exemption. The bankruptcy trustee responsible for managing your case will sell the property for the benefit of your creditors.

In Chapter 13 bankruptcy, you can keep all of your property however, that luxury comes at a priceliterally. Youll pay your creditors the value of any property not covered by an exemption in your Chapter 13 repayment plan.

For example, say you own a car outright worth $3,000, and your state has a vehicle exemption of up to $5,000. Heres what would happen in each chapter.

- Chapter 7 Bankruptcy. If you file for Chapter 7 bankruptcy, you will get to keep your car because the exemption would protect the equity fully. In the same example, if your vehicle were worth $15,000, the bankruptcy trustee would sell your car, pay you $5,000 for the exemption, and distribute the rest to your unsecured creditors.

- Chapter 13 Bankruptcy. In Chapter 13, you wouldnt need to pay extra to your creditors through your repayment plan. However, if the car were worth $15,000, youd need to pay your creditors at least $10,000 through your plan.

Keep in mind that these examples dont take into account a vehicle loan. For more information, read How to File Bankruptcy Without Losing a Car.

A State Homestead Exemptions

Each state is allowed to pass state bankruptcy exemptions under the Federal Bankruptcy Code. So the exemptions vary by state, and you can choose to use either federal or state bankruptcy exemptions. Check your state homestead exemptions where you can also take a bankruptcy exemptions calculator that helps you understand whether your home is at risk.

Recommended Reading: How Do You Repair Your Credit After Bankruptcy

Who Is Eligible For The Homestead Exemption And How Do You Claim It

Eligibility for the Florida homestead exemption is almost as generous as the exemption itself. To claim this unlimited-value exemption, youll need to be able to prove that this property if your familys primary residence. You will also be required to demonstrate the fact that you have owned this property for at least forty months.

It is important to note that filing for chapter 7 bankruptcy in Florida will not stop the bank from collecting on your home loan if it is past due. If you intend to file for chapter 7 bankruptcy in Florida, you will first need to ensure that you are current on your house payments. Otherwise, your property may not be eligible for this exemption and your property may be surrendered in the agreement.

Can You Keep Your House Or Car After Filing For Bankruptcy

When good people fall on hard times and begin considering getting a fresh start through bankruptcy, perhaps the most feared potential losses are ones house and car. Transportation has become a necessity in terms of gainful employment and everyone needs a roof over their heads.

In Virginia, the law allows for a variety of bankruptcy exemptions and with the help of an experienced personal bankruptcy attorney, you may be able to keep your house and car. At the Law Office of Rebecca L. Evans, we work with everyday people just like you to help them get the fresh start they deserve. We wont judge you, criticize you or talk down to you we have your best interest in mind and work with the sole purpose of helping you make your life better.

Recommended Reading: Bankruptcy Laws In Wisconsin

You May Like: Who Can File For Bankruptcy In Ny

How Are Exemptions Determined In A Chapter 7 Bankruptcy

Since your house must be considered exempt from the bankruptcy for you to have the most favorable scenario for keeping it, knowing how exemptions are determined is critical. State or federal homestead exemptions determine how your home is handled in a bankruptcy. While specifics will vary by state, heres how the exemption works.

Theres usually a certain period of time that you must live in the house before it can be considered for an exemption. For example, if you file under the federal statute, you must own the home for 40 months.

The second key determinant for an exemption is the amount of equity you have in the home, which requires knowing your home value. State and federal statutes let you exempt a certain amount of equity from being used by a trustee to pay off creditors and lenders. The exact amount that you can protect will vary from state to state.

Be sure to check the law in your state. Certain states allow you to double the amount of equity exempted if you file for bankruptcy jointly as a married couple.

Its especially important to remember that if you have so much equity that you fall above the exemption amount, your bankruptcy trustee may choose to sell your home to pay back creditors. Theyll pay you back for any exempted equity following the sale, but youll have to find a new home.

There are instances where you may have options in deciding which exemption rules apply, so speaking with your bankruptcy attorney is always wise.

Can I File Bankruptcy And Keep My Car And House

Bankruptcy can be a scary process when you do not know what property is at stake. When people file, one of their fears is that they will lose essential property such as their car or their house.

Based on state bankruptcy exemptions, the equity value of your property, homestead protection laws, and what chapter you file for, filers can have a better likelihood of keeping both their car and home during the bankruptcy process.

Depending on whether you file for Chapter 7 liquidation or Chapter 13 wage earners plan, will determine what you will owe, how and if you can keep your car and home.

Also Check: What To Know Before Filing Bankruptcy

Common Exemption Types Are:

Homestead Exemption. This protects your equity in your primary residence that you own and occupy, usually up to a certain amount

Vehicle Exemption. This protects your equity in your car or other vehicle up to a certain amount.

Wildcard Exemption. This allows you to save property that is important to you and that you wouldnât be able to protect otherwise, up to certain limits.

The key to knowing whether your property is protected is knowing which âexemptionâ laws apply.

What Happens If My Property Is Not Exempt

Sometimes, you will own property that exceeds your maximum exemption amount. This is called a non-exempt asset. For example, letâs say you own a $10,000 car and your state only gives you a $5,000 exemption for your vehicle with no wildcard. What happens then?

In principle, your trustee is entitled to seize and then resell your car. From the sale proceeds, the trustee would have to give you your $5,000 exemption amount first. Then, the trustee would take $5,000 for creditors. In reality, though, the trustee will have significant costs in seizing the car and then reselling it, so after all these costs are factored in the trustee will have less than $5,000. As a result, the trustee would usually prefer to cut a deal with you. Typically, the trustee would agree to let you keep your car for a cash payment that is less than $5,000 – perhaps $2,000 cash. The trustee will usually accept payments in installments from wages you earn after filing.

In addition, if the vehicleâs value is over the exemption limit by only a small amount – say $1,000 – the cost of seizing and selling the property would eat up any value to the trustee. So in these cases, the trustee will leave the property to you for free.

On the other hand, what if you have $10,000 in cash and your state only allows you to protect $5,000 in cash. In this case, there are no transfer costs to the trustee. The trustee would simply demand that you turn over the entire $5,000 surplus amount.

Don’t Miss: Homes Up For Auction

Downsides To Keeping Your House When Filing For Bankruptcy

You may desperately want to keep your house, even if youre so deep in debt youre considering filing bankruptcy. Thats understandable it not only has an emotional attachment, but could some day be an asset, even if youre behind on payments now.

That said, there are some financial downsides to hanging on to your house through a bankruptcy proceeding.

If you file for Chapter 13 bankruptcy, you have to continue making your monthly mortgage payments, as well as pay what you were behind on. This can be difficult, even if the payment plan that you, the court and your lenders agree to, seems to be doable.

Almost two-thirds of Chapter 13 bankruptcies fail. Its tough to keep to a payment plan over three to five years, even though modifications are allowed. Those involve going back to court and explaining why you need one. Through it all, you have to keep current on your mortgage payments, as well as all the other payments agreed to in the plan.

If you file for Chapter 7 and keep your house, you must make the monthly payments. The only hope for a modification, is the bank itself.

Bankruptcy, obviously, is complicated, and if youre worried about keeping your house, its even more so. If youre asking, Should I file for bankruptcy? your first move should be to talk to a credit counselor.

Advertiser Disclosure