What Happens If I Dont Quite Qualify For Your Bankruptcy Division Program

Mortgage after bankruptcy is an obtainable goal, and we are dedicated to helping our clients purchase or refinance a home after bankruptcy. If we cant help a client immediately, we provide a path to success by working tirelessly with our borrowers to address the areas that are holding them back. Peoples Bank is here to help you reach your home ownership and mortgage goals.

Get Ready For Take Off

Rocket Mortgage® is an online mortgage experience developed by the firm formerly known as Quicken Loans®, Americas largest mortgage lender. Rocket Mortgage® makes it easy to get a mortgage you just tell the company about yourself, your home, your finances and Rocket Mortgage® gives you real interest rates and numbers. You can use Rocket Mortgage® to get approved, ask questions about your mortgage, manage your payments and more.

You can work at your own pace and someone is always there to answer your questions 24 hours a day, 7 days a week. Want a fast, convenient way to get a mortgage? Give Rocket Mortgage® a try.

Usda Loan Requirements After A Bankruptcy

USDA loans are a zero down payment program for homes in a rural area. Here are the basic requirements to qualify:

- You will have to wait three years after filing for bankruptcy

- Must be a citizen of the US or be an eligible non-citizen

- Must be legally able to borrow

- Must occupy the home as your primary residence

- Must currently be without safe and sanitary housing now

- Must not have the current ability to obtain a conventional loan from other sources and lenders

- May not be barred from participating in any federal loan programs.

- Must meet the income limits set by the program

You May Like: Pallets Of Goods For Sale

Alternative Loan Options With Chapter 13

Some alternative mortgage programs offer home loans to people in Chapter 13 bankruptcy. These Non-Qualified Mortgages do not meet the standards for government or conforming mortgages. As such, theyre not eligible for backing from Fannie Mae, Freddie Mac, or any federal agency

Lenders assume extra risk when they fund these types of loans, and borrowers can expect to pay higher mortgage interest rates and fees. But they may be appropriate if you want to borrow higher loan amounts or wait less time before borrowing.

Va And Usda Loans With Chapter 13 Bankruptcy

Like FHA loans, VA and USDA loans are backed by the federal government. They also have similar rules about qualifying with Chapter 13.

- You must be at least 12 months into your repayment plan with on-time monthly payments

- You need written approval from the court or bankruptcy attorney to apply for the loan

- You need to meet loan program guidelines

If you completed your full Chapter 13 plan and the court has discharged you, there are no special criteria to apply for a VA or USDA loan.

Both these loan programs have similar benefits. No down payment is required, and mortgage rates tend to be very low.

To qualify for a VA loan, you need:

- Qualifying military service: You must be an eligible veteran, service member, or surviving spouse

- Fair to good credit: The Department of Veterans Affairs technically does not set a minimum credit score for these loans, but most lenders require a FICO score of at least 580-620

USDA loans are very affordable, but a bit harder to qualify for. Youll need to:

- Meet income eligibility: This loan type is meant for low- to moderate-income home buyers in qualified rural areas. Your household income cant be more than 115% of the area median income

- Have good credit: Most USDA lenders require a FICO score of at least 640

- Buy in a rural area: USDA loans are only available in areas defined as rural by the Department of Agriculture. However, this broad definition includes about 97% of the U.S. landmass

You May Like: Does Claiming Bankruptcy Affect Your Spouse

Conforming Loans With Chapter 13 Bankruptcy

Its much tougher to get a conforming loan after a Chapter 13 bankruptcy filing. Fannie Mae and Freddie Mac the two agencies that set conforming loan rules are stricter than the government agencies. They will not allow borrowers to apply while working through a Chapter 13 plan.

Your bankruptcy must be either discharged or dismissed to qualify for a conventional mortgage. And theres a waiting period:

- Two years after your Chapter 13 discharge date or

- Four years after your Chapter 13 dismissal date

Remember, discharge happens after you complete the 3- or 5-year repayment plan. So altogether it could take up to seven years after filing for Chapter 13 before you can get a conventional loan.

Filers who fail to complete the plan may have their bankruptcy dismissed. They probably still owe their creditors and will have to wait at least four years from the dismissal date before they can apply for conventional financing.

Filers with multiple bankruptcies in the past seven years will have to wait at least seven years from their most recent discharge before applying.

If Your Mortgage Is Sold

According to the Consumer Financial Protection Bureau or CFPB, if your mortgage is sold, the new lender must “notify you within 30 days of the effective date of transfer. The notice will disclose the name, address, and telephone number of the new owner.”

Please note that it’s important to read the fine print when you take out a mortgage. You can check your original loan agreement and your documentation for a section that defines the responsibilities of each party if the mortgage is sold or assigned to another company.

Read Also: Pallets For Sale Wholesale

Getting A Mortgage After Bankruptcy: Waiting Periods

Understand itll take time to rebuild the trust needed for lenders to consider your application. In most cases, the earliest Rocket Mortgage® can help you refinance your house after bankruptcy or get into a new one is 2 years after the discharge or dismissal.

The length of the waiting period depends on the type of bankruptcy youve filed and the type of mortgage loan you want to get.

Which Lenders Will Approve A Loan During Chapter 13

VA, USDA, and, sometimes FHA loans are available during Chapter 13 bankruptcy. Most major lenders are authorized to do FHA and VA loans. USDA mortgages are a little harder to find. Remember that mortgage lenders can set their own lending rules and some will be more amenable to borrowers with Chapter 13 than others.

In addition, youll have better luck if your finances are currently stable. A better credit score or higher income can work in your favor when you have past credit issues. If youre right on the edge of qualifying for instance, if your score is exactly 580, you have low income, and you want an FHA loan it could be tougher to get approved.

Youll also need to shop around and compare your options. All mortgage borrowers should shop for their best interest rate. But for borrowers with Chapter 13 this is doubly important. Youre not just shopping for a good deal youre shopping for a lender thats willing to approve you.

Also Check: How To Get Credit Score Up After Bankruptcy

Whats The Difference Between A Bankruptcy Filing Date And A Discharge Date

The filing date is the day you file a petition with your local bankruptcy court. The discharge date is the day youre no longer liable for the debts included in your bankruptcy. This date could be a few months after the filing date or several years later, depending on whether you file Chapter 7 or 13.

Are They Being Upfront With What They Can Offer

Some bankruptcy mortgage lenders will try and attract customers with an extremely low interest rate. While this number looks good on paper sometimes a lender will not be able to deliver on their upfront advertised interest rate. Some home loan companies lure you in with a low interest rate only to add more fees or request a higher down payment amount. It is important that you understand that a lender who provides you with the lowest interest rate, may not be the top company for you to partner with.

Don’t Miss: Is Direct Liquidation Legit

What Happens When Your Mortgage In Sold

If the mortgage lender that originated your loan goes bankrupt, your mortgage has value and is purchased by another lender or investor in the secondary market. The secondary market is where previously-issued mortgage loans are bought and sold.

Although a mortgage for the borrower is a debt or liability, a mortgage to the lender is an asset since the bank collects interest payments from the borrower over the life of the loan. Interest payments made to a bank are similar to an investor earning interest or dividends for holding a bond or stock. A dividend is a cash payment paid to shareholders by the company that issued the stock. Similarly, the interest payments that you pay on your mortgage are akin to you paying the bank monthly dividend payments.

As a result of bankruptcy, the mortgage lender’s assets, including your mortgage, are packaged together with other loans and sold to another lender or service company, which collects your payments and services the loan. The new owner of your loan makes money on any fees and interest from the mortgage.

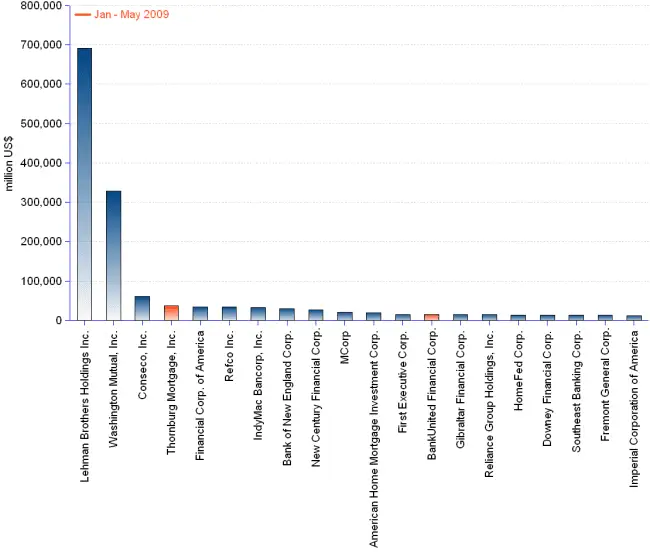

Your loan can also be sold to Fannie Mae or the Federal National Mortgage Association . Together, as of 2020 data figures, Fannie Mae and the Federal Home Loan Mortgage Corp purchase or guarantee 62% of all mortgages originating in the United States.

How To Purchase Or Refinance While In Chapter 13 Bankruptcy

Options for Navigating a Home Loan While in Chapter 13 Bankruptcy

Are you in a Chapter 13 bankruptcy? Currently own a home and have equity? OR are you renting and wish you could buy before rates rise? If yes, there may be good news for you. Under current FHA and VA programs, options may be available for homeowners or renters to obtain the home loan financing they are looking for. Ive been helping borrowers navigate this challenging situation for over a decade.

For homeowners looking to refinance a current mortgage to better terms, consolidate a 1st and 2nd mortgage, there also may be options. Many borrowers are also wanting to pay off their Chapter 13 balance in full and look to obtain an early discharge with a cash out refinance. If you have enough equity, you may be able to use it to pay your mortgage debt and applicable interest. For current renters looking to buy and start building equity there might be a potential program for you too!

Sound intimidating? Its really not, it is just a process that we take one step at a time. No matter where you are in the country, if you are 12 months or more into a Chapter 13 bankruptcy, then there may be hope to buy or refinance a home. Feel free to reach out with your specific details and I will be happy to discuss your situation in detail. I hope this sheds some positive light on home loans while in Chapter 13 bankruptcy.

Don’t Miss: How To File Bankruptcy Without Money

Famous Mortgage Companies That Deal With Bankruptcies Ideas

Famous Mortgage Companies That Deal With Bankruptcies Ideas. Peoples bank offers a variety of credit options for bankruptcy. Once you have 20% equitybecause you have paid.

Mortgage lenders treat chapter 7 bankruptcies differently than they do chapter 13 bankruptcies. Mortgage specializing in bankruptcy, chapter 13 bankruptcy mortgage, ex bankrupt mortgage, best mortgage for bankruptcy, mortgage for bankruptcy clients, best mortgage after bankruptcy, bankruptcy home, for. 6 since its inception, the lender has originated over $78 billion in loans.

Source: insurancenoon.com

Mortgage specializing in bankruptcy, chapter 13 bankruptcy mortgage, ex bankrupt mortgage, best mortgage for bankruptcy, mortgage for bankruptcy clients, best mortgage after bankruptcy, bankruptcy home, for. Two years after a chapter 7 bankruptcy has been filed, most mortgage companies may be willing to finance a mortgage for you.

Source: www.currentschoolnews.com

Mortgage companies that deal with bankruptcies. These lenders offer options for both new home purchases, and refinance programs.

Source: gustancho.com

Its a wipeout of much of your outstanding debt. These lenders offer options for both new home purchases, and refinance programs.

Source: kansascitybankruptcy.com

Chapter 7 is also called straight or liquidation bankruptcy. Below are a few of the best mortgage lenders that deal with bankruptcies differently.

Source: lawguideline.orgSource: www.slideshare.netSource: www.youtube.com

Despite A Past Bankruptcy Our Access To Programs Can Help You Get A Mortgage

Bankruptcy cripples your finances and will make it difficult for you to find financing for a while. However, if you need to refinance or you want a mortgage on a new home, Midland Mortgage Corporation has access to bankruptcy-friendly loan programs. We will prepare you to secure the best rates for your mortgage as soon as funding is available to you. However, there are several issues affecting your access to the most popular programs.

You May Like: Is Kohl’s Filing For Bankruptcy

What Can You Do If Your Mortgage Is Sold To A Bad Company

Your bank must give you a credit possession move notice when your home loan is sold. The new proprietor of your credit must tell you inside 30 days of the compelling date of move. Remembered for this notification ought to be the accompanying data: the new proprietors name, address and phone number , the date of move, and whether the exchange of possession is recorded in freely available reports.

Youll need to peruse the primary home loan explanation you get from your new bank cautiously check that all the data it records is valid and precise. In case youre trying to apply for an advance change, you may need to start the cycle once more.

Note that managing another organization for your home loan implies that you may need to round out desk work that may appear to be unique, talk with new staff, and send your installments to another location. Try not to be reluctant to contact your new servicer on the off chance that you have questions.

Usda Loan After Bankruptcy

The USDA rules are similar to the FHA. You will need to wait at least 2 years after filing a chapter 7 bankruptcy. For a chapter 13 bankruptcy, you may be eligible after making 1 years worth of payments on time.

As you can see, there are different rules related to waiting periods for various types of mortgage programs. If you have had a recent bankruptcy, you may have options to get a mortgage. If you would like some help finding a mortgage lender, we can help match you with a lender in your location.

Also Check: Florida Foreclosures Suspended 2021

How Long After Bankruptcy Can You Buy A House

In some cases, you can apply for a mortgage immediately after a bankruptcy is discharged or dismissed. In other cases, you can get a mortgage after a waiting period of 2 or 4 years after discharge or dismissal. In still others, you may have to wait as long as 7 years. It depends on which mortgage you select, the type of bankruptcy you declare and your bankruptcys disposition during your post-bankruptcy period.

Va Loan Requirements After A Bankruptcy

You can get a VA loan after a bankruptcy if you are able to wait two years from your bankruptcy filing date. You will also need to show that you have your credit back in good standing with on time payments.

- You will have a two year waiting period first after filing for bankruptcy

- You will need to meet the eligibility criteria as a veteran

- Zero down payment

- No PMI required for a VA loan

- You must meet the minimum income requirements

- You will have to pay the VA funding fee which can also be borrowed.

Read Also: Total Debt Of Usa

Other Reasons Your Mortgage Could Be Sold

It’s important to note that it’s normal business practice for some lenders to sell their mortgages to other companies in situations outside of financial distress. Investors want to buy mortgages because it provides them with fixed interest payments.

Also, banks that issue mortgages or any loans have limits on how much they can lend since banks have only so much in deposits on their balance sheets. As a result, selling your mortgage to another service provider removes your loan from the bank’s books and frees up their balance sheet to lend more money. If banks couldn’t sell mortgages, they would eventually lend all of their money out and would be unable to issue any more new loans or mortgages. The economy would likely struggle in such a scenario, which is why it’s allowed for bank loans to be sold off in the secondary market.

What Kind Of Interest Rate Should I Expect After A Bankruptcy Plan

Many clients who are currently completing, or are coming out of a bankruptcy plan have been stuck with high rates for years during their bankruptcy plan. Home loan interest rates are determined by the market, and a borrowers unique qualifying criteria. Our clients are often pleasantly surprised when they see the mortgage rate for which they qualify. Our bankruptcy home loan division takes pride in offering highly competitive home loan rates to all of our clientele, which includes those interested in obtaining a mortgage after bankruptcy.

Recommended Reading: Can Judgements Be Discharged In Bankruptcy

Respond To Lender Inquiries

Once you submit your preapproval application, the rest is in your lenders hands. Your lender will review your income, assets, debt and credit to see if you qualify for a mortgage. If you seem like a good candidate, your lender will send you a preapproval letter. You can use your letter to start shopping for a home.

Your lender might need to contact you to ask questions about items on your credit report. This is especially common after an adverse financial event like bankruptcy. Be honest and respond to your lenders inquiries quickly to improve your chances of approval.