Bankruptcy Proof Of Claim

When you receive a notice that your customer has filed for bankruptcy, it should be reviewed to determine if a proof of claim needs to be filed.

A proof of claim is a document filed within the bankruptcy court that alerts the court, debtor, trustee and other interested parties that a creditor wishes to register a claim against the assets of the bankruptcy estate. This document is important because it provides proof that the claim is valid and owed and notifies the Trustee of the creditors claim, as well as what class to associate the claim with.

How May A Debt Collector Contact You

A collector may contact you in person, by mail, telephone, telegram, or fax. However, a debt collector may not contact you at inconvenient times or places, such as before 8:00 a.m. or after 9:00 p.m., unless you agree. A debt collector also may not contact you at work if the collector knows that your employer disapproves of such contacts.

Personalize The Collection Process

The individual should be at the heart of every debt collection strategy. Nowadays, many agencies are shying away from mass, repetitive collection calls. On average, this approach makes people embarrassed, angry, and resentful. None of these things lead to customer satisfaction. Treating each debtor scenario uniquely and individually helps gain trust and satisfaction with the consumer. An easy way to accomplish this is to have one agent assigned to an individual for the entirety of the repayment relationship. This builds rapport and leads to the debtor paying quickly and on-time more often than not.

Read Also: What Is Chapter 7 Bankruptcy Definition

The Foundation Of Credit Service Company Is Service

The secret of our success lies in demonstrating respect for the debtor while protecting the reputation of our client. Our highly trained staff approaches debt recovery with the utmost professionalism because we understand our communication with your customers is a reflection on your company.

We are active members in good standing of ACA International, The Association of Credit and Collection Professionals, which is dedicated to promoting professional, ethical conduct within our industry. Licensed and bonded in the state of Arkansas, our ACA membership networks us with over 3500 collection agencies nationwide with the same high industry standards.

Tailor Communication Based On Preferences

There are many media channels and communication tools agencies can use to reach out to individuals. Unfortunately, not all are compliant when it comes to debt collection. Obtain the correct and proper authorizations and understand how your debtor wants to receive correspondences from your agency. Some want the convenience of an SMS text message or email correspondence. Others may request you only reach out to them via a phone call. Whichever is preferred, ensure they can easily opt-out of or update their options. Making this experience more consumer-friendly leads to less tense discussions once you have the debtors attention.

Read Also: Foreclosure Process In Nc

With Corporate Monitoring Ncs Credit Will:

- Monitor your customer for corporate compliance for the life of the UCC filing

- Provide an email notification to alert you of an entity name or status change

- Recommend what you need to do to retain your secured position

- Post the updated Corporate Certificate to your NCS Online Services portal

Learn more about corporate monitoring.

How To Remove Credit Collection Services From My Credit Report

If you dispute the notice and Credit Collection Services cant verify it, it could be removed from your credit report. Lexington Law Firm is a professional credit repair organization that helps individuals remove false, unsubstantiated, unfair or inaccurate negative items, such as charge offs, from their reports. Contact us today if you need help removing these items from your credit report.

Don’t Miss: Which Type Of Bankruptcy Results In Liquidation

Should I Pay For Delete With Credit Collection Services

Paying off Credit Collection Services to have credit bureaus delete it from your report seems ideal. There’s one problem. Paying a debt in collections changes your credit report status from ‘unpaid’ to ‘paid’. The result? Your collections still appears on your report for 7 years . This means your credit is still affected.

But – there is one solution.

You can get your collection completely removed. Call to find out how.

Who Is Midland Credit Management

Midland Credit Management helps consumers resolve outstanding account balances that are past-due. Over the years, we have helped millions of consumers achieve their goal of paying off their debt and achieving financial freedom. Start your journey by logging in now. You can also chat live with one of our highly trained Account Managers.

Midland Credit Management services accounts that have been sold to one of the MCM family of companies, including MCM, Midland Funding, LLC, Atlantic Credit & Finance, Asset Acceptance, and more.

If you received a letter from Midland Credit Management, this means a creditor you had an account with has closed your account and sold it to one of our family of companies. You will need to work with MCM, not your original creditor, to resolve your account.

Midland Credit Management empowers consumers by creating payment plans that work for them. We have helped millions of consumers work toward improved financial health.

Read Also: Does Bankruptcy Get Rid Of Irs Debt

Treat Customers With Respect

Professionalism is important in all businesses. When youre rude or unprofessional to an individual, they are more likely to avoid your communications. If you cannot communicate, you cannot collect the debt on behalf of your client. Ultimately, this means your agencys profits suffer.

Collecting late payments can be frustrating. However, its not an excuse to be impolite to debtors. Use official and compliant language. Ensure all communication written or verbal are formal and polite. Train agents off the bat how to successfully communicate with a rude consumer. Learning positive talking points can be difficult, but doing so leads to less friction during an already difficult conversation and goes a long way to skew customer satisfaction in your favor. If youd like to read on about creating positive collection call, check out our recent blog here.

How Do I Remove Credit Collection Services From My Credit Report

Removing Credit Collection Services from your credit report may be possible if any information on the account is incorrect, error’d, or fraudulent, and is not fixed in an appropriate amount of time. According to a study by the U.S. PIRGs, 79% of credit reports contain mistakes or serious errors. We specialize in going after these types of accounts for our clients.

Recommended Reading: How Much Is It To File Bankruptcy In Utah

All Collection Services Provided Through The Corporate Office In The Buffalo Ny Area

What are the benefits of having our third party collection services done through our corporate office? Management, team leaders, and collectors easily work together to accomplish goals and tasks. Questions are easily answered, and ideas are bounced around between employees. Everyone works together and gets things done in a timely and professional manner.

Make Use Of Customer Satisfaction Surveys

Customer surveys reveal a plethora of helpful information. Agencies should survey individuals throughout the entire process of repayment. But, aim only to ask questions that improve your service delivery. Feedback from these surveys can help pinpoint any issues and prepare for future problems. They can also help determine why some accounts slip into a permanent, non-payment status.

Don’t Miss: Best Place To Buy Liquidation Stock

Tips For Dealing With Ccs

When you type up the letter, make sure that you mention the fact that youre aware of your rights as the FDCPA outlines them. Debt collecting services are required to provide proof of your debt, which can often be difficult for them to do.

Additionally, there is a statute of limitations placed on your debt, limiting the amount of time the credit reporting agency may sue you for repayment. Each statute varies from state to state, so be sure to research your state’s specific laws concerning credit suits.

Update: This article has been updated to reflect the current CFPB and BBB complaints against CCS. The BBB rating for CCS has been updated as well as CCSs current contact information.

Disclaimer: This story was originally published on October 12, 2017 on BetterCreditBlog.org. To find the most relevant information concerning collections or credit card inquiries, please visit: or

Can I Remove Credit Collection Services From My Credit Report With A Pay

Even after you pay off debt in collections, it can still be reported as a negative item on your credit report for years. You can attempt to remove it from your credit report by sending the collection company a pay for delete letter. A pay for delete letter is a negotiation tactic where you offer the collection company to pay off your entire debtoften morein exchange for removing the negative item from your credit report.

If youre considering sending a pay for delete letter, make sure you have the funds to pay off the amount in collections. We also recommend that you research if your collection company has been receptive to pay for delete letters in the past.

Also Check: How Does Filing Bankruptcy Affect Me

What Types Of Debt Collection Practices Are Prohibited Prohibited Behaviors Include Harassment False Statements And Other Unfair Practices

Harassment – Debt collectors may not harass, oppress, or abuse you or any third parties they contact. For example, debt collectors may not:

- use threats of violence or harm publish a list of consumers who refuse to pay their debts use obscene or profane language repeatedly use the telephone to annoy someone

False statements – Debt collectors may not use any false or misleading statements when collecting a debt. For example, debt collectors may not:

- falsely imply that they are attorneys or government representatives falsely imply that you have committed a crime falsely represent that they operate or work for a credit bureau misrepresent the amount of your debt indicate that papers being sent to you are legal forms when they are not indicate that papers being sent to you are not legal forms when they are.

Debt collectors also may not state that:

- you will be arrested if you do not pay your debt they will seize, garnish, attach, or sell your property or wages, unless the collection agency or creditor intends to do so, and it is legal to do so actions, such as a lawsuit, will be taken against you, when such action legally may not be taken, or when they do not intend to take such action

Further, debt collectors may not:

- give false credit information about you to anyone, including a credit bureau send you anything that looks like an official document from a court or government agency when it is not use a false name

Unfair practices

May A Debt Collector Contact Anyone Else About Your Debt

If you have an attorney, the debt collector must contact the attorney, rather than you. If you do not have an attorney, a collector may contact other people, but only to find out where you live, what your phone number is, and where you work. Collectors usually are prohibited from contacting such third parties more than once. In most cases, the collector may not tell anyone other than you and your attorney that you owe money.

Read Also: Is There A Cheap Way To File Bankruptcy

Why Is My Debt In Collection

If your outstanding balance is not paid by the due date of the last reminder, the debt is sent to collection.

Can I still pay Klarna directly?

No, once the debt is sent to collection, you will have to contact the debt collection agency directly for payments, questions and settlement information.

You can find contact information for the collection agency printed on your debt collection letter.

Good to know: If a payment is late, you will not be able to continue using Klarna until youve paid off your debt. Late payments might also be reported to the credit bureaus.

Related articles

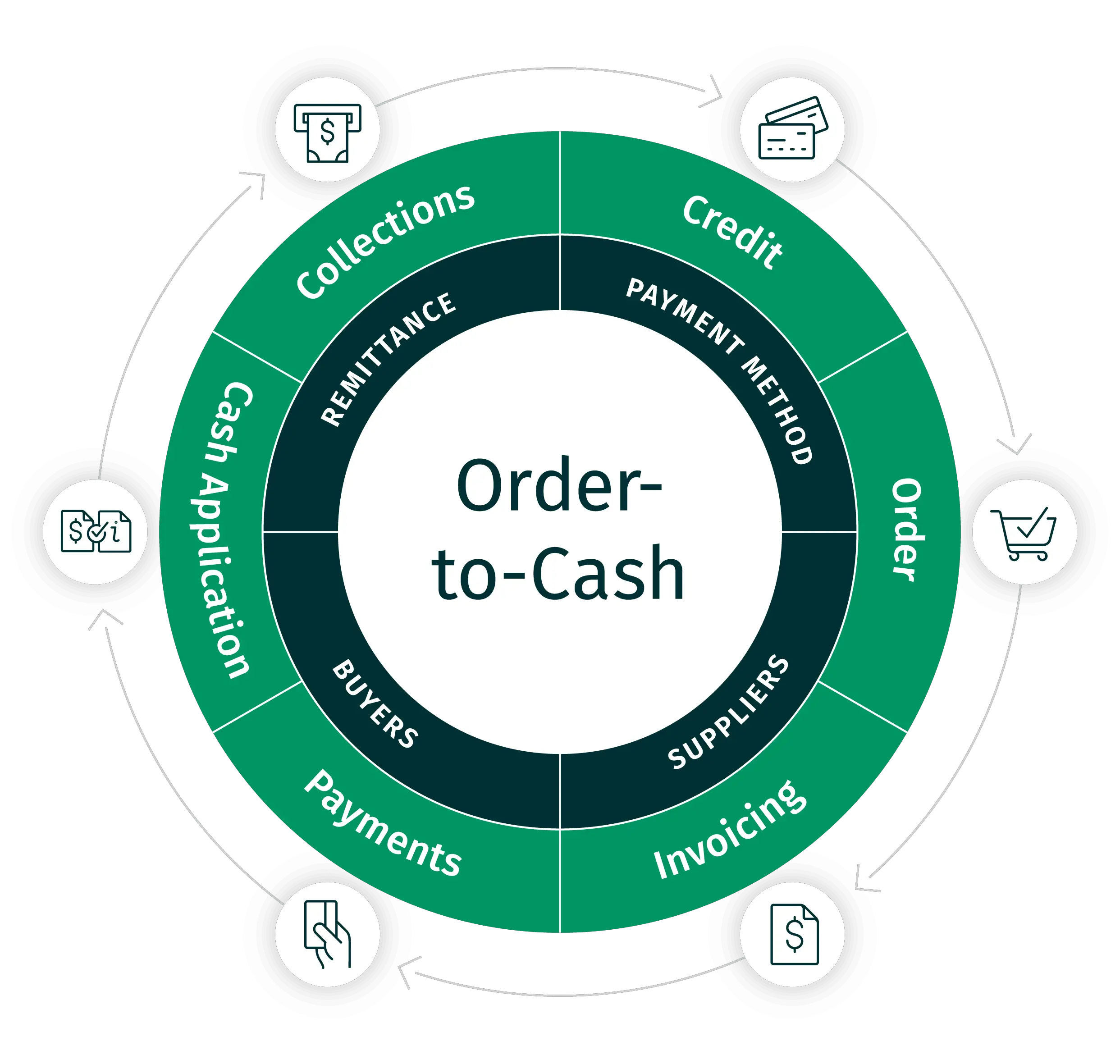

Have An Effective Strategy For Receivables Management

Within your agency, improving your receivables management cycle leaves debtors more satisfied. This discussion should start with your payment processor and establishing a collection agency merchant account. Please make sure you have a full self-service payment arsenal onhand so individuals can pay when they want and how they want. Adding value services such as pay by text, IVR, or even web payment negotiation tools can go a long way to motivate debtors to pay more frequently and on-time. Furthermore, ensure invoices and account balances are easily accessible and simple to understand. Not leaving any room for questions to arise makes you guarantee payments flow your way easily and consistently.

Recommended Reading: Liquidation Pallets For Sale Online

Whats The Difference Between Midland Funding And Midland Credit Management

Midland Funding, LLC is a debt purchaser, while Midland Credit Management is both a debt purchaser and servicer. Midland Credit Management services accounts that it owns as well as accounts owned by affiliate companies, like Midland Funding. This is why you may see Midland Funding on your credit report, but Midland Credit Management is contacting you regarding your unpaid debt owned by Midland Funding.

What To Do After Receiving A Notice From Credit Collection Services

First, be sure to read the notice very carefully and confirm that you really owe the money claimed by Credit Collection Services. Many people are scared of debt collection companies and will pay a statement immediately, without question. Instead, you should take the time to understand if you really even need to pay the notice.

Make sure you recognize the bill and are confident it is yours. Even if you think the bill is yours, consider seeking legal advice to confirm you are liable.

When you receive a notice from Credit Collection Services, send them a debt verification letter. This will mean they have to verify all details of your debt or stop further attempts at collection.

Also Check: Find Repossessed Houses For Sale

Speak Professionally And Authoritatively

Most of us take our speaking voices for granted. But the tone, pitch, inflection, and even the speed at which you talk can have a powerful influence on your listener. Think about typical news anchors or radio commentators. They have voices that command attention. With a little effort, you can develop one too.

Try recording a general collection call opening and then listen to yourself. Make adjustments as needed, and try again. This will not only improve how you come across on the phone, but it will also build confidence. It does take a little time and extra work, but remember, success is strongly linked to preparation.

Here are a few hints that might help:

- Dont chew gum or drink when youre on the phone

- Speak a bit slower and enunciate

- Use a lower-pitched voice

- Pause more often

- Make sure you pronounce the ending consonants of words and dont slur

- Smile while you talk although the person on the end of the line cant see it, they will hear it and everyone responds more openly to a smile than to a scowl

Adhering to these simple tips will greatly improve your telephony skills and give you the authority to command the conversation.

Every Collector Is Certified By The Commercial Collection Agency Association Of The Commercial Law League Of America And The International Association Of Commercial Collectors

One of the many reasons that weve been in business since 1962 is because of our commitment to professionalism and upholding collection standards. We make sure that our collectors have the proper training and the necessary certification. When you have an account with CCC of NY, you know its being handled by the best!

Recommended Reading: Does Bankruptcy Stay On Your Record Forever

Will Credit Collection Services Try Suing Or Garnishing My Wages

It’s very unlikely that Credit Collection Services decides to sue. In rare cases it may happen, but it is not the norm. State and federal laws have limits or ‘exemptions’ that apply to bank and wage garnishments. We strongly recommend giving us a call to determine the likelihood of a lawsuit, but also steps you can take to get this collection removed.

The Best Content And The Best Training Providers Are At Trainupcom

Get the latest industry news, recommended courses, & promotions from TrainUp.com sent straight to your inbox.

Terms and Conditions

Please read these Terms and Conditions carefully before using Capital One Spring member exclusives at TrainUp.com.

Your access to and use of the Service is conditioned upon your acceptance of and compliance with these Terms. These Terms apply to all Capital One Spring members who wish to access or use the Service and by accessing or using the Service you agree to be bound by these Terms.

This site uses cookies. We will never sell or rent your information. By signing up for a TrainUp.com account as a Capital One Spring member, you will receive emails in relationship to your content registration and monthly updates. You will only receive emails from TrainUp.com and never a third-party source.

The Service may employ the use of third-party services to allow access to course contents. By submitting your information, you grant us the right to provide the information to these third parties as needed to support your use of the service.

You acknowledge and agree that TrainUp.com shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any such content, goods or services available on or through any such third party web sites or services.

TRAINING CATEGORIES

You May Like: What Happens When You Declare Bankruptcy Uk

Knowing Your Fair Debt Collection Practices Act Rights

Harassing calls from a debt collection company tend to trigger a range of unpleasant emotions, from anxiety, fear, anger, frustration and beyond.

Unfortunately, a lot of people who get these calls just dont understand their rights. The truth is that debt collectors actually have a set of rules they have to follow when attempting to collect on a debt. The Federal Trade Commission enforces these rules, which are collectively known as the FDCPA, and prevents debt collectors from harassing you.

Therefore, if youre contacted by a debt collector, simply state that you understand your rights under the FDCPA.

Here’s a brief list stating your rights:

- CCS cannot suggest that they can have you arrested or imprisoned, as its illegal to do so.

- They are not allowed to harass or threaten you in any way.

- They cant harass you at work if you state you’re not allowed to receive calls.

- They must provide documentation proving the validity of their claim at your request .

- They cannot send letters with the appearance of an official government or court letter.

- They may not threaten you with legal action, whether wage garnishment or harm to your credit, without following through.

- They can only call you between the hours of 8 a.m. and 9 p.m. in your time zone, not theirs.

With this in mind, here is the process to remove CCS from your credit report.